The dollar soars as strong job growth paves the way for the third 75 points rate hike

August 05, 2022 @ 16:50 +03:00

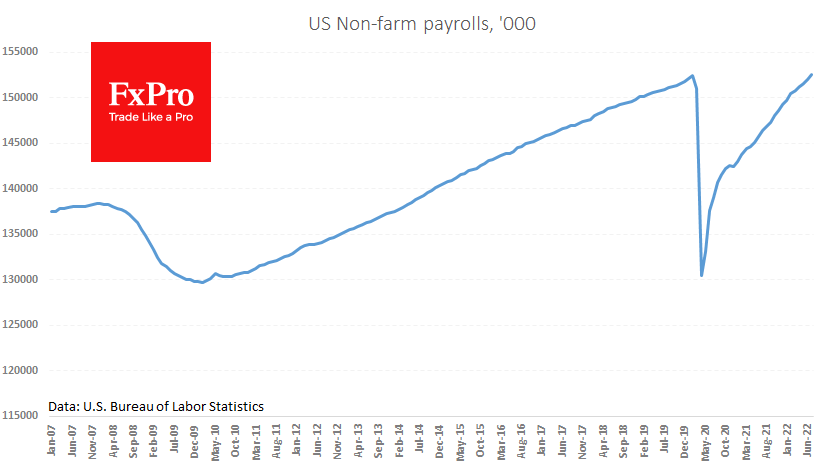

The US economy created 528K new jobs in July, doubling expectations and exceeding the peak employment level set before the pandemic. Notably, construction and manufacturing recovered, probably due to falling commodity prices in these sectors.

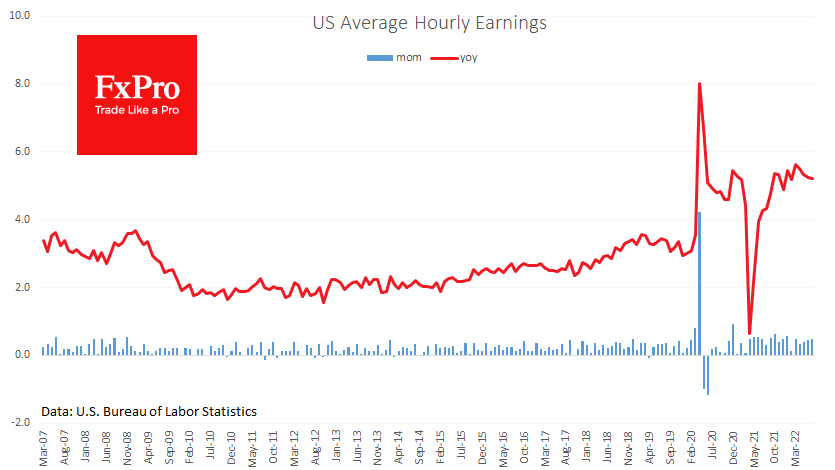

The hourly earning rate has maintained at 5.2% y/y with an upward revision of the previous month and a gain of 0.5% for July. The unemployment rate declined from 3.6% to 3.5%, but this is mainly due to a decline in the active labour force from 62.2% to 62.1%.

Such strong employment growth data came as a surprise to the markets. And understandably so, with the latest economic assessments betraying this picture. Weekly jobless claims have remained on an upward trend since March, and this divergence is not easy to explain.

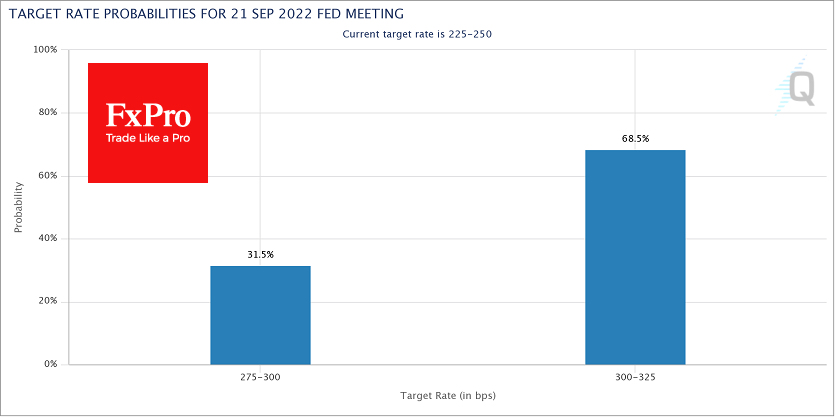

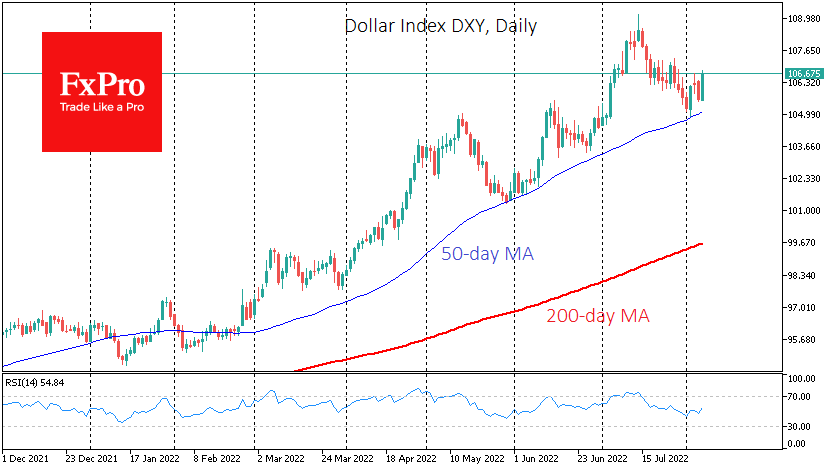

A solid increase in employment plus faster wage growth is raising expectations of a third consecutive 75 points Fed rate hike in September. CME’s FedWatch tool shows a 69% chance of such a move, double that of a day ago versus 3.4% a month ago. This is obviously positive news for the dollar and negative for the stock market.

Earlier in the week, Fed officials promoted the idea that markets underestimated the central bank’s hawkishness. With factual evidence of the economy’s strength, investors may return to buying the dollar, betting on continuing extreme policy tightening.

The FxPro Analyst Team