Market Overview - Page 73

June 1, 2023

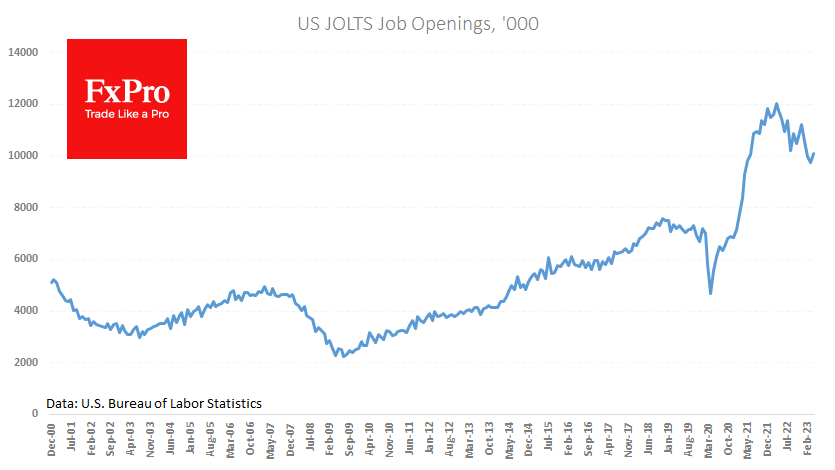

The US will release its official labour market report tomorrow, and traders are busy analysing data from related indicators, which consistently point to a market improvement rather than a looming recession. The fast-growing indicator for new vacancies rose again in.

June 1, 2023

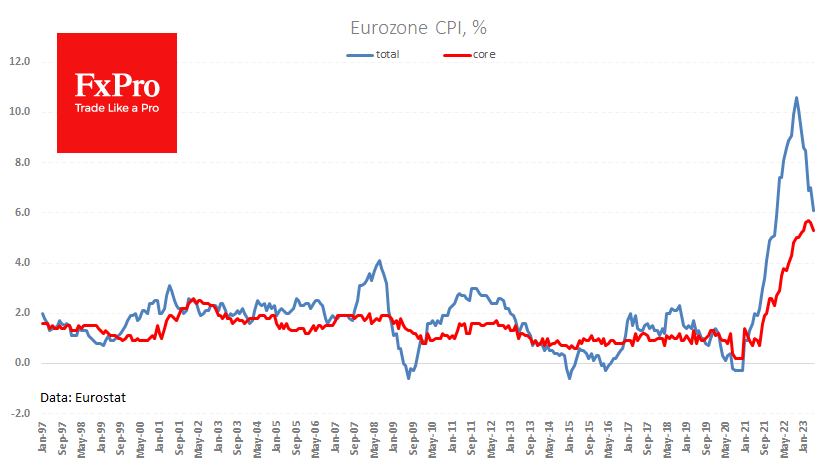

The euro is hovering around the $1.07 level, barely recovering above that mark on Thursday morning despite a sharper-than-expected drop in inflation. Eurostat’s preliminary estimate showed a decline in annual inflation in May to 6.1% from 7.0% in April. Economists.

May 31, 2023

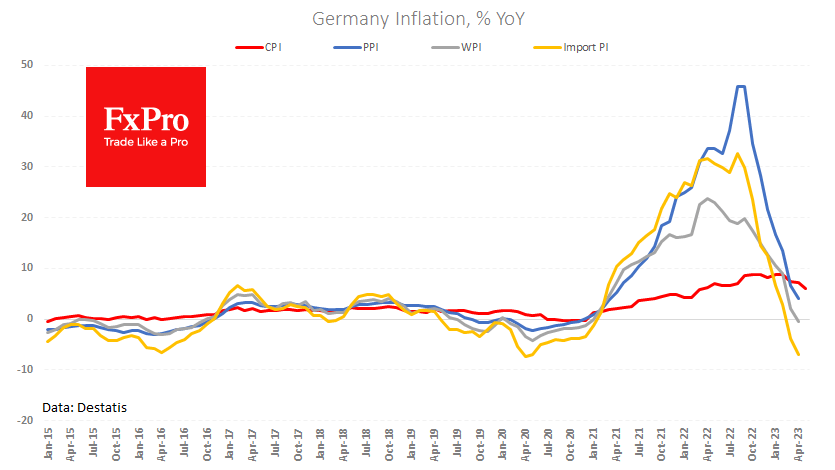

Consumer prices in Germany fell by 0.1% in May, compared with a rise of 0.2% forecasted by analysts, according to a preliminary estimate by Destatis. Year-over-year inflation in Europe’s largest economy slowed to 6.1% from 7.2%, the lowest rate since.

May 31, 2023

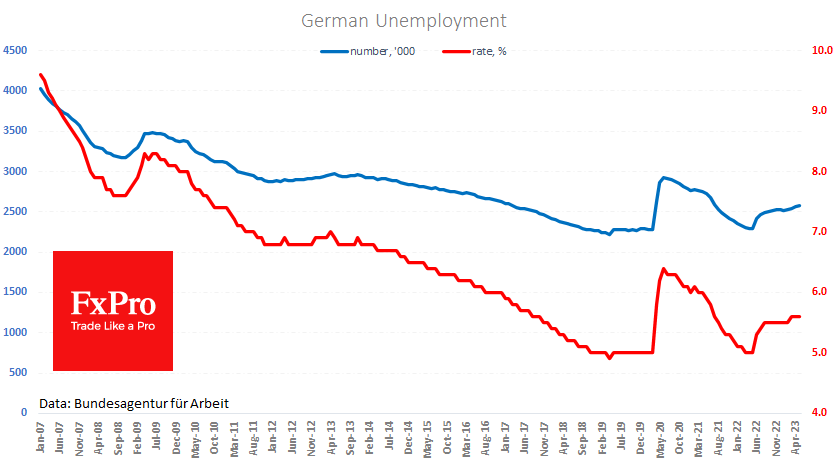

Weak Chinese manufacturing data put pressure on the single currency as Europe, particularly Germany, is highly correlated with China. However, the Eurozone’s data is not so bad today. The number of unemployed in Germany rose by 9K, down from 23K.

May 31, 2023

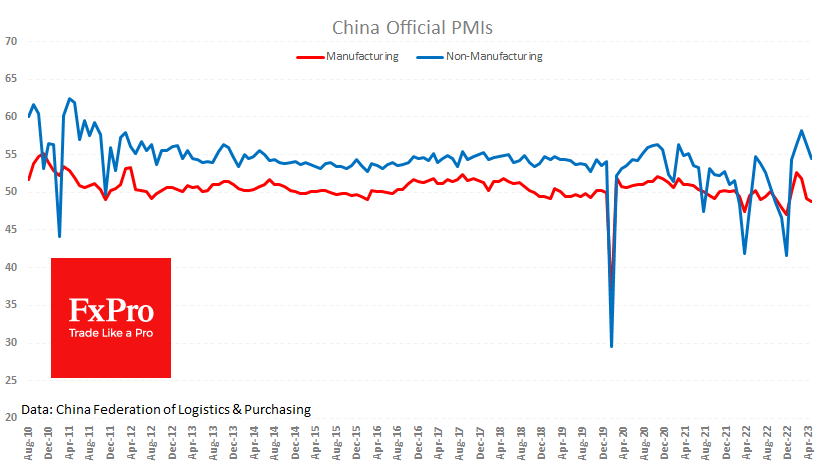

The official services and manufacturing PMIs were much weaker than expected, adding to the move into defensive assets on concerns over China’s economy. The Manufacturing PMI fell from 49.2 to 48.8 instead of the expected 49.5. Readings below 50 indicate.

May 30, 2023

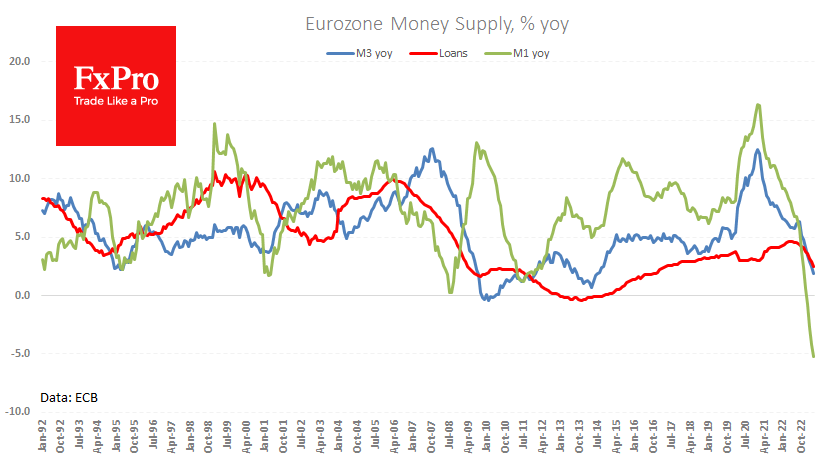

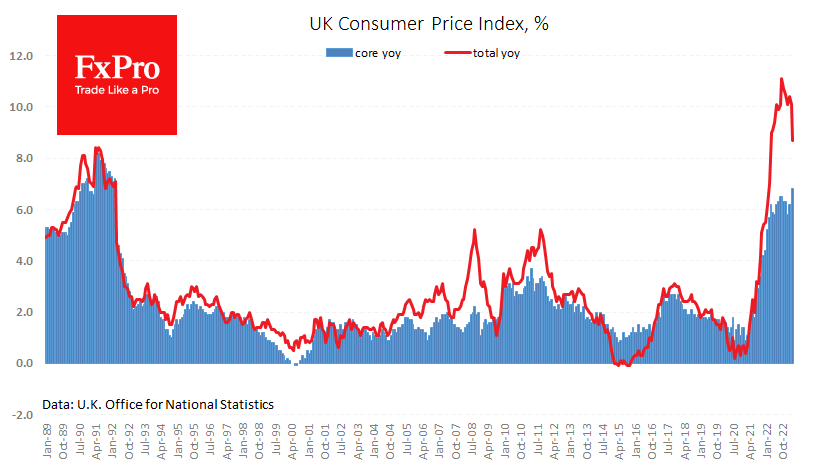

Recent eurozone data showed a stronger economic response to the monetary tightening that has already taken place. Spain reported that consumer inflation slowed from 4.1% to 3.2% y/y in May, against expectations of 3.6% y/y. This is a new low.

May 30, 2023

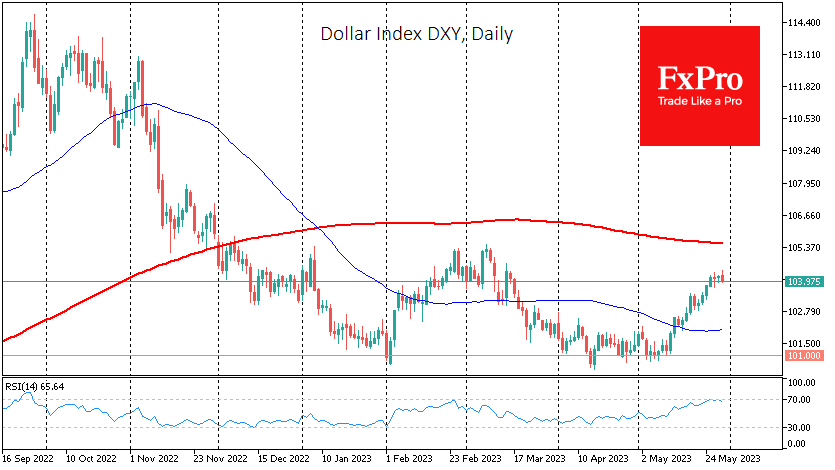

The dollar continues to rally, having gained around 3.4% from its early May lows, and has hovered around 104.2 for the past four trading sessions. The dollar is in locally overbought territory against a basket of major currencies, the euro.

May 29, 2023

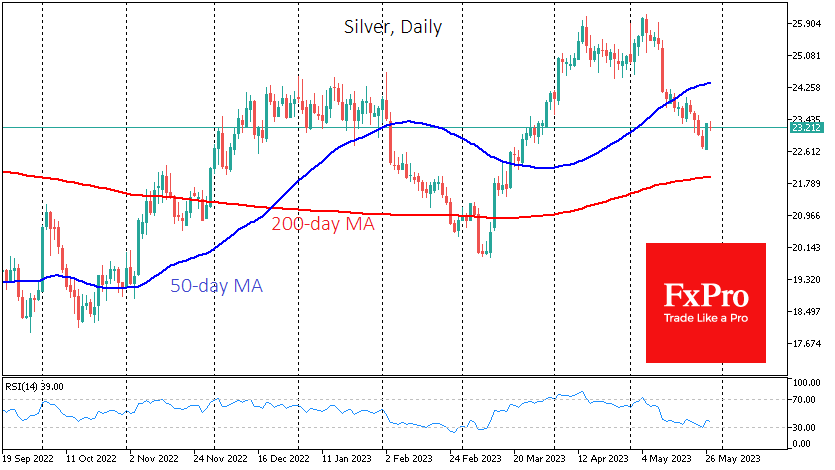

Silver jumped 2.8% on Friday, an important signal of the end of the bearish momentum that has seen the price fall by more than 13% in three weeks. Although silver is resting on Monday along with most developed markets, Friday’s.

May 29, 2023

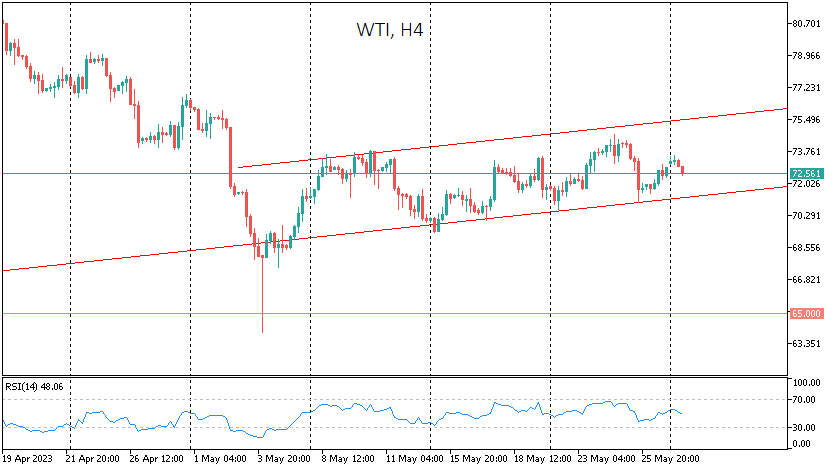

WTI remains within the upward trend formed in early May. However, be prepared for another test of this trend support at $71 and a possible move lower. The current upward trend in oil has been shaped by signs that the.

May 25, 2023

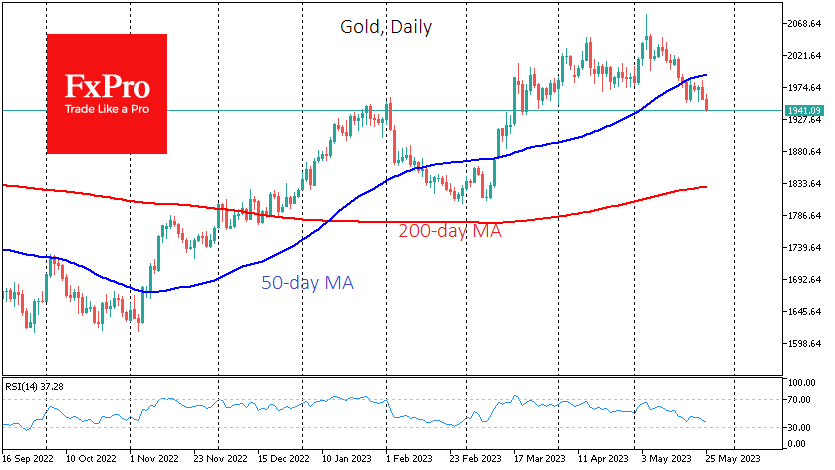

Gold is finding support in the $1950 area on this week’s declines but is not finding support from buyers on the rally above $1985. Support for this trading range is provided by the area of the late January price peak,.

May 25, 2023

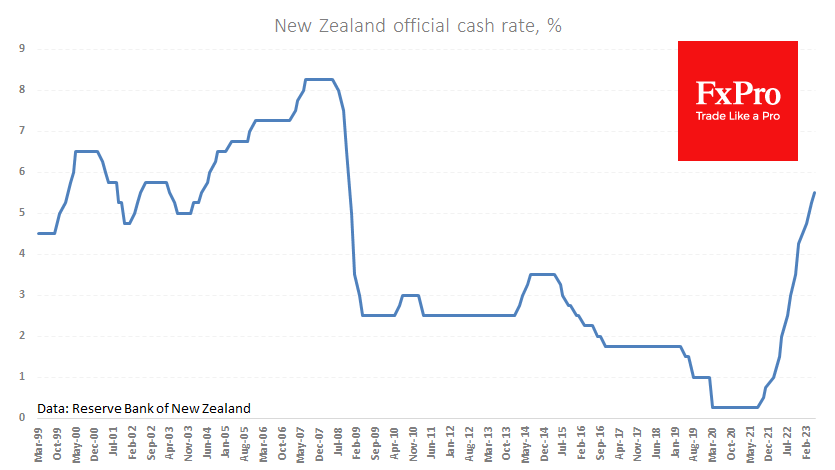

On Wednesday, the Reserve Bank of New Zealand raised its key rate by 25bp to 5.5%, the highest since October 2008, which was widely expected by markets. The RBNZ’s accompanying commentary was full of dovish signals. The central bank noted.