The inflation wheel has turned, hitting the dollar

August 10, 2022 @ 17:42 +03:00

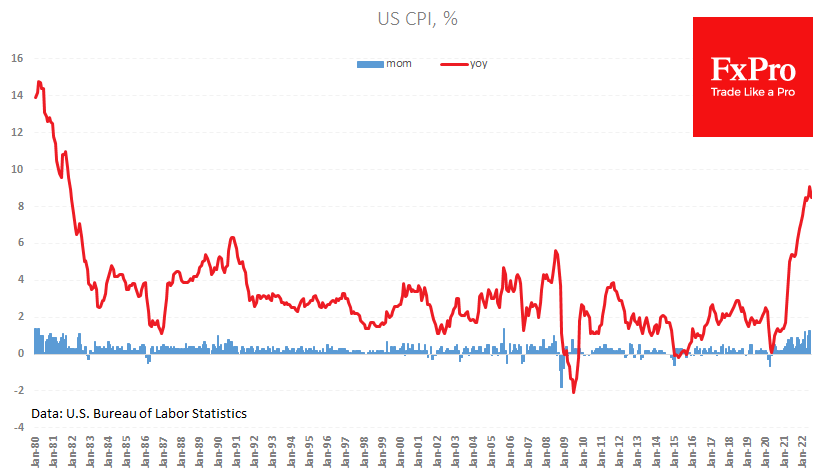

US consumer inflation slowed to 8.5% in July from 9.1% a month earlier. As we had pointed out, the fact was noticeably lower than the forecasted 8.7%, and this caused an immediate market reaction. FedWatch Tool showed the market’s estimate of a 75-point hike in the Fed Funds rate at the end of September fell from 68% to 33%.

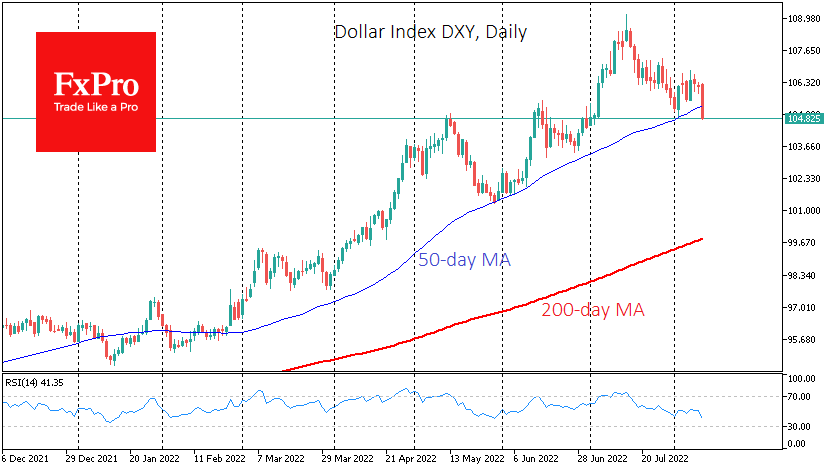

The currency market and index futures also saw a momentary reaction. The Dollar Index lost 1% within 15 minutes of publication, confirming its status as the market’s most important economic indicator.

The technical picture keeps a close eye on how the day will close. A DXY consolidation below 105.20, where the 50-day moving average and the local August lows are concentrated, could be confirmation of a reversal of a Dollars’ bull trend since May 2021. For most of these 14 months, the Fed has been tightening its rhetoric and accelerating rate hikes.

A sharp slowdown in inflation and signs that this move will continue in the coming months set the markets up for a reversal of Fed rhetoric. Right now, a 50-point rate hike is the most likely scenario. Further prospects are shrouded in uncertainty and tightly linked to inflation data. The Fed may move to a 25-point rate hike in November or December. The key word is “uncertainty” because it determines the degree of market volatility and investor sentiment. We are near the point of a cycle change, which means we are not in danger of a calm market.

The FxPro Analyst Team

GBP | BOE Governor Andrew Bailey Speaks

GBP | BOE Governor Andrew Bailey Speaks