Market Overview - Page 6

December 16, 2025

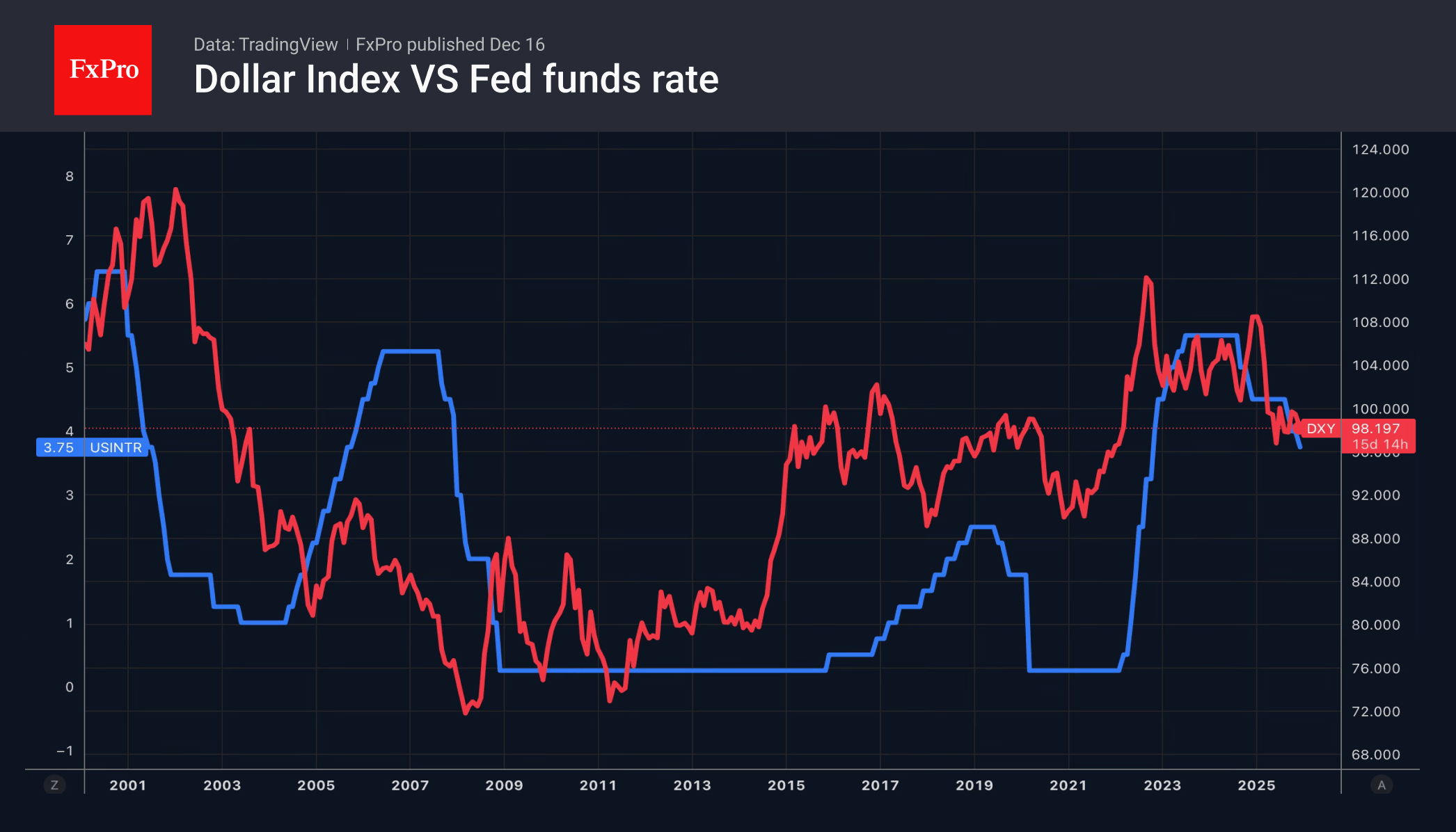

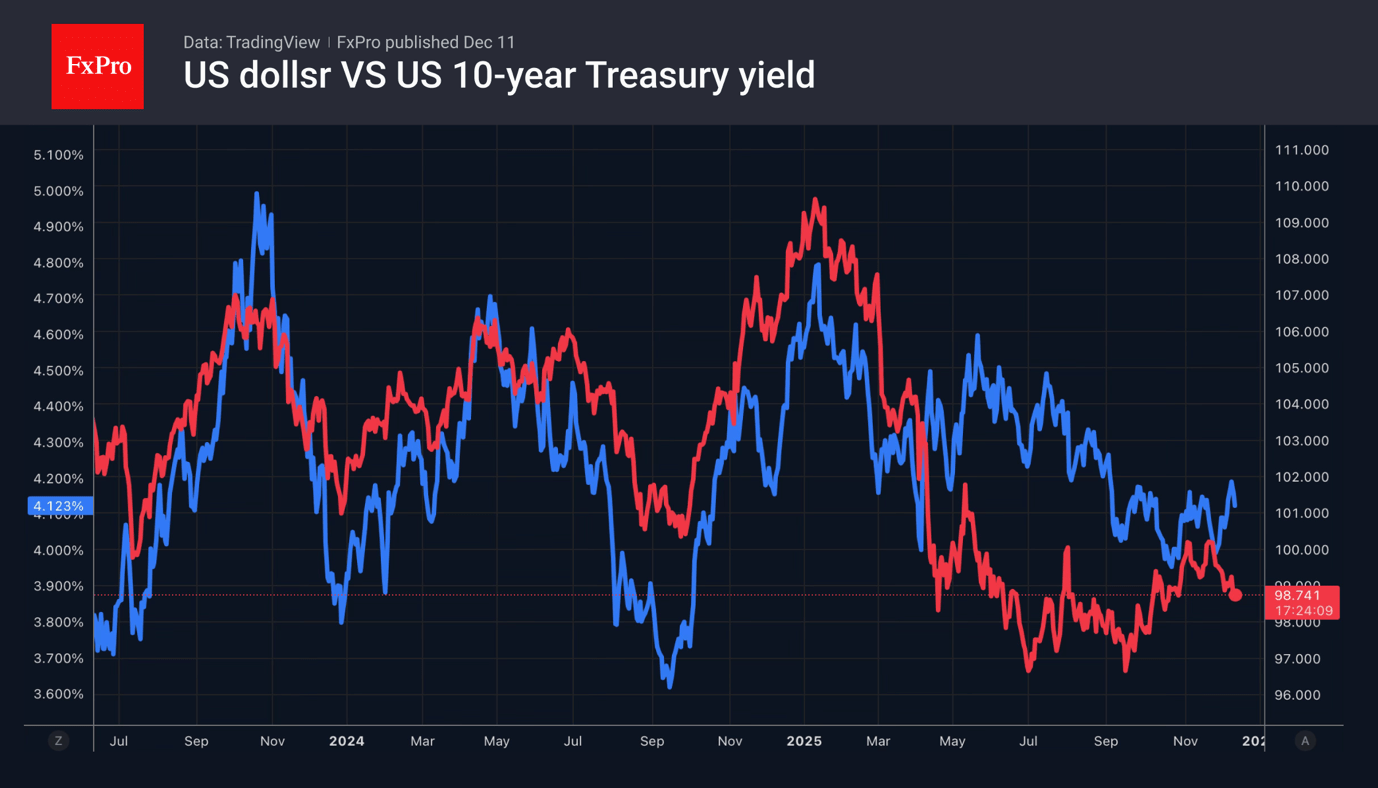

This year risks being the worst for the US dollar since 2017. Since the beginning of 2025, the DXY has lost about 9.5% and is likely to continue falling due to divergences in monetary policy. Major central banks are holding.

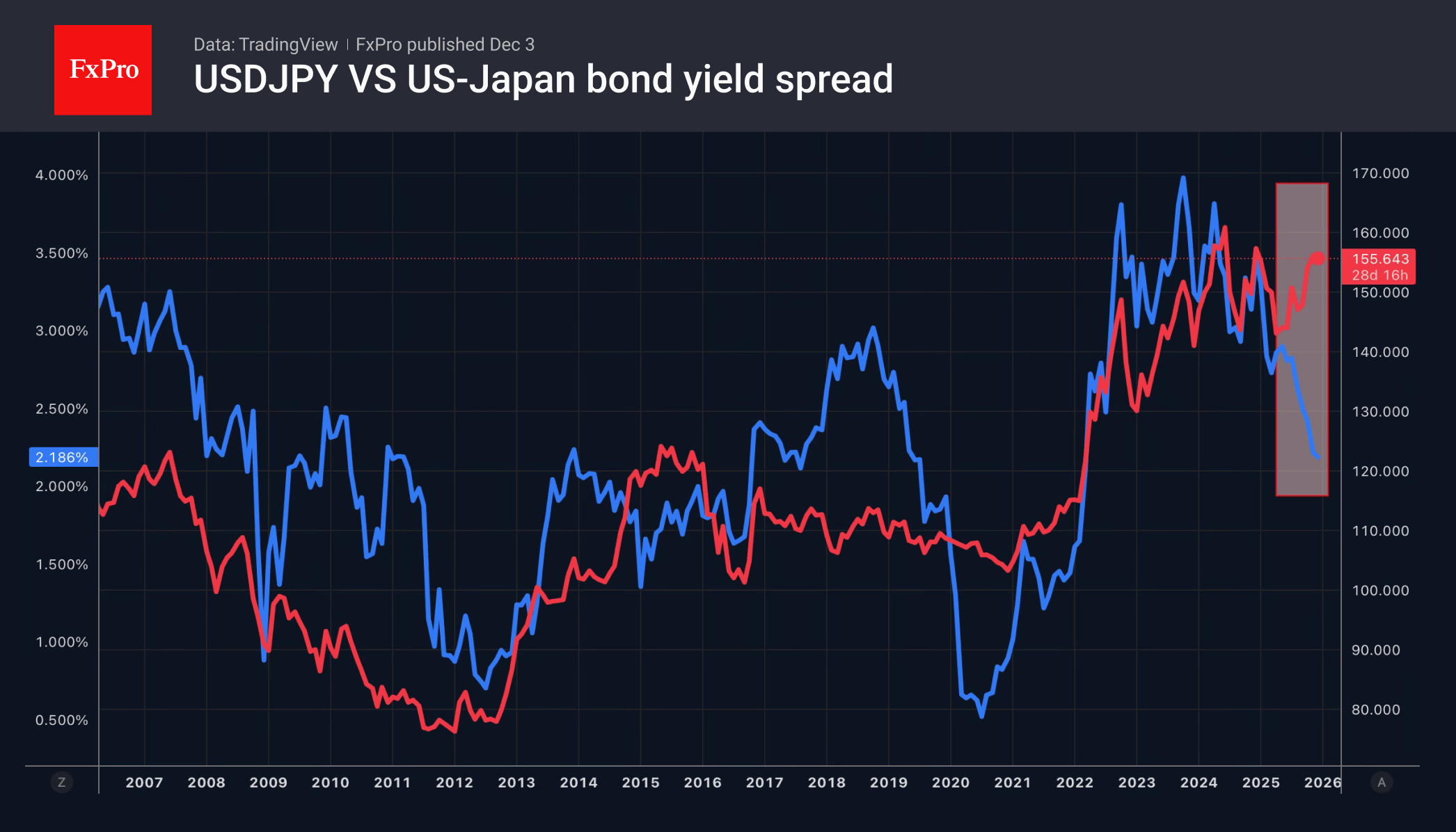

December 15, 2025

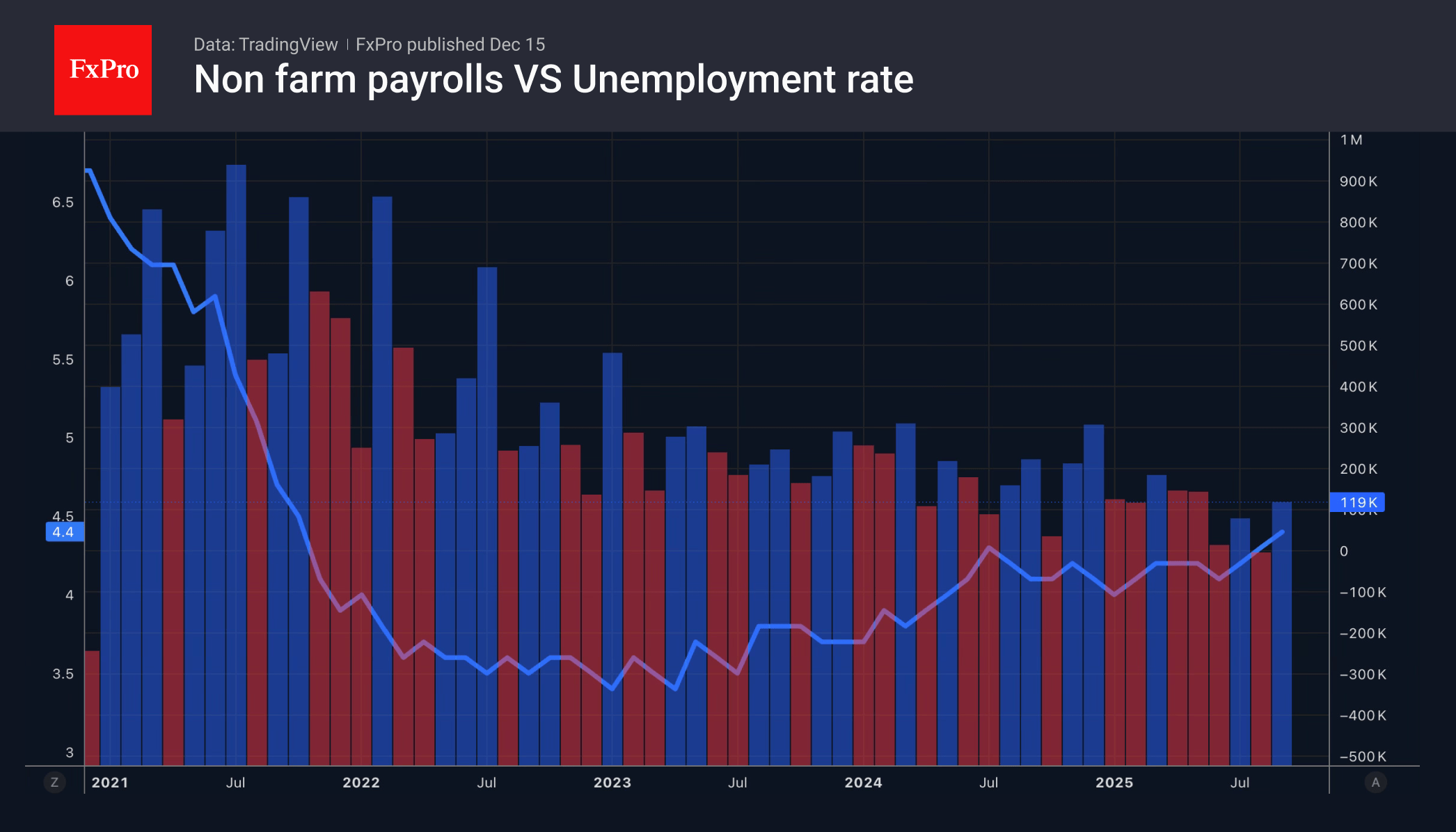

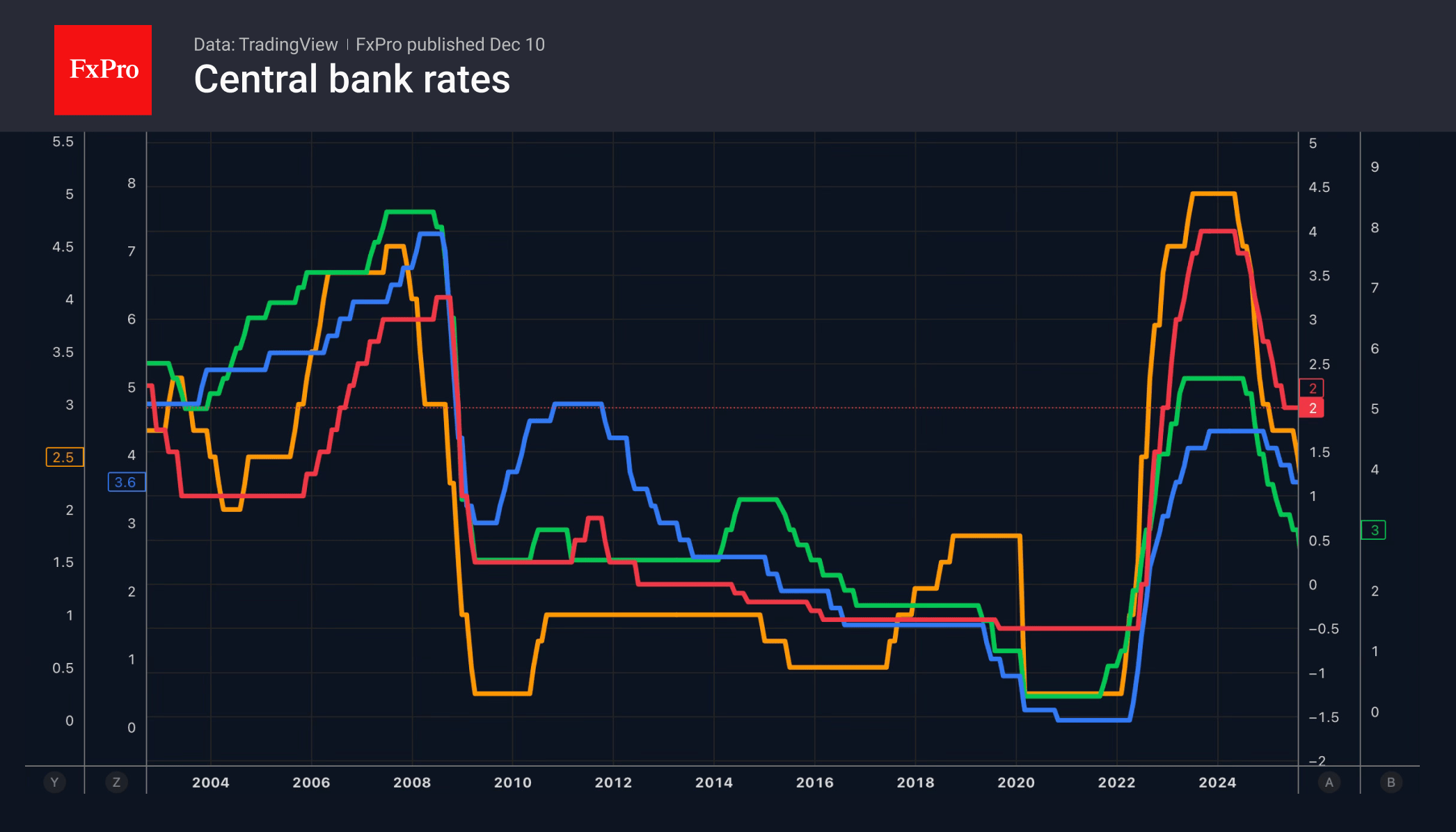

Trump pushes for more Fed rate cuts, while no changes are expected from the ECB until 2027. The BoE is concerned about the weak economy, while the yen has become a plaything for carry traders.

December 12, 2025

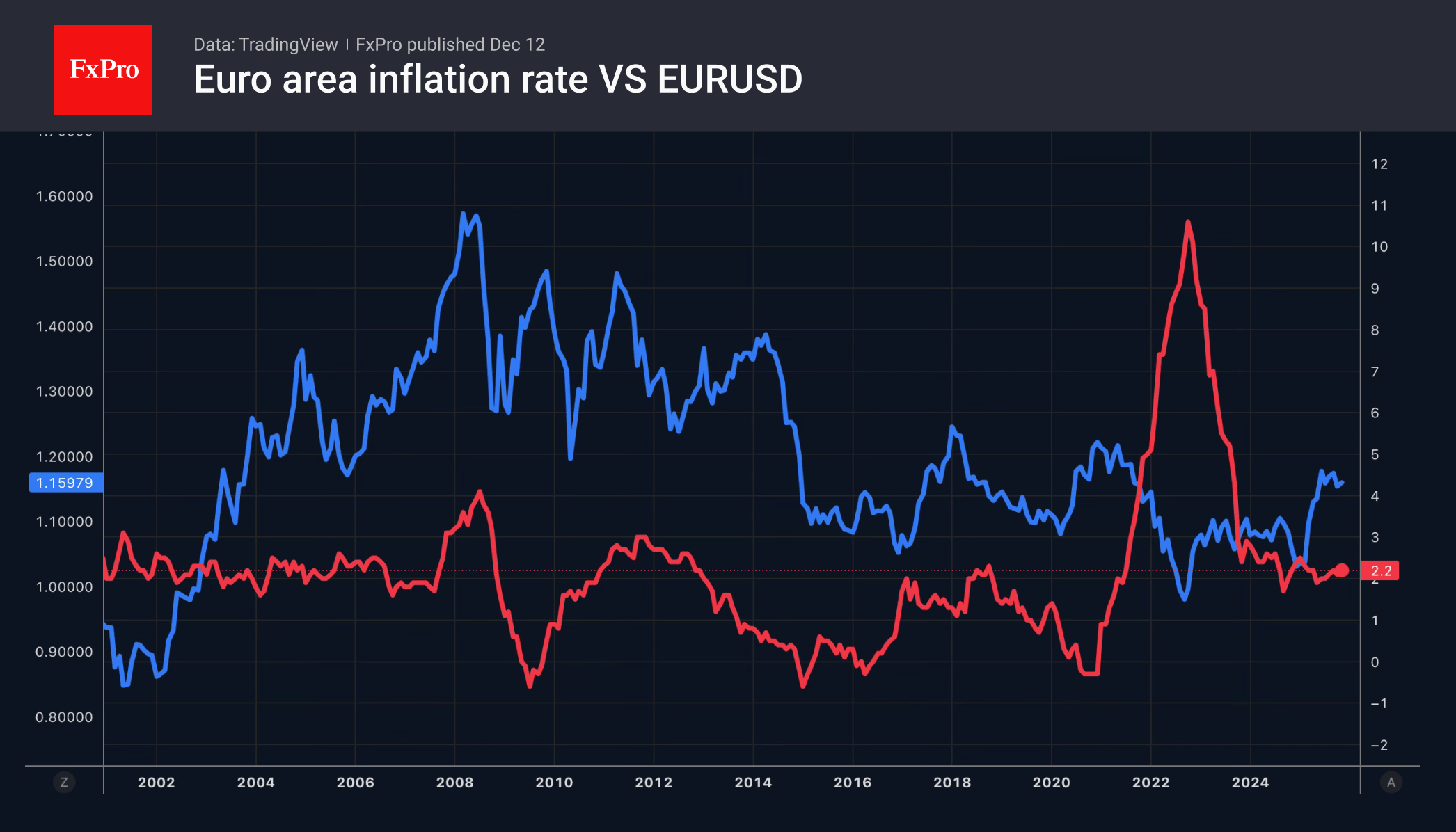

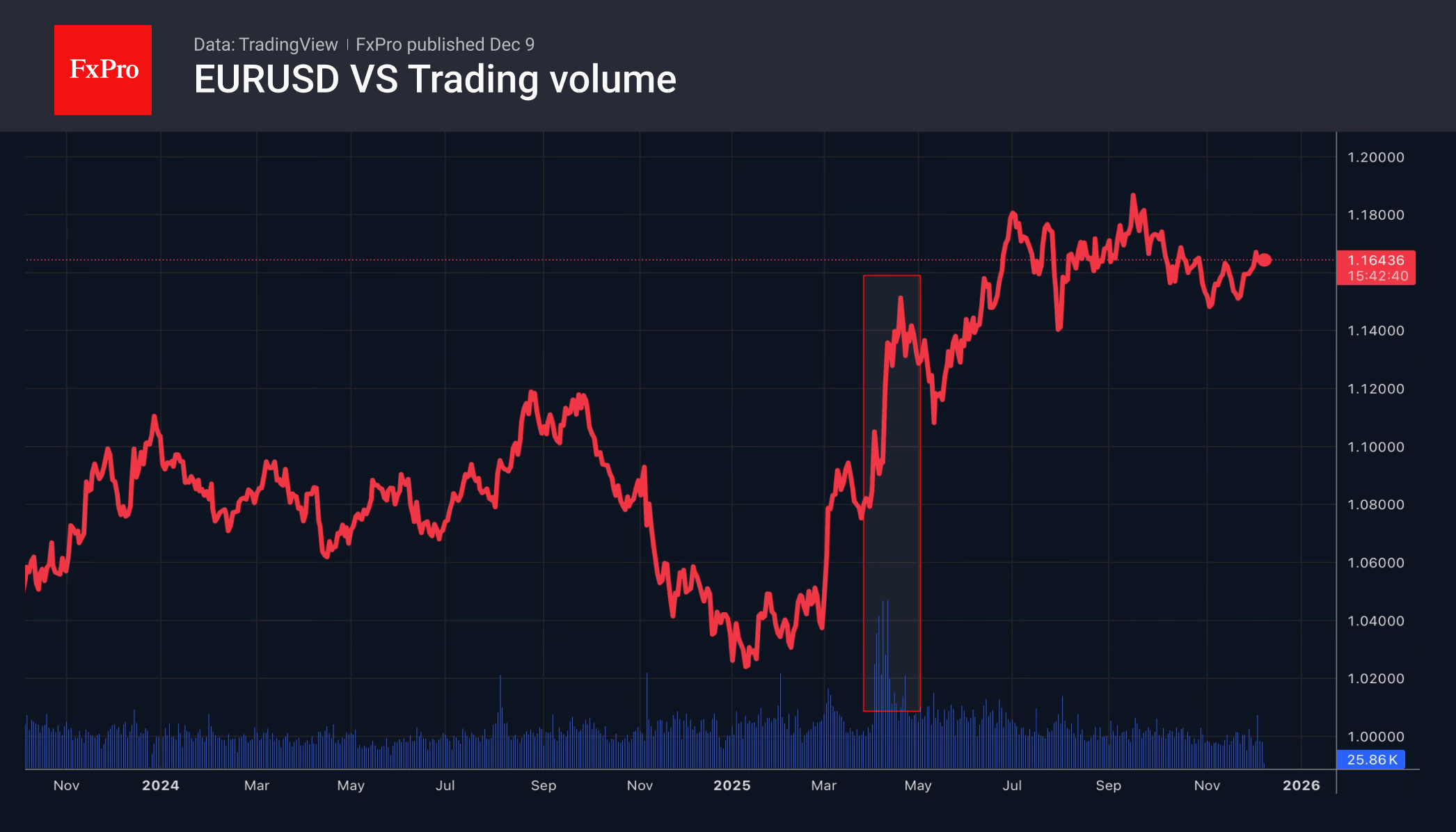

The ECB is weighing the strengths of the euro, and the US jobs report will determine the path of EURUSD. Switzerland and Canada are satisfied with the current interest rates.

December 11, 2025

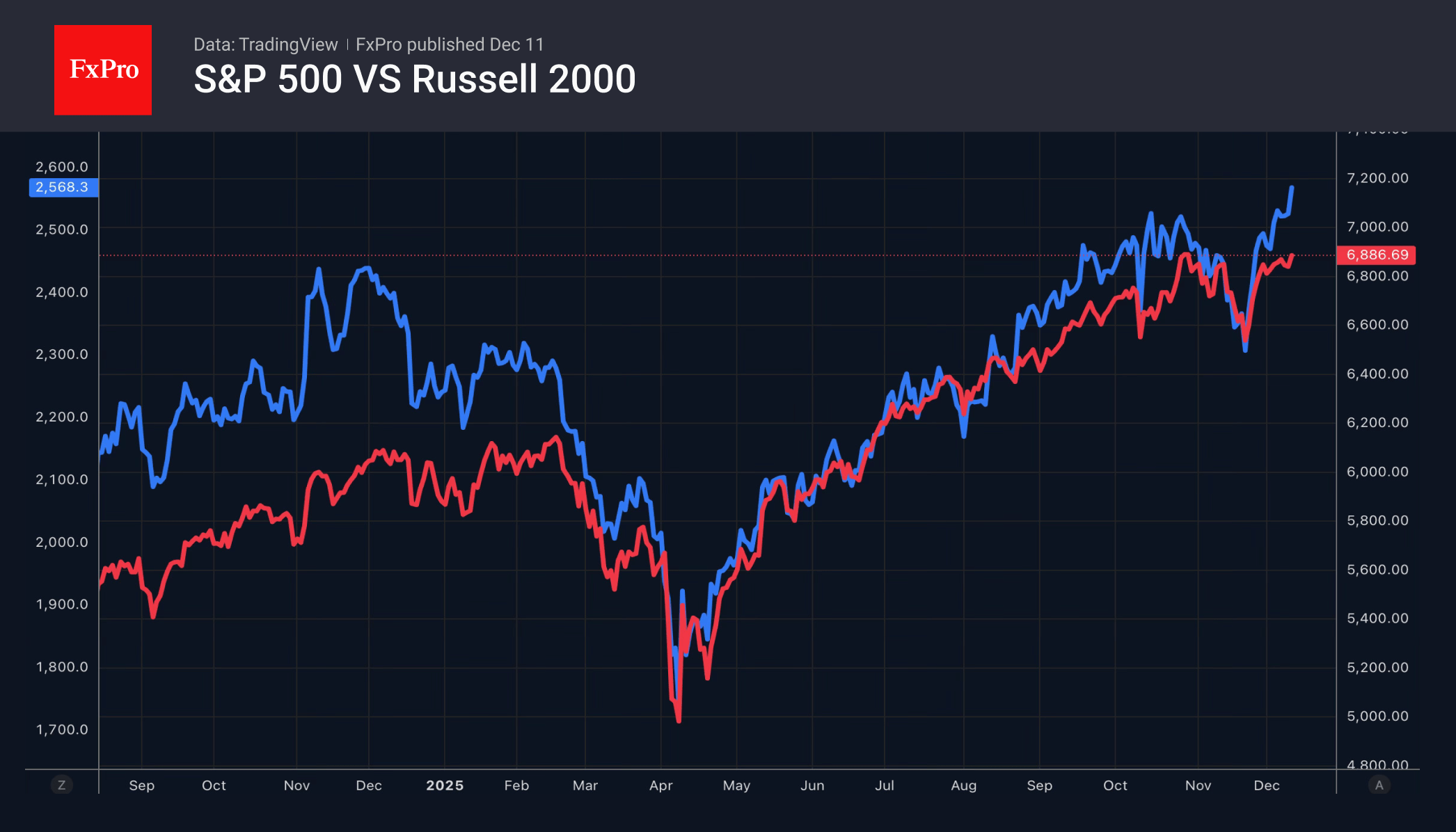

Stock indices The Fed managed to please the American stock market by easing its policy and forecasting an increase in GDP from 1.8% to 2.3%, as well as a slowdown in inflation from 3% to 2.5% in 2026, while also.

December 11, 2025

The Fed lowered rates to 3.50–3.75% and resumed asset purchases. The CHF is gaining on lower tariffs, while the GBP is relying on hawkish BoE.

December 10, 2025

While some central banks are signals end of easing cycle, the Fed intends to continue. The USD remains stable as the White House confirms the Fed's independence.

December 9, 2025

Tariffs have changed the status of the dollar, and the Fed may help it. The ECB and RBA could hike rates in 2026.

December 9, 2025

Gold retreats on Fed’s hawkish stance; high ETF demand and Chinese purchases sustain prices, but easing may slow gains.

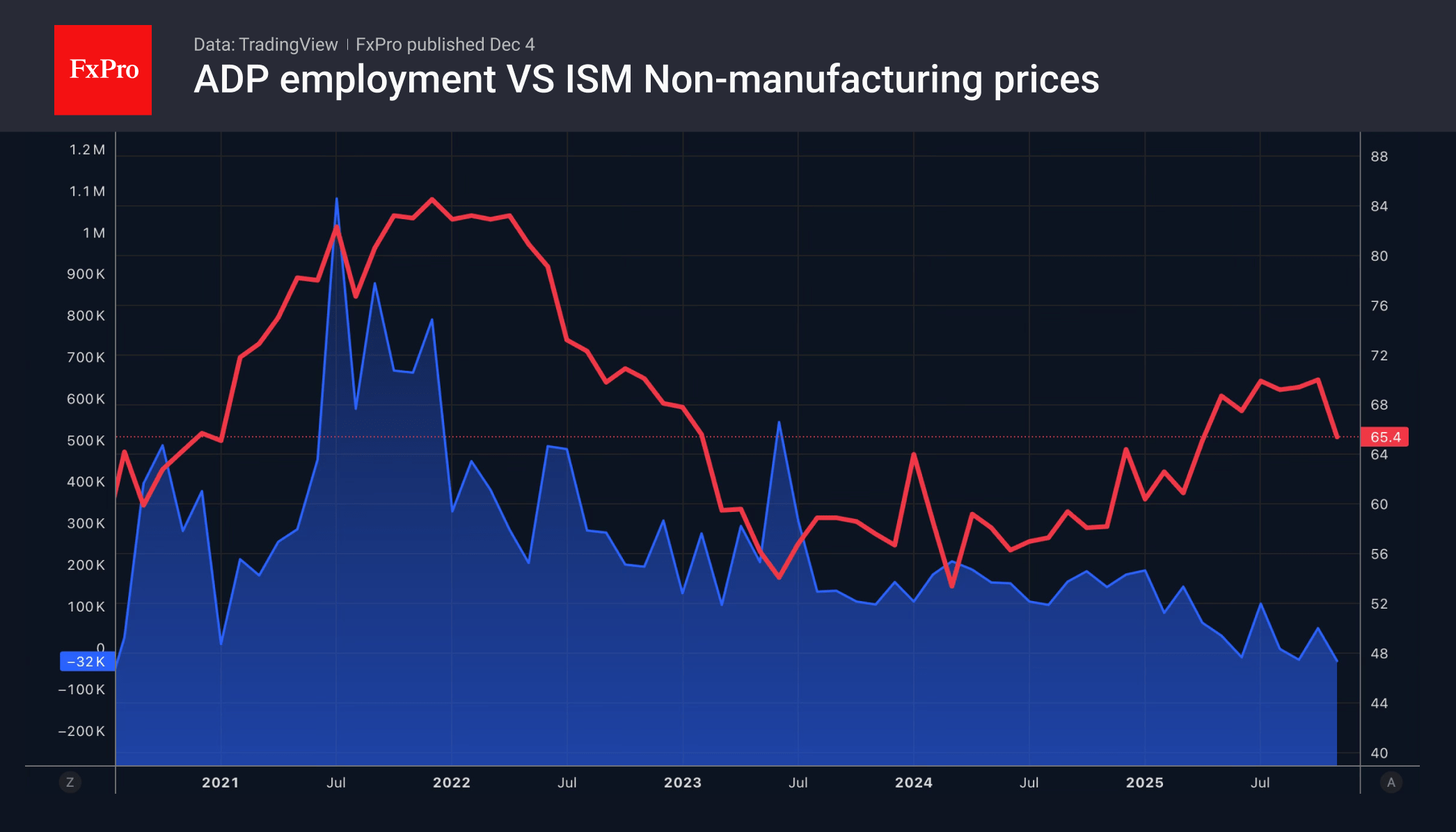

December 8, 2025

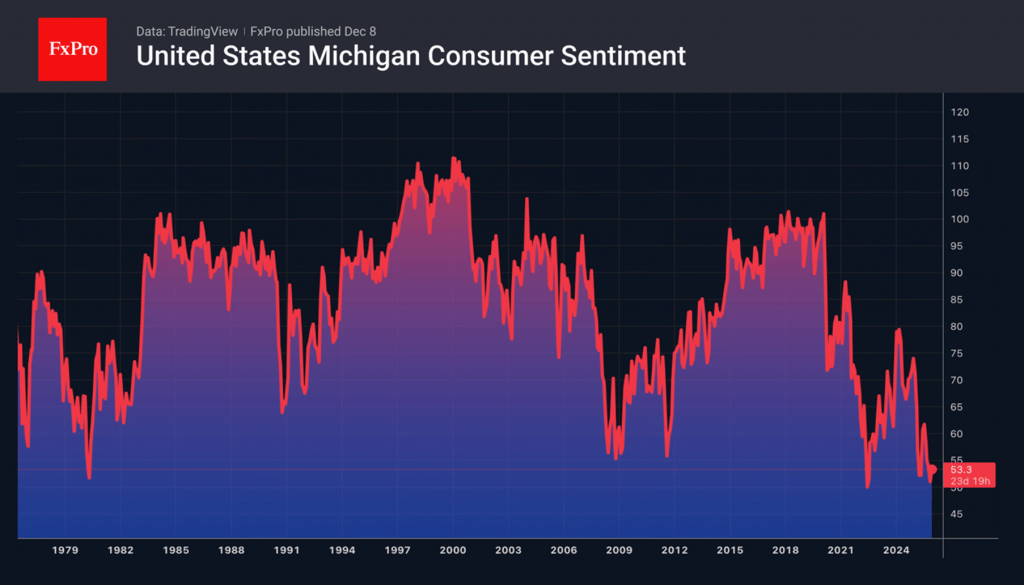

Americans are unhappy with high prices and tariffs and are sceptical about the economic outlook, but they continue to spend money. The University of Michigan Consumer Sentiment Index rose to 53.3 in December, driven by optimism about the end of.

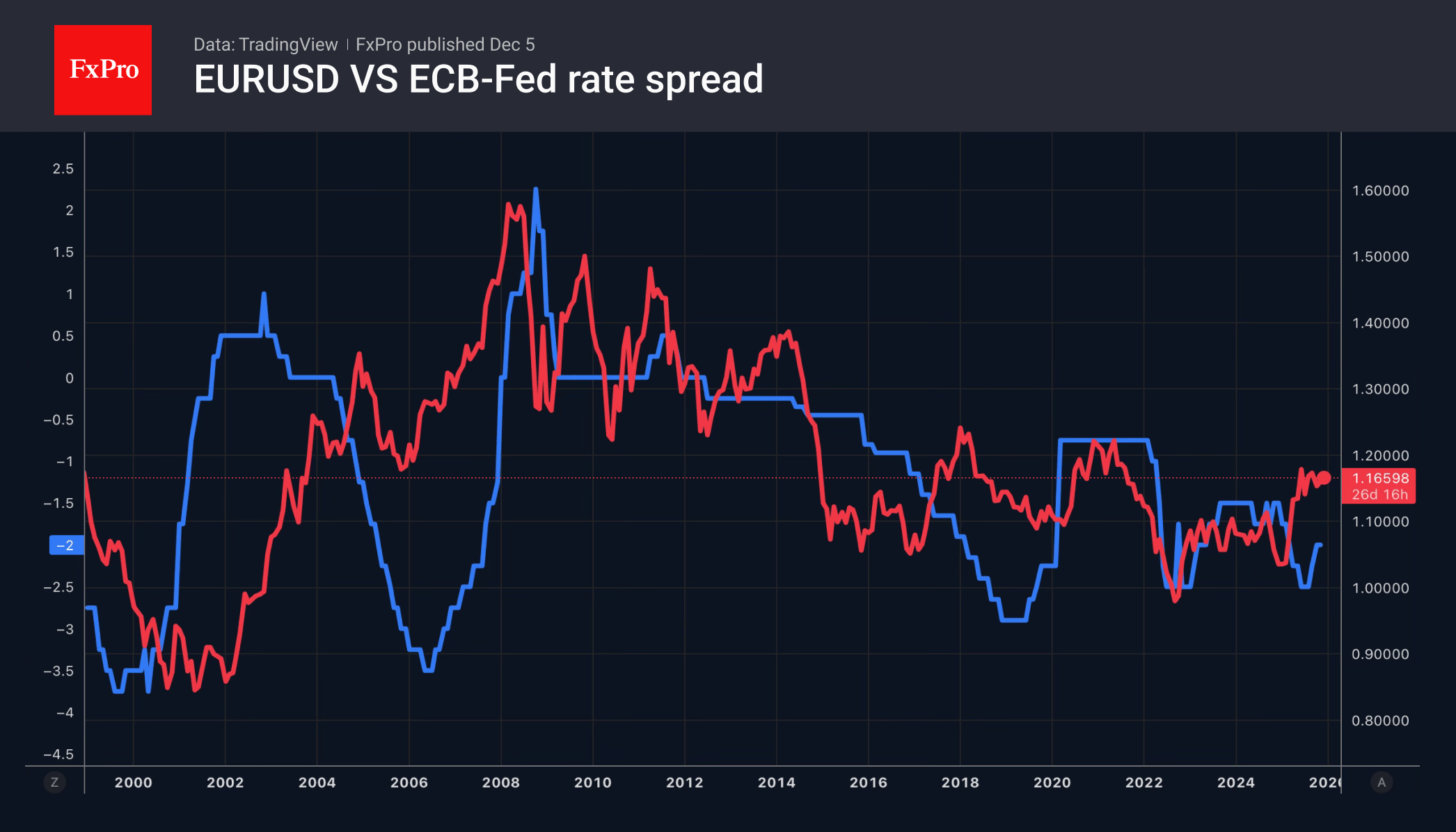

December 5, 2025

In 2026, experts favour the yen, see modest euro growth, and expect pressure on the franc, with Fed policy still key for the dollar.

December 4, 2025

The euro strengthens on improved business activity and stable policy, while the US dollar weakens amid rate cut prospects and economic vulnerabilities.