Market Overview - Page 57

February 8, 2024

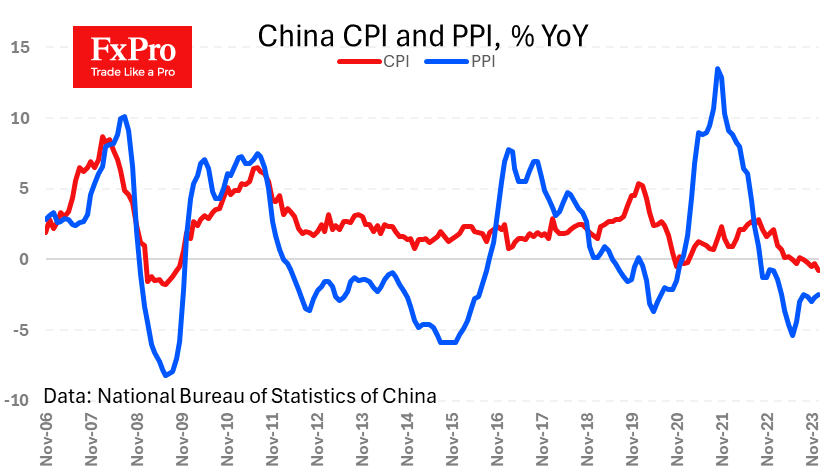

Inflation in China remains below expectations, adding to investor concerns about the world’s second-largest economy. The consumer price index for January was 0.8% lower than a year earlier, more than the 0.3% drop in December and the 0.5% expected. Recall.

February 7, 2024

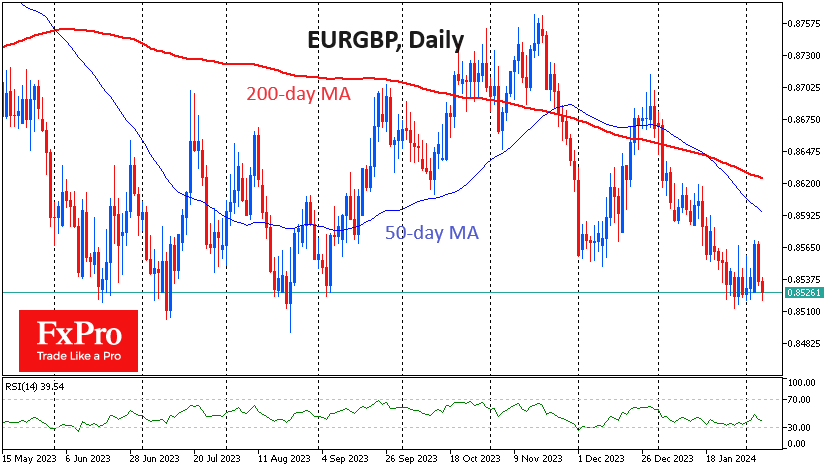

The euro is back at 0.8520 against the pound. The pair bounced off this level in June and August last year. Reaching the same level in late January triggered a shake-out, but active declines resumed on Tuesday and Wednesday, and.

February 6, 2024

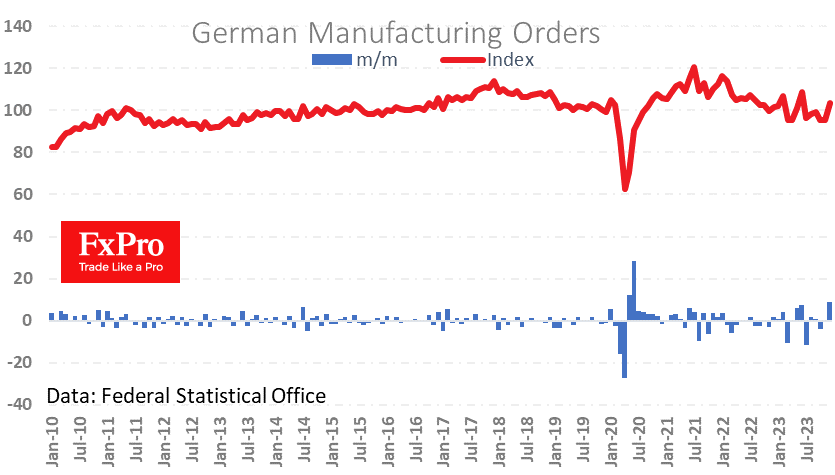

Industrial orders rose 8.9% in December against expectations for a 0.1% decline, a rare positive for Germany that the euro chose to ignore. This is the most robust monthly increase since mid-2020’s lockdowns. In the same month last year, the.

February 6, 2024

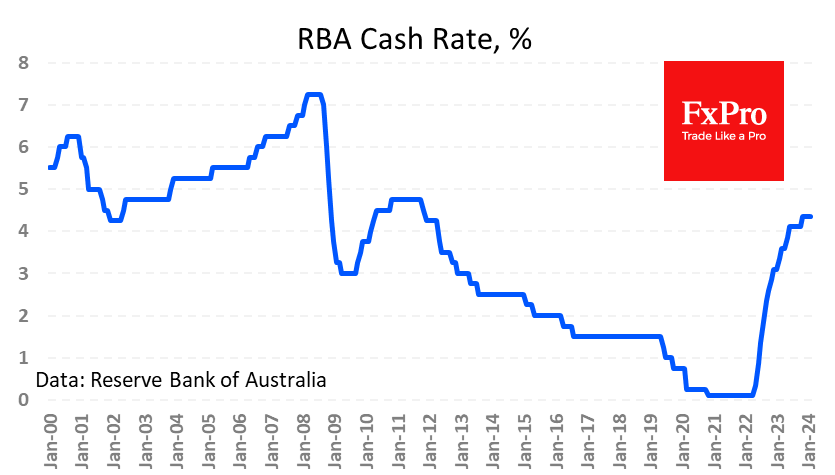

The Reserve Bank of Australia kept its cash rate unchanged at 4.35% for the third consecutive meeting. The markets widely expected the decision, but the tone of the accompanying commentary was more hawkish than the market had anticipated, adding to.

February 5, 2024

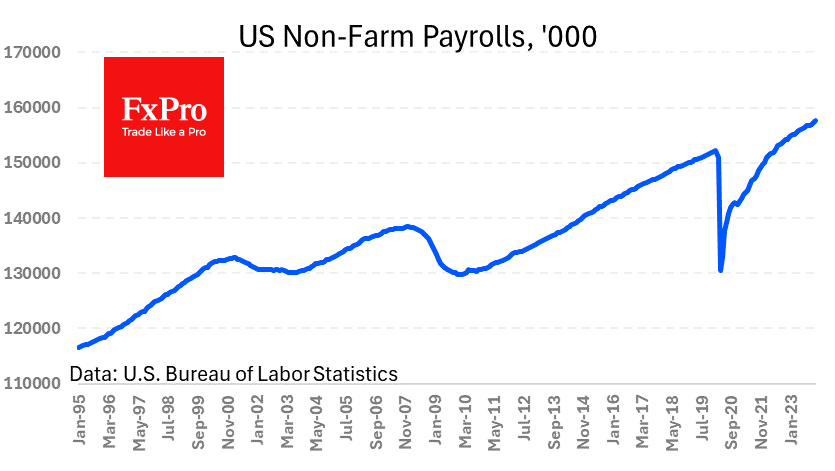

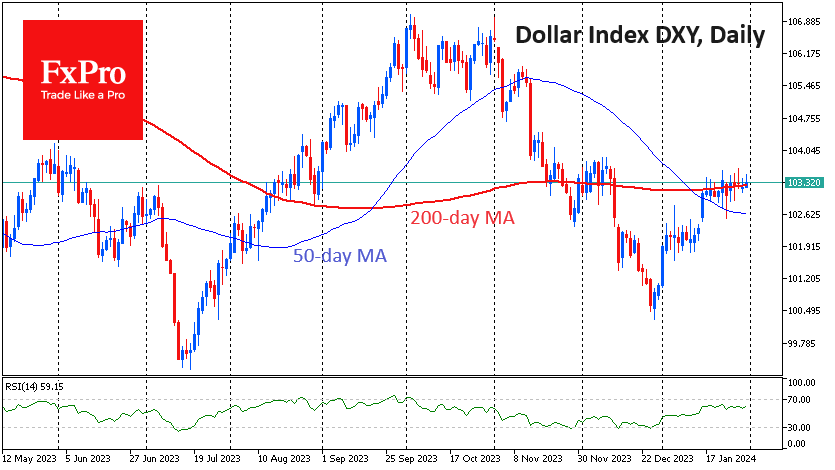

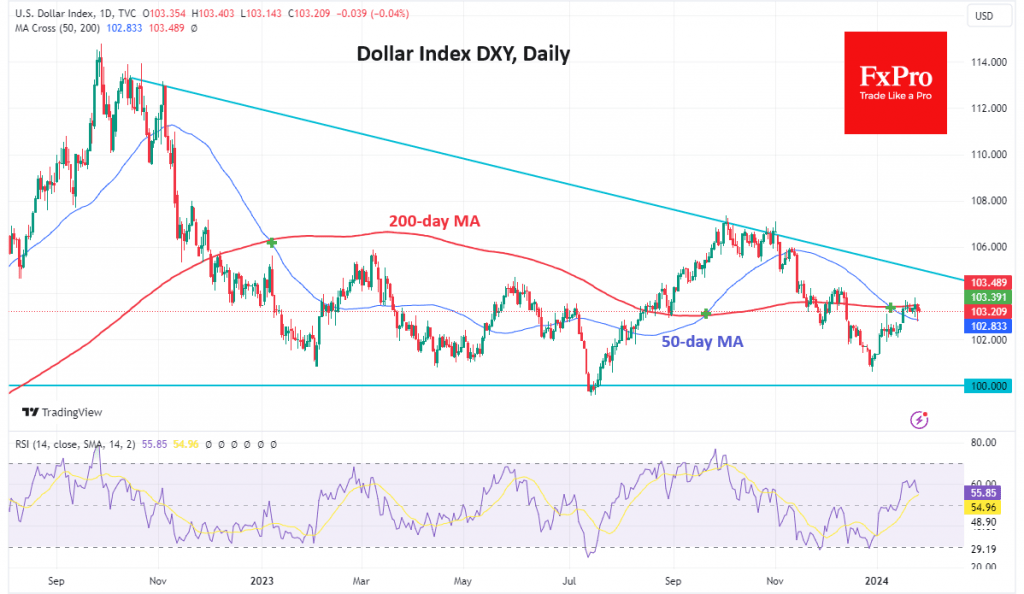

Friday’s US Non-farm Payrolls figures triggered a rally in the dollar. At the beginning of last week, the market also responded to the FOMC’s comments with dollar buying. In other words, the two main market drivers were working in the.

February 2, 2024

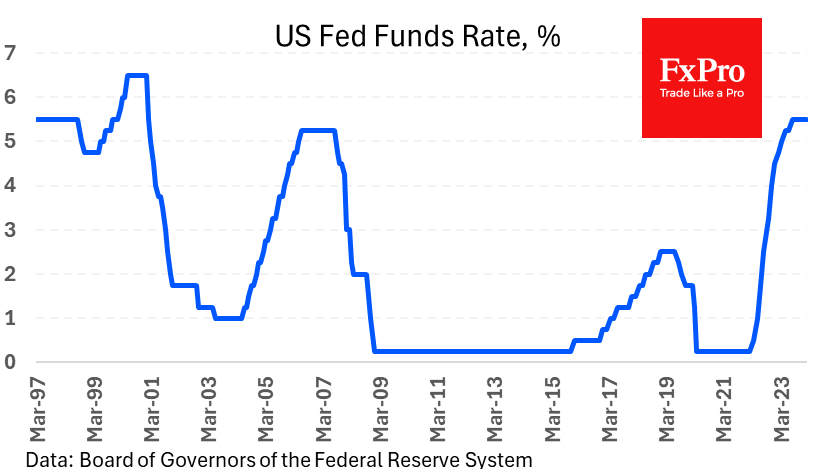

The US Federal Reserve left its key interest rate unchanged but altered its rhetoric, suggesting that the next step will be an easing of policy. At the same time, Powell went out of his way to tamp down expectations of.

January 31, 2024

The pause in the currency market is dragging on. Over the past two weeks, the Dollar Index has risen 0.15%, although intraday volatility has been within normal limits. This is by no means a balanced market but rather a manifestation.

January 30, 2024

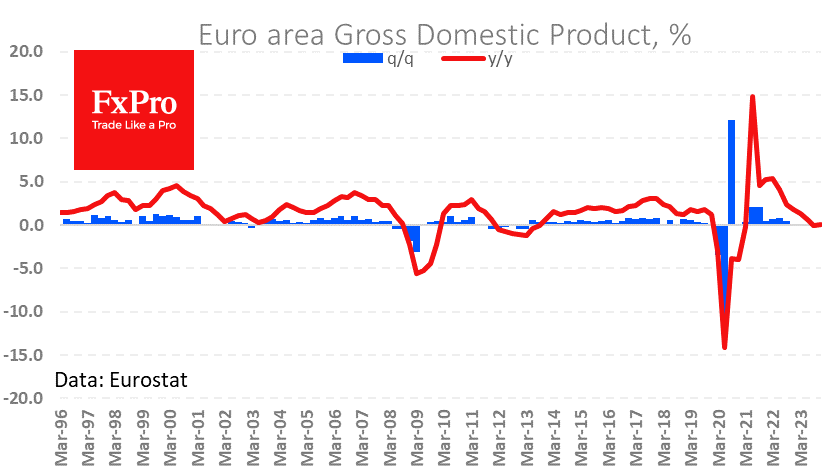

It’s not often that Europe produces better-than-expected economic data these days, and today was a rare exception. According to preliminary estimates, eurozone GDP was virtually unchanged in the final quarter of last year, compared with an expected contraction of 0.1%..

January 30, 2024

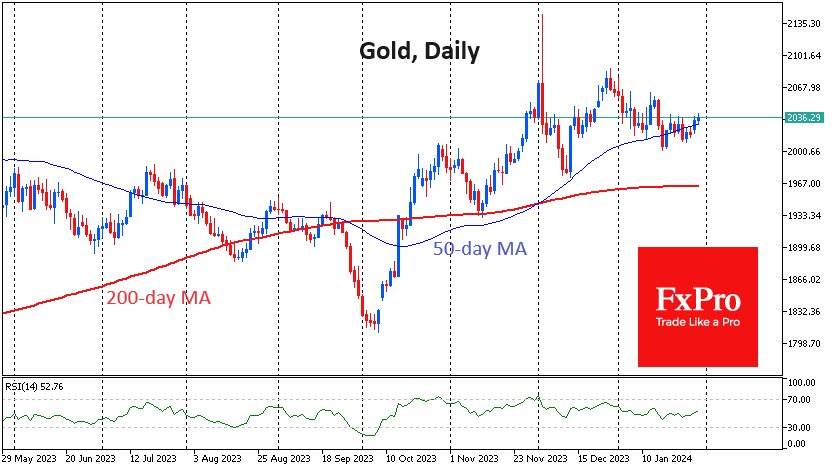

Gold rose to $2,040 per troy ounce on Tuesday morning, a two-week high. The positive momentum is being driven by risk appetite on global platforms. One of the reasons for the increase in demand for the metal could be the.

January 26, 2024

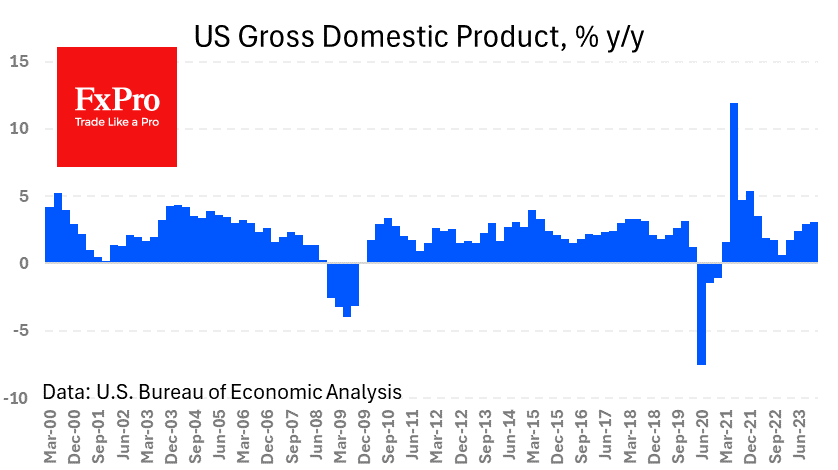

America continues to release strong macro data, with a fresh batch of GDP and New Home Sales figures coming above expectations, supporting dollar-buying interest late in the day. The US economy grew at an annualised rate of 3.3% in the 4th.

January 25, 2024

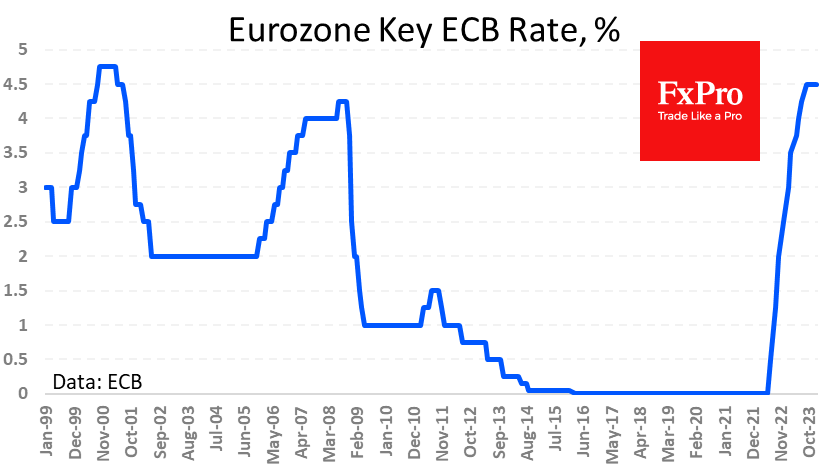

The European Central Bank left monetary policy unchanged, keeping the key rate at 4.5% since September. Much of the focus of the Q&A session revolved around the timing of the first decline, with commentators trying to figure out whether June.