Market Overview - Page 55

March 1, 2024

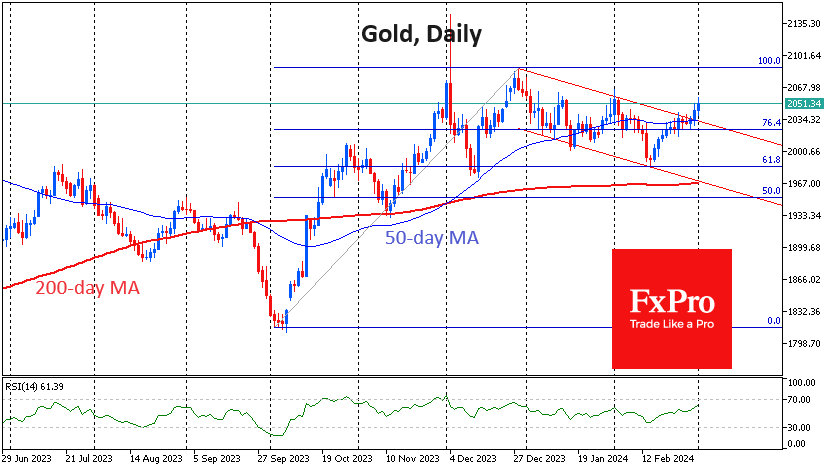

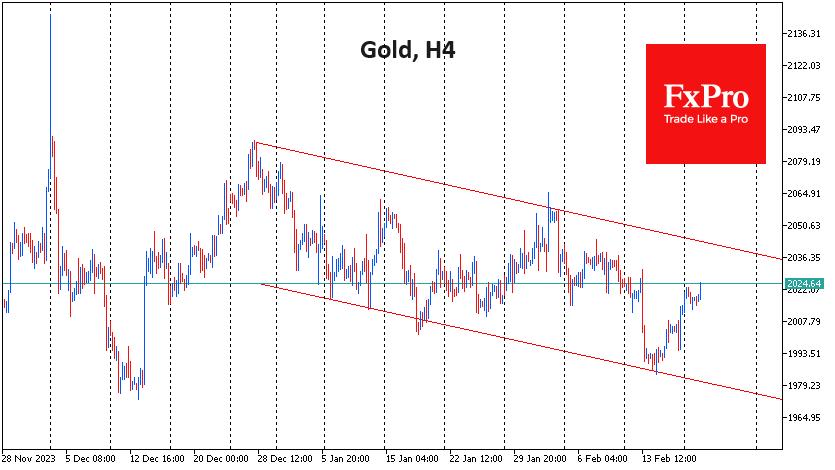

Gold has gained less than 1% over the past two days, but the gains are significant because they mark a break in the downtrend since late December. Thursday’s and Friday’s gains also reaffirm gold’s ability to rise above its 50-day.

February 29, 2024

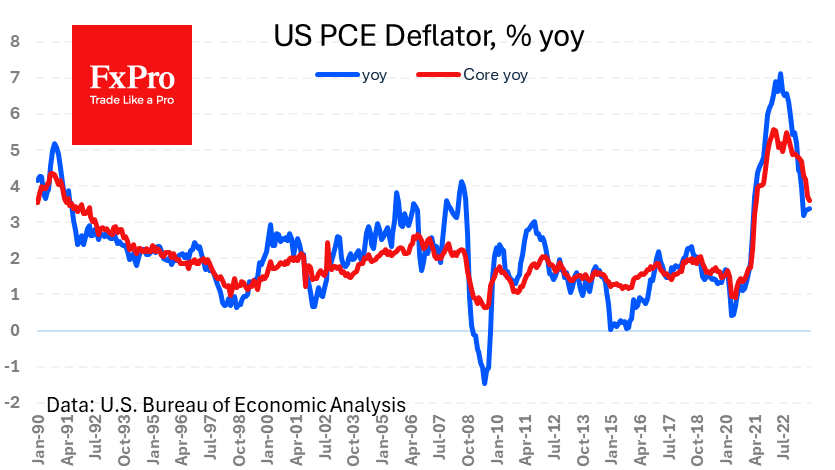

This week, the markets were mostly looking forward to the release of the US personal income and spending data, with a focus on the accompanying price index. The Personal Expenditure Price Index, excluding food and energy, rose 0.4% m/m and.

February 29, 2024

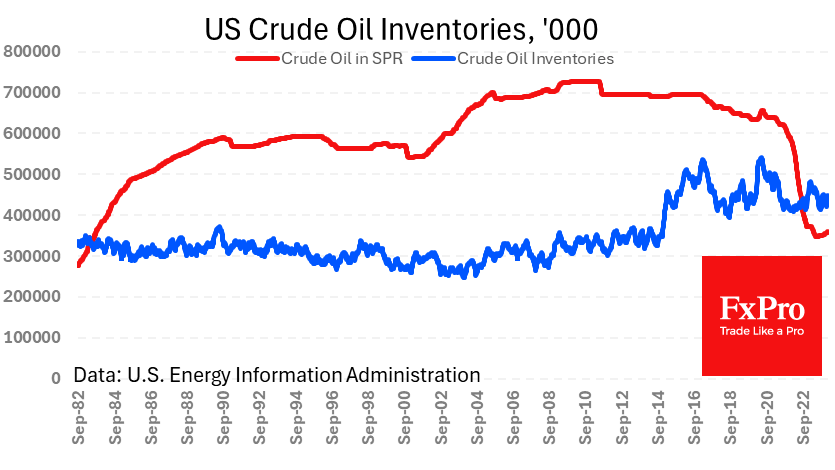

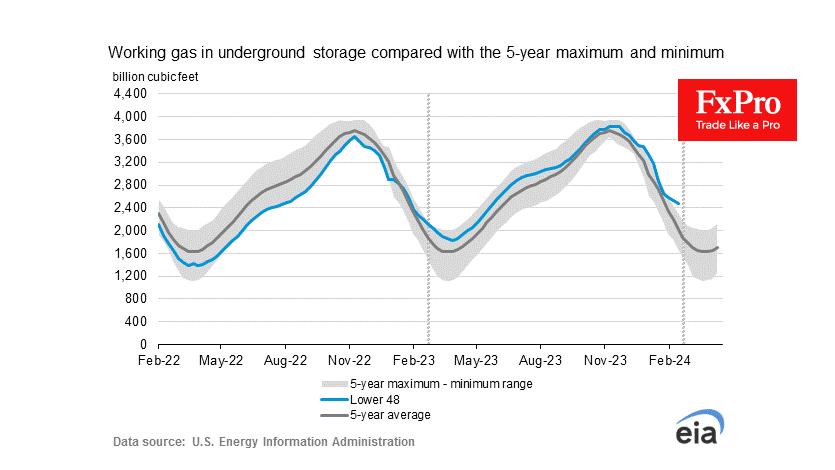

America continues to build up its oil reserves, albeit at a relatively slow pace and from a low base. Last week, commercial oil inventories rose by 4.2 million barrels. About ¾ million barrels were added to the Strategic Petroleum Reserve,.

February 28, 2024

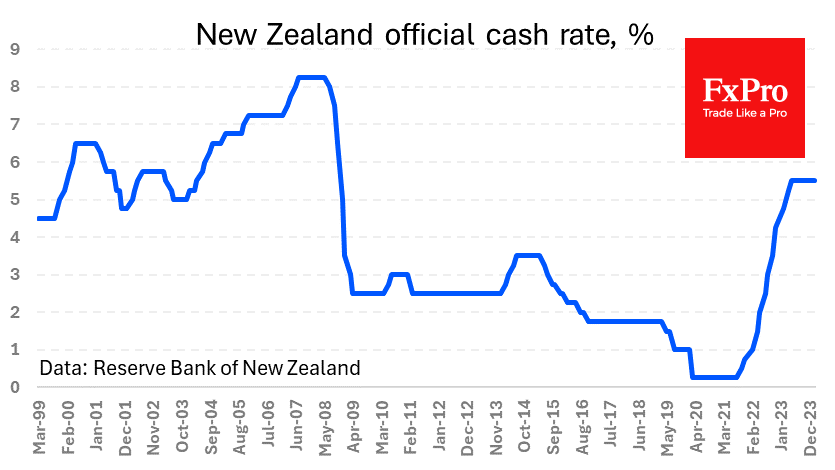

The New Zealand Dollar is down 1.2% since the start of the day on Wednesday due to disappointment with the RBNZ’s actions and comments. The country’s central bank left its key interest rate unchanged at 5.5% and signalled its willingness.

February 27, 2024

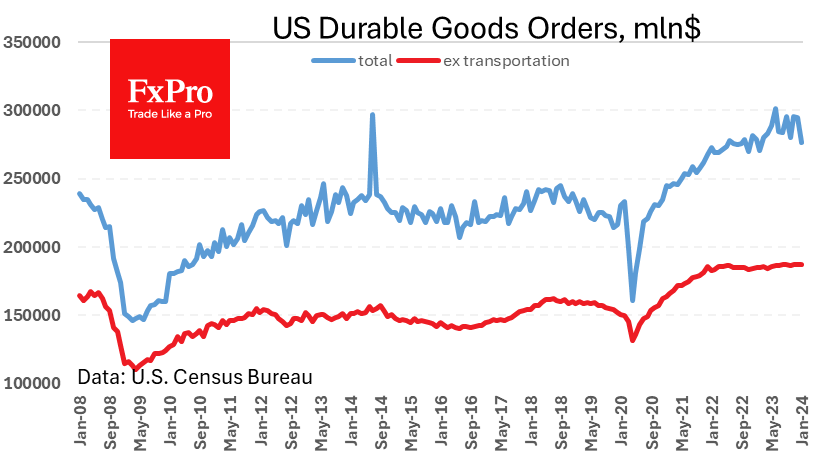

US durable goods orders decreased 6.1% in January after falling 0.3%. The cost of total orders in January was the lowest since September 2022, although it has been quite volatile in recent months due to transportation orders. This was worse than the.

February 27, 2024

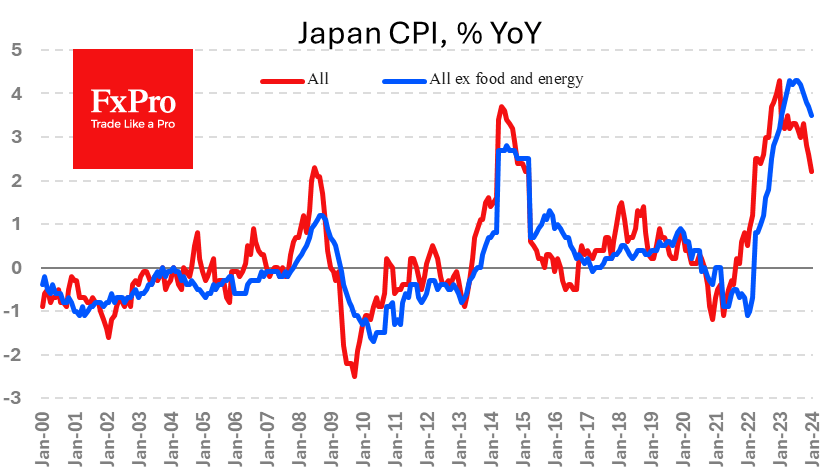

Japanese consumer inflation slowed from 2.6% y/y to 2.2% y/y in January. The data was slightly higher than the expected 2.1%, providing temporary support for the Yen, which rose 0.4% after the release, pushing USDJPY back to 150.10. Prices excluding.

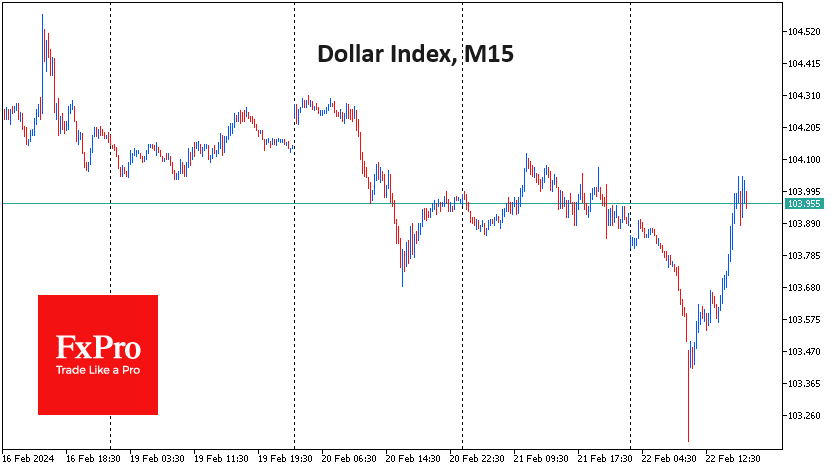

February 26, 2024

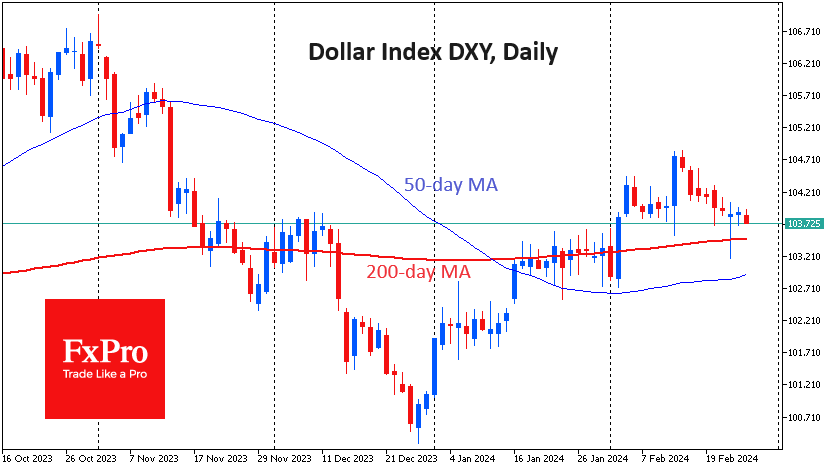

The Dollar Index is giving up positions painfully slowly. It is under pressure for the ninth session in a row, but at the same time, the market is unable to accelerate or break this downtrend. Individual currency pairs are now.

February 23, 2024

Oil is down 1.3% since the start of the day on Friday and remains on a tight leash around its 200-day moving average. The previous afternoon, oil managed to resist pressure from a strengthening dollar. It failed to make any.

February 22, 2024

Something important happened in the currency markets on Thursday. The initial and relatively sharp fall of 0.7% in the dollar index was reversed, and now, as trading begins in New York, we are seeing a strengthening to the day’s opening.

February 21, 2024

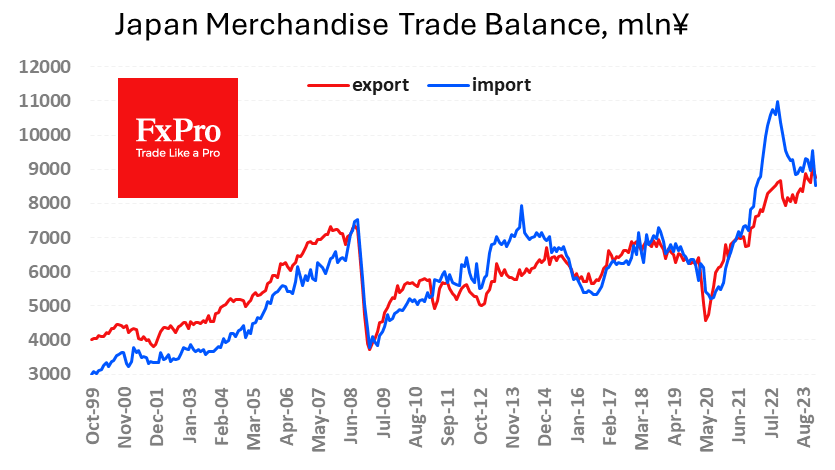

The impact of the Yen’s fluctuations was evident in the country’s latest external trade report. On a seasonally adjusted basis, January recorded the highest surplus in three years. The 235B yen ($1.57B) surplus of exports over imports represents 1.3% of total.

February 20, 2024

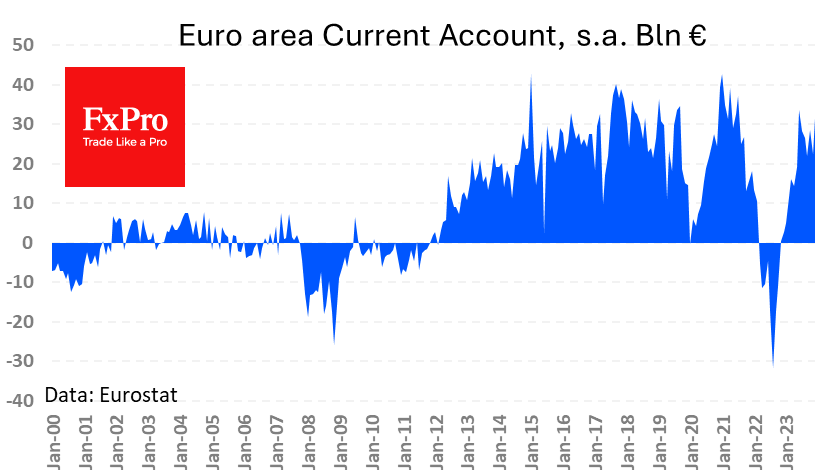

The eurozone’s current account surplus climbed to a six-month high of 31.9bn in December. Analysts, on average, had expected a decline to 20.3 bn from 22.5 bn the previous month. The current level was seen in the eurozone during the.