Market Overview - Page 5

January 7, 2026

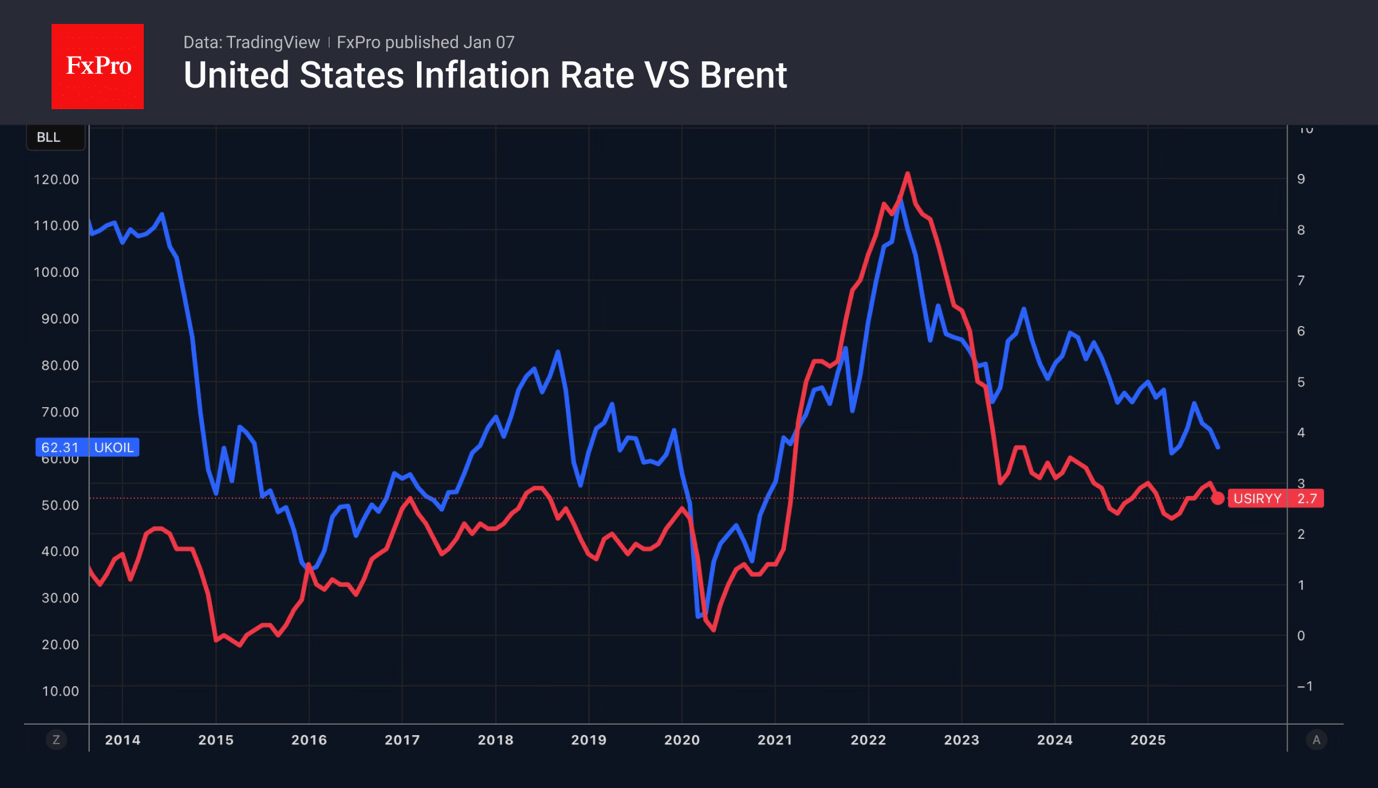

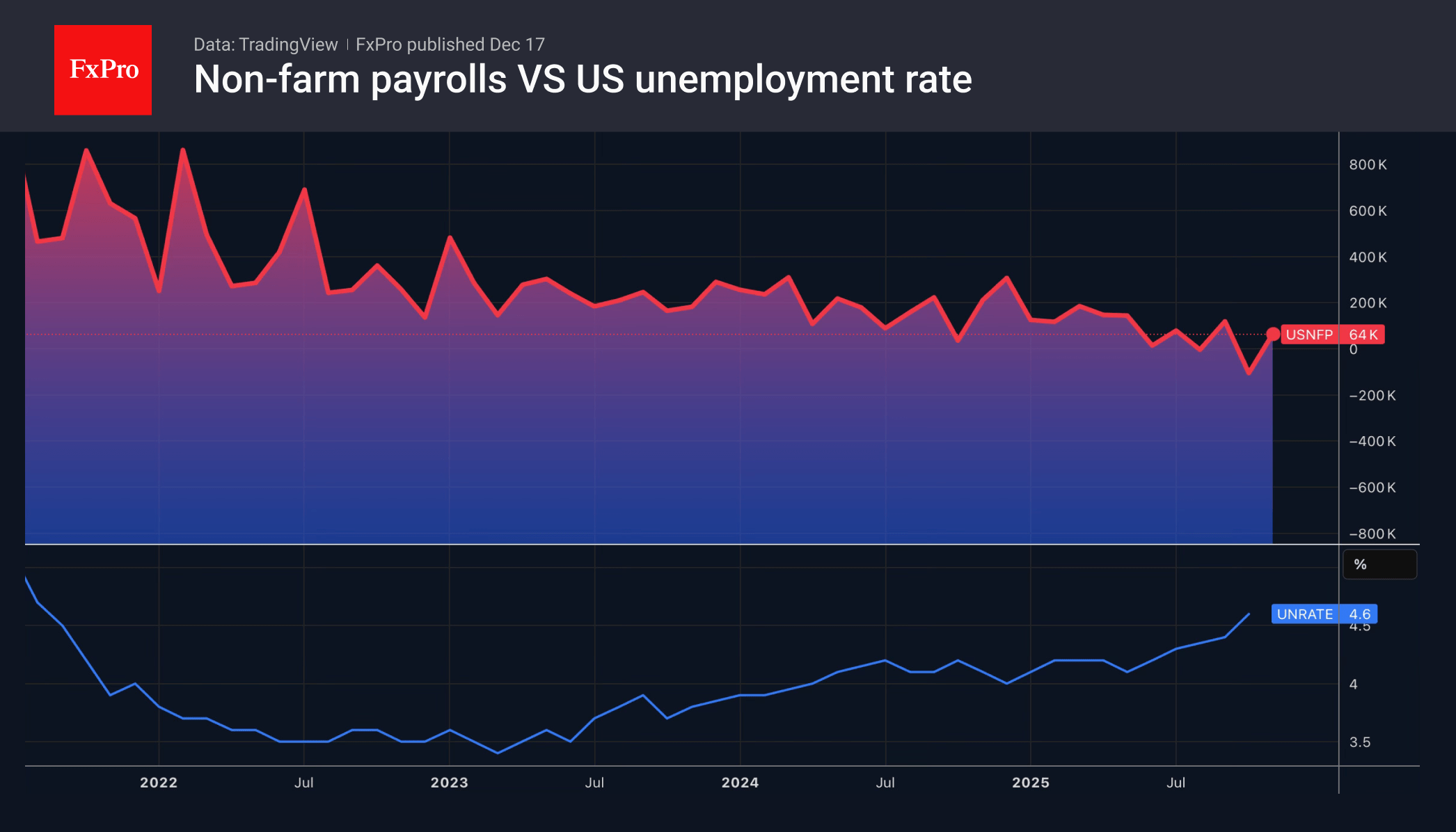

Buy the rumour, sell the fact. The strengthening of the US dollar is due to expectations of positive labour market statistics, a chance of another easing from the Fed in March fell to 45%, and demand for safe-haven assets in.

January 6, 2026

• The reduction in geopolitical risks in Venezuela has weakened the greenback. • Precious metal investors bought up the dip. The US dollar has been on a rollercoaster ride thanks to the retreat of geopolitical risks. Donald Trump said that the.

January 5, 2026

The rise in geopolitical risks against the backdrop of the kidnapping of Venezuelan President Nicolas Maduro by the US has increased demand for the US dollar as a safe-haven currency. Coupled with expectations of a prolonged pause in the Fed’s.

December 31, 2025

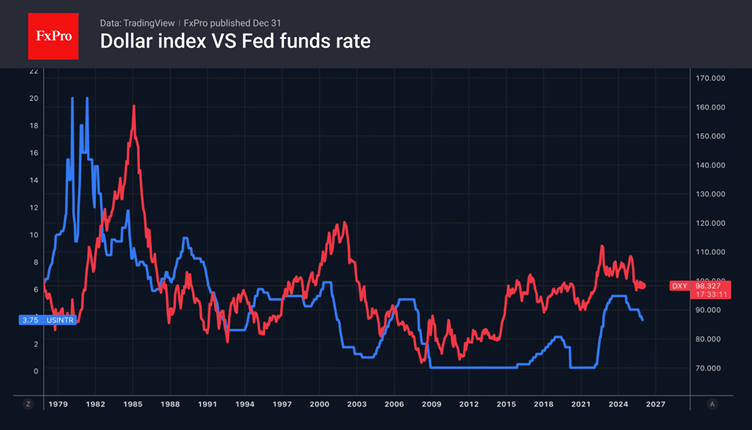

• The return of American exceptionalism will help the greenback. • The yen will start the new year with interventions, and the RBA with a rate hike. The US dollar ends 2025 with its worst performance in nearly a decade..

December 30, 2025

• Precious metal sell-offs shake investors. • Donald Trump renews criticism of the Fed. While major global currencies, led by the US dollar, are recovering very slowly after Christmas, the precious metals market has been rocked by a real thriller..

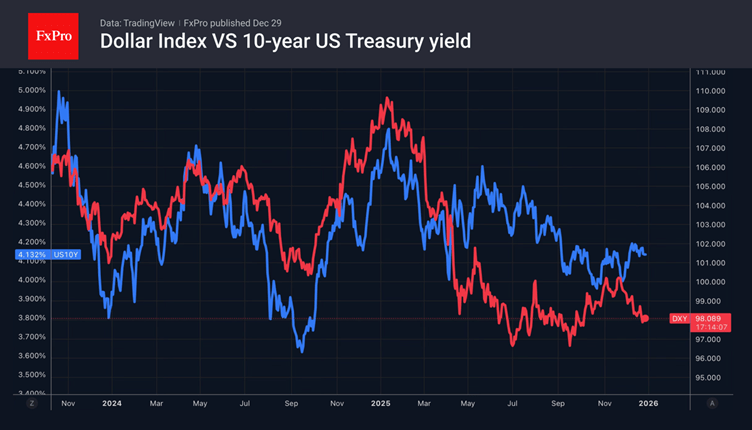

December 29, 2025

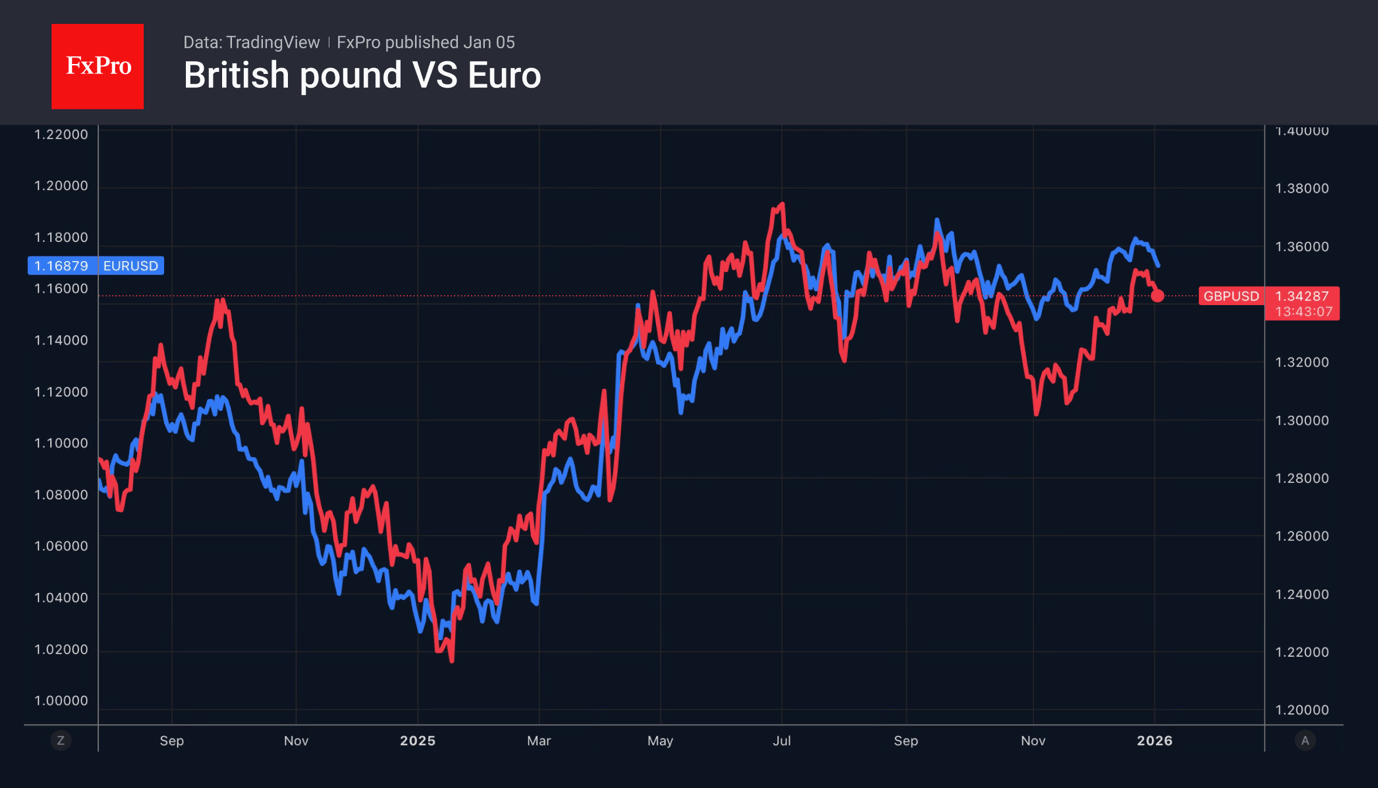

• Rapid GDP growth in the eurozone has helped EURUSD. • USDJPY risks rising to 164. Christmas week turned out to be the worst for the US dollar since June. Falling Treasury yields and new S&P 500 records caused the.

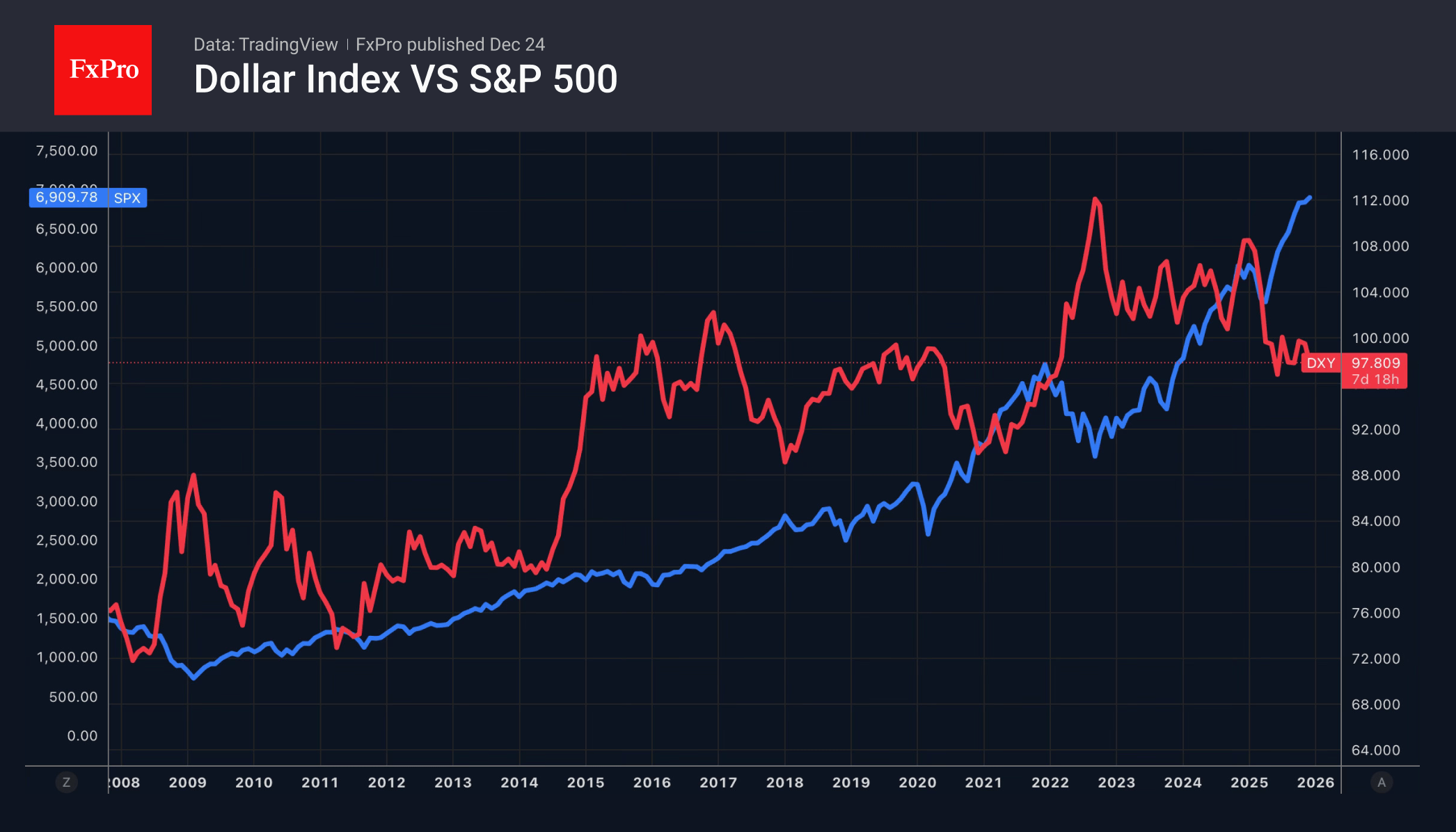

December 24, 2025

The US dollar is falling as a safe-haven asset amid growing risk appetite. Gold is performing well, but other assets in the sector are looking even better.

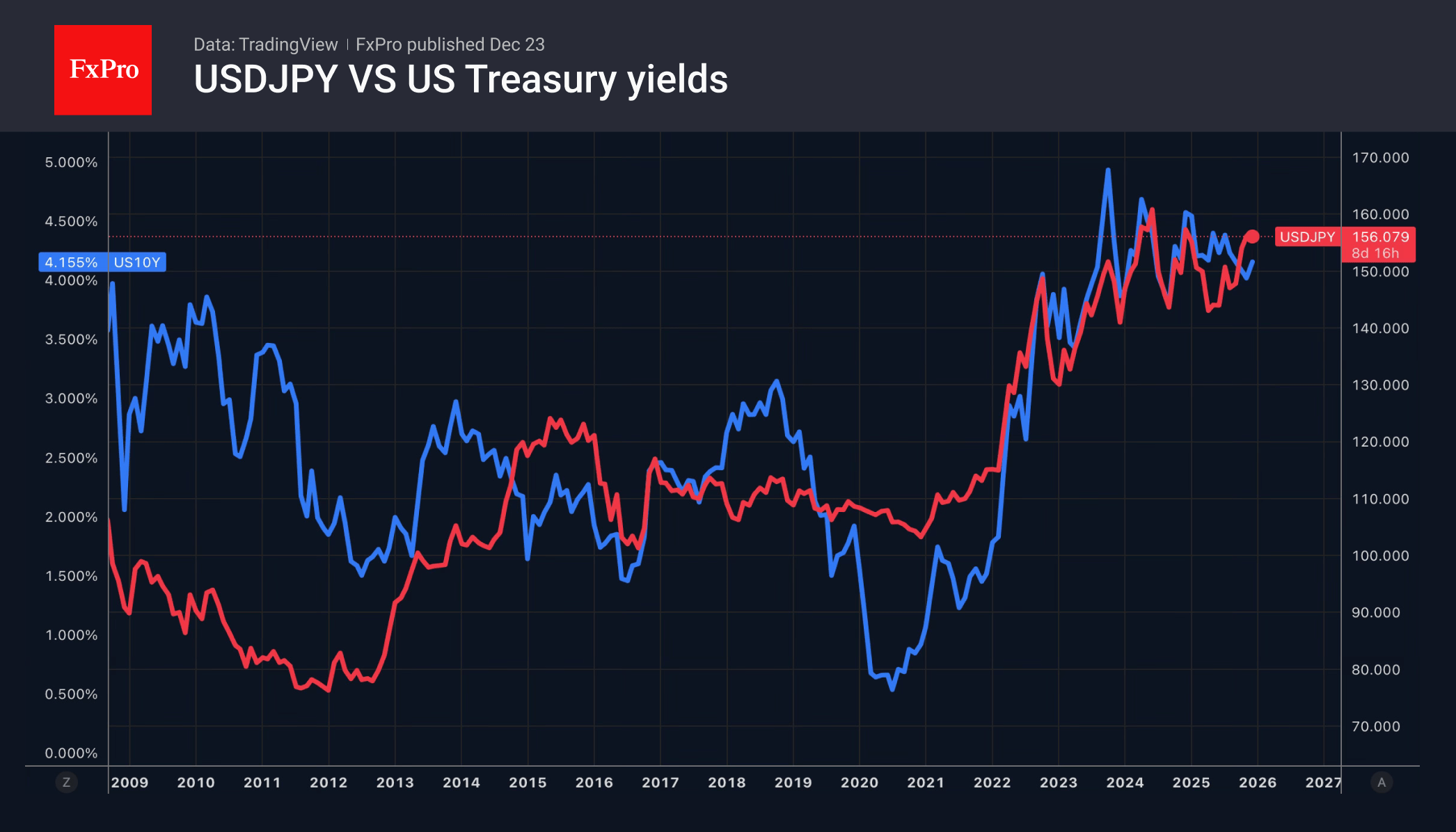

December 23, 2025

Verbal interventions by the Japanese government helped the bears on USDJPY. The weakness of the US dollar and the fall in Treasury yields allowed gold to set its 50th record in 2025.

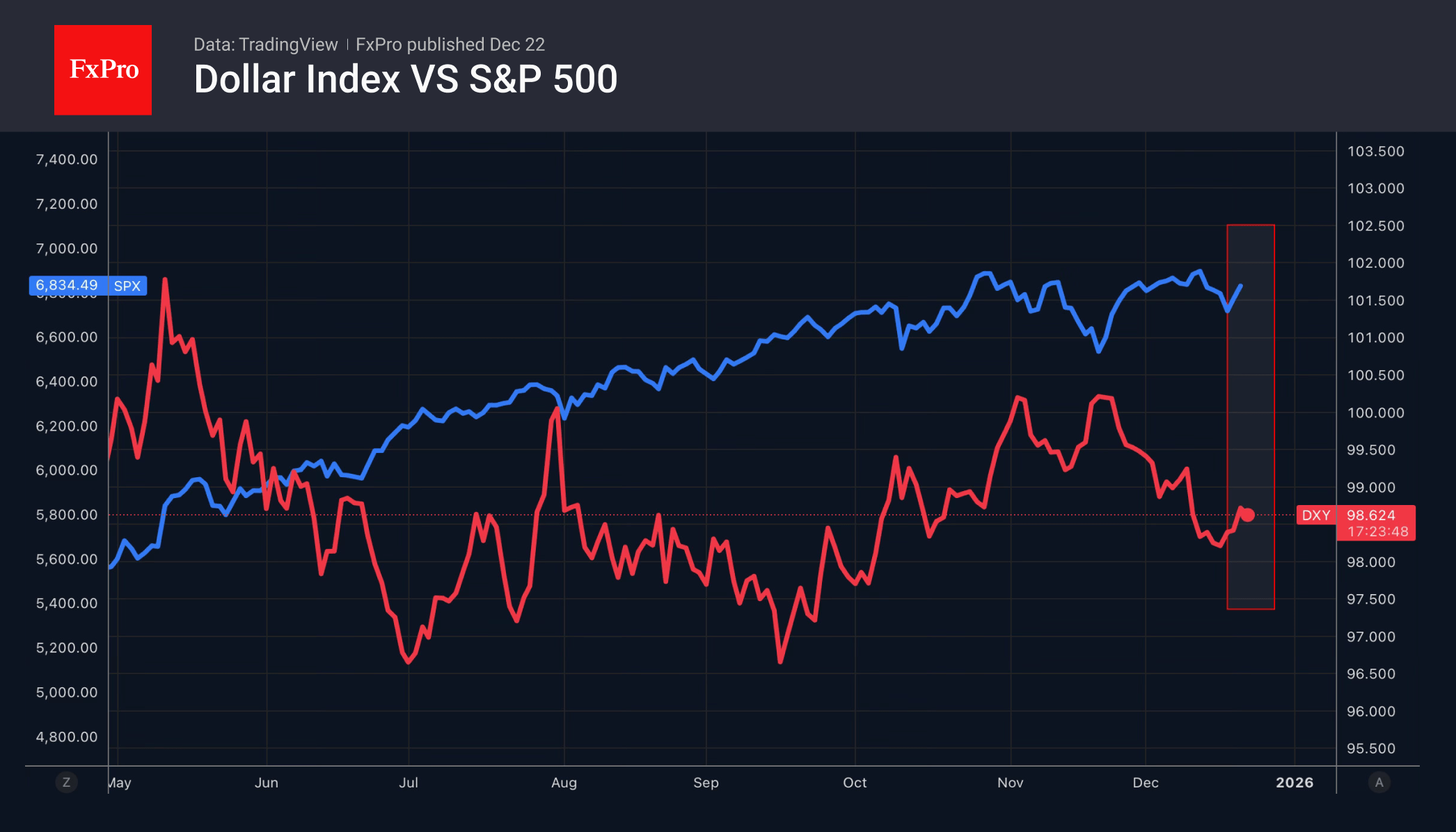

December 22, 2025

Gold hit a record high above $4,400 as US dollar strength and global risks drove investor demand; forecasts suggest gold could reach $4,900 in 2026.

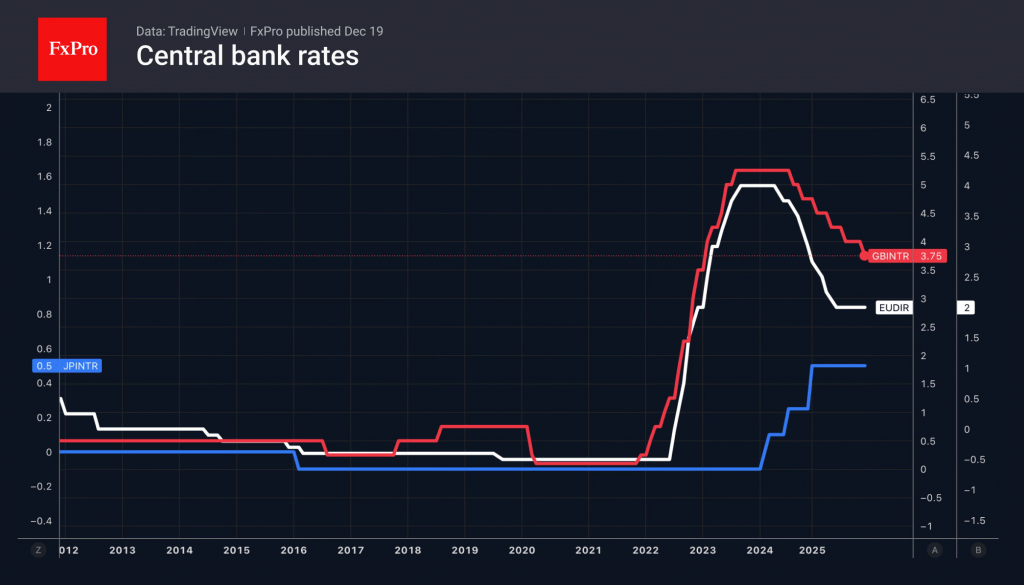

December 19, 2025

Central banks prefer to pause. The strengthening of the dollar prevented gold from reaching a record high.

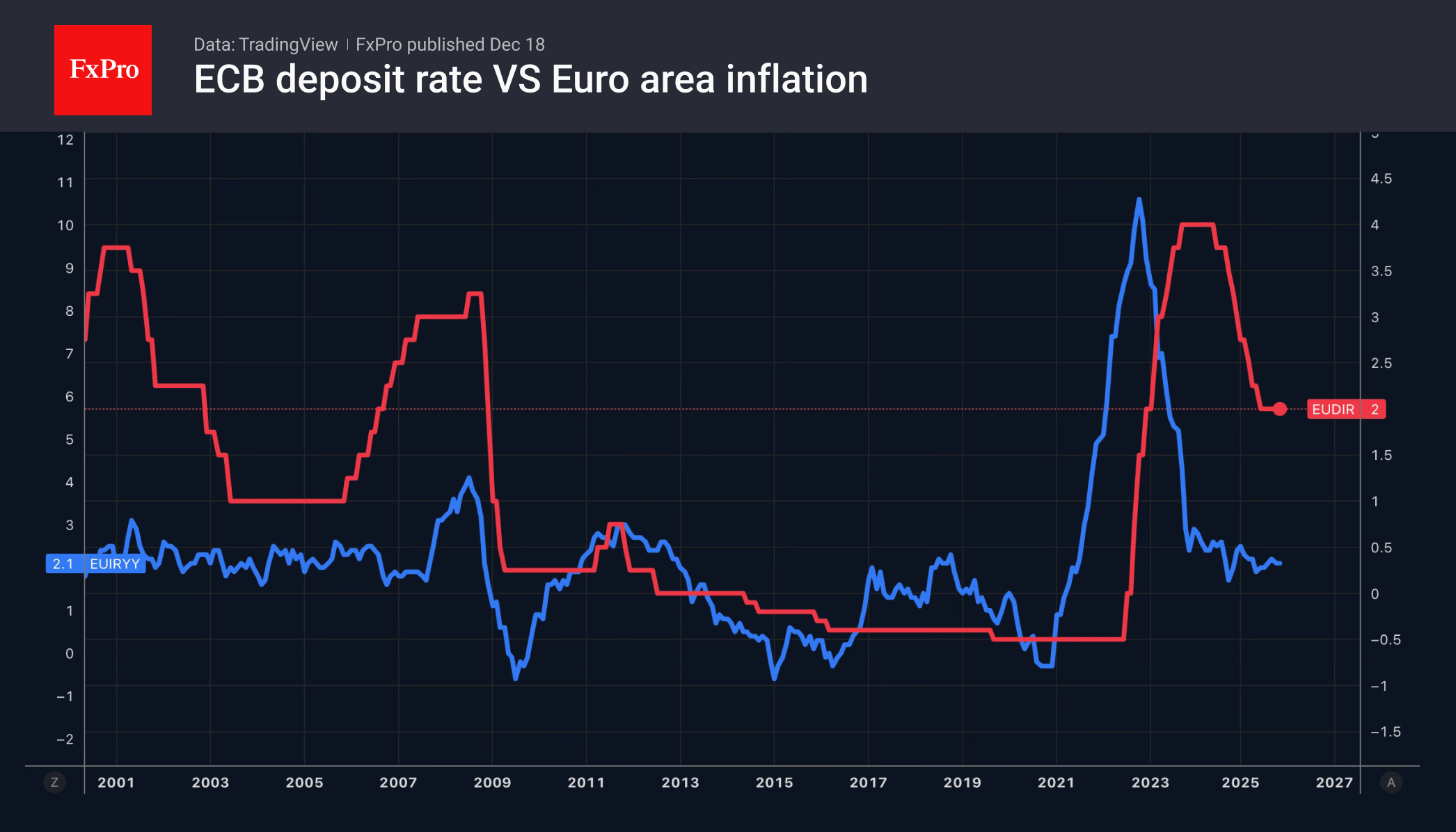

December 18, 2025

Waller's dovish rhetoric halted the bears' attack on EURUSD. Slowing UK inflation caused the pound to fall, while the BoJ is preparing to raise rates.