Market Overview - Page 49

May 29, 2024

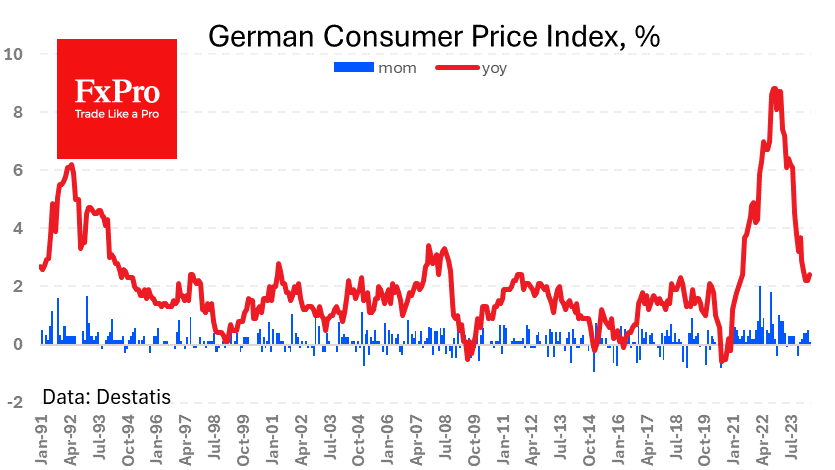

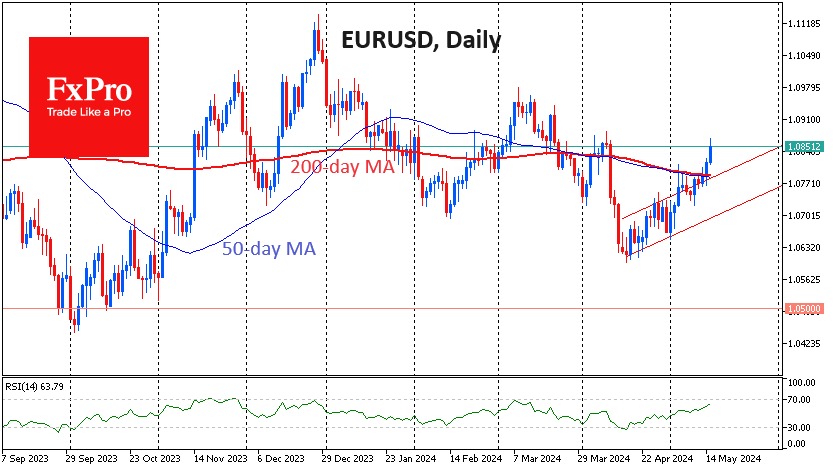

German inflation confirmed an acceleration. Harmonised CPI rose to 2.8% vs 2.4% a month earlier and 2.3% in March. This is positive news for the Euro, which is lagging behind the Pound and relatively weak against the Dollar, based on.

May 29, 2024

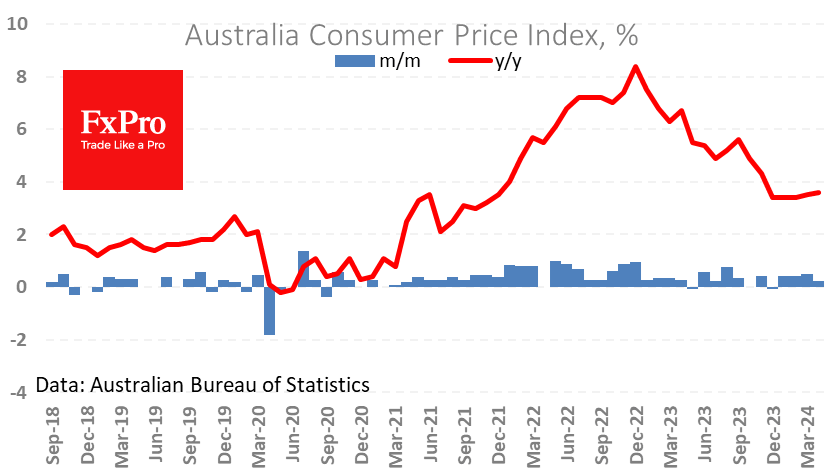

Consumer inflation in Australia rose in April, contrary to the expected decline. Year-on-year price gains totalled 3.6% vs. 3.5% previously, and average forecasts of a decline to 3.4%. The inflation rate reached a plateau late last year, falling to 3.4%,.

May 28, 2024

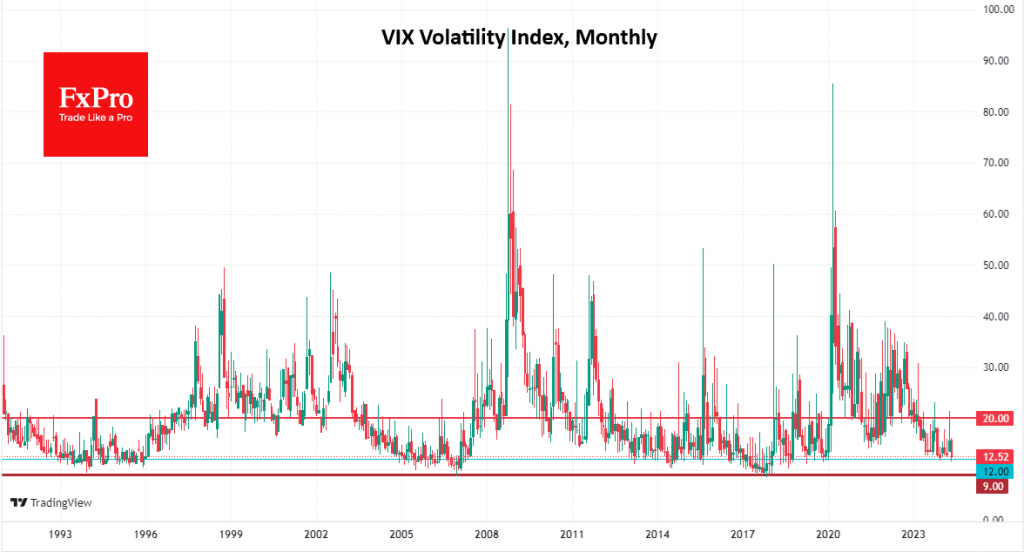

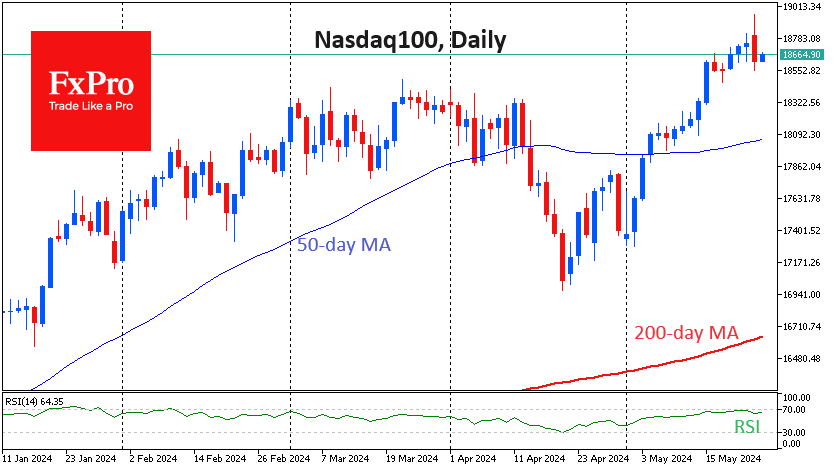

The Nasdaq100 and S&P500 indices are showing measured gains, while volatility has declined to levels last seen in January 2020. Many traders are looking at this volatility compression as the calm before the storm, something we saw just over four.

May 27, 2024

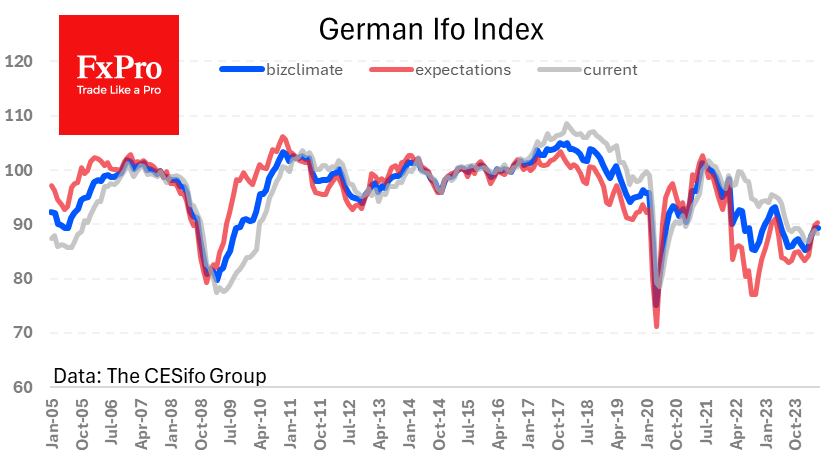

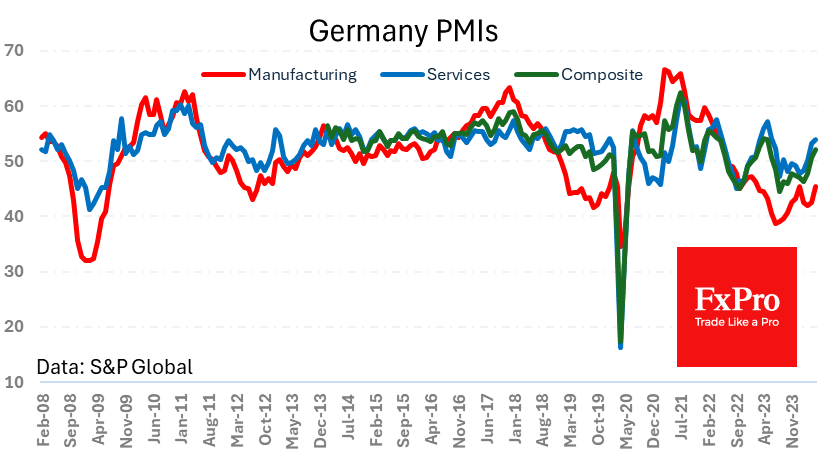

The improvement in Germany’s business climate stalled in May, according to data released by Ifo. The index remained at the same level of 89.3 as a month earlier. The indicator was last higher in May last year, but analysts, on.

May 27, 2024

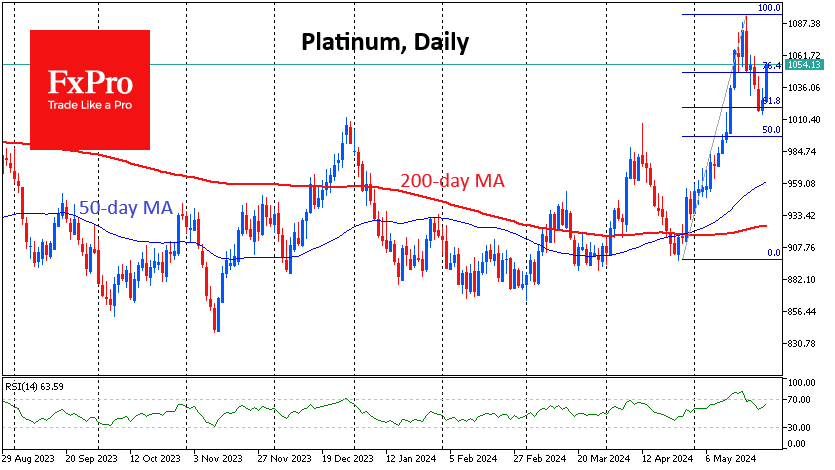

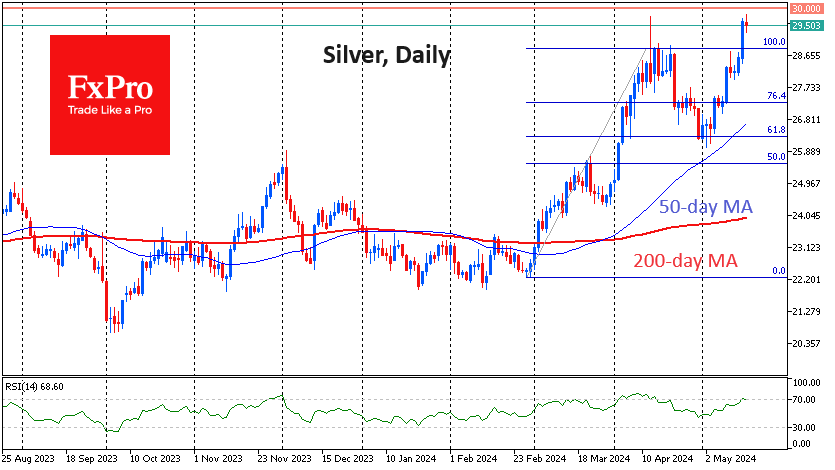

Precious metals are gaining on Monday in the second day of growth after last week’s heavy sell-off. Platinum is recovering the most, jumping 2.9%. Palladium is gaining about 2%, also noting the recovery of buyers’ appetite after the recent drawdown..

May 24, 2024

The Nasdaq100 index was once again the main driver of growth in US indices in May, indirectly also positively influencing markets elsewhere. On Thursday, the index was approaching the 19,000 level, adding over 11% to the 19 April lows. An.

May 23, 2024

Preliminary estimates of European business activity indices noted an overall acceleration in the Eurozone economy better than expected, helping the Euro find temporary support as it approaches 1.08. Germany provided the biggest upside to expectations this time around after months.

May 22, 2024

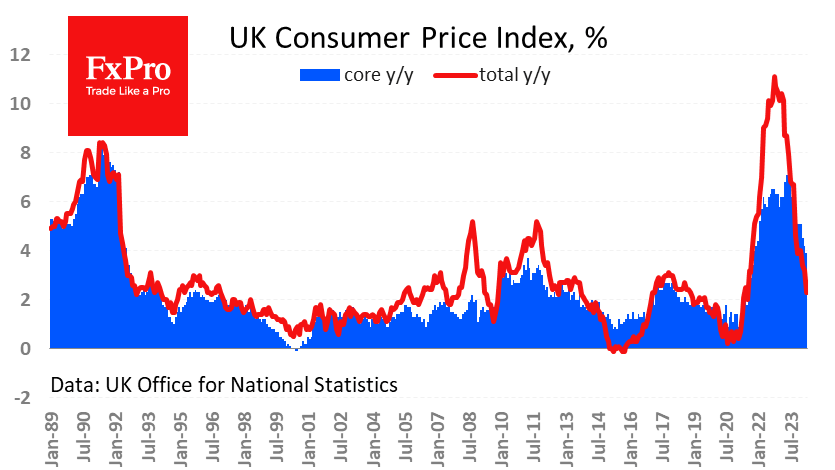

Inflation in the UK exceeded forecasts, making traders and investors cautious about the prospects for policy easing in the coming months. Consumer prices rose by 0.3% m/m vs. 0.2% expected. Annual inflation slowed to 2.3% last month from 3.2% in.

May 20, 2024

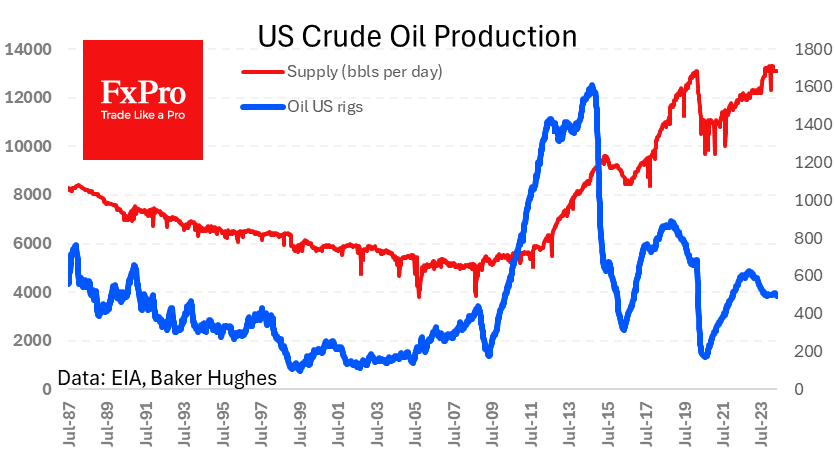

Oil is losing about 0.75% of its peak on Monday, having hit a strengthening sell-off as it attempts to climb above $80/bbl WTI and $84/bbl Brent. Interestingly, oil is declining despite the death of Iran’s president, which should reinforce the.

May 17, 2024

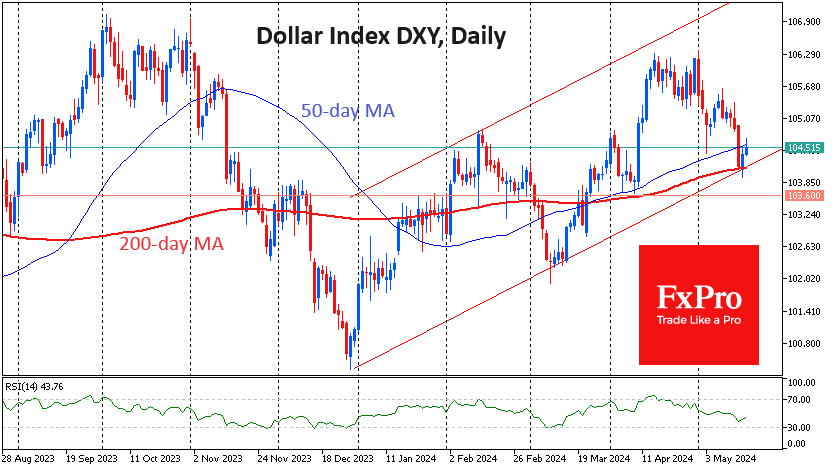

The US dollar is not giving up without a fight, gaining for the second day in a row against a basket of major currencies. Buyers seized the initiative after the Dollar touched the lower bound of its uptrend, which coincided.

May 17, 2024

Silver climbed above $29.8, rewriting the highs from January 2021, but once again faced selling intensification from that level for the first time in four years and has pulled back to $29.40 at the time of writing. Silver does not.