German CPI fell in May, but inflation risks remain high

May 31, 2023 @ 17:09 +03:00

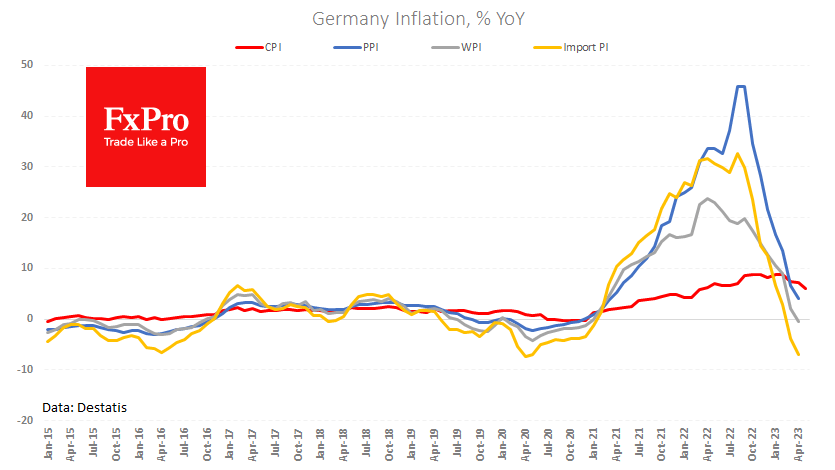

Consumer prices in Germany fell by 0.1% in May, compared with a rise of 0.2% forecasted by analysts, according to a preliminary estimate by Destatis. Year-over-year inflation in Europe’s largest economy slowed to 6.1% from 7.2%, the lowest rate since March 2022.

The import price index, released today, fell 1.7% in April and was 7% lower than a year earlier. This is the eighth month in a row that the index has fallen, which may put further pressure on consumer prices in the coming months.

Does this mean inflation is firmly on a downward path and the European Central Bank’s job of tightening policy is done? Not likely, as the euro area is now close to full employment, and service prices continue to push up headline inflation.

Therefore, retreating from a hawkish policy stance would rapidly put inflation back on the economic agenda, repeating the Fed’s mistakes in the 1970s. Besides, the current situation allows the world’s central bankers to move away from zero-interest-rate policies and perpetual quantitative easing and return to conventional policy tools.

The FxPro Analyst Team