Eurozone Data Signals Stronger Economic Response to Tighter Policy

May 30, 2023 @ 16:48 +03:00

Recent eurozone data showed a stronger economic response to the monetary tightening that has already taken place.

Spain reported that consumer inflation slowed from 4.1% to 3.2% y/y in May, against expectations of 3.6% y/y. This is a new low since July 2021 after a slight dip the month before.

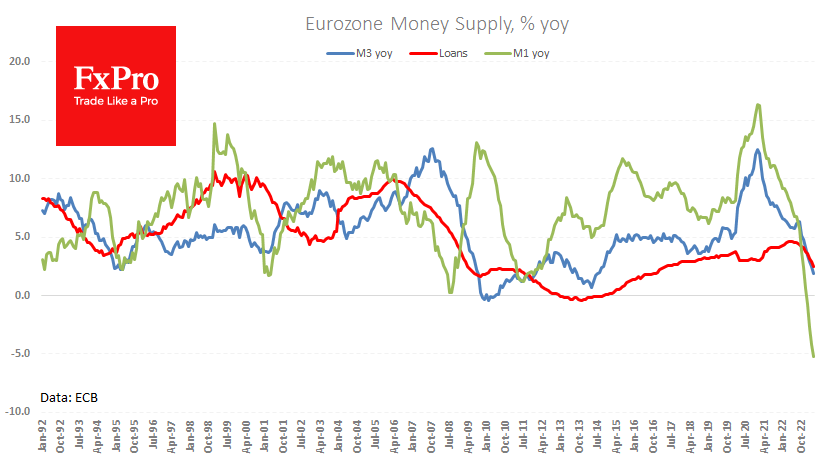

Eurozone data showed that the growth rate of the M3 money supply slowed to 1.9% y/y (2.1% expected). Rising interest rates slowed the growth of new loans to 2.5% y/y, the lowest since 2017.

In theory, a decline in the above indicators would be considered bearish news for the currency, suggesting a softer tone from the central bank in the near term. However, today we are focusing on the euro’s accumulated oversold condition against the dollar and the franc, which supports the single currency.

Moreover, it should not be forgotten that recent comments from ECB officials remain hawkish on inflation. And history suggests they are often more hawkish than the Fed regarding returning to the 2% target.

The FxPro Analyst Team

GBP | BOE Governor Andrew Bailey Speaks

GBP | BOE Governor Andrew Bailey Speaks