Market Overview - Page 37

October 26, 2024

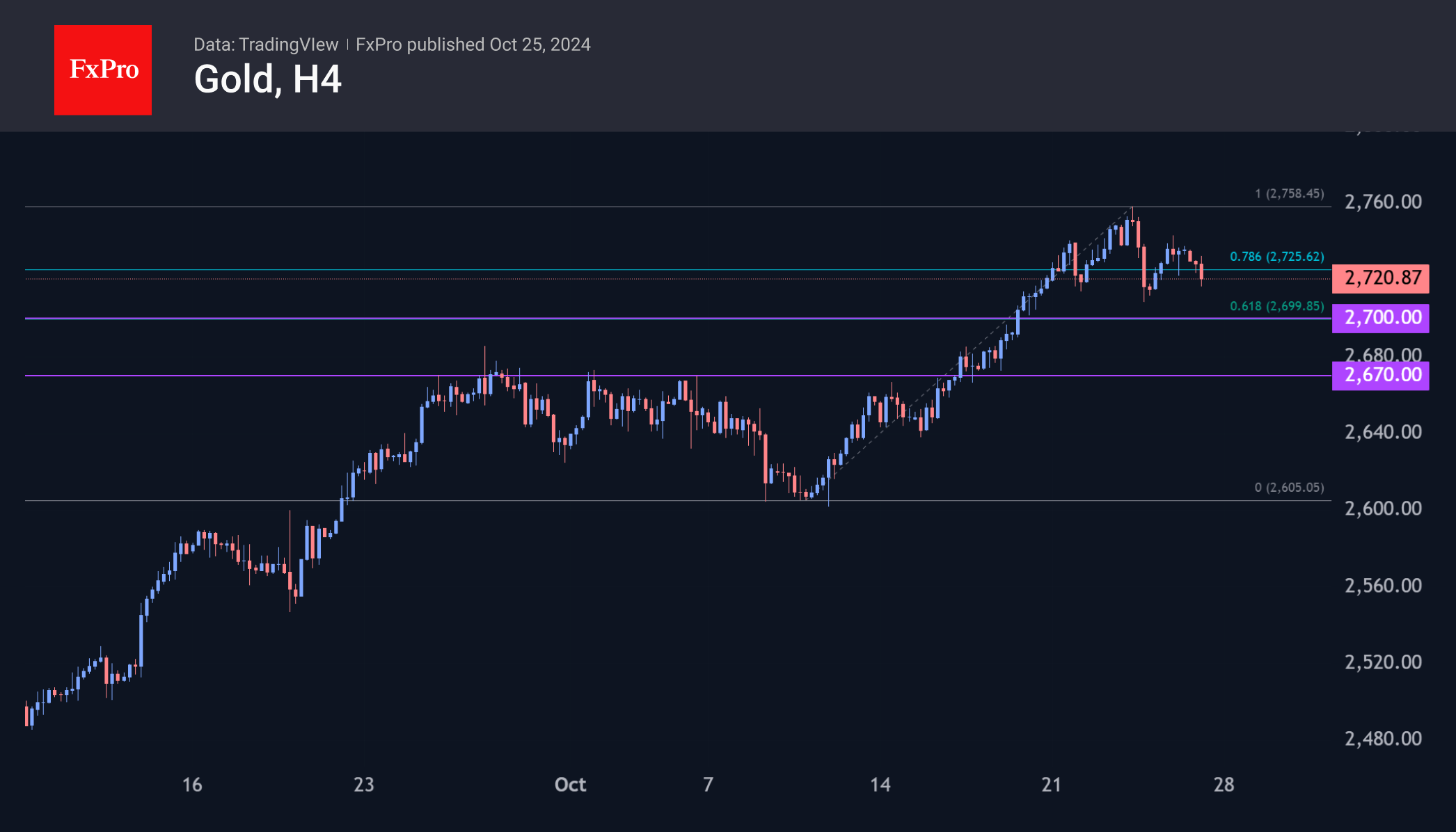

Gold continued to hit all-time highs in the first half of the week, peaking at $2,758, lately retreating. Meanwhile, Palladium was star of the week among the metals.

October 24, 2024

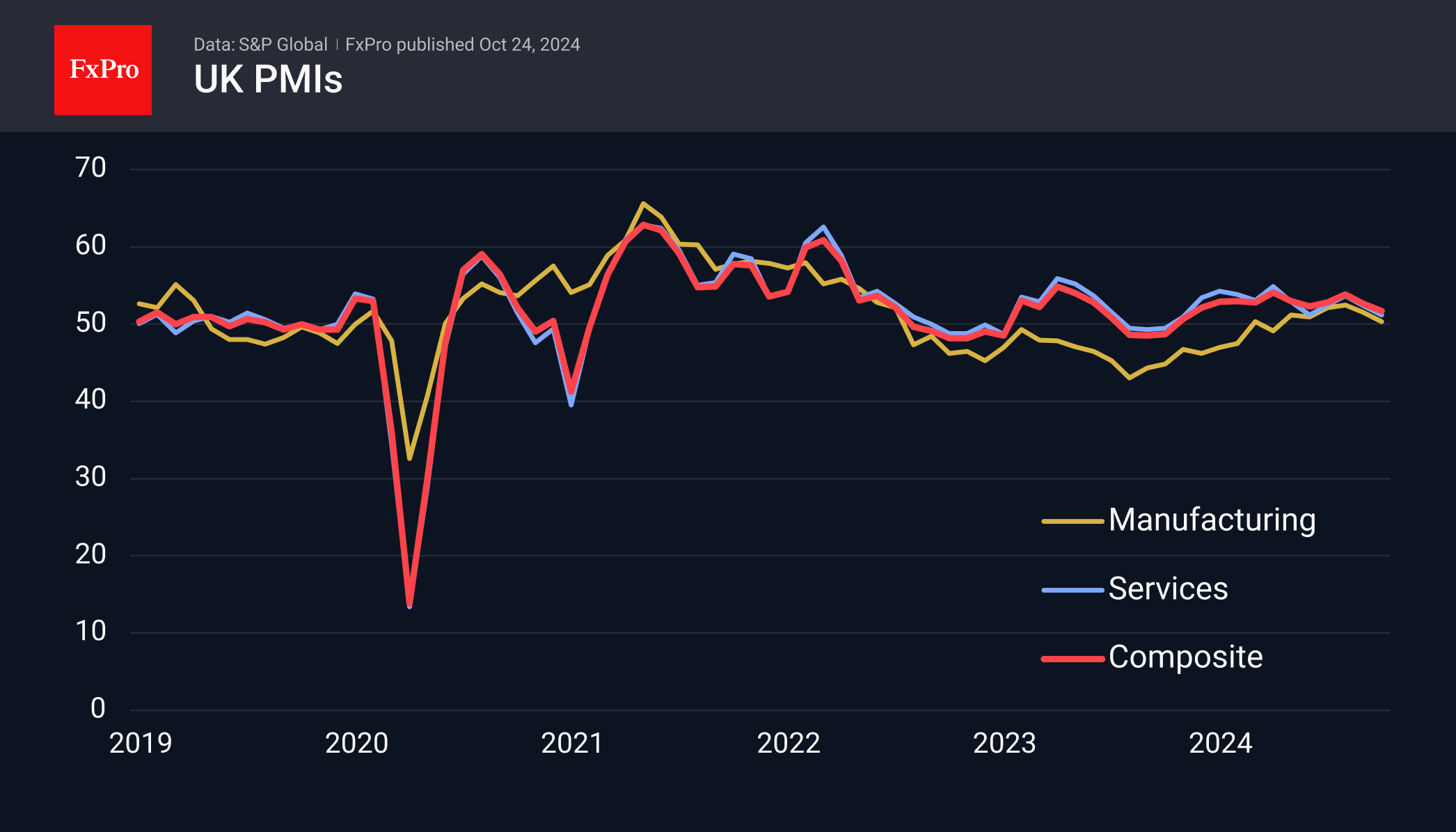

Despite weak PMI figures for October in the UK, GBPUSD rebounded by 0.5% due to a tired US dollar. The indices still indicate growth, but caution is advised for GBPUSD buyers.

October 24, 2024

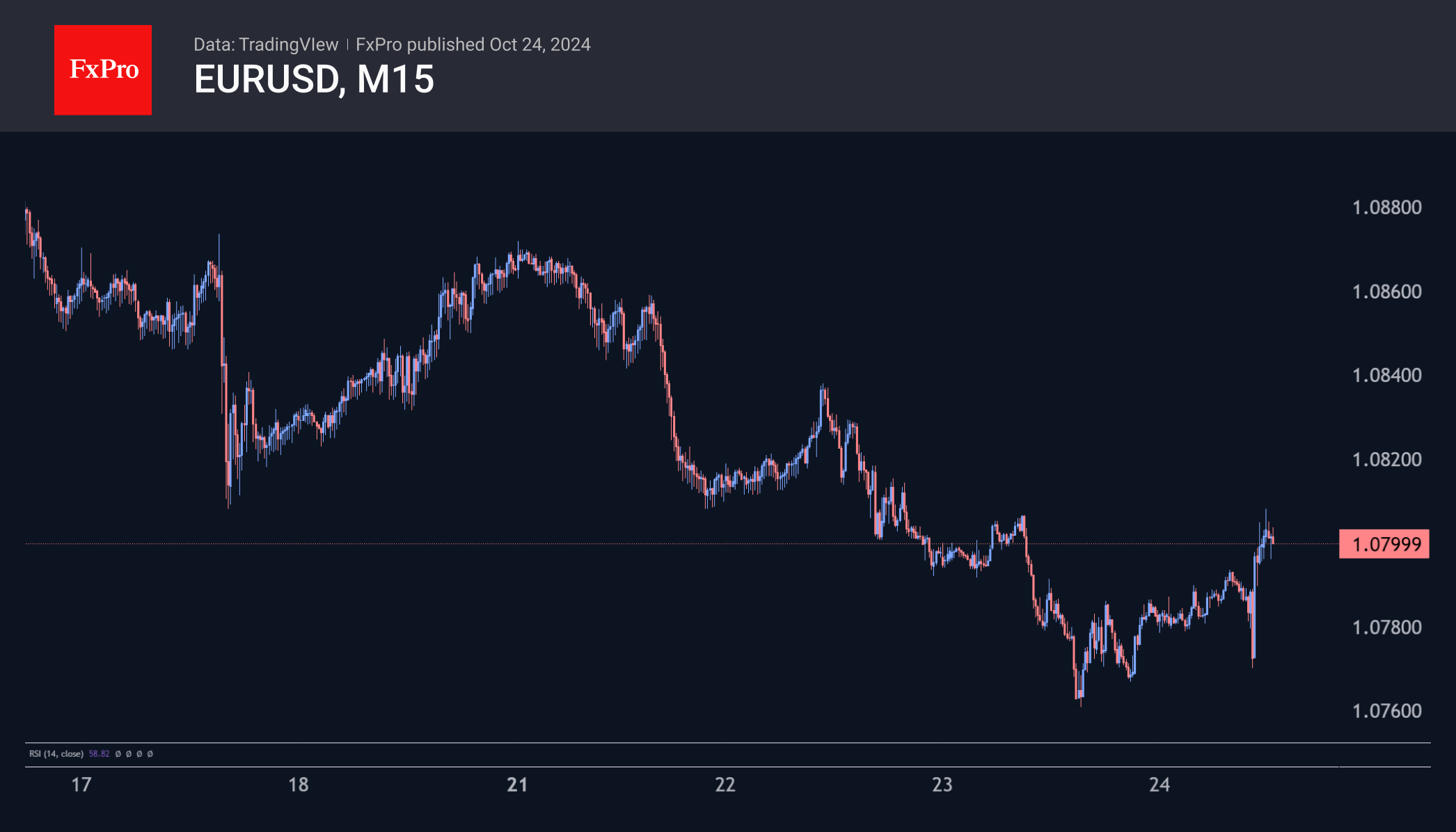

Flash Eurozone PMI showed mixed data, with Germany's business activity beating forecasts and France's service sector declining further. The stronger-than-expected German data temporarily halted the euro's decline, but it is unlikely to change the trend or the ECB's dovish stance on interest rates.

October 23, 2024

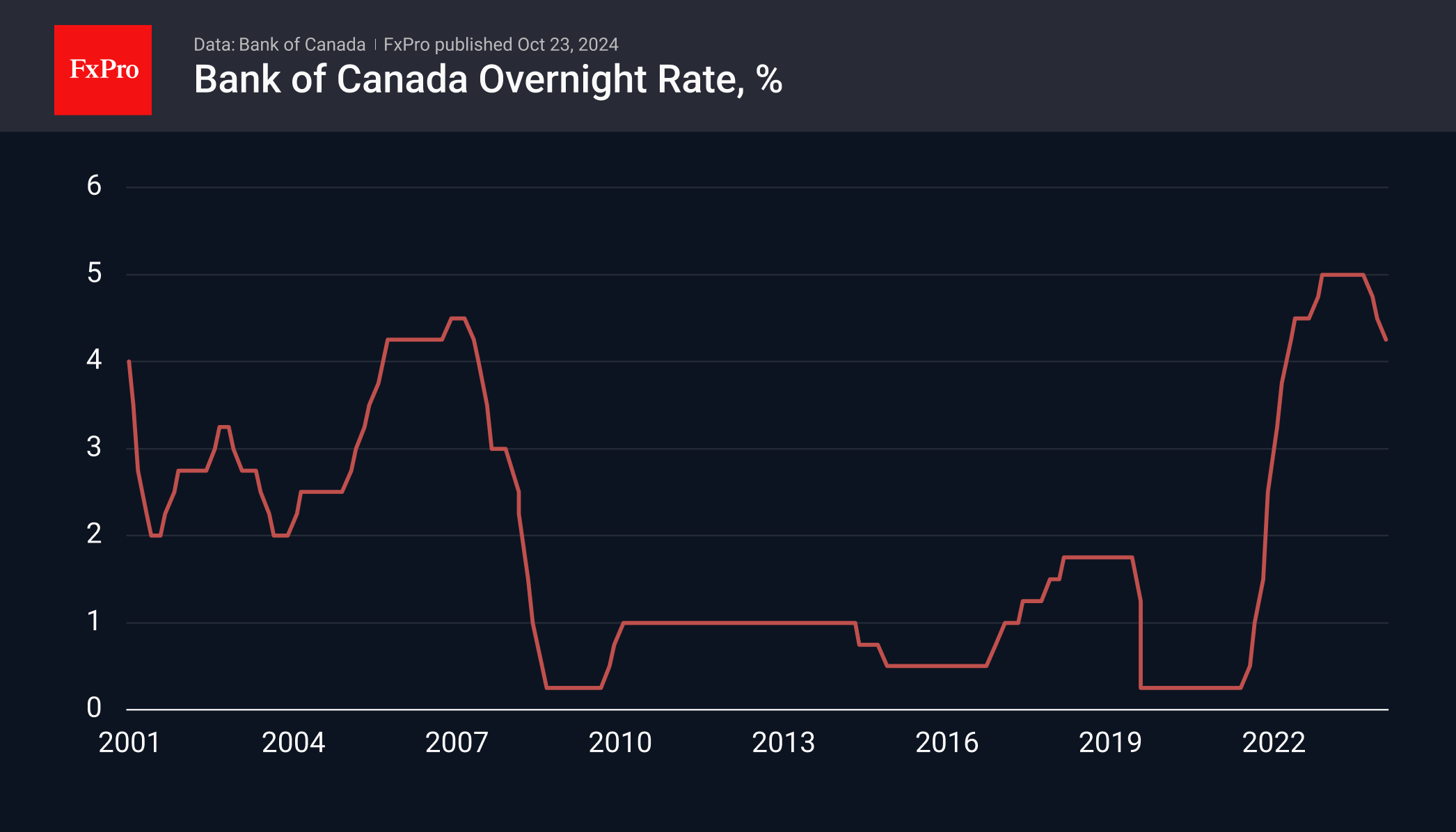

The Canadian dollar has weakened in anticipation of the Bank of Canada's rate decision. However, if the Bank of Canada's comments remain dovish, the USDCAD pair could continue to rise.

October 23, 2024

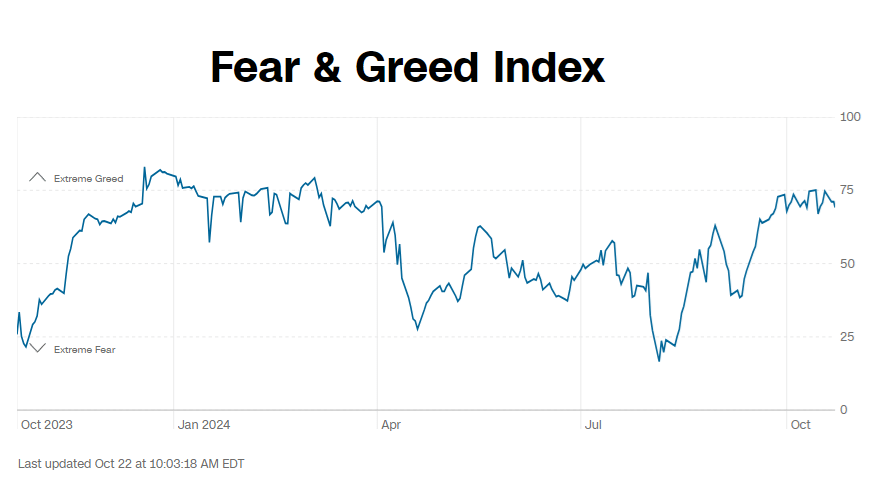

The S&P500 and other US indices are showing signs of a potential correction before the election, with the sentiment on Greed territory and the VIX volatility index indicating heightened nervousness. There is potential for the S&P500 to reach a correction target of 5600-5700.

October 22, 2024

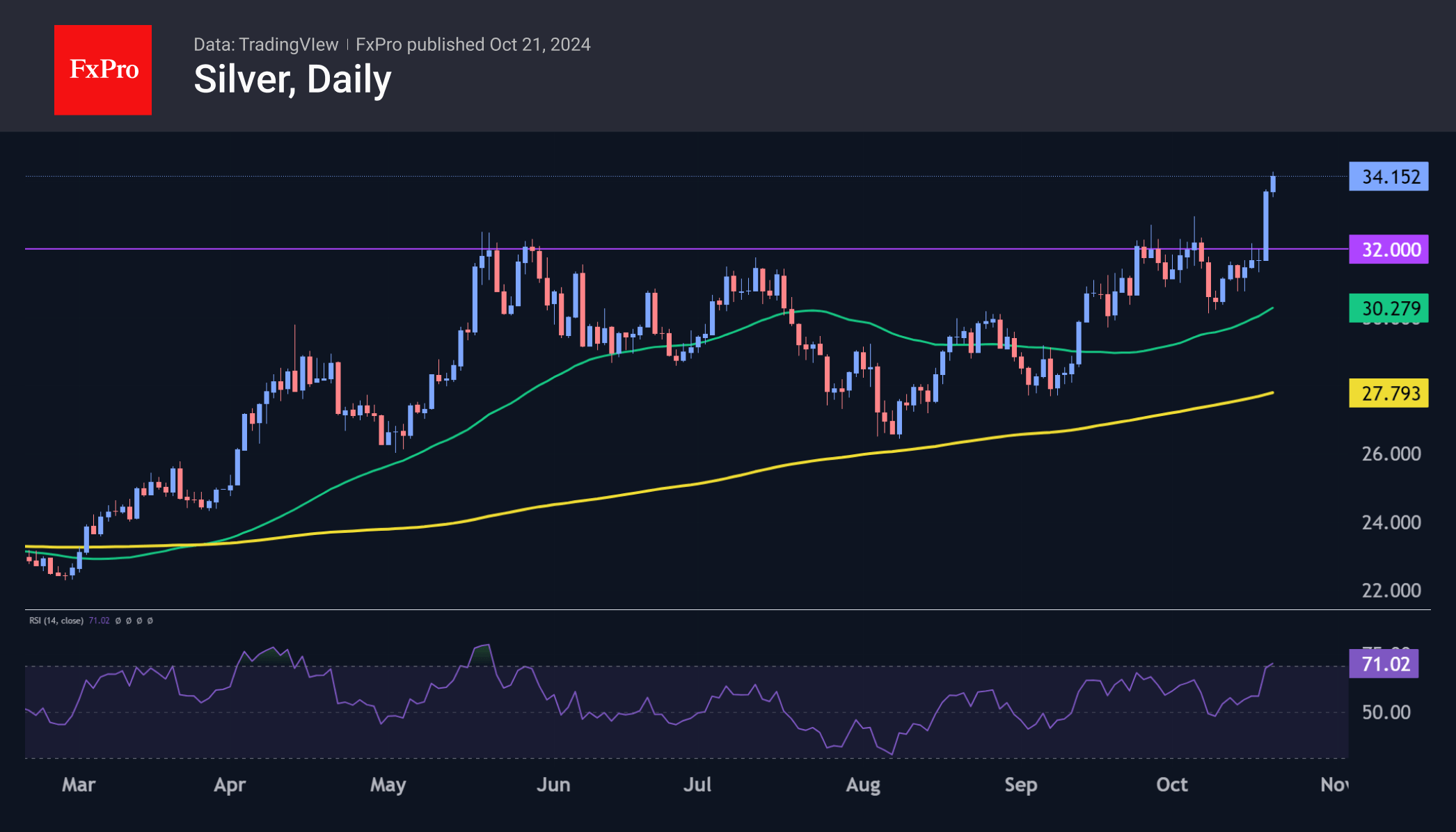

Silver prices surged last week, reaching 12-year highs. While a short-term correction may occur, the rally could continue and potentially reach all-time highs near $50.

October 21, 2024

The German Producer Price Index fell more than expected, increasing the likelihood of further monetary policy easing in the eurozone. This weakened the euro against the dollar, with a potential path towards lower support levels.

October 19, 2024

The key events for the market this week will be the interest rate decision from the People’s Bank of China on Monday and the Bank of Canada’s rate decision on Wednesday, where there may be a fourth cut this year,.

October 19, 2024

Oil has lost around 8% since Monday, experiencing downward momentum at the beginning and end of the week. It ended the week below $73 per barrel Brent. The price of oil had risen rapidly in early October. However, all bullish.

October 18, 2024

Dollar The dollar has been on an impressive streak, gaining almost daily, particularly against emerging market currencies. This is the currency market’s reaction to Trump’s higher chances of winning the presidential race, fuelled by his promises of increased trade tariffs..

October 16, 2024

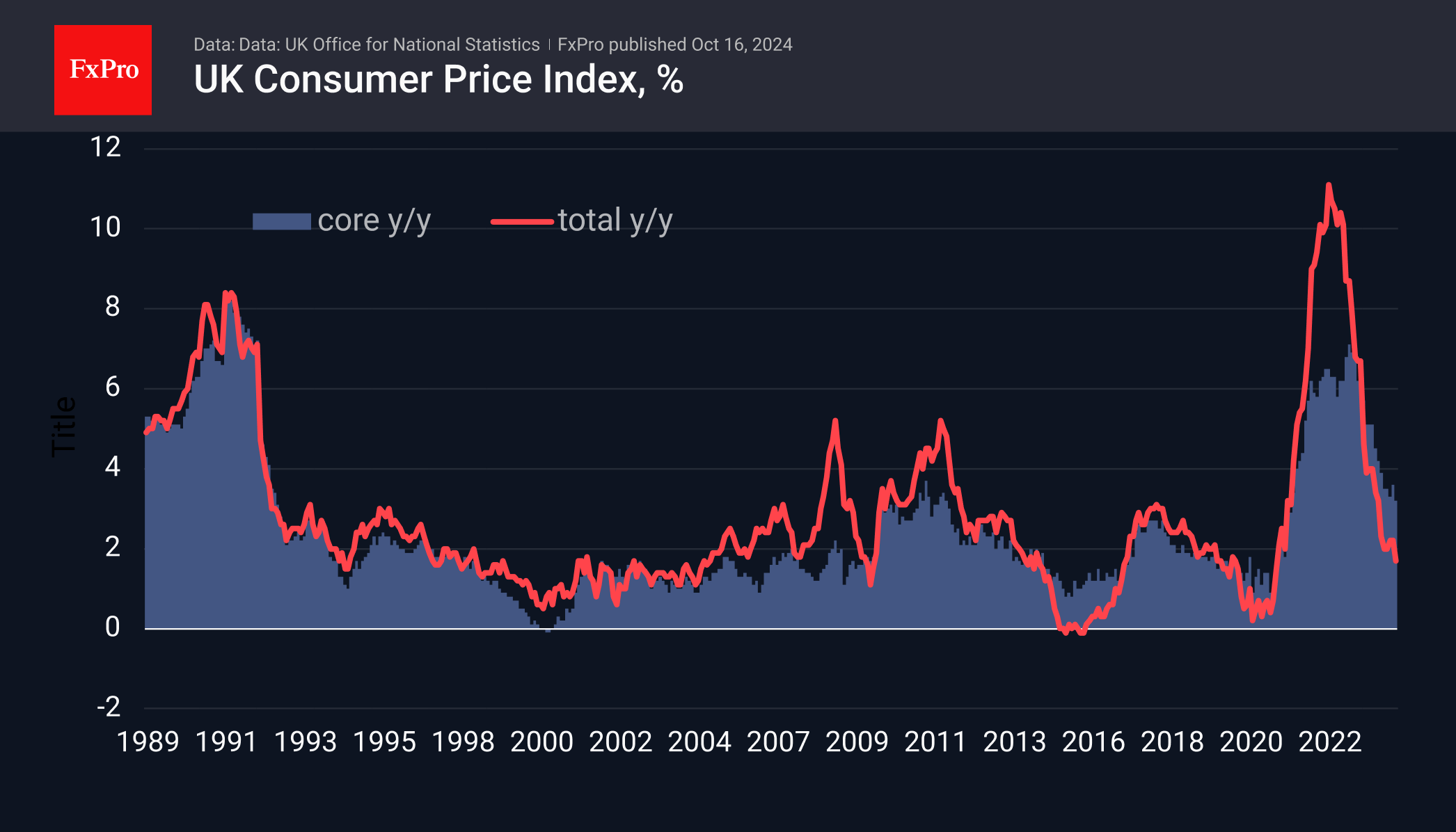

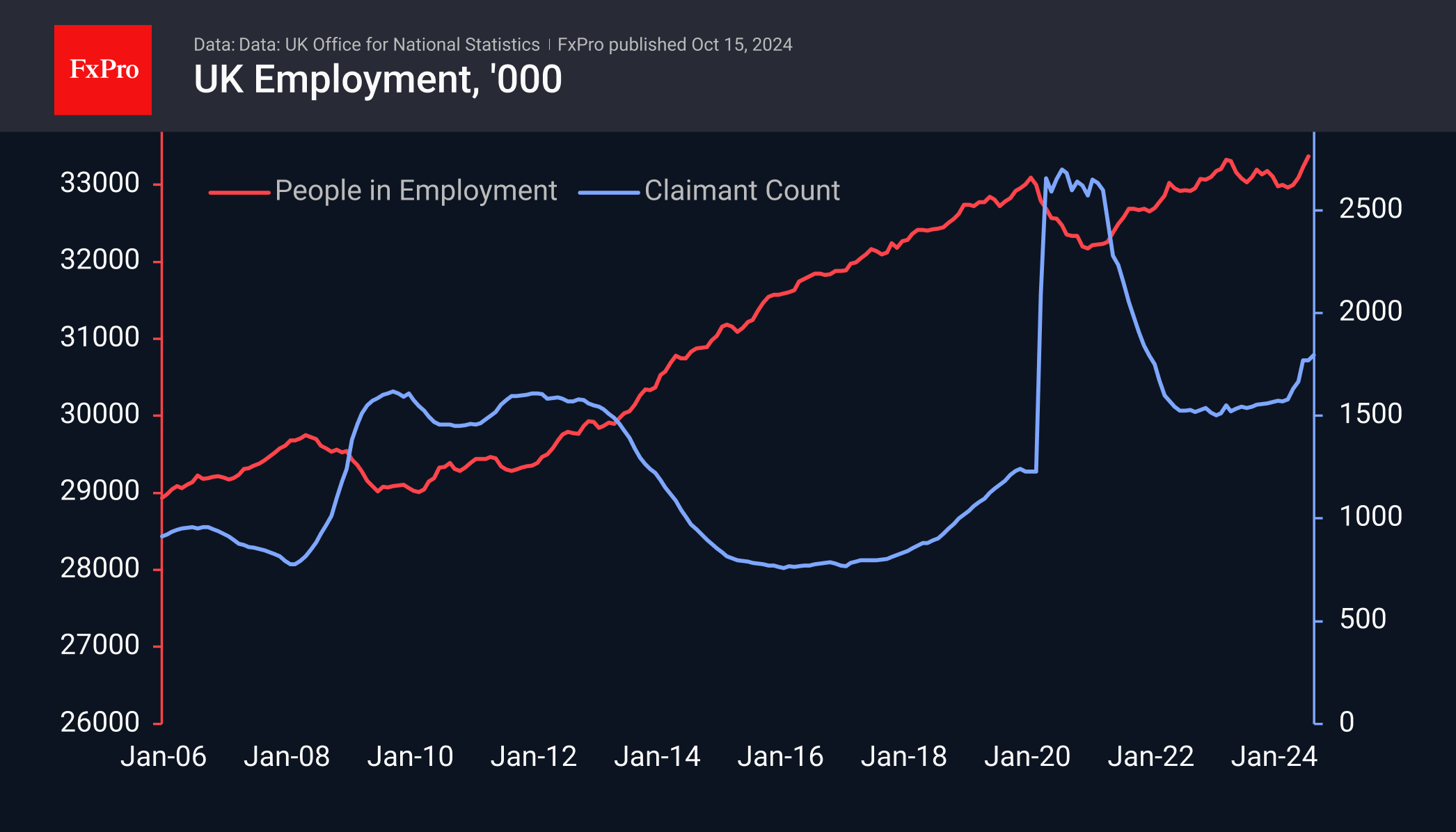

The British pound fell below the 1.30 level against the dollar after weak inflation data across indicators. This sent the pound to a two-month low on speculation that the Bank of England will cut interest rates further in the coming.