NZD is tired of flying

November 29, 2023 @ 14:31 +03:00

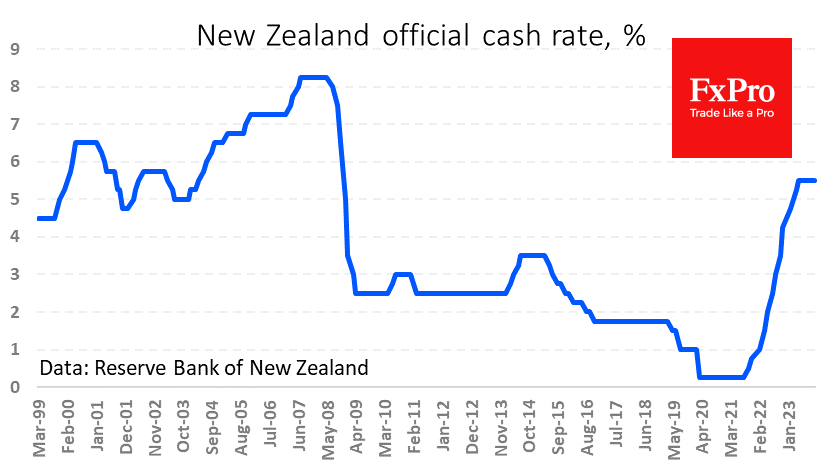

The Reserve Bank of New Zealand left its key rate unchanged at 5.5%, the highest in 15 years, but on hold for six months now. The decision was in line with market expectations. However, the NZDUSD rallied, adding over 1.2% at one point and touching 0.6200, a 4-month high. The buying impulse came from the CB’s vocal preparedness to raise rates if needed.

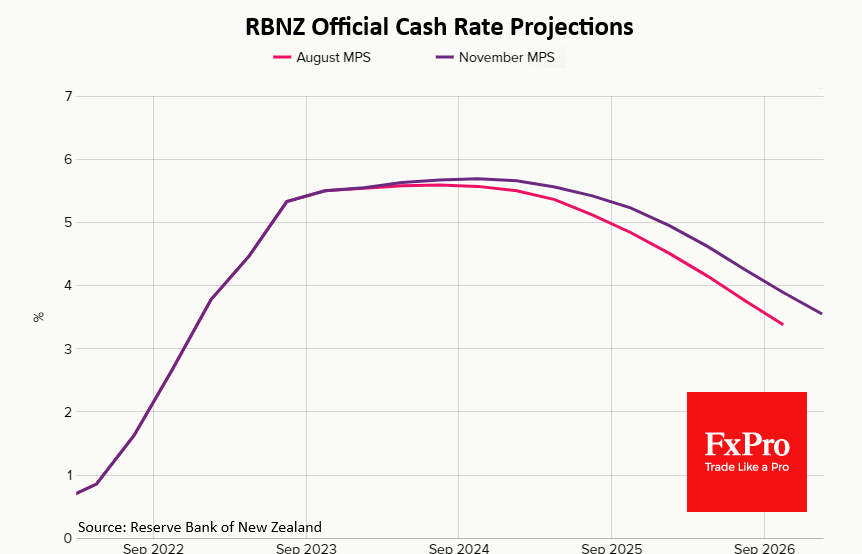

The RBNZ’s rate forecasts became more hawkish, confirming a willingness to act. The committee revised its August forecast expecting a higher rate in a year than it does now, fitting in with the latest Central Bank’s mantra “higher for longer”.

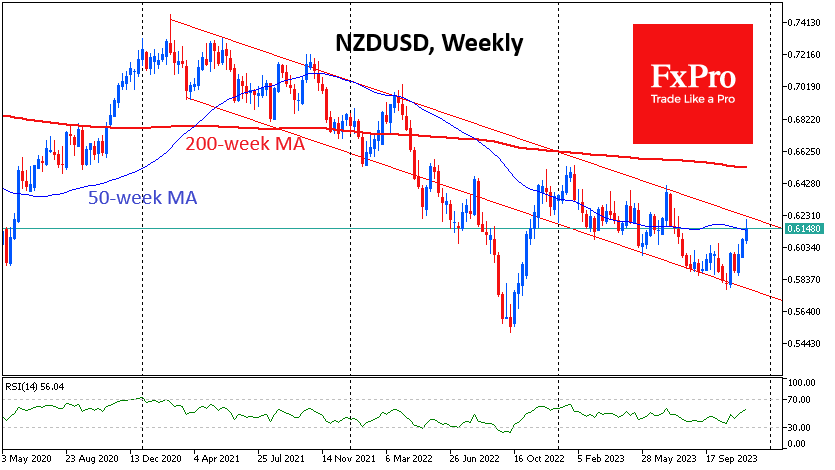

But intraday, the Kiwi’s dynamics changed dramatically. At the height of morning trading in Europe, NZDUSD erased all gains following the publication of the RBNZ decision, pulling back to 0.6150. The New Zealand dollar sell-off so far looks like profit-taking after rallying 5.8% in a fortnight following a weak US inflation report. Sellers showed up after the NZDUSD entered the overbought area on RSI on daily charts.

On the higher timeframes, NZDUSD almost touched the upper boundary of the descending corridor, which the pair has mainly followed since March 2021. This year, the pair have spent a lot of time near the lower boundary, while reversals down from the upper boundary have been swift. During the period of this channel, it took only 5-6 weeks to move from the upper boundary of the range to the lower boundary. If the pattern repeats for the sixth time, NZDUSD could reach the 0.5750 level in early January.

The alternative bullish scenario will become mainstream only if NZDUSD can stay within the short-term growth momentum and overcome the previous local top at 0.6400.

The FxPro Analyst Team

GBP | BOE Governor Andrew Bailey Speaks

GBP | BOE Governor Andrew Bailey Speaks