German business climate: a pessimistic recovery

November 25, 2023 @ 08:43 +03:00

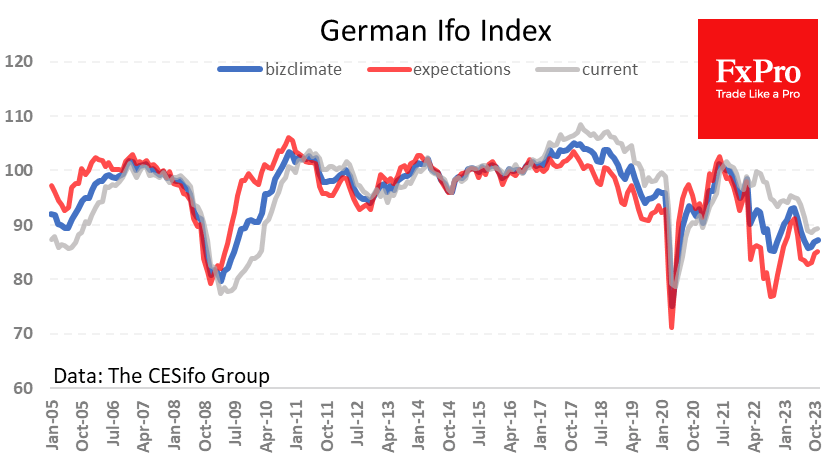

German Ifo Business Climate Index rose for the third consecutive month. Still, this recovery is weaker than expected, putting the Euro in a more vulnerable position against the Pound and Canadian Dollar, where the latest data exceeded expectations.

Germany’s business climate indicator rose to 87.3 from 86.9 a month earlier and 85.8 in August, which was the local bottom of the indicator.

The closest reversal to the current one is shown in the main index in early 2009, with the indicator recovering from slightly lower levels. However, there is a significant difference: back then, the business expectations component pulled the index upwards, but from 2017 to the present, expectations were often below current estimates.

The origins of German business pessimism can be seen in the dramatic slowdown in China and the trade wars unleashed by Trump as US president. In addition, pessimism in business circles is caused by the forced search for alternative energy sources.

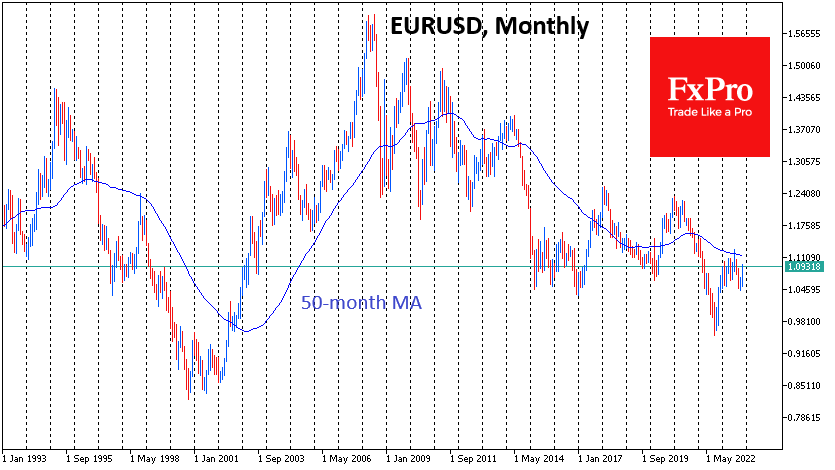

This indicator correlates quite closely with the EURUSD dynamics, and the heavy recovery is precisely what we are seeing in the most traded currency pair. Looking at the situation from the perspective of its impact on EURUSD, as long as the expectations component remains below the assessment of current conditions, it is worth setting up for a long-term downtrend in the pair, regardless of the indicator’s recovery periods.

The FxPro Analyst Team

GBP | BOE Governor Andrew Bailey Speaks

GBP | BOE Governor Andrew Bailey Speaks