Market Overview - Page 36

November 5, 2024

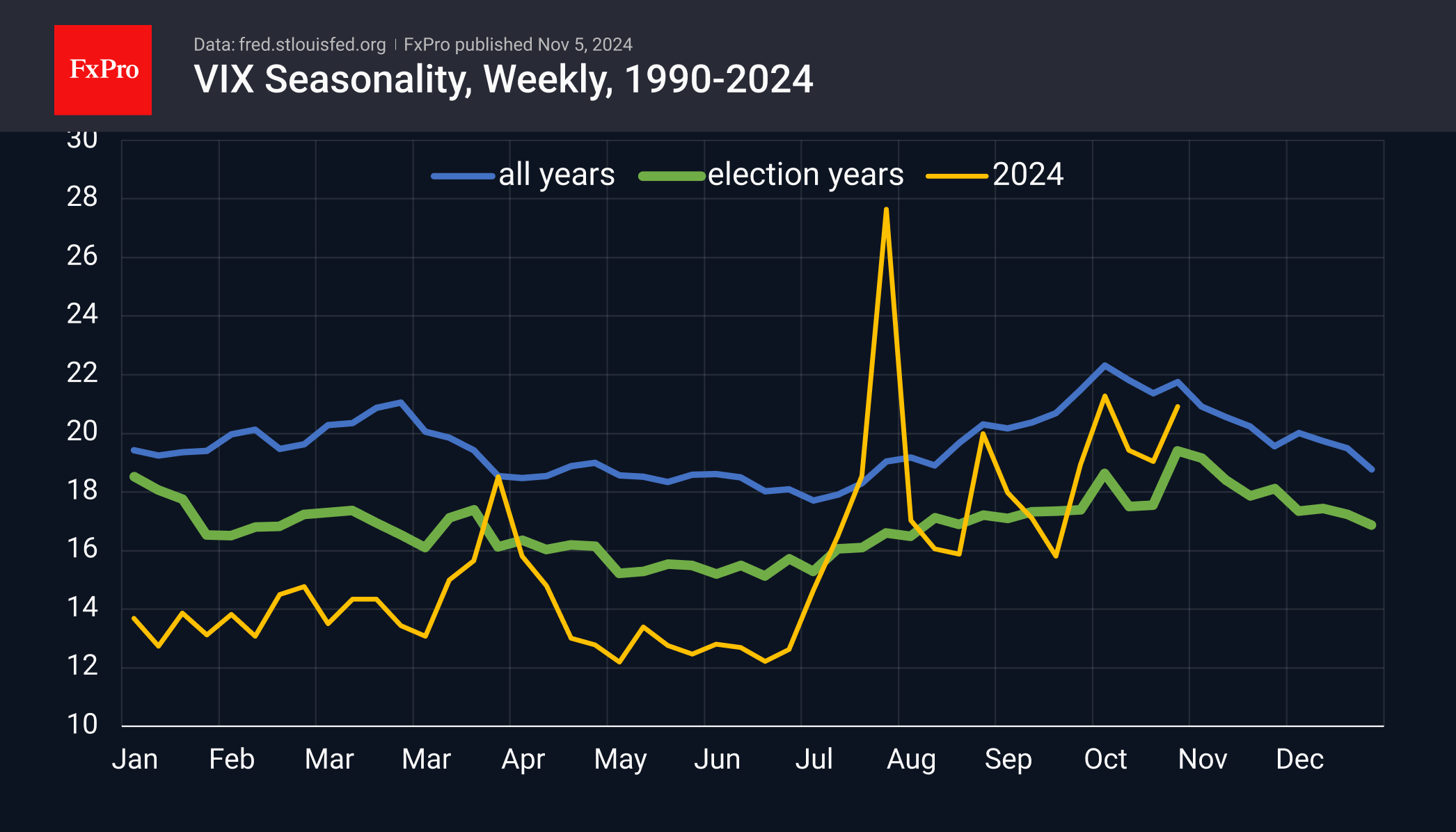

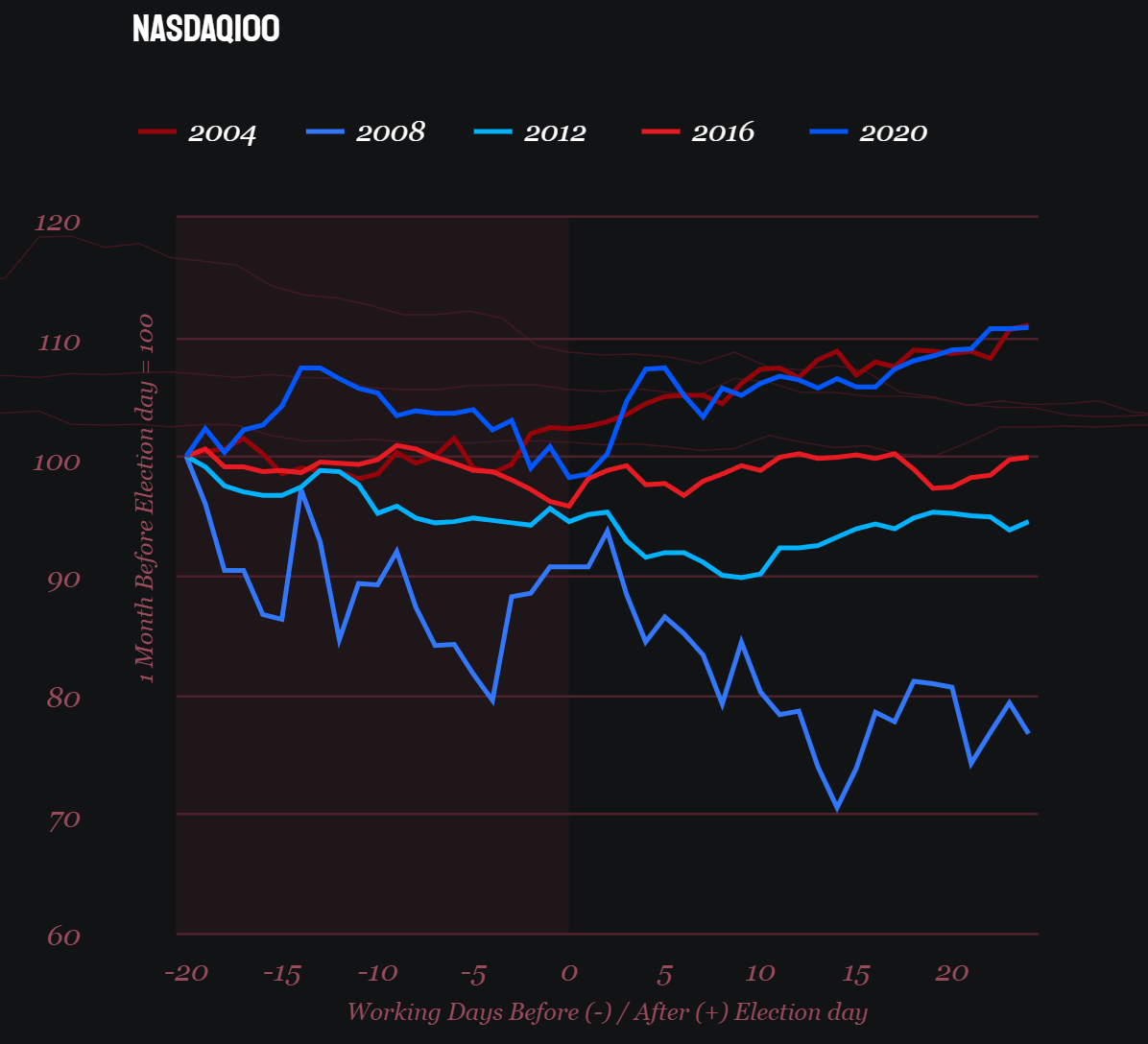

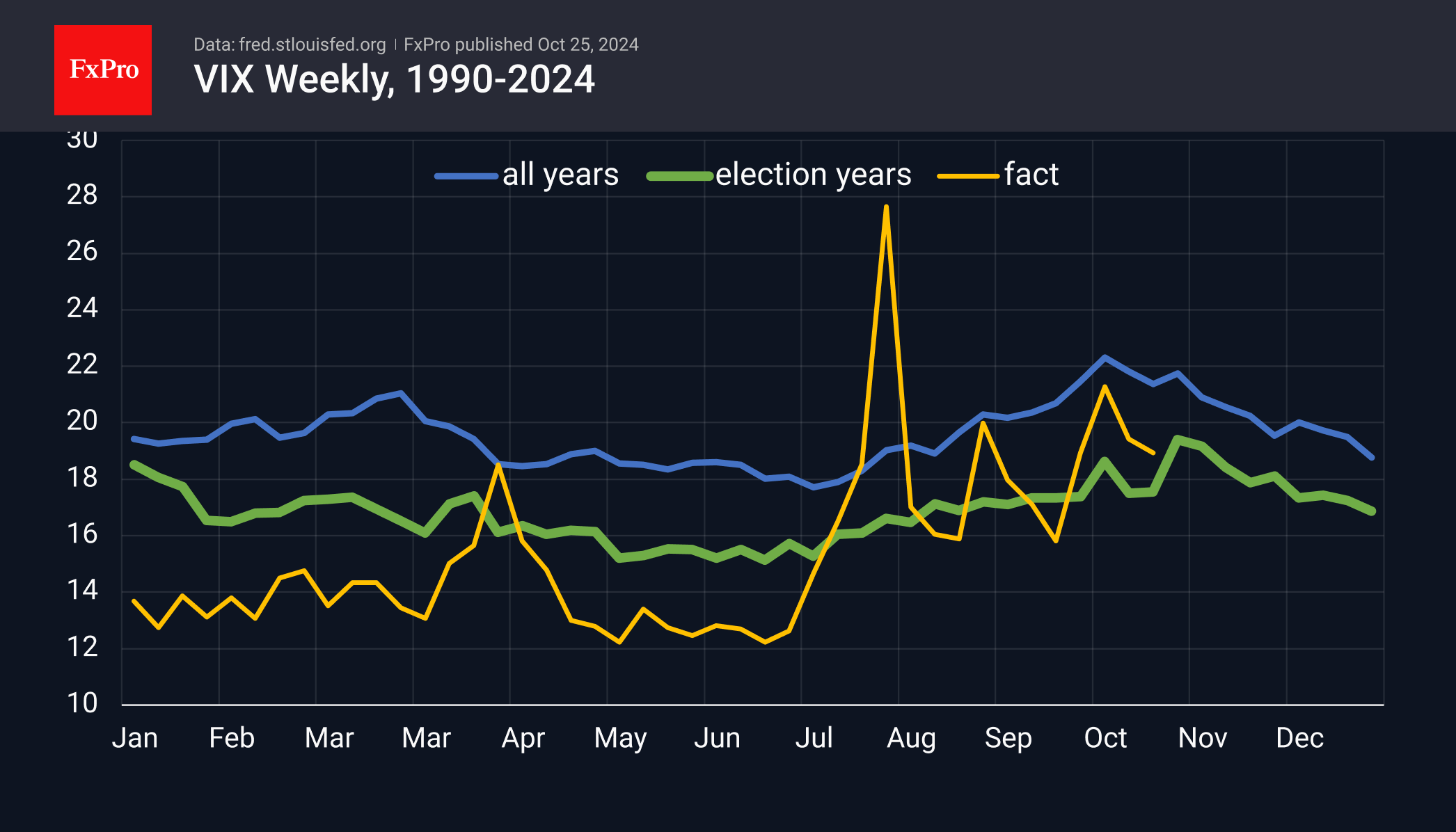

Market volatility is likely to peak this week, setting the stage for the next two to three months. Typically, volatility is synonymous with declines in equity indices, although that’s not entirely accurate. The pattern of market volatility fits well with.

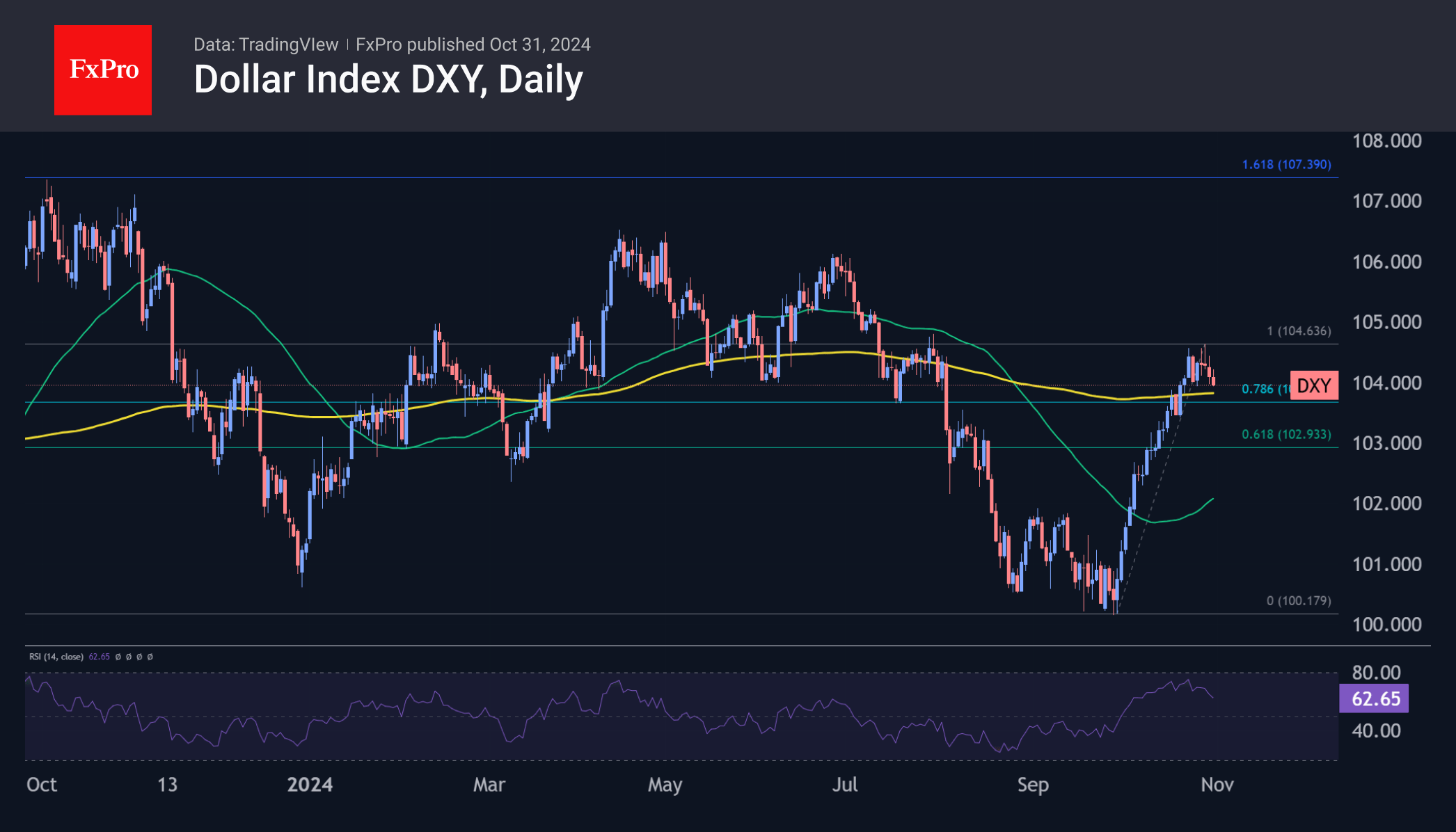

November 5, 2024

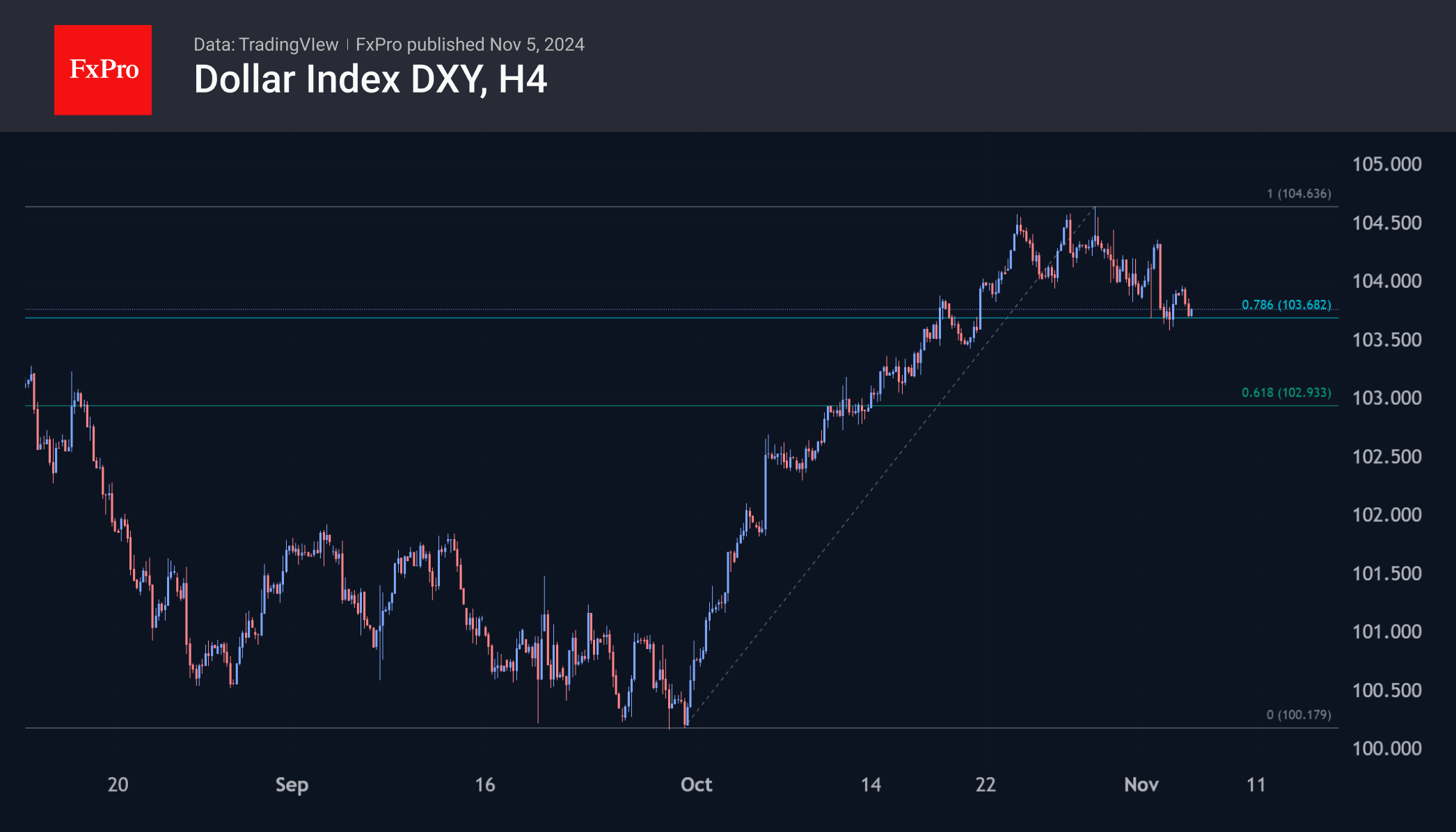

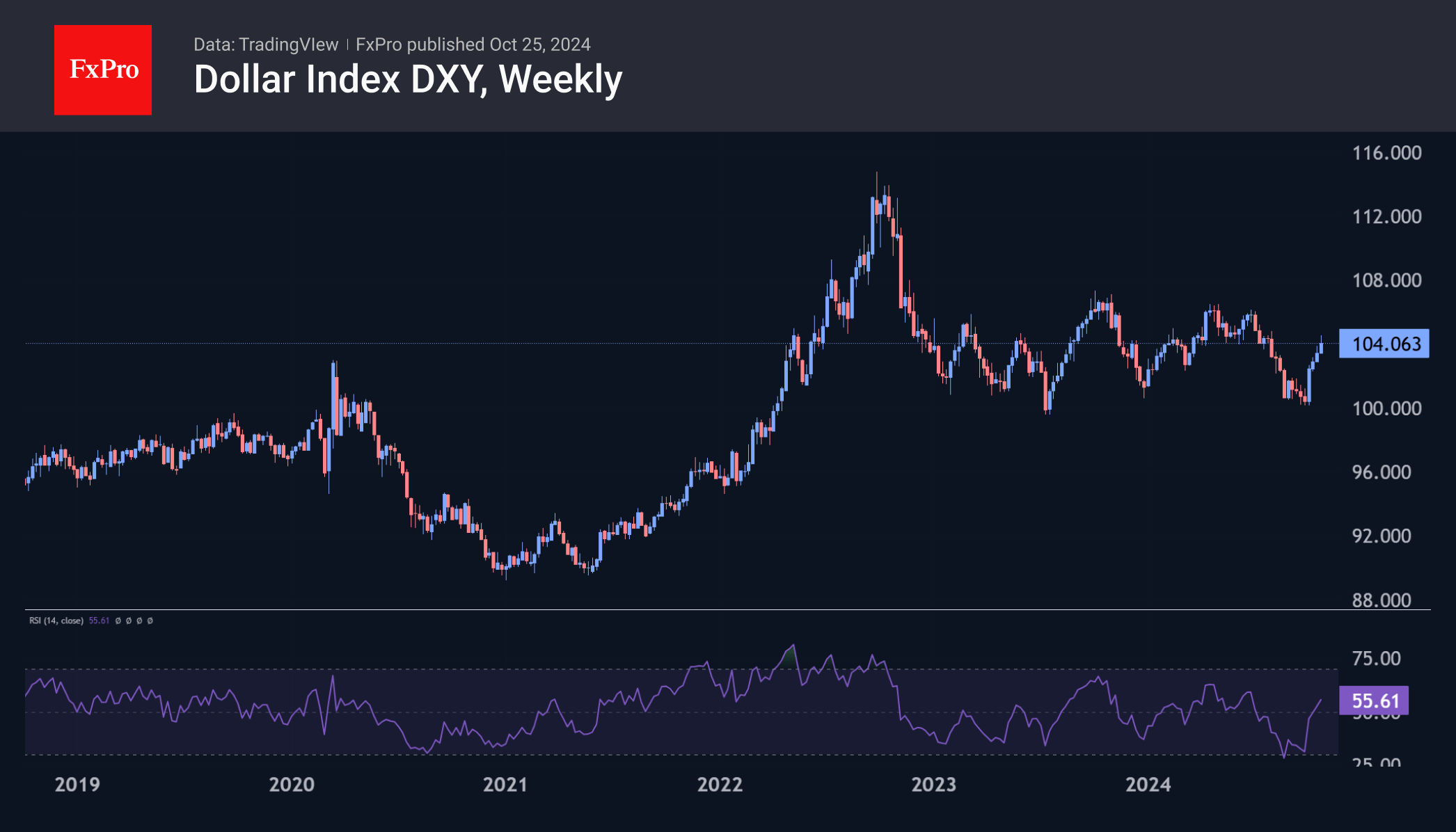

The Dollar Index DXY is poised for a new trend after a strong October. Recent pullback to 78.6% retracement level consolidates liquidity. f DXY falls below 103, it may drop to 100 or even 90. A rise above 104.5 could signal an upward trend towards 107.4 or even 114.7.

November 4, 2024

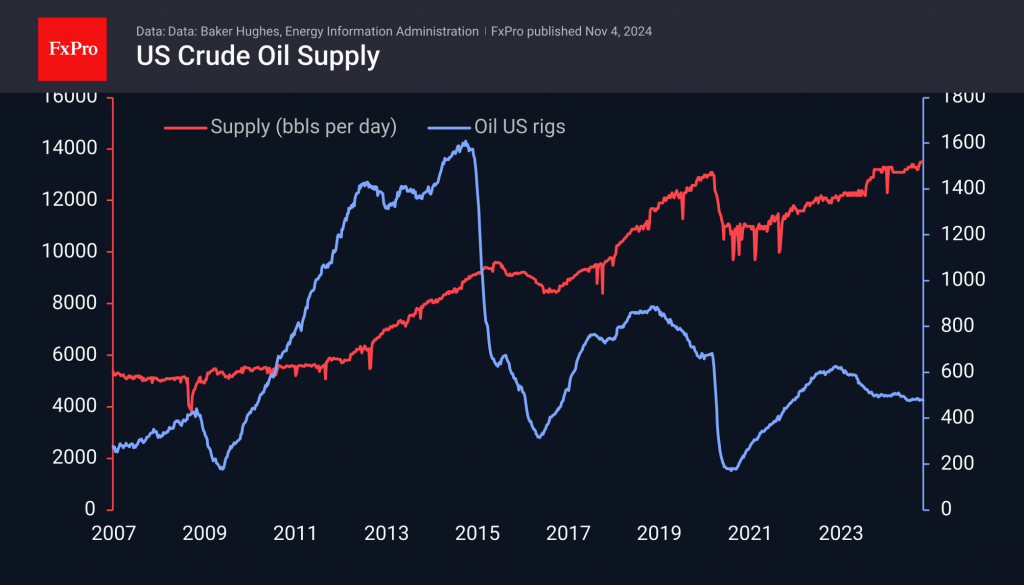

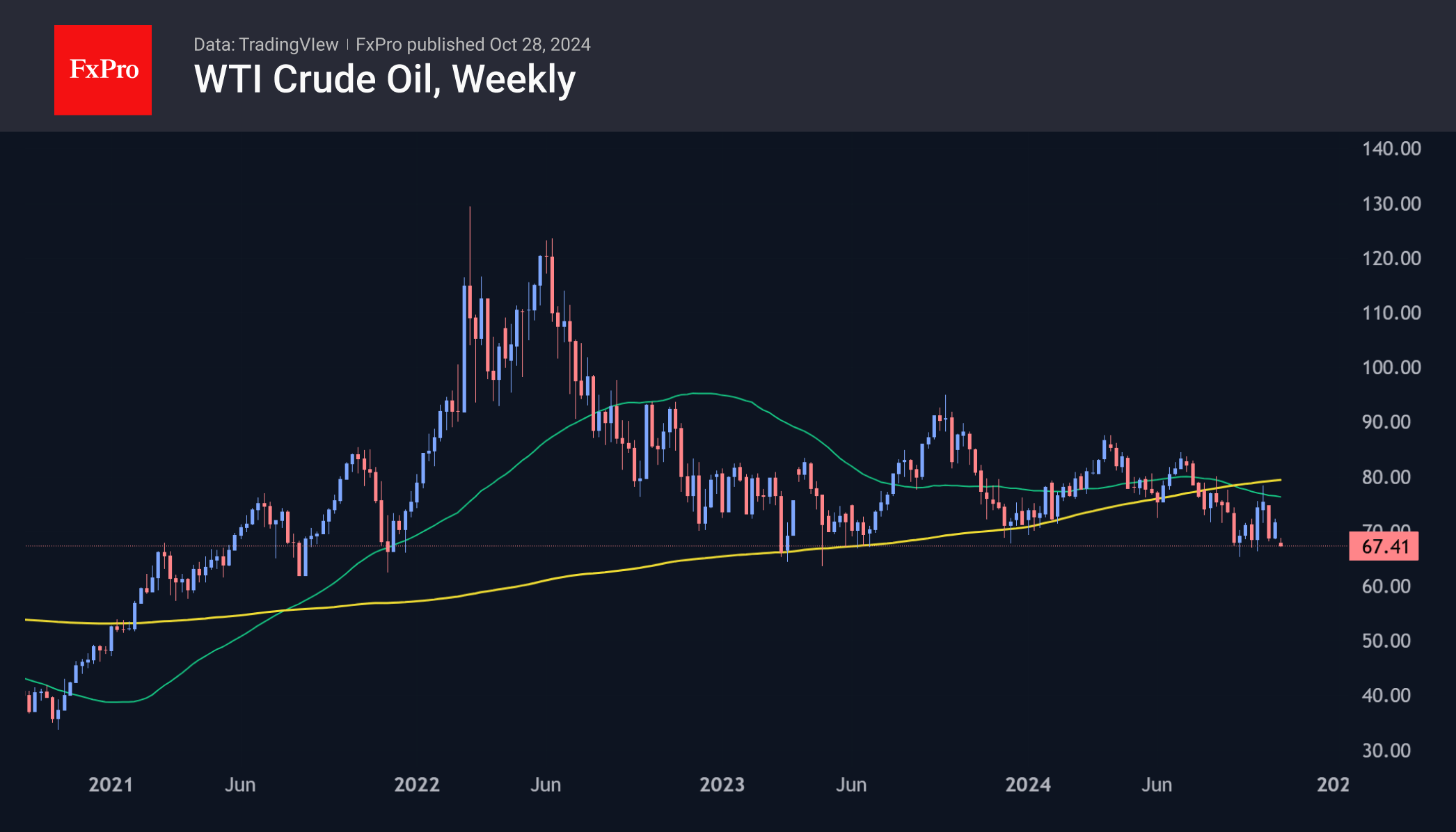

Market Picture Crude oil gained around 2.5% on Monday after OPEC+ reported that it intends to delay the cartel’s production quota increase by one month from December. The November 2023 agreement calls for eight major producers, including Saudi Arabia and.

November 1, 2024

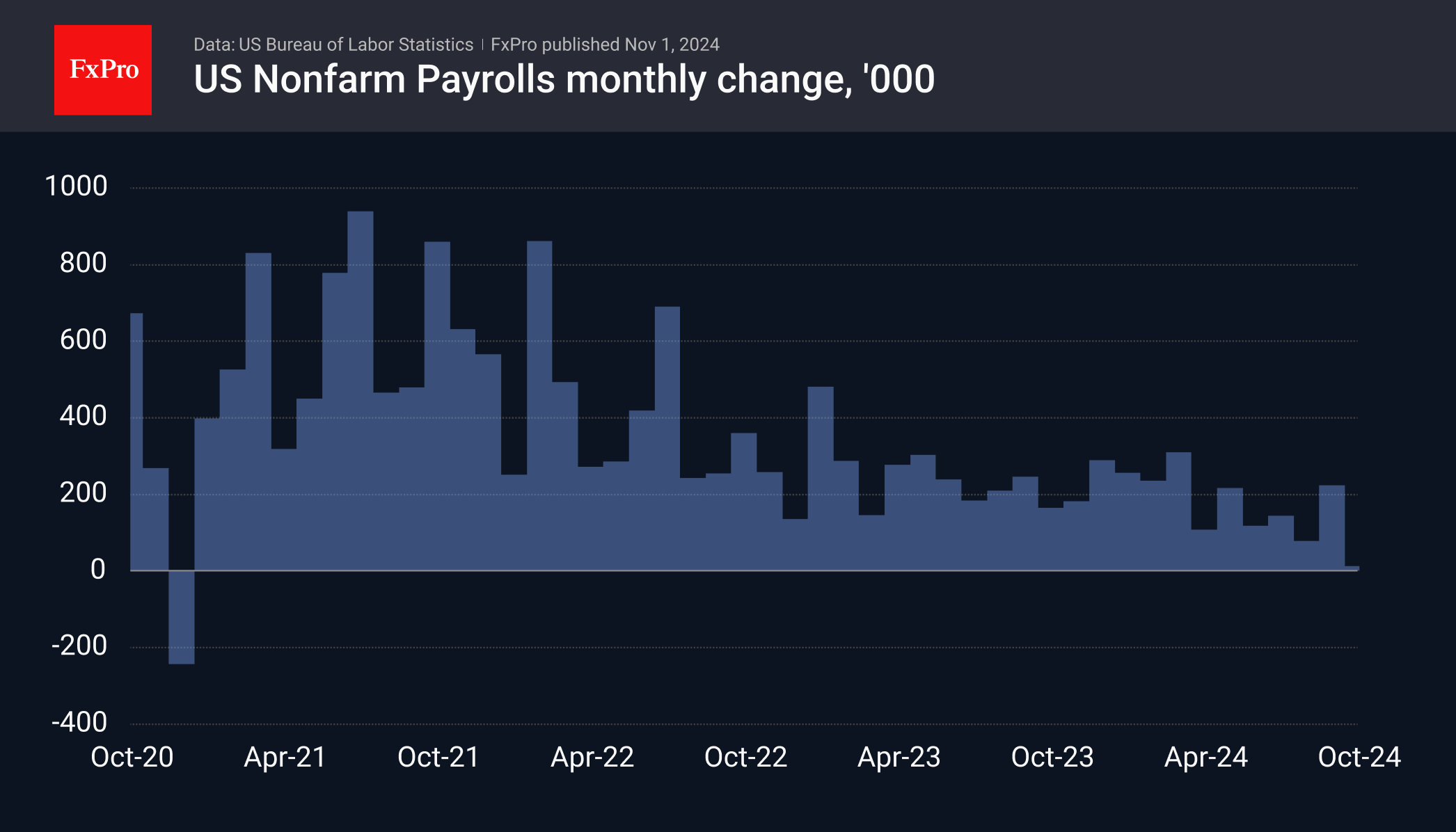

The US labour market experienced a major employment failure in October, but this does not indicate an imminent recession. Manufacturing continues to decline, but the service sector is growing to compensate.

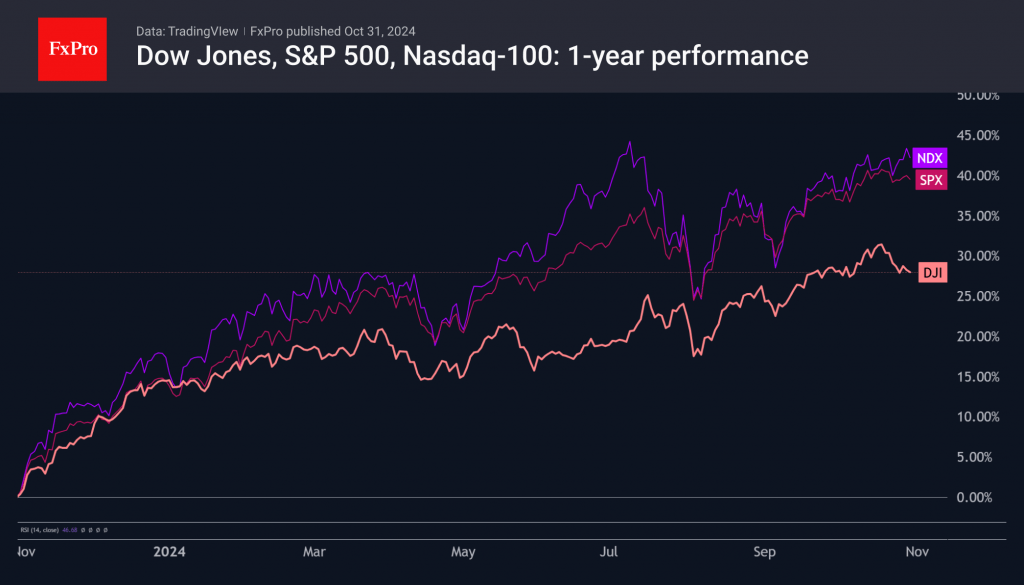

October 31, 2024

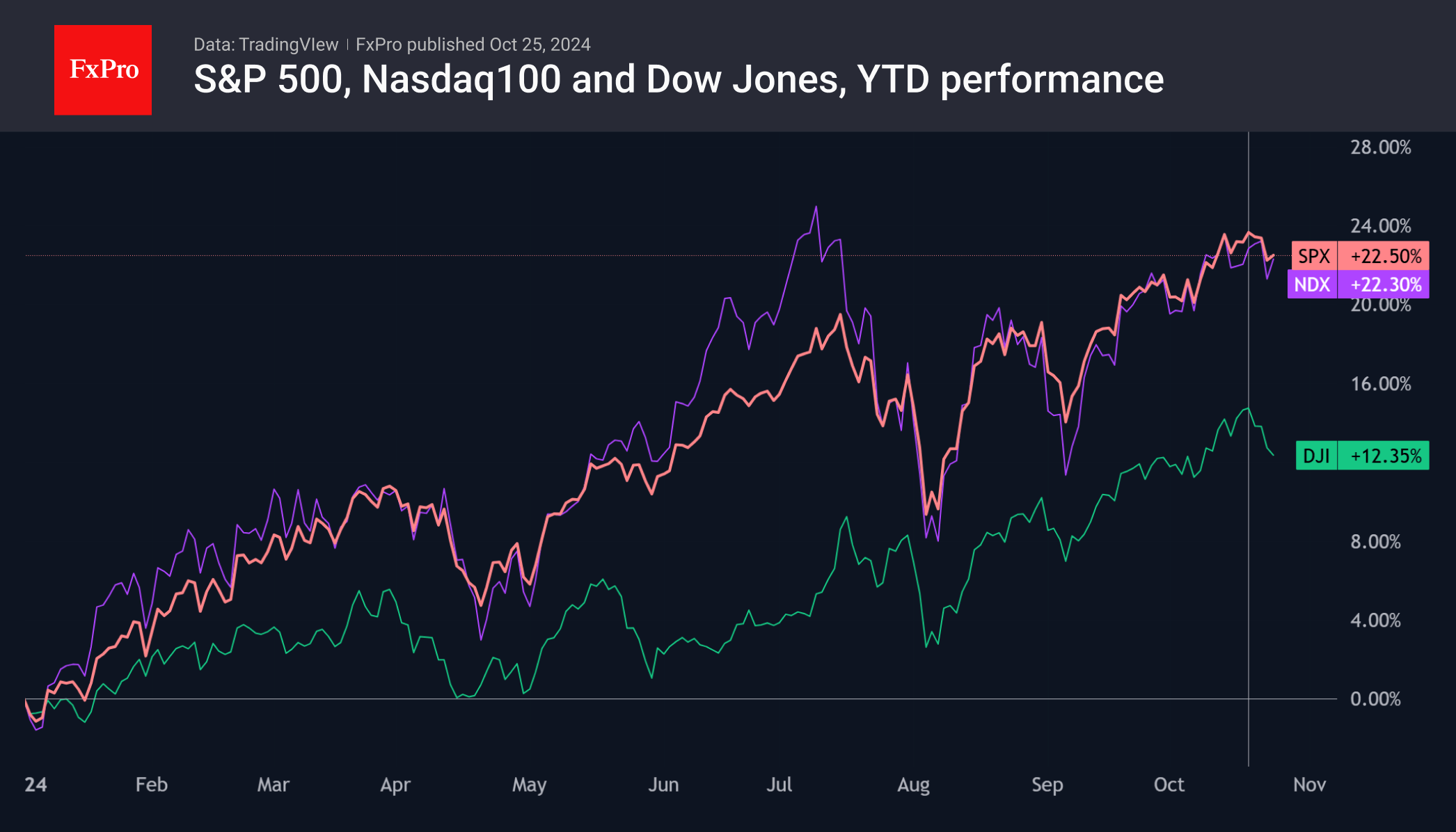

Major US indices struggled to regain growth, with the Dow Jones slipping below last week's lows and the Nasdaq100 approaching its mid-July peak before a wave of selling.

October 31, 2024

The dollar has seen a correction after weeks of growth, which is typical before important elections. Gold has been performing well, reaching all-time highs, but it has also experienced corrections in the past.

October 30, 2024

Market picture Polls and forecasts have yet to produce a clear frontrunner in the US presidential race. In recent days, there has been a widespread view that markets are pricing in a Trump victory, but for many investors it is.

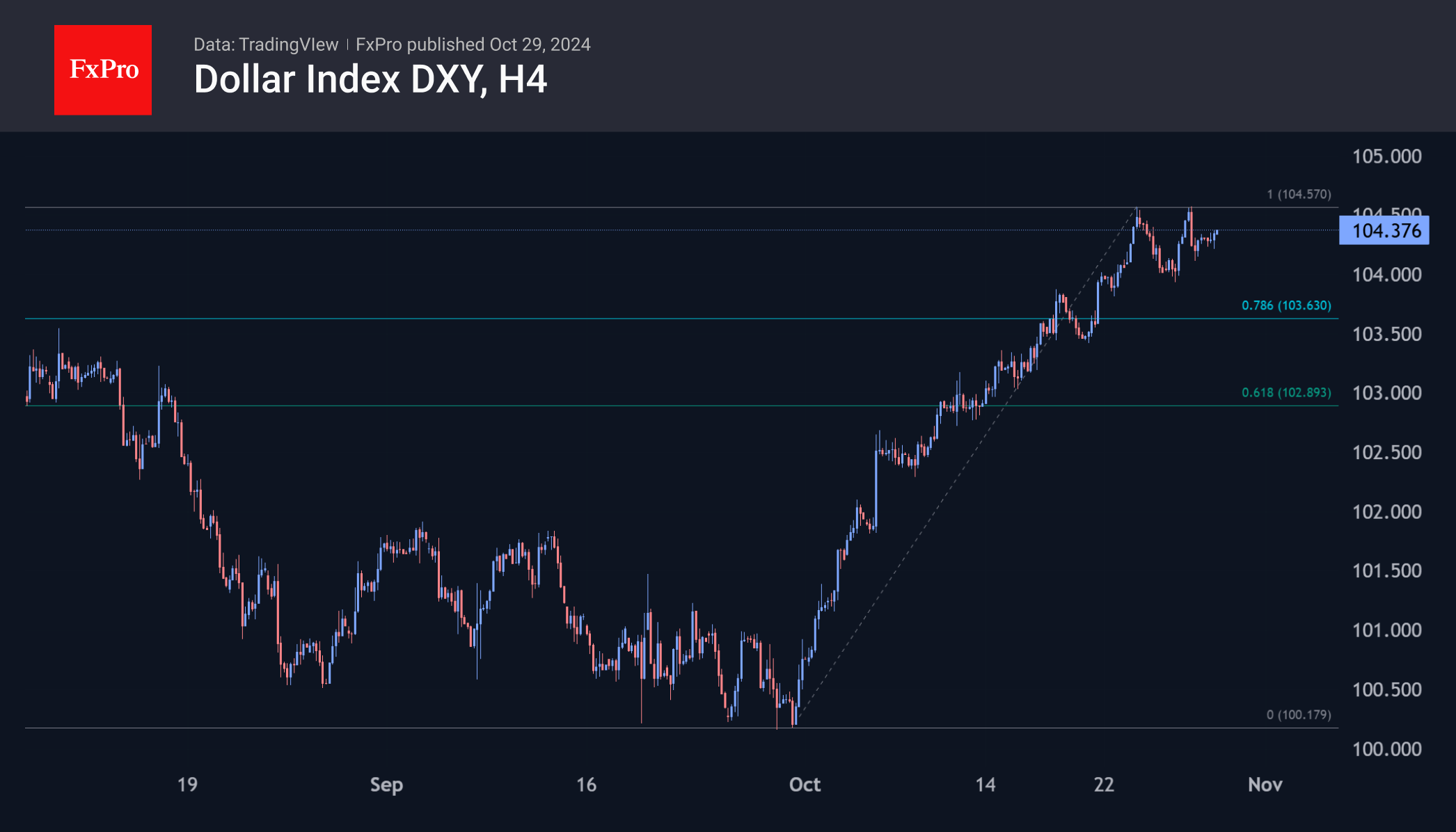

October 29, 2024

The Dollar Index stabilised in the 0.5% range for the fifth session, quietly finding its feet after a near 5% rally over the past thirty days. Since last week, currency market participants have taken a wait-and-see approach after four weeks.

October 28, 2024

The price of crude oil has fallen to its lowest levels in two months due to Israel's strike on Iran, causing a drop in the geopolitical risk premium. The decline in drilling activity, coupled with the increasing contribution of alternative energy sources, could lead to further declines.

October 26, 2024

In the upcoming week, we are expecting higher volatility, preliminary 3Q24 GDP estimates, BoJ Rate Decision and US NFP.

October 26, 2024

The US stock market experienced a decline after six weeks of gains. The Fear and Greed Index is a cause for concern, as it is moving out of a stable range. Tesla's stock saw a significant jump, while McDonald's faced negative attention.

October 26, 2024

The strength of the dollar is not due to its own strength, but rather the weakness of other currencies. Stocks and gold are rising alongside the dollar. Traders are reducing risks before important events in November. Potential pullback targets for the dollar are 103.8, 103.33, and 102.7.