Market Overview - Page 263

November 5, 2020

Bitcoin’s price climbed above $15,000 on Thursday, hitting a level not seen since January 2018 amid U.S. presidential election uncertainty. The world’s best-known cryptocurrency was last trading almost 9% higher at a price of $15,233, according to data from industry.

November 5, 2020

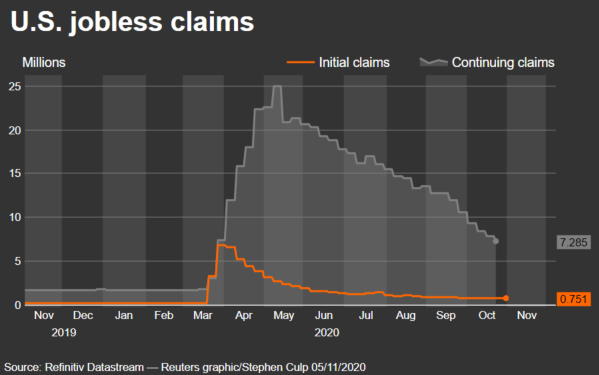

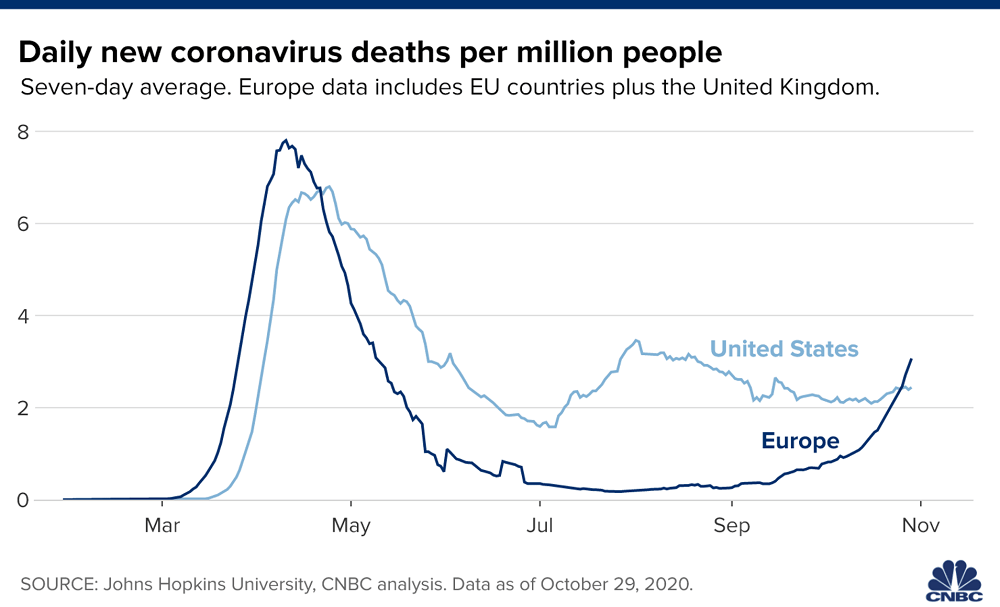

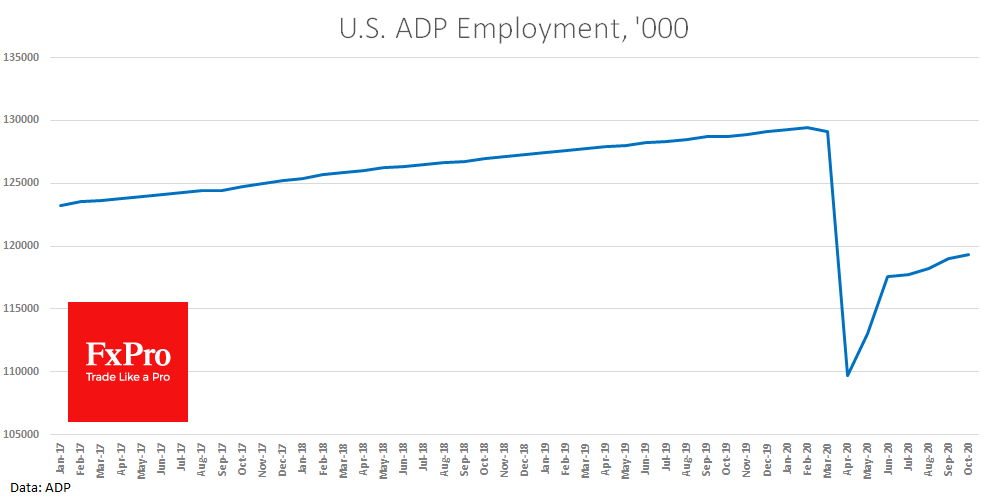

The number of Americans filing new claims for unemployment benefits fell only slightly last week, adding to signs that the economic recovery was losing steam as the COVID-19 pandemic intensifies and fiscal stimulus ends. The economy could be plunged into.

November 5, 2020

The U.S. dollar fell to two-week low against a basket of currencies and a seven-month low against the Japanese yen as surging stock markets reduced demand for the greenback, and before the Federal Reserve will conclude its two-day meeting. Democrat.

November 5, 2020

Ethereum (ETH) has hit multiple records amid news that ETH 2.0 could launch as early as Dec 1, according to crypto analytics firm Glassnode. Today’s launch of the deposit contract introduced the ability for users to deposit 32 Ether required.

November 5, 2020

The long awaited deposit contract for Ethereum 2.0 has finally been deployed opening the doors to staking opportunities for ETH holders. Deposits began in earnest with over $1 million in ETH landing in the contract within the first half an.

November 5, 2020

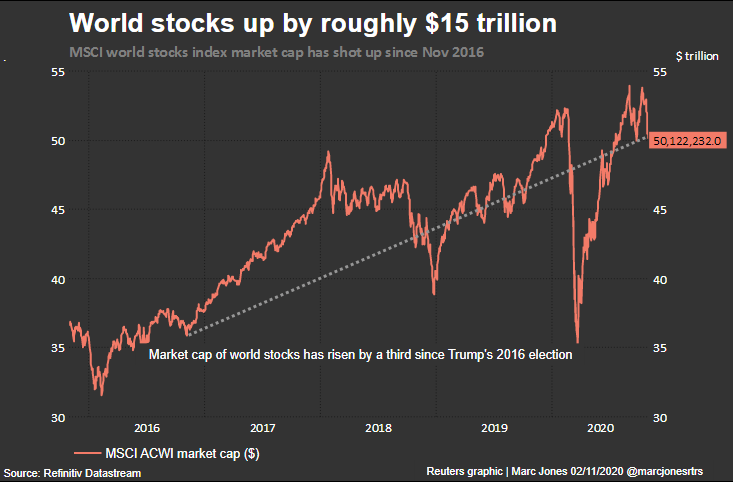

Europe and Asia’s stock markets climbed and bonds extended their rally on Thursday as Democrat Joe Biden inched closer to winning the White House and Britain’s central bank become the latest to shovel in additional stimulus. Biden is now favoured.

November 5, 2020

The European Commission is about to propose a “revolutionary” overhaul of digital regulation that could hurt the business models of Big Tech, industry experts told CNBC. The Digital Services Act, due to be presented in early December, is expected to.

November 5, 2020

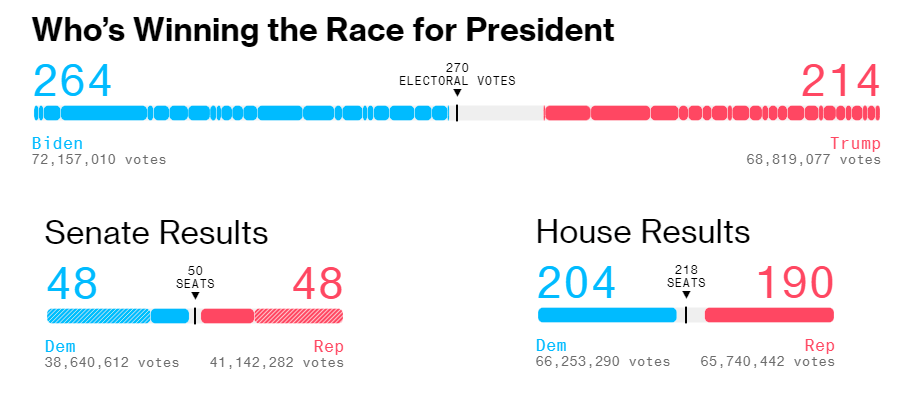

The winner of the US Presidential Race is still uncertain, and vote count continues. Both Trump and Biden say they are on their way to victory, but this confrontation promises to escalate into lawsuits and further counting of votes. The.

November 5, 2020

The U.K.’s central bank on Thursday held interest rates steady as England enters a fresh period of national lockdown measures expected to hit the country’s economic recovery. Along with maintaining its main lending rate at 0.1%, the Bank of England’s.

November 4, 2020

The Turkish lira resumed its drop as early presidential election results in the U.S. pointed to a closer race than polls had predicted, while traders focused on the prospects for a local interest-rate hike. The lira fell as much as.

November 4, 2020

People are tired in France where President Emanuel Macron imposed the country’s second nationwide lockdown beginning Friday to combat a resurgence of the coronavirus outbreak in Europe, says Parisian videographer Joseph Savage. “There was a kind of united front the.