The crude oil price still has plenty of room for growth

November 11, 2020 @ 14:36 +03:00

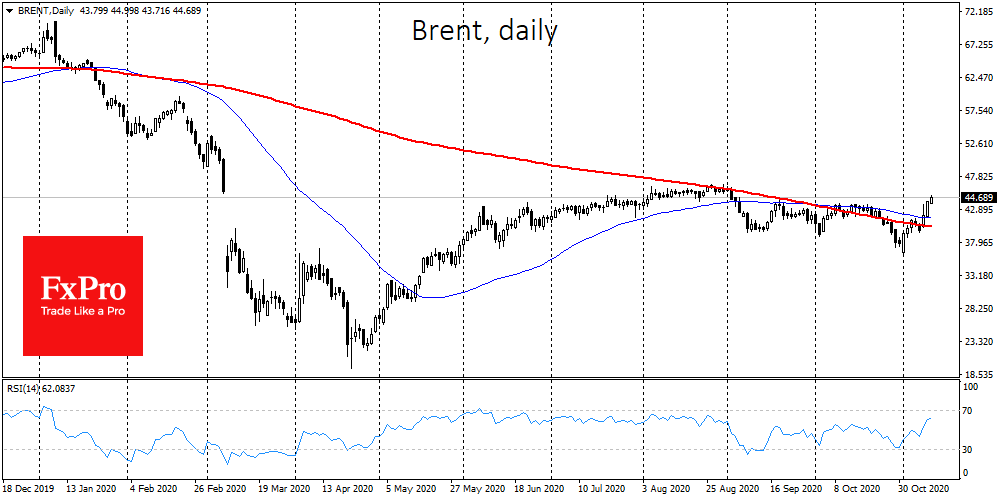

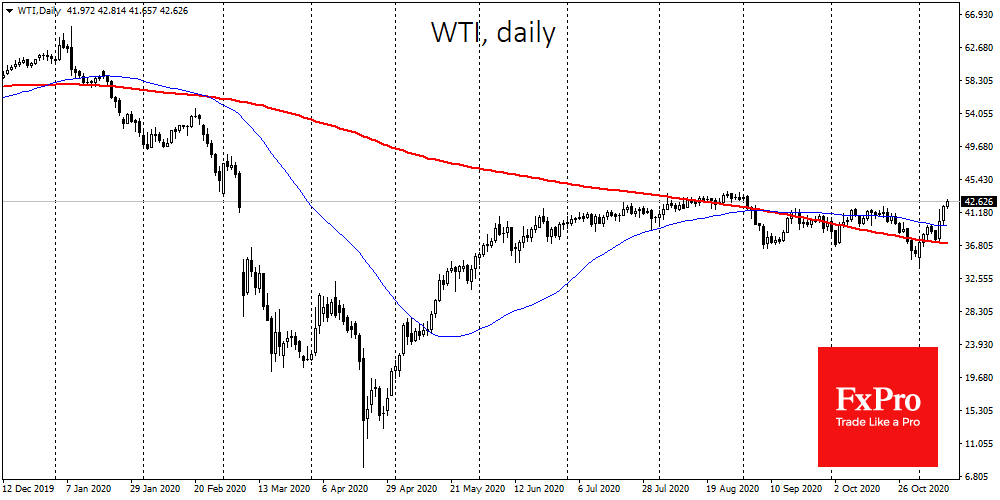

Oil is growing steadily this month and since the beginning of the week, it has climbed by 12.5% for WTI and 11.5% for Brent.

Both popular oils have returned to their 2-month highs, although they opened November with a drop to their lowest prices since late May. A combination of positive factors reversed the short-term trend.

The latest driver was the nightly API data, which showed a decrease in inventories for Crude, gasoline and distillates. These figures have regained the momentum of oil growth, indicating that demand is already returning, and is not just a positive expectation for the coming months.

The Energy Ministry (EIA) also supported the bullish attitude in the markets, slightly improving its forecast for oil demand in 2020. At the same time, the US production forecast was lowered by 60 thousand barrels to 11.39 MBD.

Expectations for 2021 continue to assume a lower production level of 11.1 MBD.

Besides, markets have strengthened their forecasts of recovery in oil and gasoline demand since the beginning of the week, amid hopes for vaccine progress.

Even before this news, commodity sales in the first days of November were halted by reports of continued close cooperation within the OPEC+ framework. Representatives from Saudi Arabia and Russia made it clear that they were ready to extend tighter production quotas for longer. This has removed concerns from the market about oil supply levels getting out of control.

Also overnight, the Saudi prince held a video conference with representatives of Iraq, where previously, oil was produced above the established quotas. However, they now promise to stick to the agreements.

The US data further cemented that supply recovery has not kept pace with demand, pushing prices up.

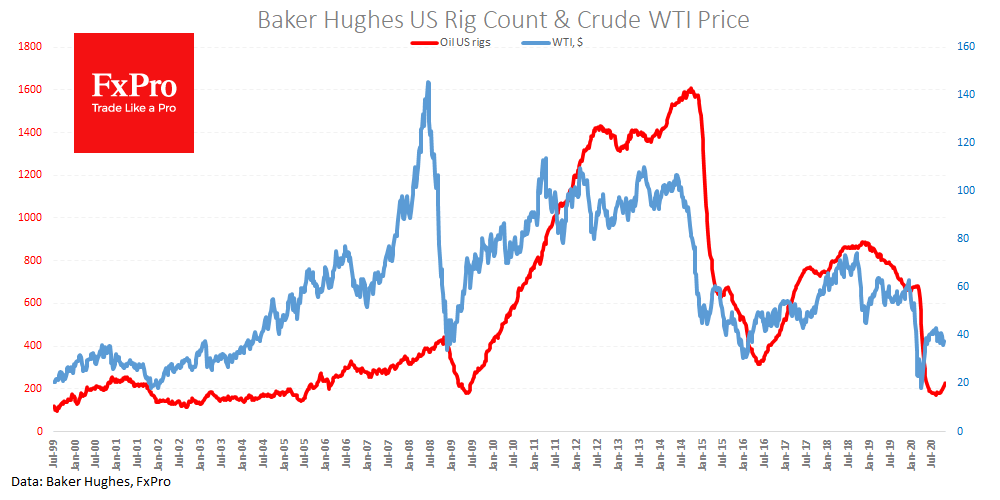

The steady recovery of drilling activity in the US in recent weeks appears to be a small bounce after a historic setback, so the US Department of Energy is preparing for a decline in production in the coming year.

On the technical side, oil has made a significant breakthrough with a sharp move above the 50- and 200-day moving averages.

The nearest targets for the bulls on oil may be the August highs of $44 for WTI and $46 for Brent.

Moving beyond these levels will open up significant space for Techanalysis, up to 50 for WTI and 53 for Brent.

However, there is scepticism about the prospects for sustainable growth above these levels as demand remains very fragile due to increasing coronavirus restrictions around the world.

We should not forget that even if the vaccine is successful, the economy will still be reeling from the impact over the coming quarters and maybe even years.

The FxPro Analyst Team