Vaccine-based market optimism risks quickly losing ground

November 10, 2020 @ 13:00 +03:00

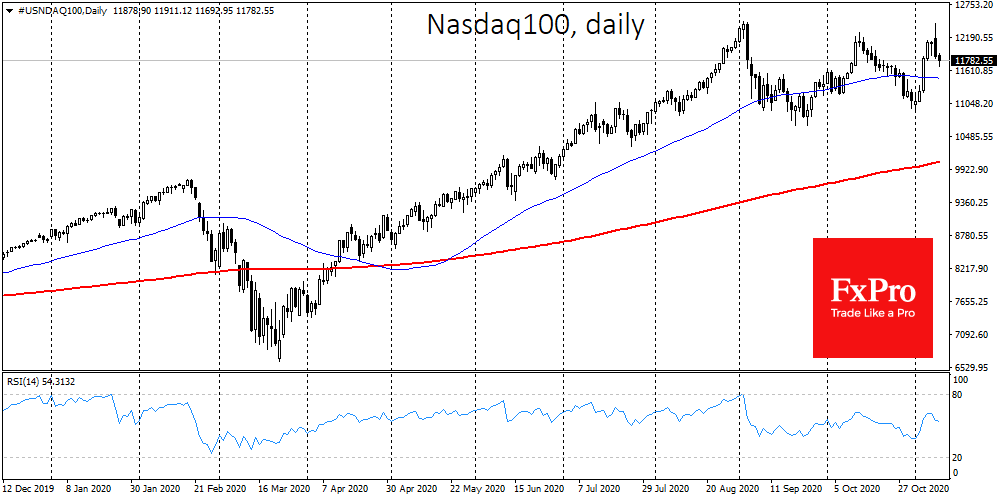

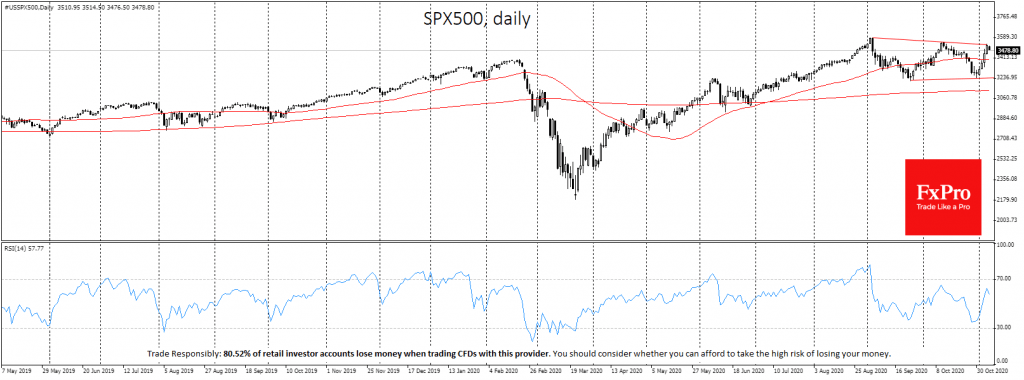

Global markets soared on Monday after news of the successful results of the third phase of the joint Pfizer and BioNTech vaccine development. Futures on the S&P 500 and Dow Jones soared to new historic highs, but could not sustain them. The Nasdaq100 had an even heavier correction, as the initial spike in stocks included in this index very quickly turned into a sale.

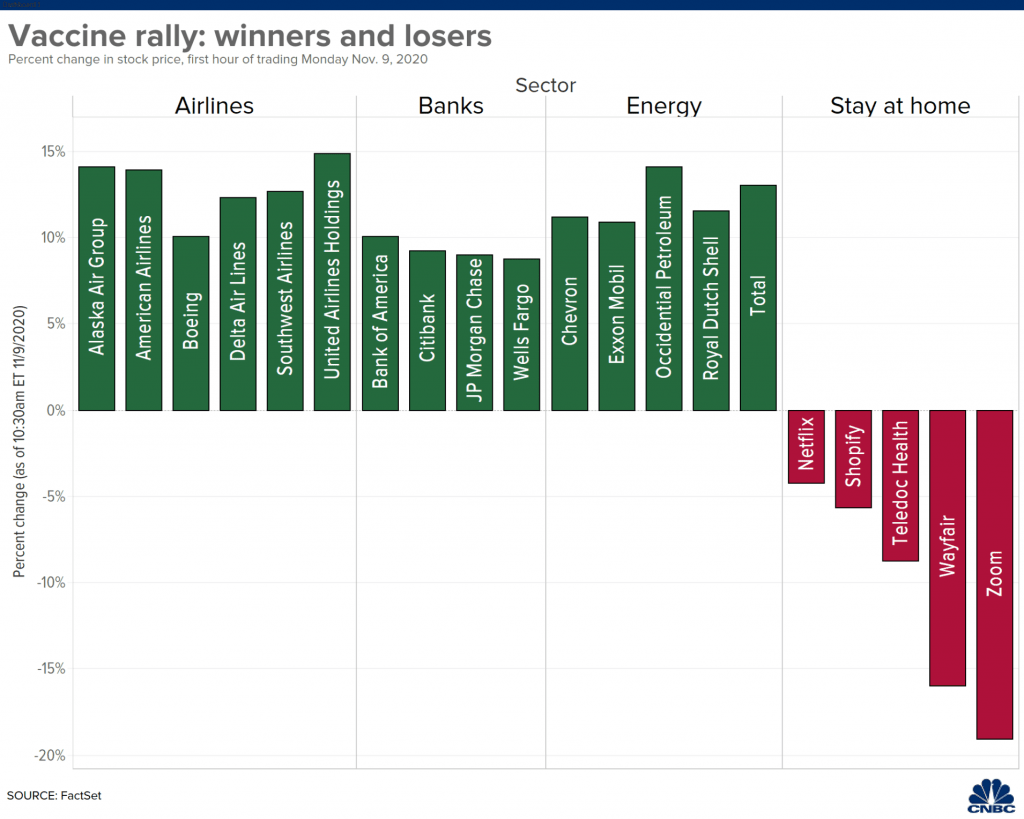

The initial move was a complete reversal of the trends of the previous months: the growth leaders included stocks of cinema chains, cruise companies, airlines, and theme parks, as well as oil producers. All grew on speculation around the possibility of quickly returning to normal-ish life, as Pfizer can swiftly put the vaccine to mass production.

The same idea of a rapid recovery has led to an abundance of profit-taking in recent hippie stocks such as Zoom, Peloton and many others. ‘Stay-at-home’ shares decline caused a 1.5% slip in the Nasdaq100 on Monday and is further developing its decline at the beginning of trading on Tuesday.

The caution of senior politicians also fuelled caution on the markets. Johnson was very restrained in commenting on the progress of the vaccine. As with Moderna, development can be difficult.

Even more disturbing comments came from the US. President-elect Biden who noted that there is still a “dark winter” ahead, bringing back to the markets fear of a new lockdown amid records for new daily cases and multi-month highs for daily deaths.

The Fed Chairman noted yesterday the risks of increasing consumer credit defaults and the increased leverage of hedge funds. These same factors have become a trigger for the global financial crisis. They are not as extreme now as they were 13 years ago. However, the state of the economy and increased uncertainty is causing us to look forward with caution.

In other words, it may well turn out that a short-squeeze caused yesterday’s jump in stocks more near the index highs than by material improvements and forecasts. This means that profit-taking sentiment may soon dominate and this is a very fragile state in which bad news can quickly turn into a full-scale selloff.

The FxPro Analyst Team