Market Overview - Page 127

September 23, 2021

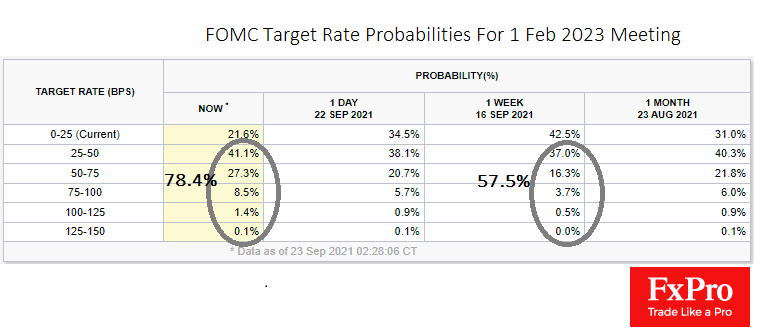

The US central bank kept its monetary policy unchanged at the end of the two-day meeting. This was in line with market expectations and therefore did not cause much excitement. Nevertheless, the outcome of the discussion was neither dull nor.

September 23, 2021

The big central bank week continues. Following the Fed yesterday, the Swiss National Bank left its policy unchanged and now the markets’ attention is turning to comments and signals from the Bank of England. Market participants will assess the chances.

September 22, 2021

Markets are quiet in anticipation of the Fed’s comments later today. The most popular currencies and equity indices have stabilised near important levels near the limits of their trading ranges, from where they are equally likely to step back into.

September 21, 2021

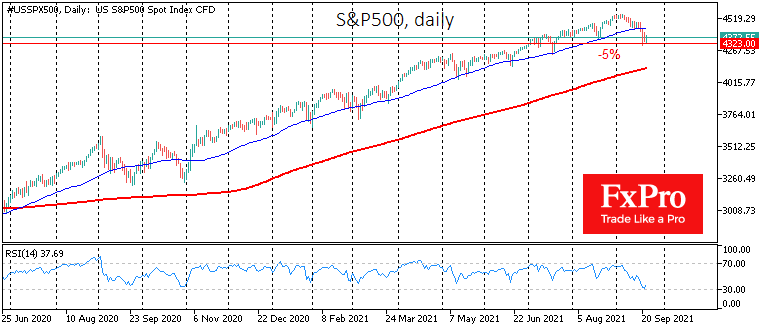

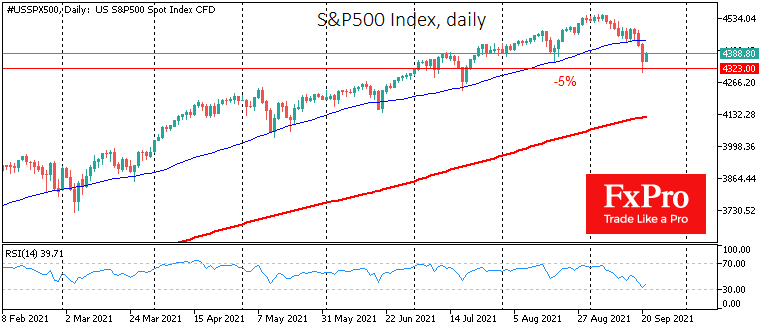

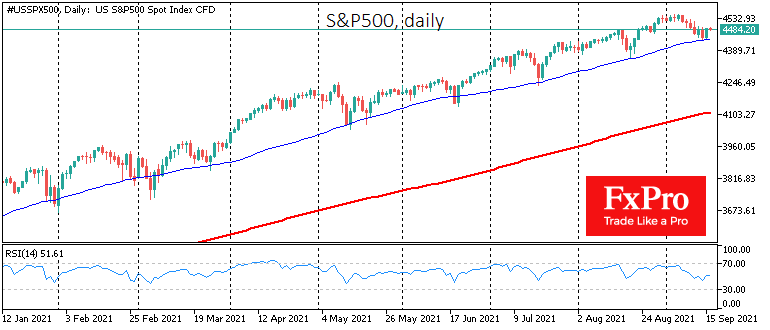

The Dow Jones index experienced its worst drop in 10 months on Monday, falling 600 points or 1.8%. The S&P500 index lost about the same amount, 1.7%. The dollar index climbed to monthly highs, trading above 93.0. Intraday, the S&P500.

September 17, 2021

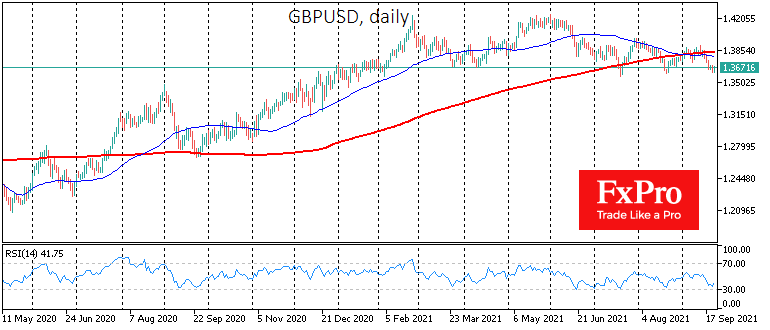

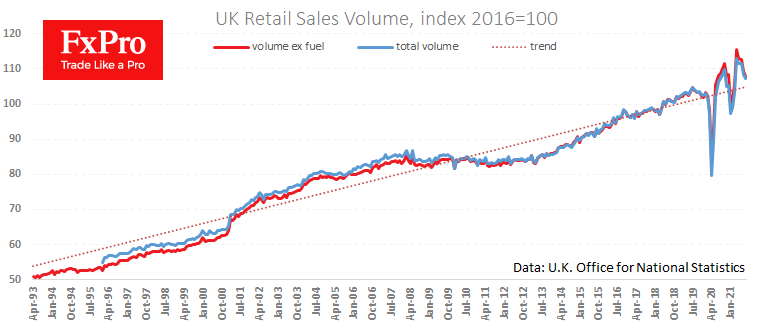

UK retail sales collapsed by 0.9% in August, an unpleasant surprise against a 0.5% rise expected. The retail sales index is above pre-pandemic peaks, but the markets should be alarmed by the volatility of the data. Weak retail activity figures.

September 17, 2021

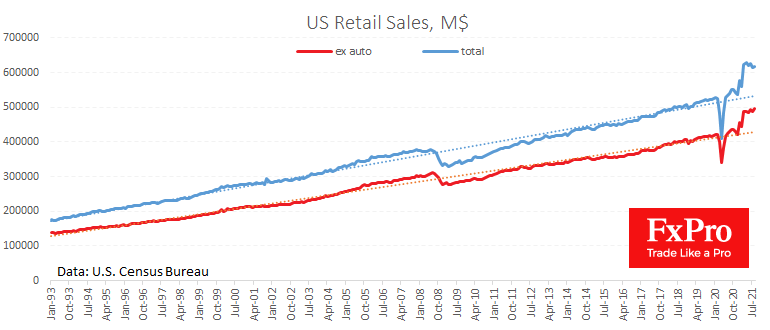

The US Retail sales notably exceeded expectations, adding 0.7% in August vs an expected 0.7% decline. The increase to August last year is an impressive 14.9%, dismissing fears that Americans are cutting back on spending by spending their government bailout.

September 16, 2021

Caution is an investor’s best friend these days. US indices were supported the night before after the S&P500 touched its 50-day moving average. The S&P500 gained 0.85%, the Nasdaq gained 0.82%, and the Dow Jones gained 0.68%. It must be.

September 15, 2021

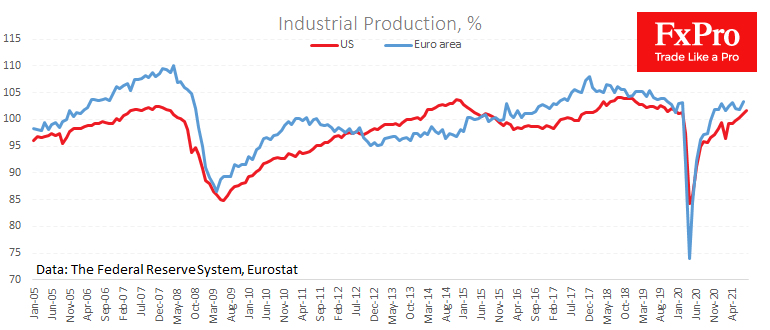

Today is industrial production data day. China, the euro area and the USA published their figures. While the US and China are reporting for August, aggregate data for the euro area only came for July. Europe managed to surprise with.

September 14, 2021

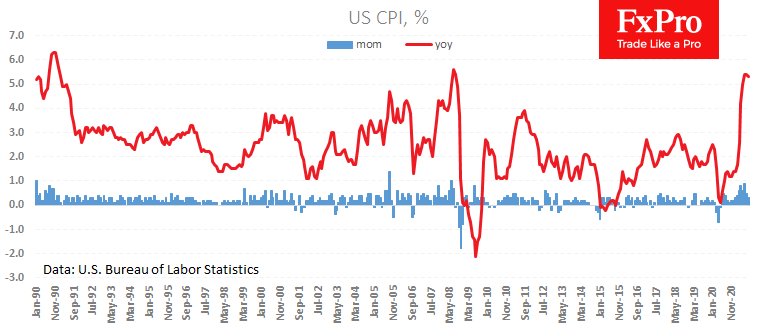

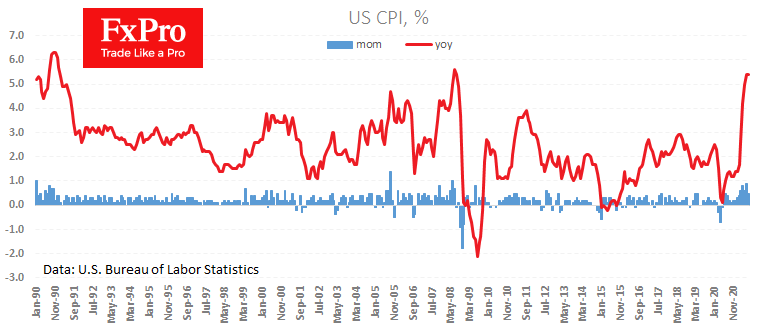

US Consumer inflation started to slow, as can be seen in the latest official data. The consumer price index added 0.3% m/m during August. Growth to the same month a year earlier slowed to 5.3% for the overall index and.

September 14, 2021

US consumer inflation is in the spotlight today, where forecasters expect a slowdown in the year-over-year growth rate from the current 5.4%, a high in the last 30 years. The wait-and-see attitude of the markets probably reduced the degree of.

September 13, 2021

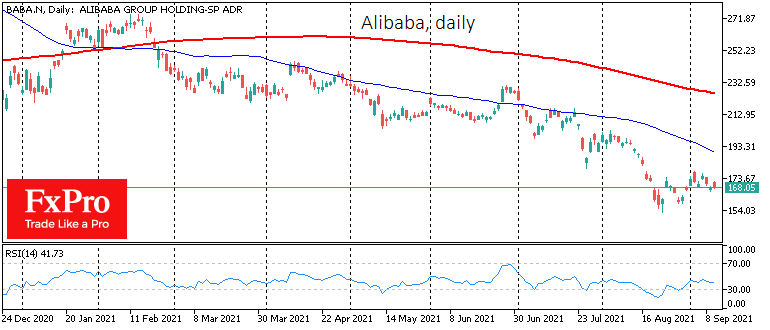

Two of the world’s largest economies are in sync with pressure on their fintech giants. Access to user data and the growth of ecosystems have effectively created new monopolists that have lately been profiting lavishly from this information themselves and.