US Treasuries yields pullback pressured USD, but unlikely for long

November 09, 2021 @ 16:17 +03:00

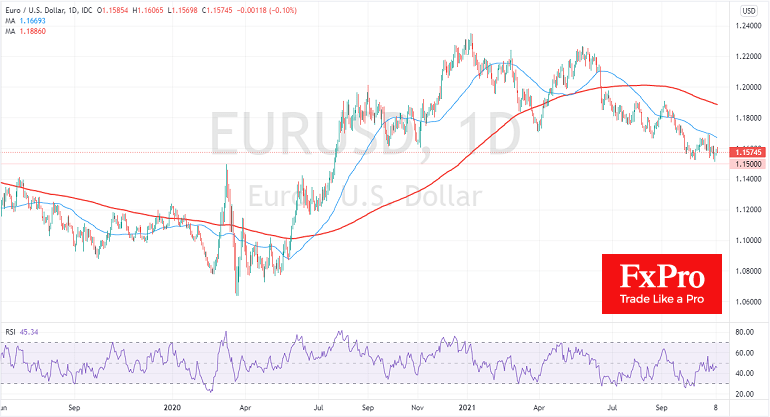

The single currency managed to pick up demand from buyers on the downside in the 1.1500 area, falling back to the October lows and briefly renewing its lows from July 2020.

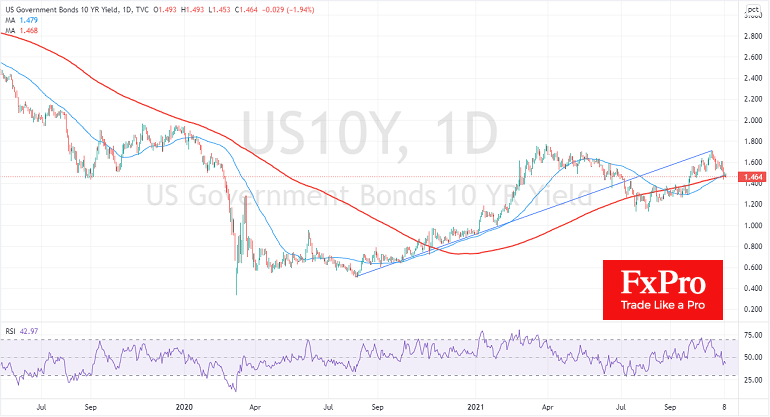

A temporary recovery in the EURUSD exchange rate was facilitated by a fall in US government bond yields from the second half of last week. A reduction in the yield spread reduces the attractiveness of buying US debt securities compared to European ones.

Yields on 10-year Treasuries have now stabilised at 1.48%, near their 50 and 200-day moving averages. A decline from these levels could be an essential first signal to break the uptrend.

A further decline in yields in the USA could intensify the selling of the Dollar.

However, the chances of such a breakdown are slim because of high inflation and reduced asset purchases on the Fed’s balance sheet. These factors simultaneously create upward pressure on yields.

The higher chances that the Euro’s recovery momentum would fade in the coming days or hours, renewing its drag for the EURUSD towards levels below 1.1400. Pressure on the single currency is already visible against the pound. EURGBP has encountered intensified selling on the approach to 0.8600, where selling has intensified from lower levels than in late September.

The FxPro Analyst Team