Growth in equities goes to smaller firms – a bullish sign

November 08, 2021 @ 18:02 +03:00

Markets continue to see increased demand for risky assets thanks to several fundamentally positive news at once, from solid labour market data and the adoption of a support package to hopes for a covid-19 pill from Pfizer.

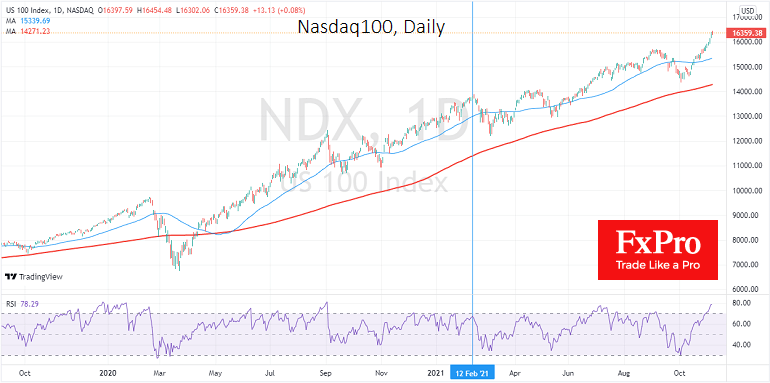

A rally in equities is getting underway in the US markets, with the Nasdaq100 adding 12.7% from its local lows of October 13, when the latest rally started. During the same period, the S&P500 and Dow Jones gained 8.9% and 6.7%, respectively.

We pay attention not only to the rally’s strength but also to the balance of power between the key US indices. Stocks in the Nasdaq are very sensitive to changes in interest rates. In the last two weeks, we have seen a decline in US 10-year yields, which have fallen from levels above 1.7% to 1.48% at writing.

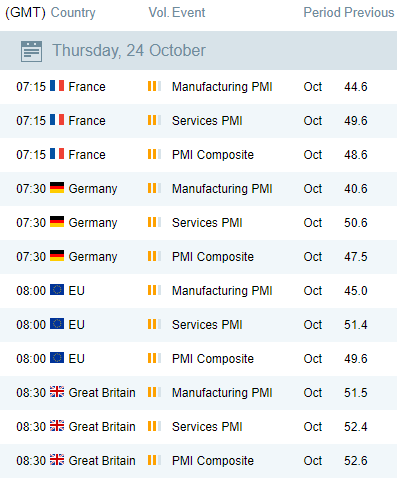

Behind the decline in long-term bond yields has been an impressive performance by the world’s major central banks, the Fed, the ECB, the Bank of England and the Bank of Japan, who have convinced markets that they are being too hasty with their rate hike forecasts. The negative experience can easily explain this approach by the big four central banks after the GFC when the recovery was too uneven and lengthy.

Many observers point to fundamental differences between the current situation and what we saw ten years ago. In particular, back then, households had high debts and declining incomes. However, their debts are not as high now, and personal savings are at record highs thanks to coronavirus governments paychecks. Short-term, the current situation is favourable for equity markets.

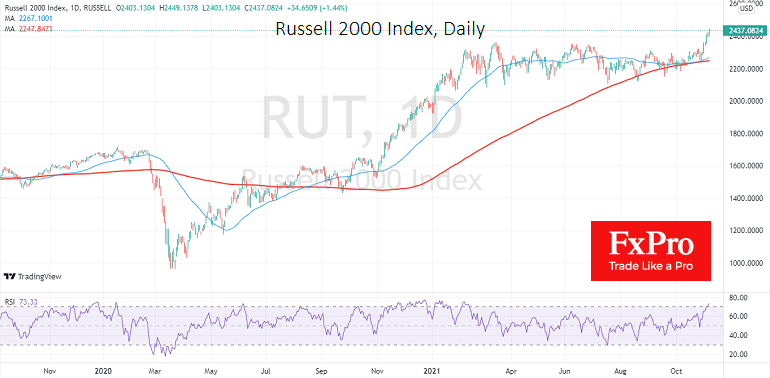

Besides Nasdaq’s bull run, it is worth noting the Russell 2000 climbing out of its sideways channel since March of this year. The growth of this index, which includes small stock market companies, is a significant signal of the strength of the current rally. It has gained 4.8% versus 3% for the Nasdaq, 2% for the S&P500 and 1.1% for the Dow Jones in the last five days.

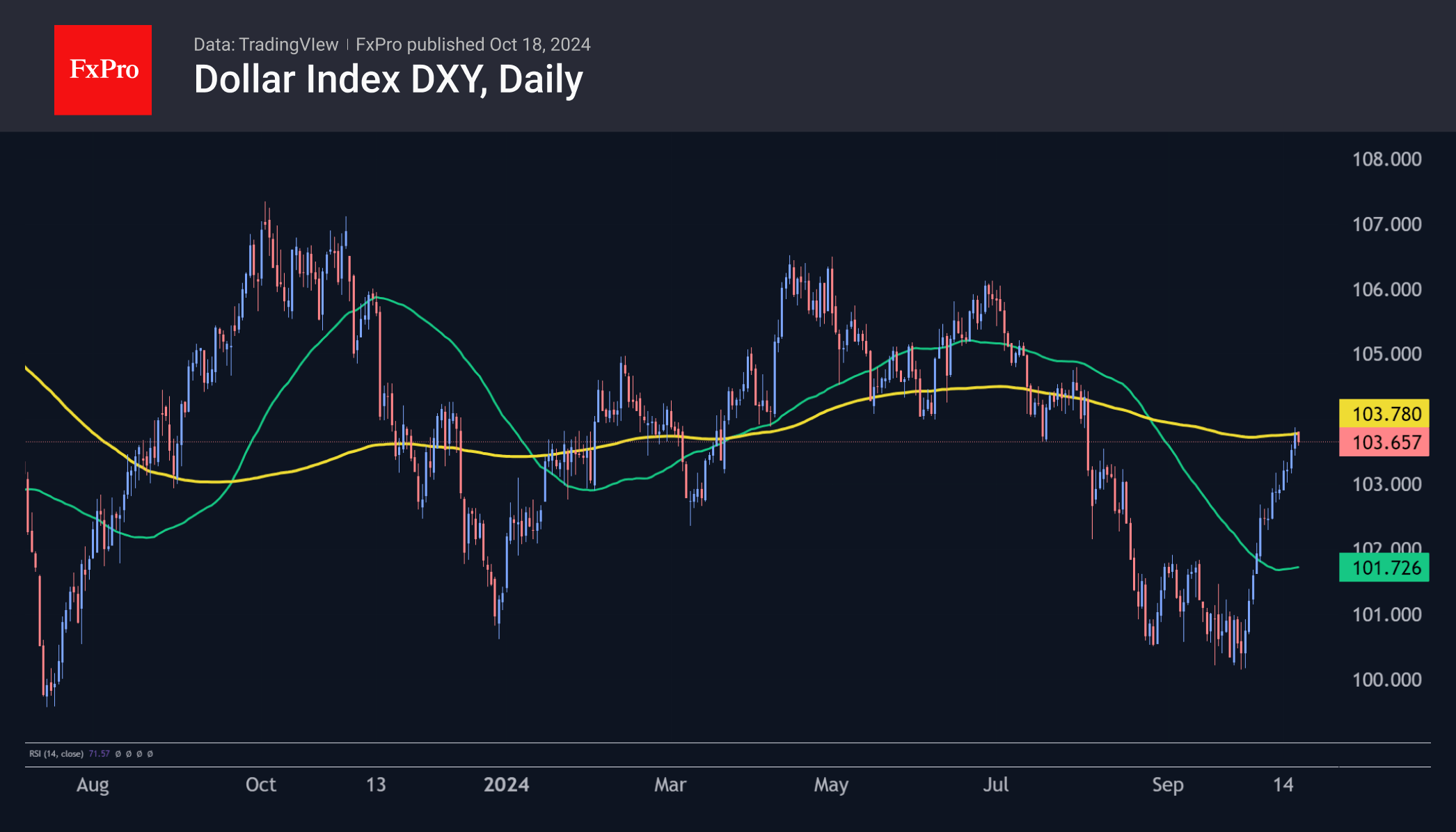

The Russell 2000 made new highs a year earlier, with a 50% rise from November to March. We may not see the same amplitude of growth this time, but the timing sets up a strong finish to the year for equities. Interestingly, risk appetite has not undermined the dollar’s position against major currencies in recent weeks, as major central banks have taken a similar or even softer approach to monetary policy than the Fed. As a result, the dollar index has remained in an upward corridor since the start of the year.

The FxPro Analyst Team

GBP | BOE Governor Andrew Bailey Speaks

GBP | BOE Governor Andrew Bailey Speaks