Market Overview - Page 125

October 20, 2021

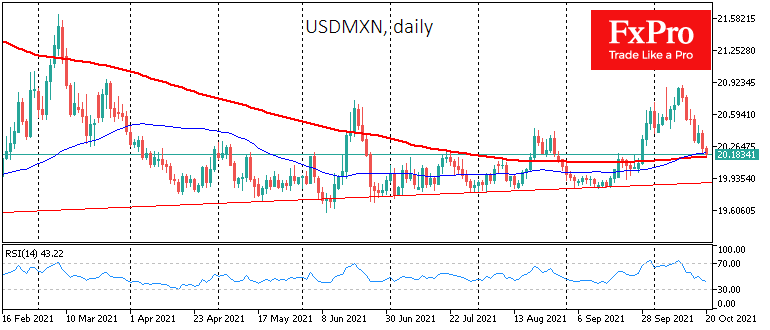

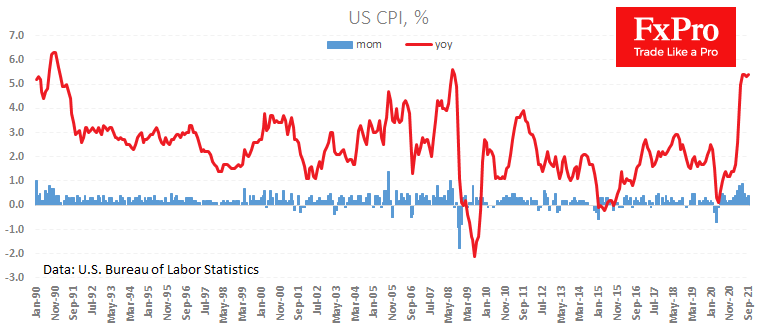

Inflation remains the biggest threat to emerging markets. In contrast to advanced economies, high current or expected inflation figures undermine the stability of the national currency. In response, emerging market central banks are forced to actively raise key interest rates.

October 20, 2021

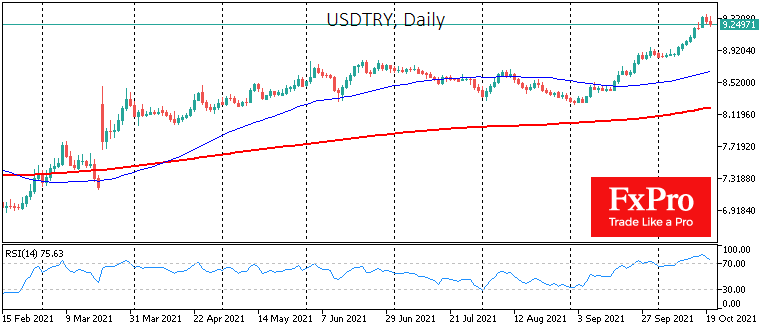

Energy prices halted their growth, while optimism in global markets continued to gain momentum. In this environment, the Turkish Lira has paused its weakening, closing Tuesday with gains against the Dollar and Euro after eight consecutive sessions of decline. In.

October 20, 2021

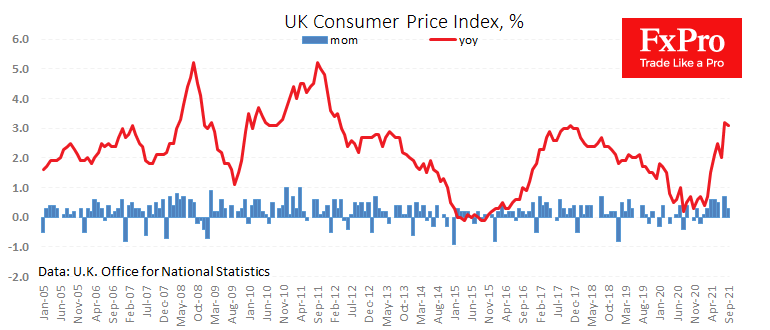

UK inflation data surprised with weakness, with the year over year price growth slowing to 3.1%. Looking back at the rate of producer price performance, it would not be surprising if the pullback in inflation was temporary and illusory, as.

October 15, 2021

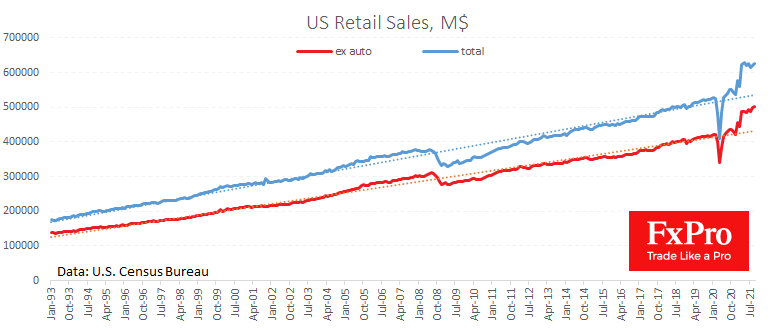

US retail sales significantly exceeded expectations, continuing a series of healthy data supporting global risk demand. US Census Bureau reported a 0.7% rise in sales for September after a 0.9% (revised from 0.7%) increase a month earlier. Sales excluding autos.

October 15, 2021

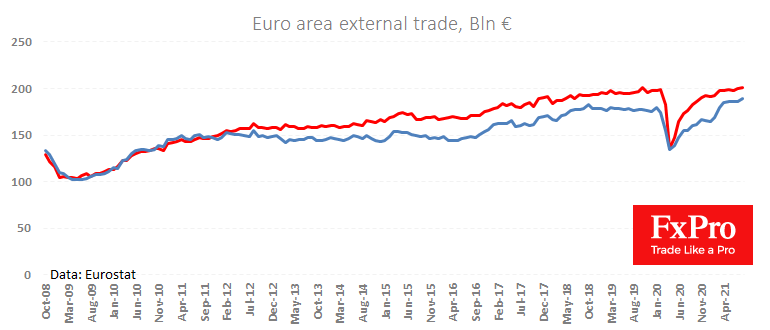

The eurozone’s trade surplus is under pressure this year, reducing support for the single currency against rivals. Data published today showed a reduction in the seasonally adjusted trade surplus to 11.1bn, compared with the expected 14.1bn and 13.5bn a month.

October 15, 2021

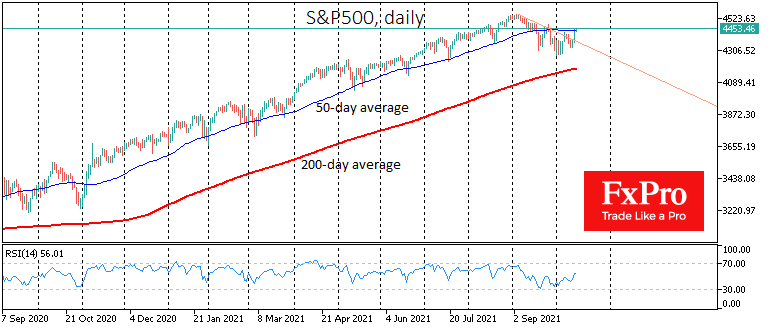

The S&P500 index closed Thursday with the biggest gain in seven months, adding 1.7%. In a sharp move, the index managed to get back above the 50-day average and maintained its position above that line as of Friday morning. Traders.

October 14, 2021

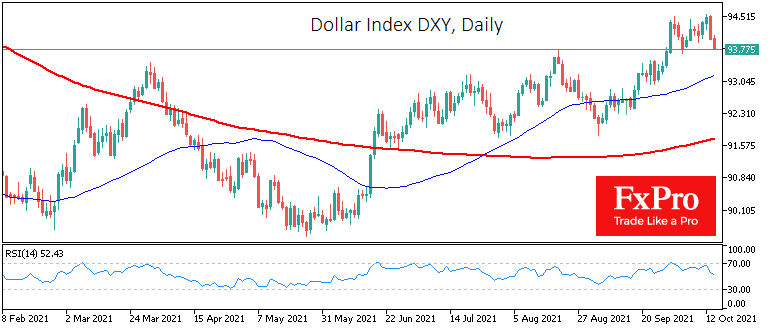

The dollar pulled back from a one-year high area, with US stock markets closing higher on Wednesday and its futures adding in trading in Asia. This performance was a market reaction to inflation data and FOMC meeting minutes. The market.

October 13, 2021

US inflation shows no signs of easing. The headline number returned to 5.4% y/y, the highest since 2008, vs the expected 5.3%. Core CPI stabilised at 4%. That is not to say that the data deviated much from expectations and.

October 13, 2021

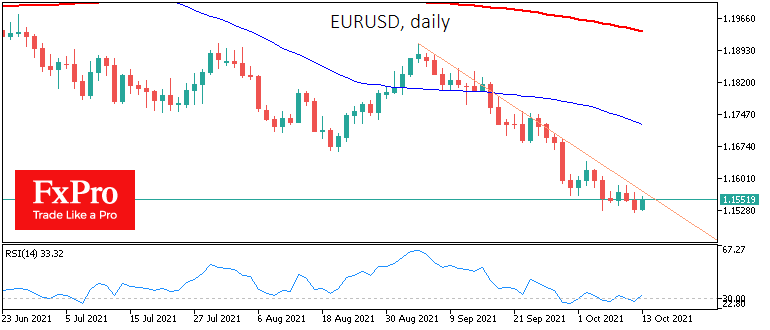

In the most traded currency market pair, there is an even more persistent downward trend. The EURUSD has rolled back to 1.1550 from the local peak at 1.1900 in early September, experiencing a systematic decline. Since late September, the RSI.

October 12, 2021

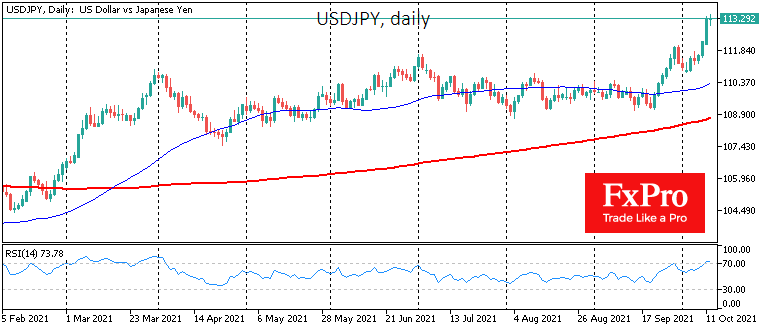

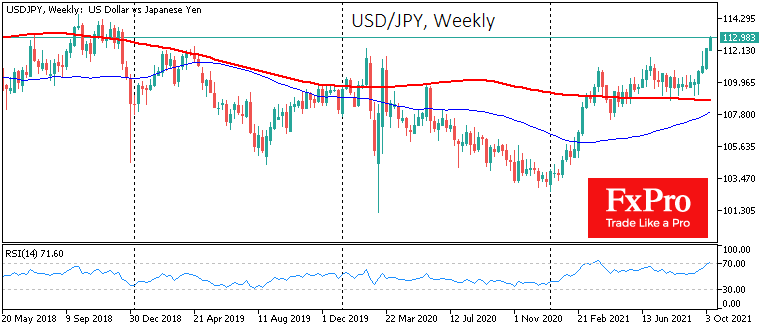

The Japanese yen has collapsed by more than 1% to 113.50 in the past 24 hours, the biggest intraday gain since November last year and sending the pair to its highest since December 2018. Often the pressure on the yen.