Unexpected US jobs drop shows that steep rate rises are not guaranteed

February 02, 2022 @ 17:57 +03:00

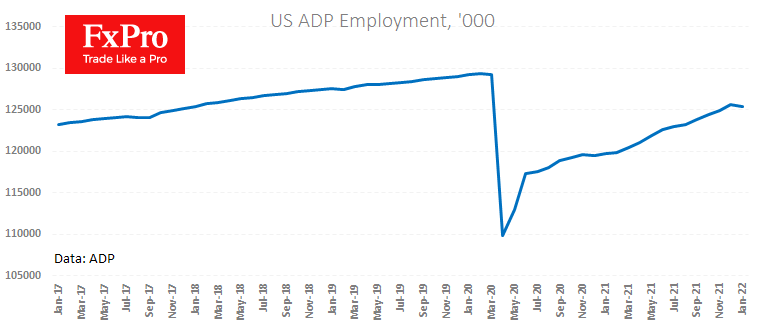

According to the latest ADP data, employment in the USA fell by 301K in January. This is sharply weaker than the expected gain of 185K after a rise of 776K in December.

The shocking dip is caused by both the sharply deteriorating coronavirus situation and evidence of how hard it is for small businesses to gain momentum. Almost half of all job losses came from small companies. From another perspective, the leisure and hospitality sector lost more than 150K jobs.

This is alarming data before Friday’s official statistics, where early forecasts had suggested a 165K increase in employment. If the official report is weak, we should expect the Fed to soften its stance and revise the market’s expectations for the rate.

The markets are almost 100% betting on a 125-point Fed rate hike in 2022. A softening of these expectations could trigger a correction pullback in the dollar.

The FxPro Analyst Team