Brent consolidates around $85-105

January 31, 2022 @ 14:20 +03:00

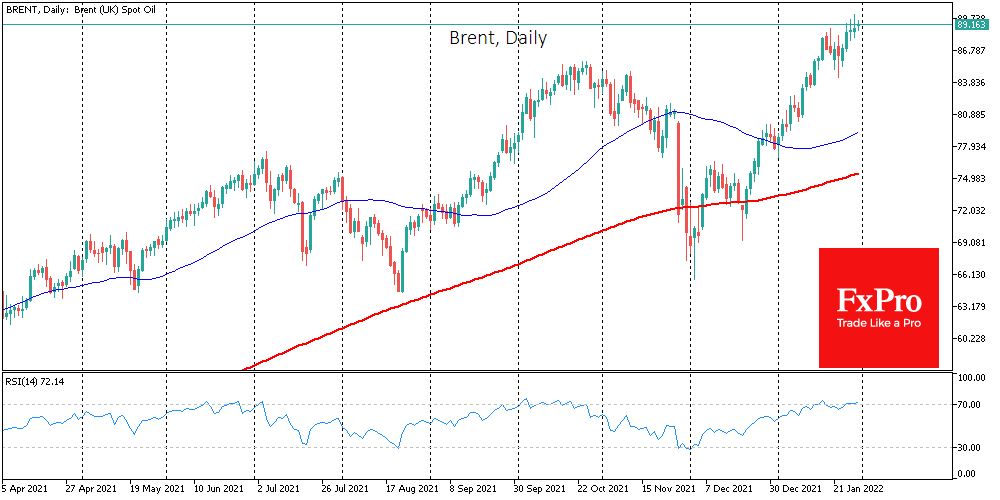

Oil has added more than 14% this month, and Brent spot contracts are trading near $90 a barrel.

Steady strengthening has been underway for the past two months after it became clear that the widespread Omicron strain is not leading to new travel restrictions.

The November correction in oil served the bulls well by unloading the market from an overhang of bullish positions. We now see a resistance breakout, which has reversed oil twice before, in 2018 and 2021.

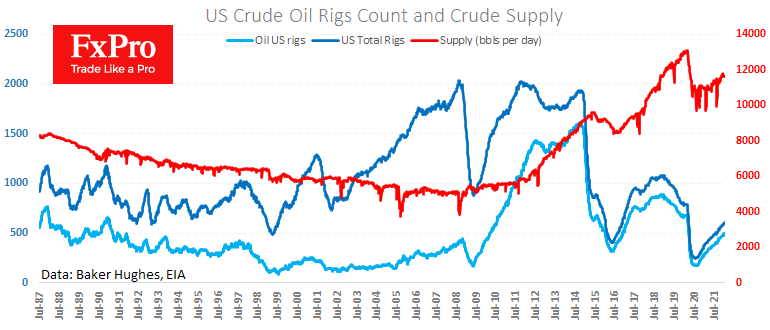

On the fundamental analysis side, we also see a short-term bullish picture for oil. The Americans continue to ramp up drilling activity, bringing the number of working rigs to 610 last week. However, this is still not enough to significantly accelerate production.

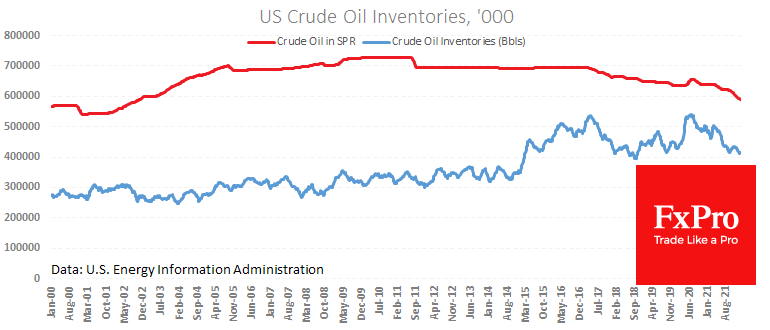

Production has stabilised around 11.7 mln BPD for the last nine weeks. These are significant volumes by historical standards: America only produced more from early 2019 to May 2020. But these volumes are not enough to stem the decline in stocks, which have returned to the region of the 2019 lows despite the sell-off and the strategic reserve.

On the other hand, there are no signs yet that OPEC+ will accelerate its 400k BPD production increase plan at the beginning of the month. Moreover, there is a chronic over-quota, meaning countries are producing less than quotas allow.

Some attribute this to Saudi Arabia and other Gulf countries pushing prices as high as possible. But several observers also point out that the cartel and many other countries cannot produce more because they have severely underinvested in past years. This argument is doubly true for Russia, the US, and several countries where production requires sustained investment.

This sets the stage for oil to move into the $85-105 area in the first half of the year. However, oil bulls should remain cautious because of tightening monetary conditions in the US and other DM countries. In addition, production is rising, albeit slowly, and the demand ceiling is just around the corner.

The FxPro Analyst Team