Market Overview - Page 123

November 26, 2021

• WTI under strong bearish pressure • Likely to fall to support level 67.35 WTI under the bearish pressure today after the price broke the two key support levels – 74.85 (low of the previous impulse wave 1) and 73.00.

November 25, 2021

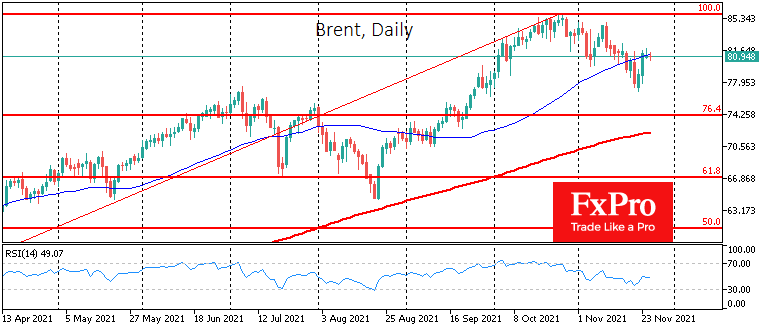

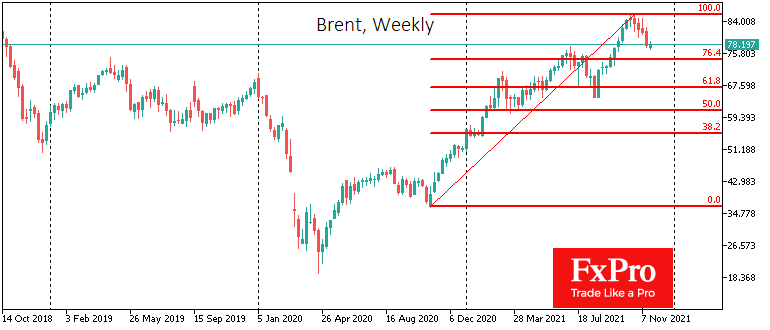

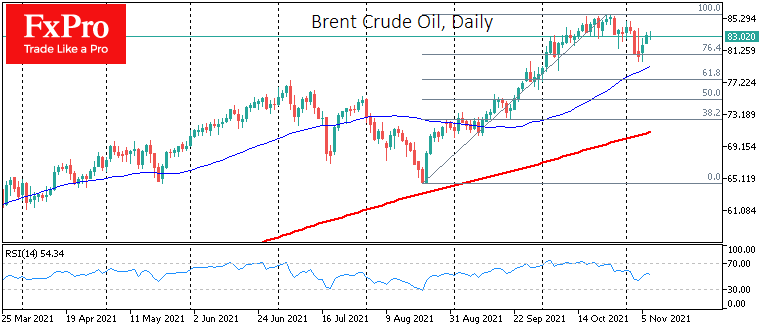

Earlier this week, the US and several major oil importers announced their intention to sell part of their strategic reserves to bring down the price. The total volume of interventions from so-called Anti-OPEC is around 70M barrels, of which 50M.

November 23, 2021

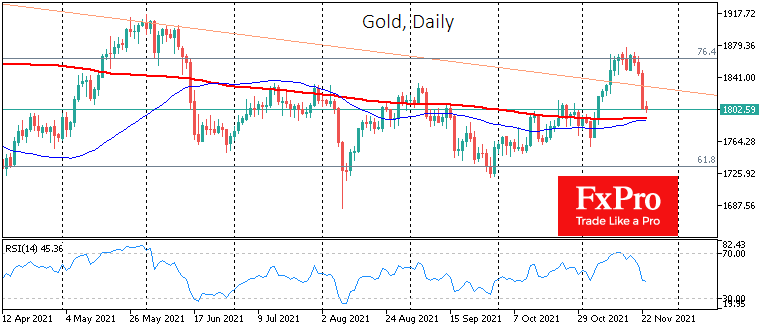

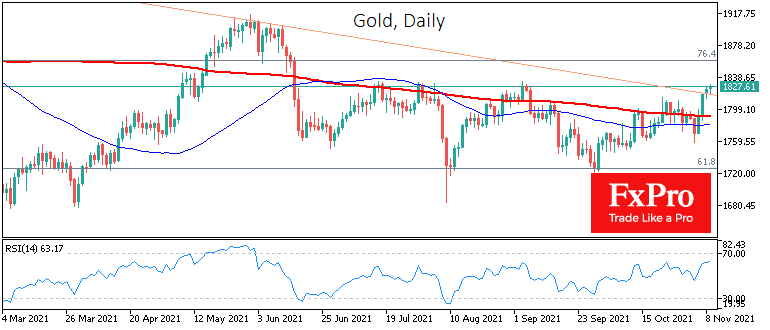

The gold bulls capitulated on Monday, pushing the price back to the $1800 area. The daily charts clearly show how the momentum of gold’s rise was losing strength in the second half of the month. We saw roughly the exact.

November 22, 2021

Oil is adding around 1% on Monday after posting the 4th week of back-to-back decline, during which WTI lost almost 12%, and Brent nearly 11%. Nevertheless, the US and oil-consuming countries continue to put verbal pressure on quotations, discussing the.

November 15, 2021

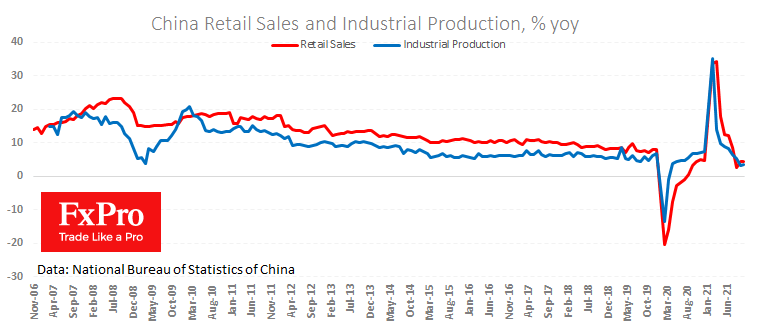

A new batch of data from China has somewhat dampened fears that the developer debt crisis has a toxic effect on the world’s second-largest economy. In October, industrial production expanded by 3.5% y/y compared with 3.1% a month earlier –.

November 15, 2021

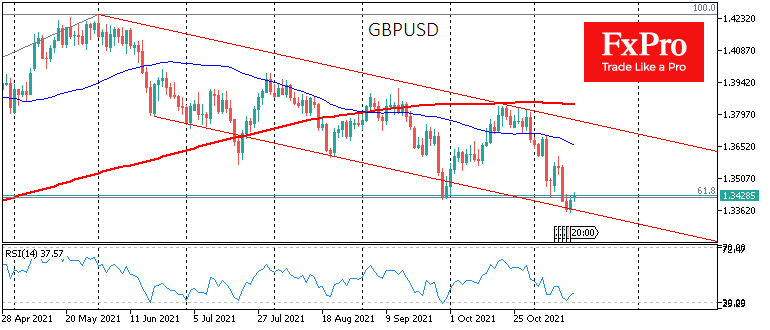

Later today, the Bank of England will get a chance to clarify its stance, which surprised traders with the pound two weeks ago. An unexpectedly dovish stance on monetary policy sent GBPUSD into the 1.3400 area, near the lows from.

November 11, 2021

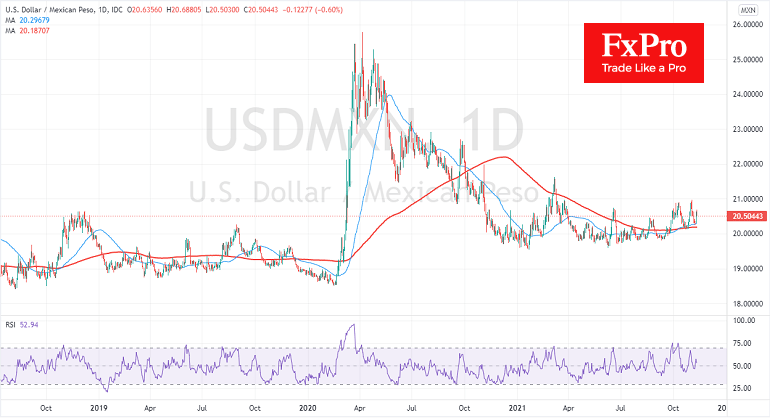

The growth of Latin American currencies marked the beginning of the month. The Brazilian real added 4% to its lows at the start of the month. It pushed the Dollar back to 5.47 against 5.7 on November 2. The Mexican.

November 9, 2021

Gold made a strong run on Thursday and Friday, adding a 2.8% during these days combined. This jump pushed gold to the important downward trend resistance line, which has been in force since August 2020. It is still premature to.

November 9, 2021

Oil is gaining for the third trading session in a row, reaching $83.4/bbl for Brent and $81.4 for WTI. After a corrective pullback to 76.4% of the August-October rally, the first significant Fibonacci retracement, the recovery gains strength. Oil buyers.

November 9, 2021

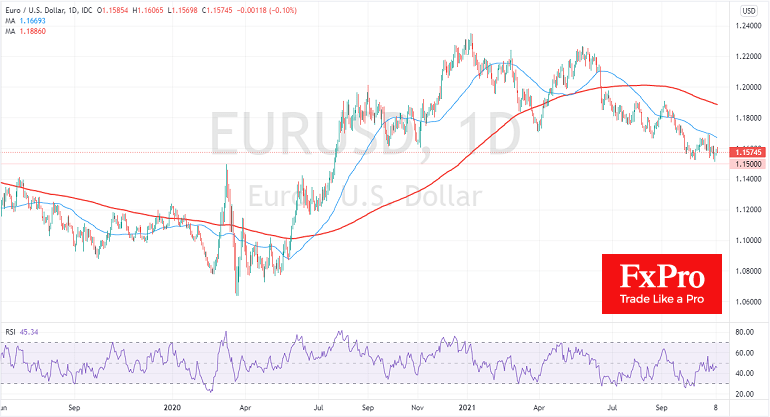

The single currency managed to pick up demand from buyers on the downside in the 1.1500 area, falling back to the October lows and briefly renewing its lows from July 2020. A temporary recovery in the EURUSD exchange rate was.

November 8, 2021

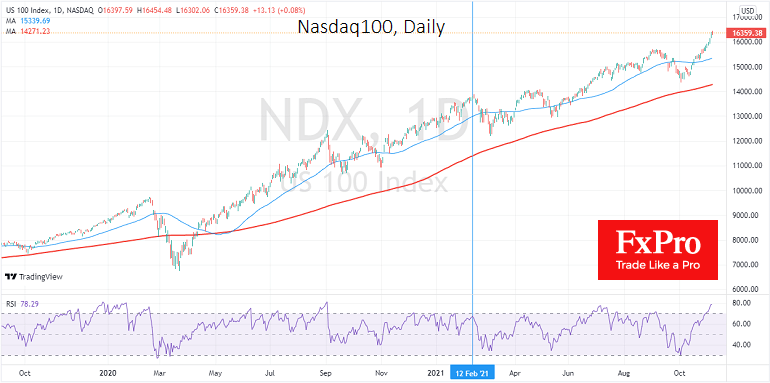

Markets continue to see increased demand for risky assets thanks to several fundamentally positive news at once, from solid labour market data and the adoption of a support package to hopes for a covid-19 pill from Pfizer. A rally in.