Market Overview - Page 100

July 21, 2022

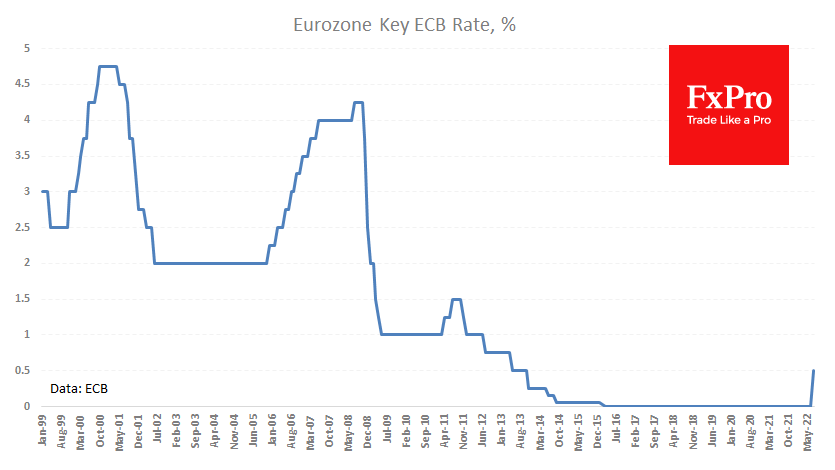

The European Central Bank increased its key rate by 50 points to 0.50%. This is more than average analyst forecasts, based mainly on old comments from Bank members. However, rumours of a more decisive move surfaced in the last few.

July 21, 2022

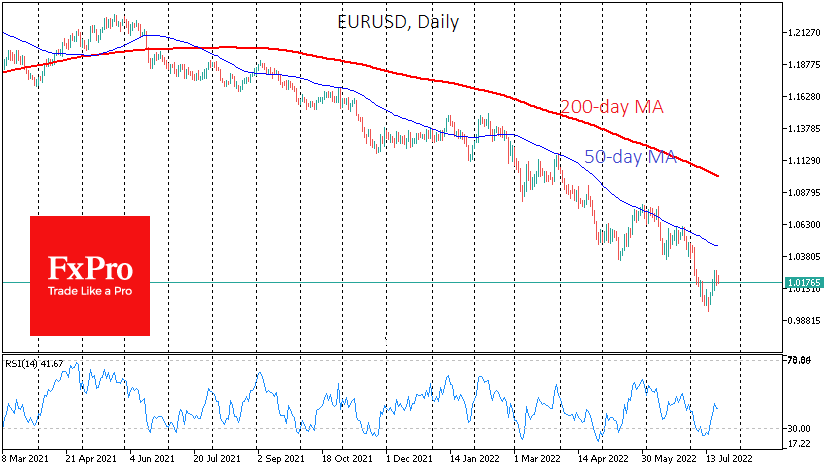

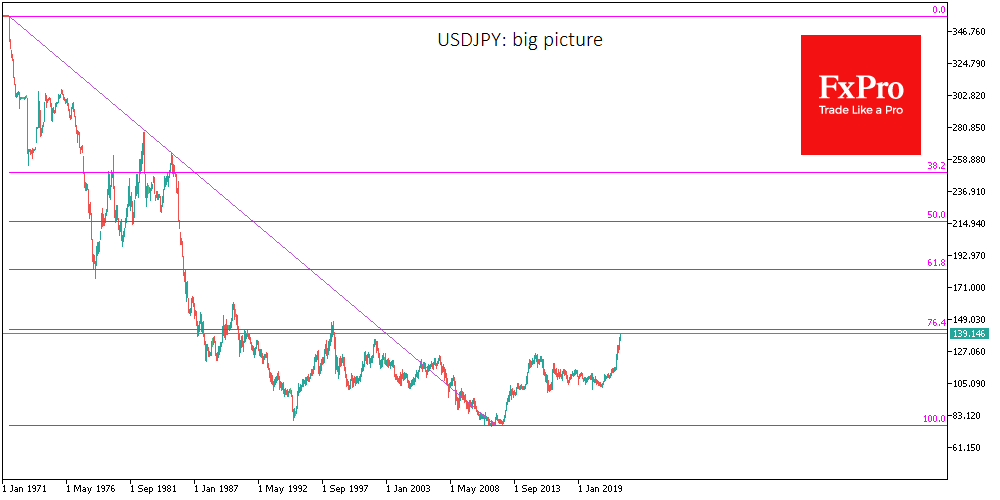

The differences between the actions of monetary authorities in various developed countries are becoming increasingly apparent. Until we see real work by the governments and central banks of the USA, Japan, or the Eurozone to change the trend, it is.

July 20, 2022

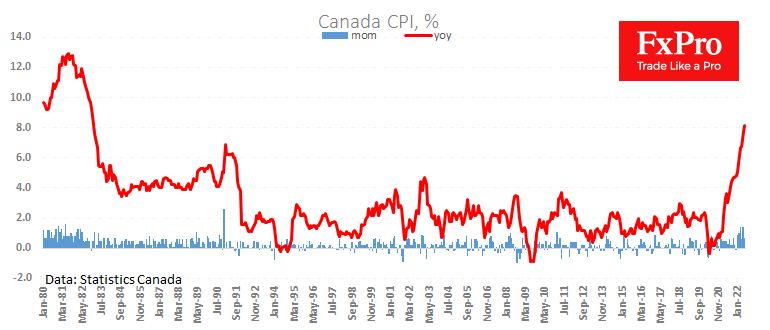

Canada took over the inflation marathon from the UK. The rate of consumer price growth accelerated from 7.7% to 8.1% y/y in June there, although it was lower than 8.4% as expected. However, an even more critical signal came from.

July 20, 2022

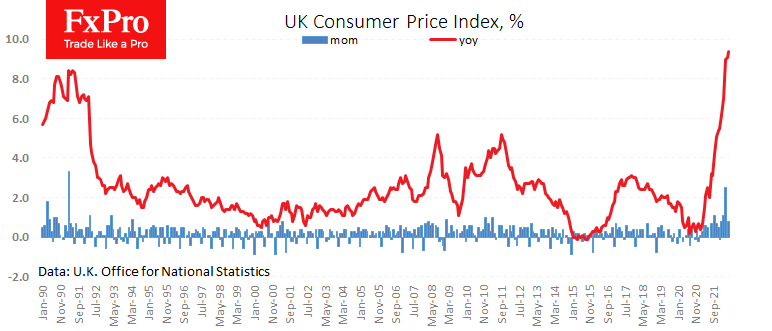

A fresh set of statistics from the UK showed that inflation is still not slowing down. The rate of consumer price growth climbed to 9.4% y/y in June after they added 0.8% for the month, four times the long-term average.

July 20, 2022

Gold is mostly missing the latest party of financial markets, where risk appetite has increased. The value of the troy ounce has changed little since last Friday, mostly hovering in a narrow range of $1702-1716, near the lows since April.

July 19, 2022

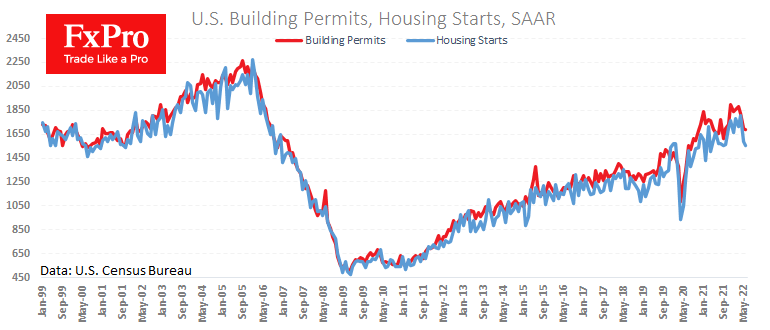

The gradual cooling of the US housing market continues, although the pace has softened somewhat. Fresh data showed a 0.6% drop in building permits issued to 1,685K (seasonally adjusted annualised rate) in June, following declines of 7% and 3% in.

July 19, 2022

The British pound is trying to return to levels above 1.2000. The pressure on the pound intensified on Monday evening, along with the reduced demand for risk assets after the US market. Today the pound will have to fight new.

July 18, 2022

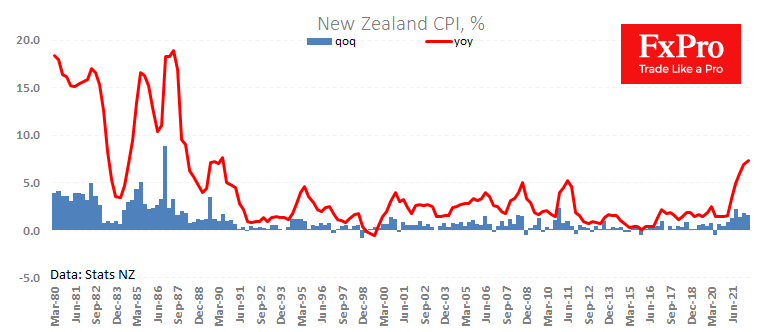

The annual inflation rate in New Zealand accelerated to 7.3%, a new high since 1990 and above average forecasts for 7.1%. The quarterly price growth of 1.7% also remains elevated, showing no deceleration in the last quarter. Short-term inflation figures.

July 18, 2022

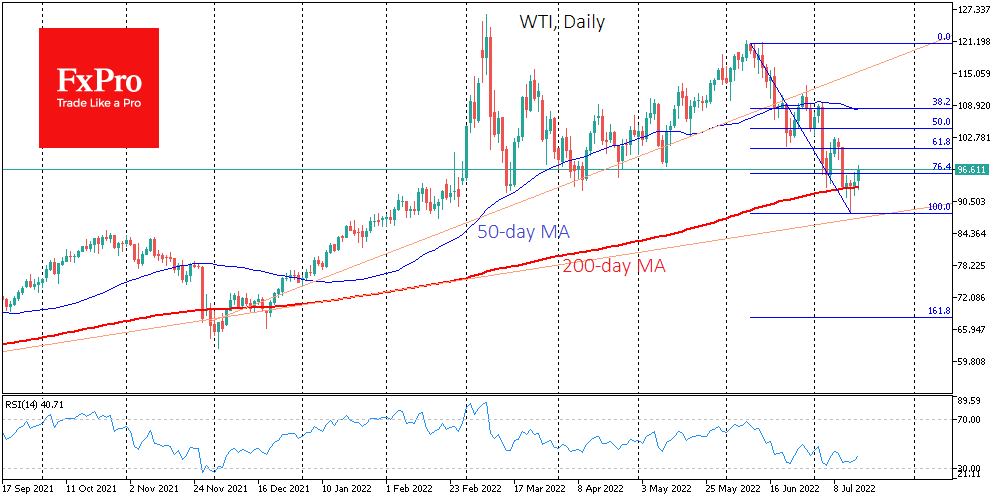

Crude Oil has added 3% on Monday after finding support late last week as expectations of a meeting between the US and Saudi leaders did not materialise. The much-anticipated and much-discussed meeting between Biden and Mohammed bin Salman took place.

July 15, 2022

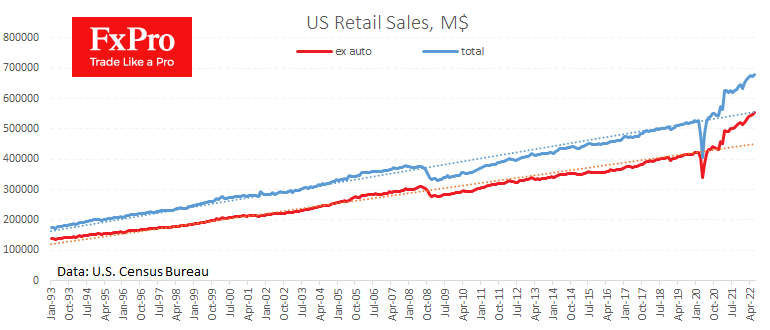

Although US retail sales figures are often the more important news, their slight overshooting relative to expectations has, in our view, less impact on markets than the import price index. According to preliminary estimates, US sales rose by 1% in.

July 15, 2022

The Chinese economy is experiencing a sharp slowdown, raising a reasonable doubt that GDP will be able to grow by the initially planned 5.5% this year. Fresh data showed that China’s economy was only 0.4% higher in the second quarter.