Gold threatens to fall down from the range

September 02, 2022 @ 13:46 +03:00

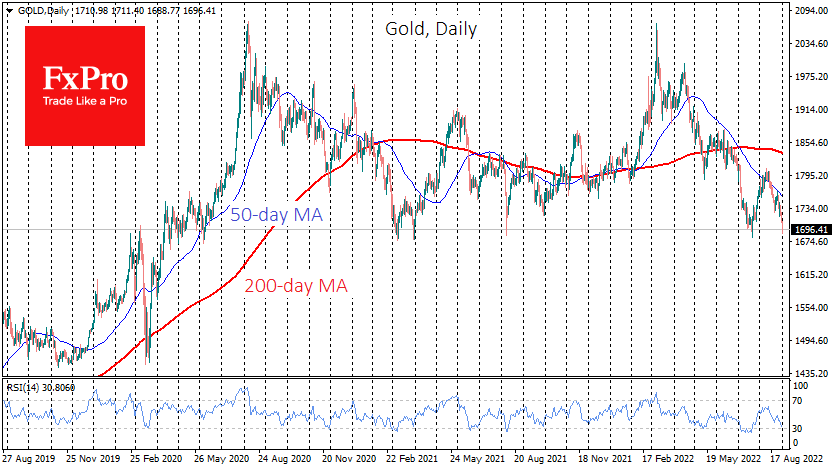

The gold price dipped below $1700 on Thursday, approaching the lower boundary of its trading range since May 2020. Gold has been finding buyers after emotional dips towards the lower boundary throughout this period.

Perhaps the main reason for the long-term bearish sentiment is the hawkish US monetary policy. A sharp tightening of policy and the Fed’s promises to raise interest rates have pushed 2-year government bond yields to levels last seen in 2007.

High short-term bond yields push investors away from alternatives such as gold, equities and emerging market currencies, raising the risk-free interest rate level – an informal benchmark for risk assessment.

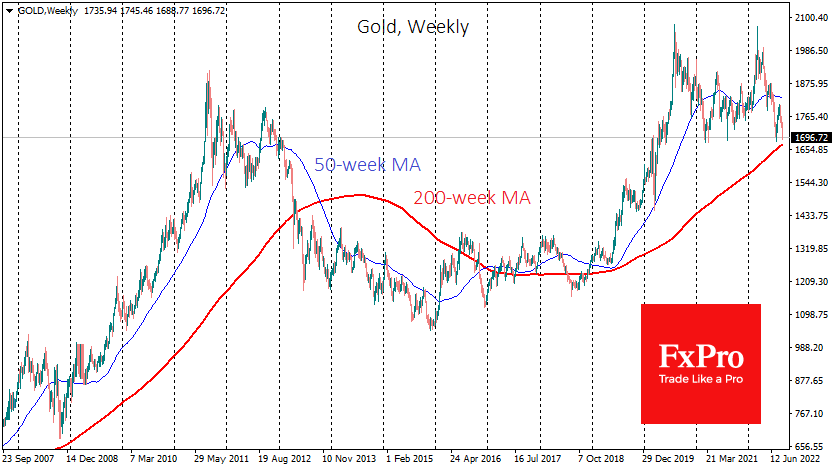

So far, gold has behaved in a frighteningly similar way to the dynamics of 2010-2013, when we saw a comparable bump at the top after a multi-year rally. Now, this period of consolidation after the rally has been longer.

However, we should be prepared for a “dam break” if we see a decisive move down from the established corridor over the next few weeks.

If the price breaks below $1680 this week or next, the market could see an absolute surrender of position traders, who have been betting on another bounce from the lower boundary. In that case, we should be prepared for gold to go into the same multi-year bearish trend as it did in 2012-2015.

Just below, through $1670 passes the 200-week moving average, a fixing under which could trigger the capitulation of the most resilient long-term betting bulls.

In that case, a decline towards $1300 would be a working scenario until the end of 2023. If the gold finds support, as it has done so many times in the past two-plus years, we could see a new upside surge after a two-year consolidation, and the 200-week average retains the long-term support it has enjoyed for the past five years.

The FxPro Analyst Team

GBP | BOE Governor Andrew Bailey Speaks

GBP | BOE Governor Andrew Bailey Speaks