Technical analysis - Page 4

January 31, 2026

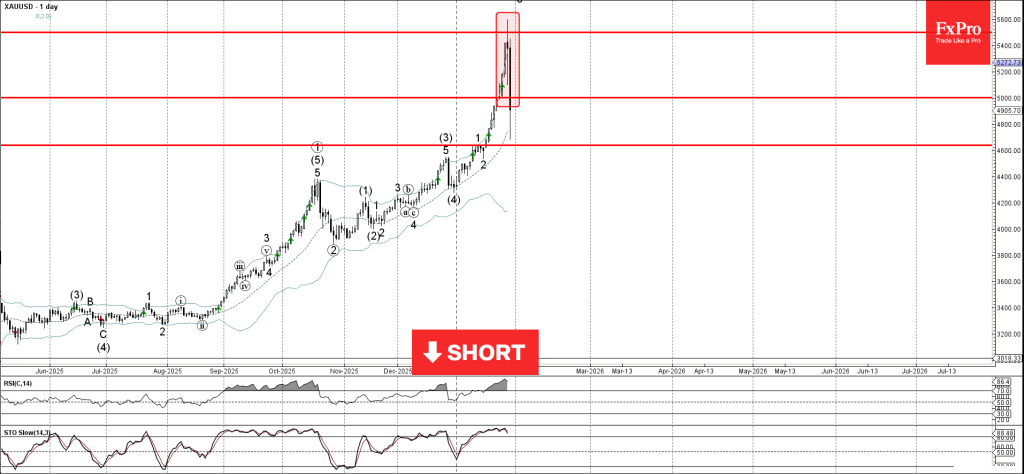

Gold: ⬇️ Sell – Gold formed daily Evening Star – Likely to fall to support level 4600.00 Gold today fell down sharply after the price failed to close above the major resistance level 5500.00, as can be seen from the.

January 31, 2026

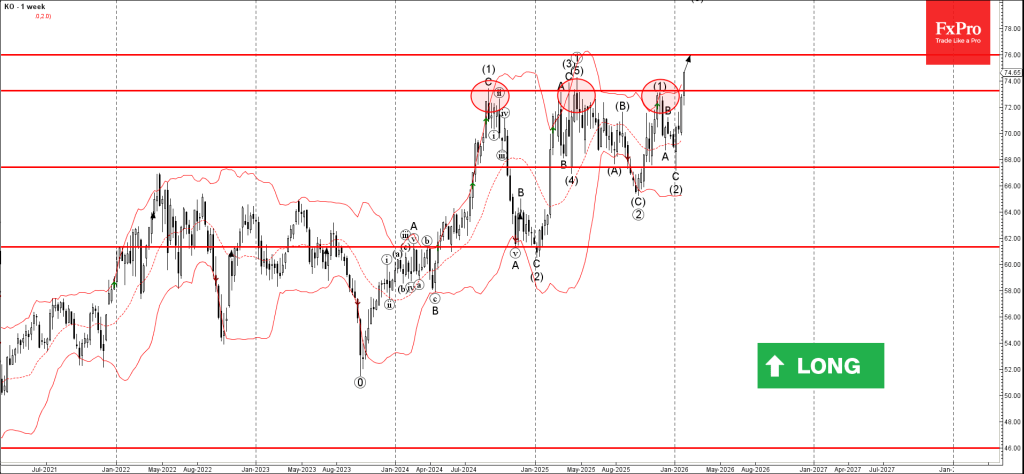

Coca-Cola: ⬆️ Buy – Coca-Cola broke long-term resistance level 73.25 – Likely to rise to resistance level 76.00 Coca-Cola recently broke above the major, long-term resistance level 73.25 (which has been reversing the price from the middle of 2024, as.

January 31, 2026

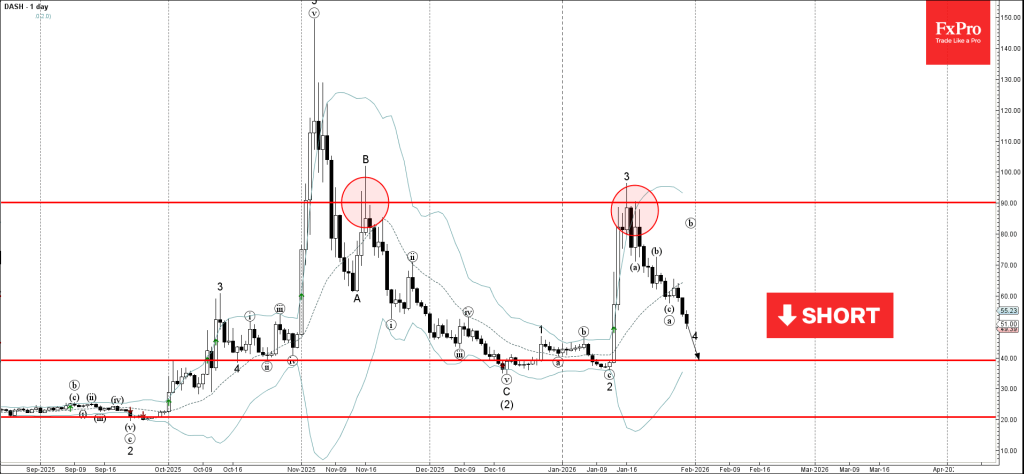

DASH: ⬇️ Sell – DASH falling inside minor correction 4 – Likely to test support level 40.00 DASH cryptocurrency recently continues to fall inside the minor correction 4, which started earlier from the resistance area between the strong resistance level.

January 30, 2026

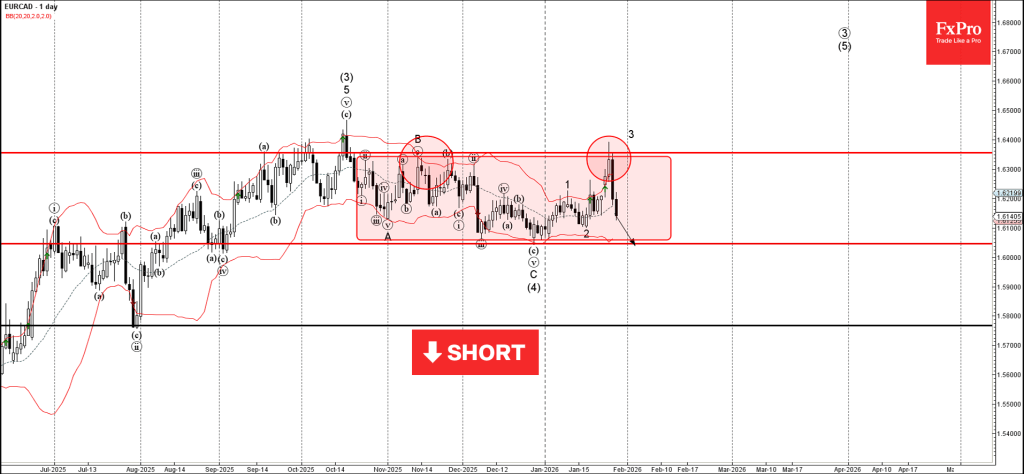

EURCAD: ⬇️ Sell – EURCAD reversed from resistance area – Likely to fall to support level 1.6045 EURCAD currency pair recently reversed from the resistance area between the strong resistance level 1.63549 (upper border of the sideways price range inside.

January 30, 2026

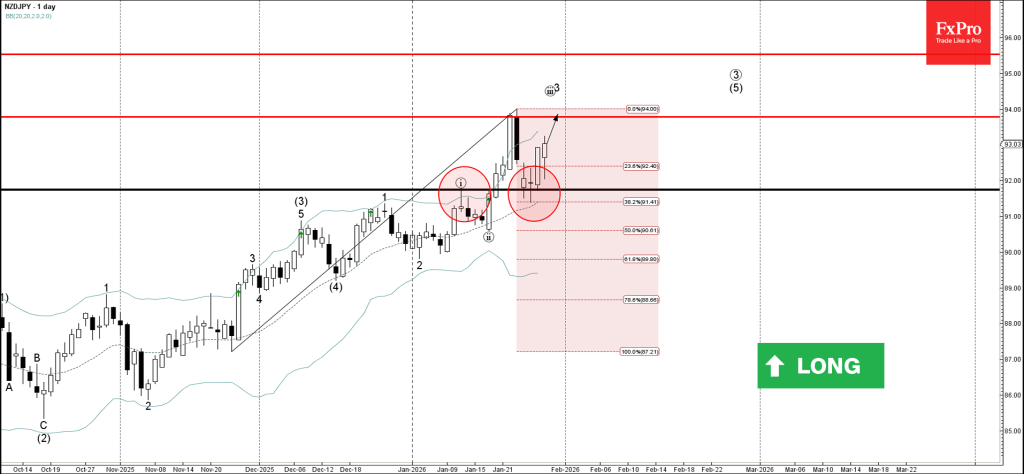

NZDJPY: ⬆️ Buy – NZDJPY reversed from support area – Likely to rise to resistance level 93.80 NZDJPY currency pair recently reversed from the support area between the key support level 91.75 (former top of wave i from the start.

January 30, 2026

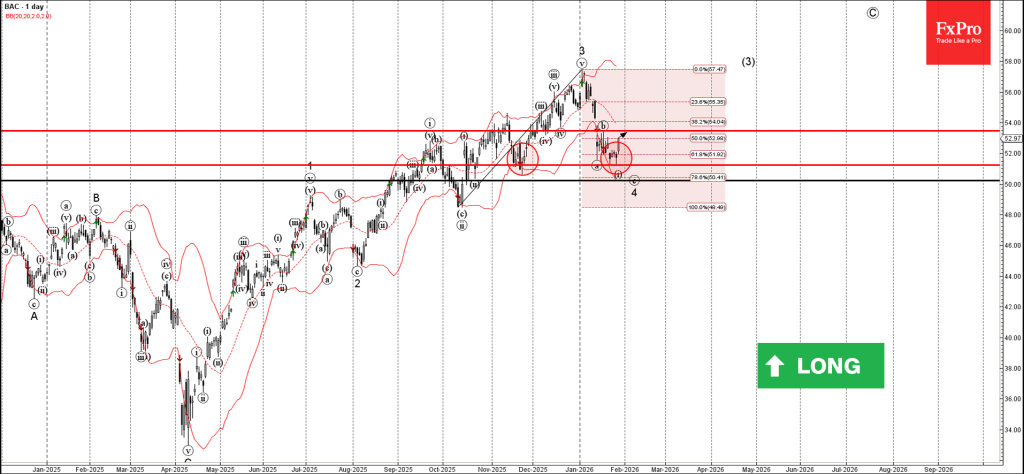

Bank of America: ⬆️ Buy – Bank of America reversed from support area – Likely to rise to resistance level 53.45 Bank of America recently reversed from the support area between the pivotal support level 51.20 (which has been reversing.

January 30, 2026

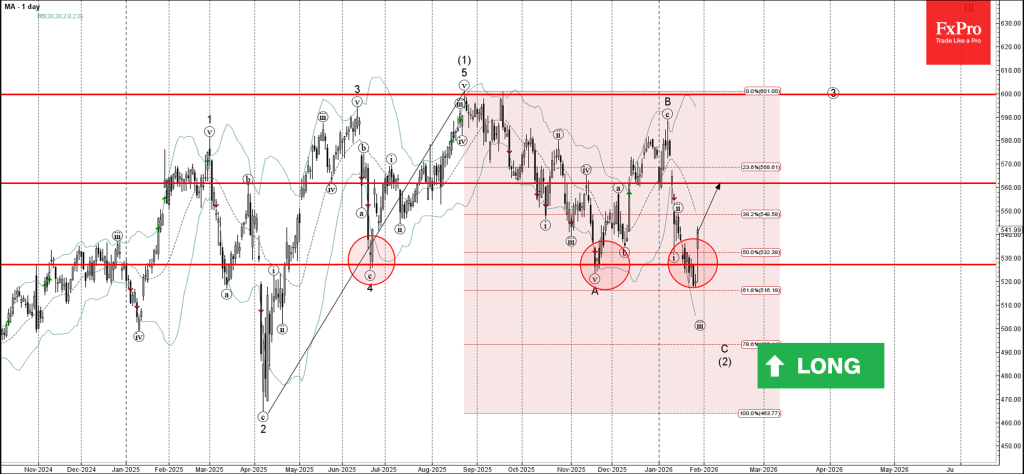

MasterCard: ⬆️ Buy – MasterCard reversed from support area – Likely to rise to resistance level 560.00 MasterCard recently reversed from the support area between the long-term support level 530.00 (which has been reversing the price from May) and the.

January 28, 2026

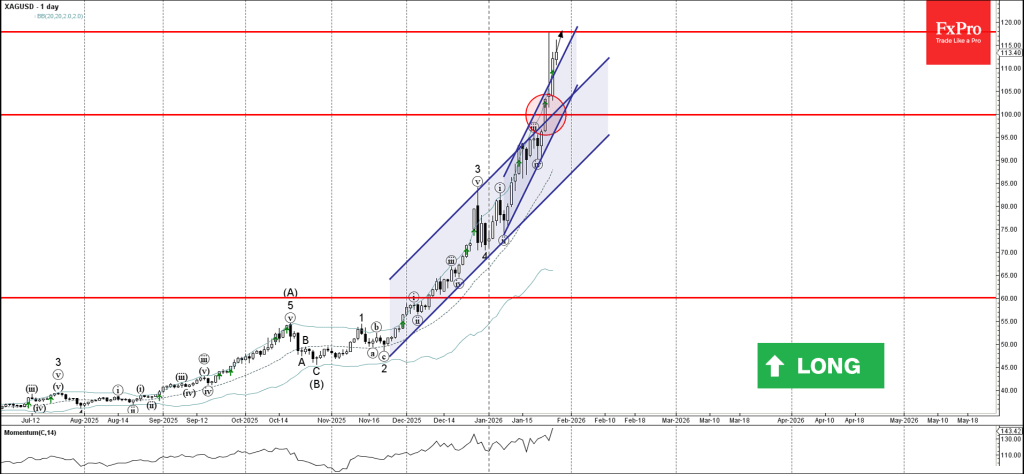

Silver: ⬆️ Buy – Silver broke round resistance level 100.00 – Likely to rise to resistance level 117.85 Silver recently broke through the resistance area at the intersection of the round resistance level 100.00 and the resistance trendline of the.

January 28, 2026

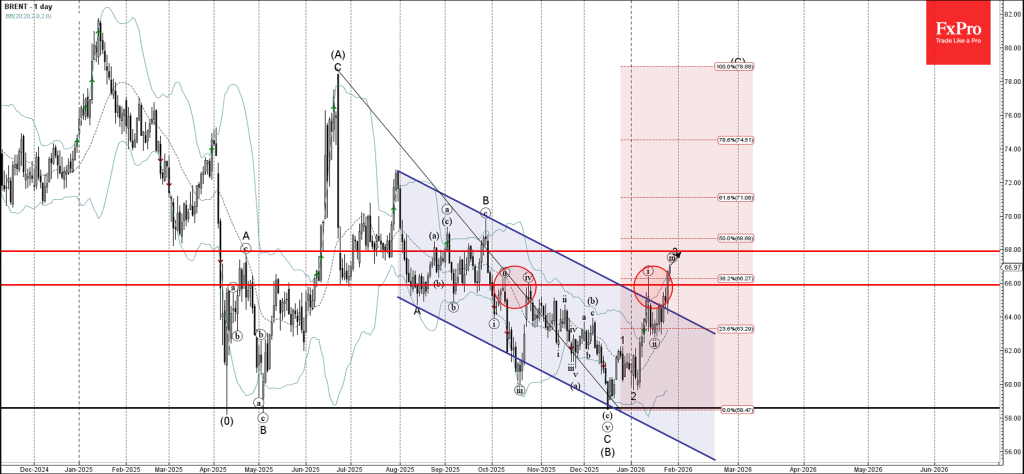

Brent Crude Oil: ⬆️ Buy – Brent Crude Oil broke resistance level 66.00 – Likely to rise to resistance level 68.00 Brent Crude Oil recently broke through the resistance area between the resistance level 66.00 (which has been reversing the price from.

January 28, 2026

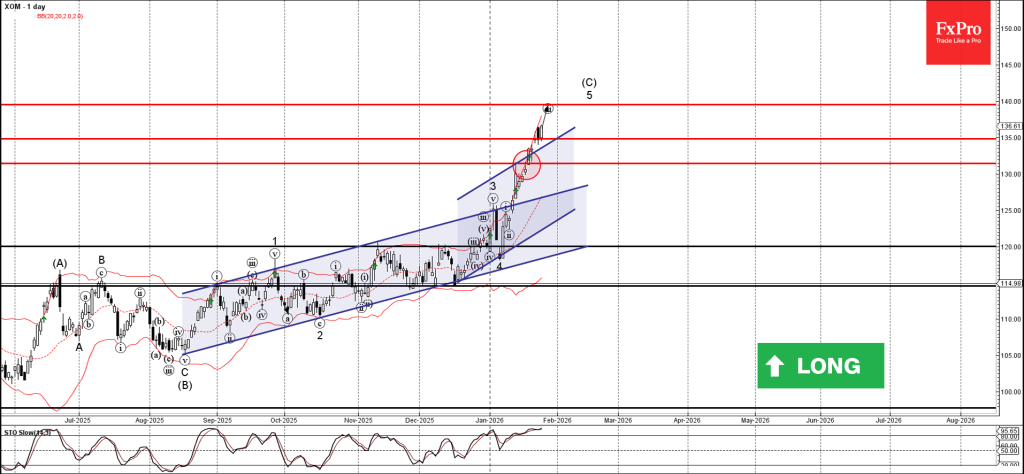

Exxon Mobil: ⬆️ Buy – Exxon Mobil rising inside impulse waves iii and 5 – Likely to rise to resistance level 140.00 Exxon Mobil has been rising sharply in the last few trading sessions, breaking through the resistance levels 131.40.

January 28, 2026

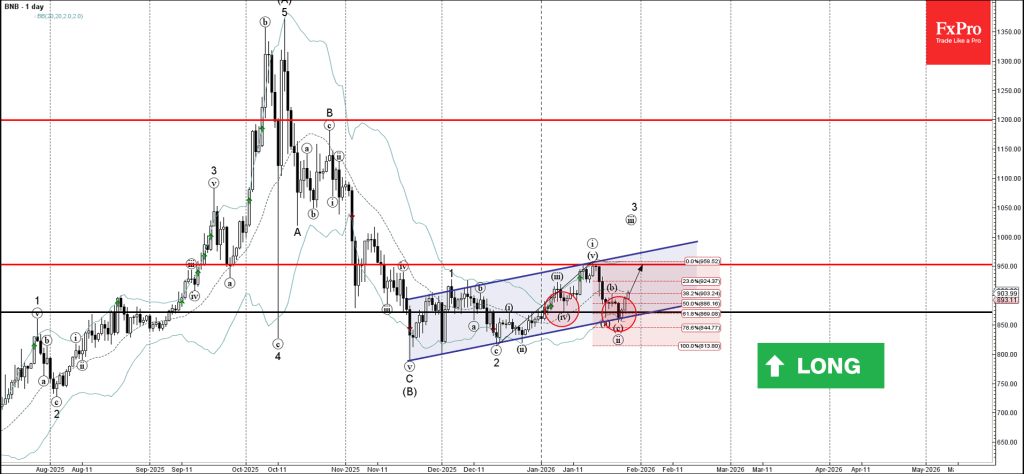

BNB: ⬆️ Buy – BNB reversed from support zone – Likely to rise to resistance level 950.00 BNB cryptocurrency recently reversed up from the support zone between the key support level 870.00 (which has been reversing the price from the.