Technical analysis - Page 143

September 25, 2023

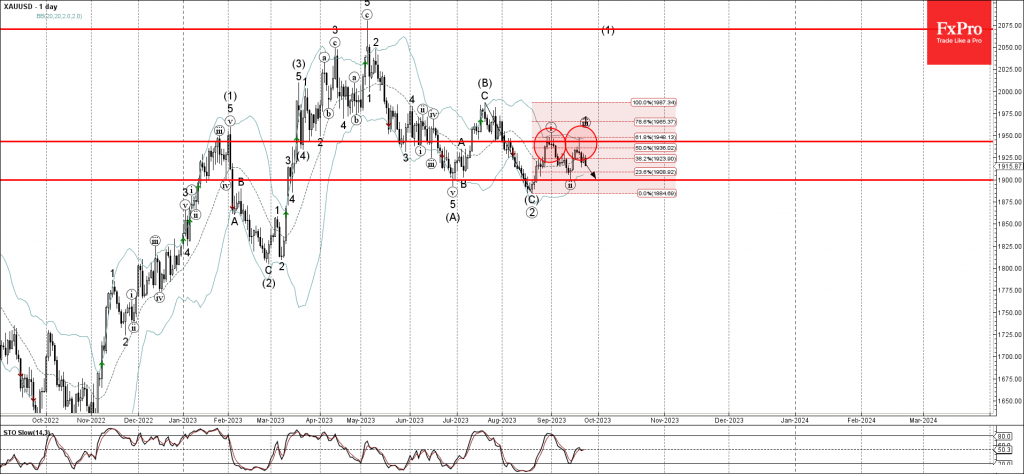

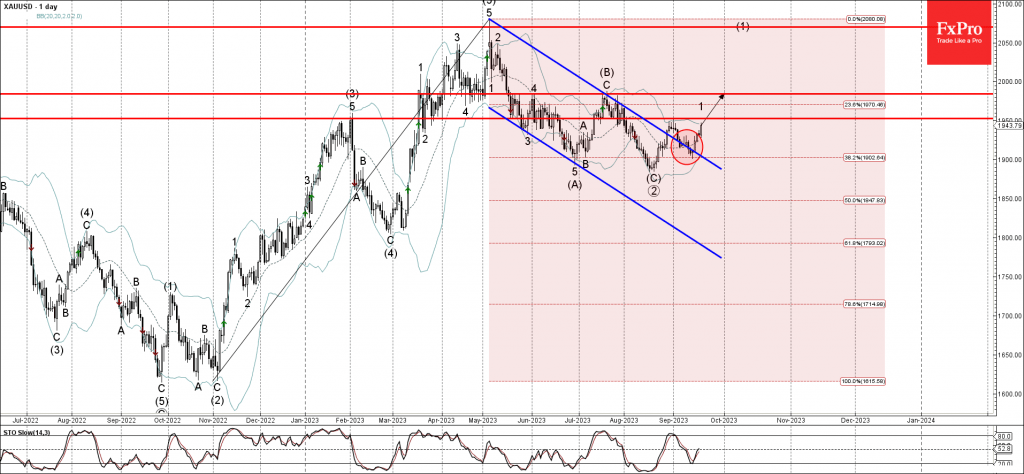

– Gold reversed from key resistance level 1950.00 – Likely to fall to support level 1900.00 Gold recently reversed down from the key resistance level 1950.00 (top of wave I from the start of this month) intersecting with the upper.

September 22, 2023

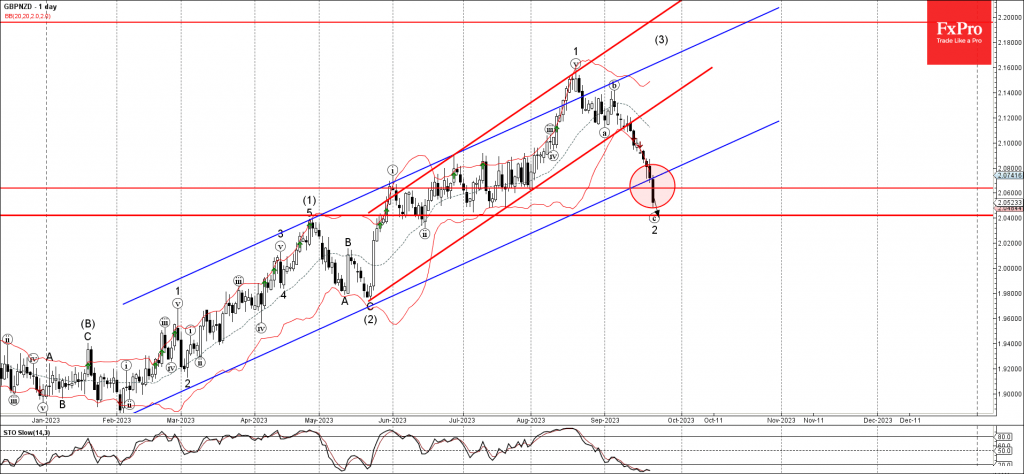

– GBPNZD broke support level 2.0640 – Likely to fall to support level 2.0400 GBPNZD recently broke the support level 2.0640 (which reversed the pair multiple times in July) intersecting with the support trendline of the weekly up channel from.

September 22, 2023

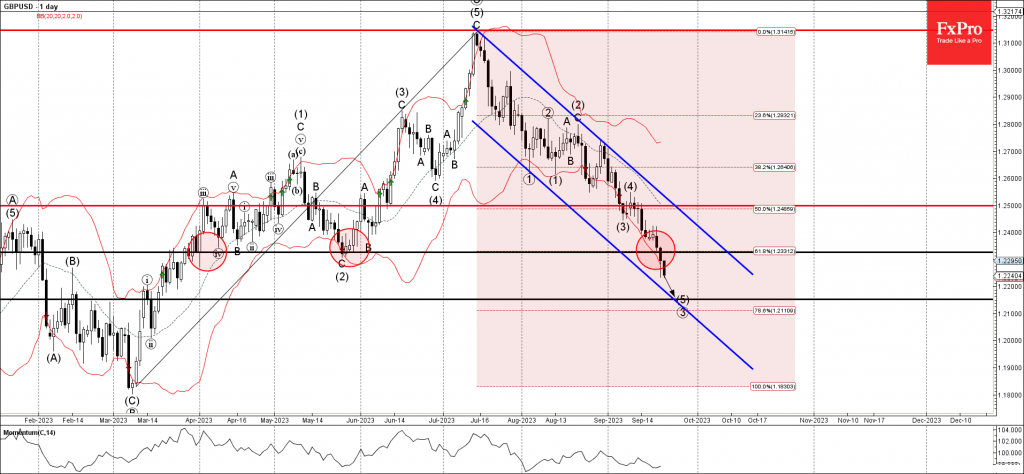

– GBPUSD broke support level 1.2325 – Likely to fall to support level 1.2150 GBPUSD recently broke the strong support level 1.2325 (which has been reversing the price from April) intersecting with the 61.8% Fibonacci correction of the uptrend from.

September 21, 2023

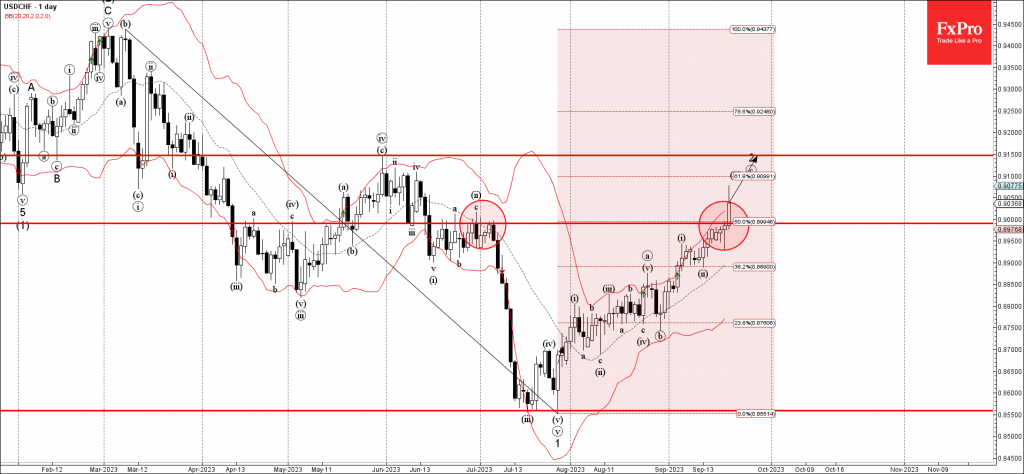

– USDCHF broke resistance level 0.9000 – Likely to rise to resistance level 0.9150 USDCHF recently broke above the round resistance level 0.9000 (which has been reversing the price from June) intersecting with the 50% Fibonacci correction of the downtrend.

September 21, 2023

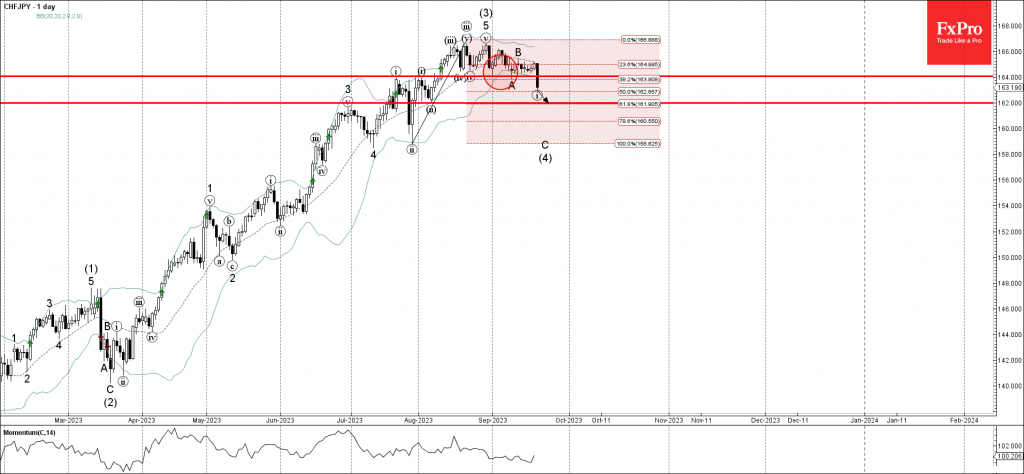

– CHFJPY broke support level 164.00 – Likely to fall to support level 162.00 CHFJPY continues to fall inside the minor impulse wave i, which previously broke the support level 164.00 (low of the previous wave A) intersecting with the.

September 20, 2023

– Gold rising inside minor impulse wave 1 – Likely to reach resistance at 1985.00 Gold continues to rise inside the minor impulse wave 1, which reversed earlier from the upper trendline of the recently broken down channel from May..

September 20, 2023

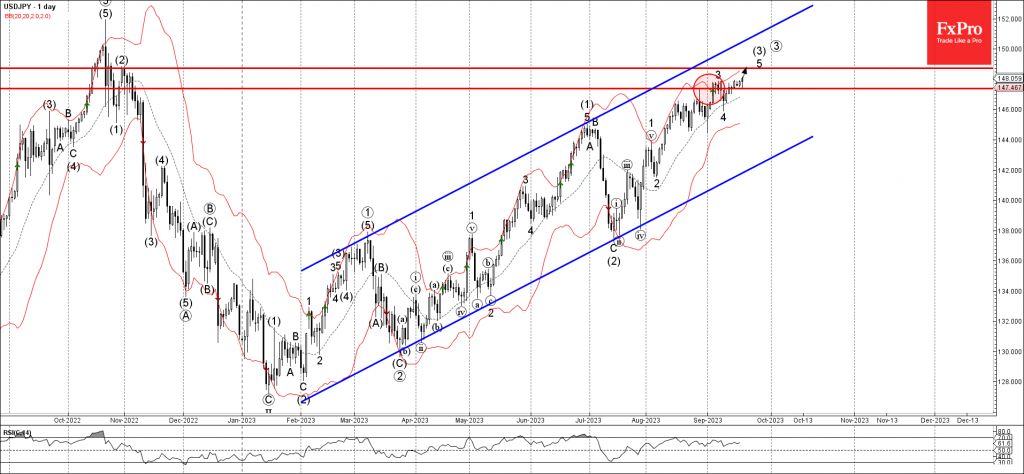

– USDJPY broke the resistance level 147,40 – Likely to riseW to resistance level 147.70 USDJPY currency pair recently broke the resistance level 147,40 (which has been reversing the price from the start of September). The breakout of the resistance.

September 19, 2023

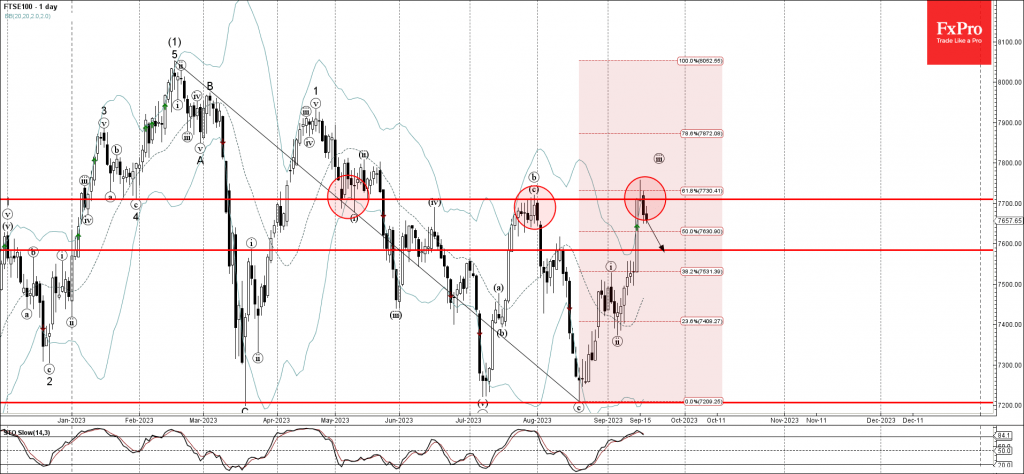

– FTSE 100 reversed from pivotal resistance level 7710,00 – Likely to fall to support level 7585,00 FTSE 100 index previously reversed down from the pivotal resistance level 7710,00 (former yearly high from July, former strong support from May) intersecting.

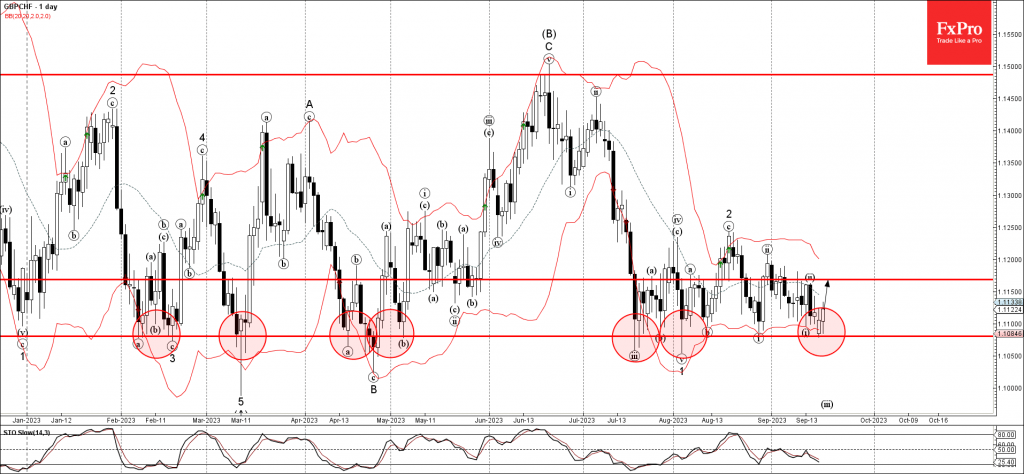

September 19, 2023

– GBPCHF reversed from multi-month support level 1.1080 – Likely to rise to resistance level 1.1170 GBPCHF currency pair recently reversed up from the major, multi-month support level 1.1080 (which has been reversing the price from February) intersecting with the.

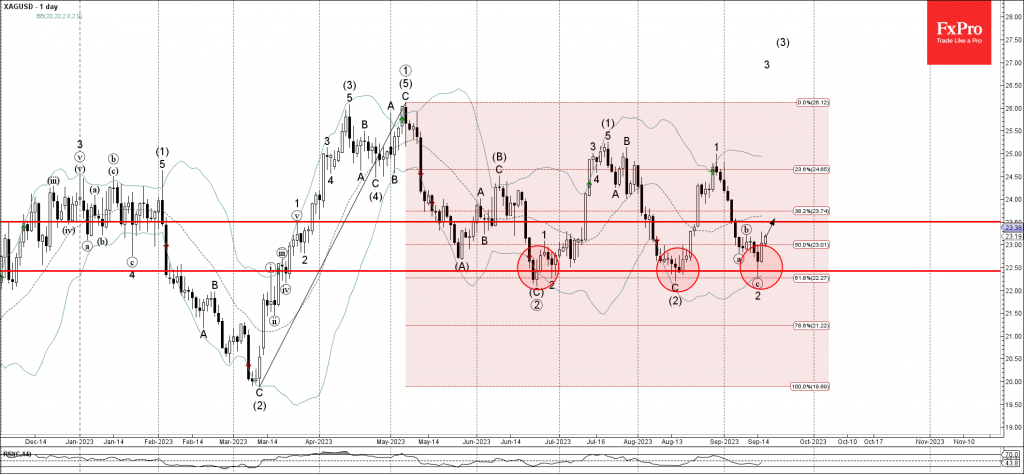

September 18, 2023

– Silver reversed from support level 22.50 – Likely to rise to resistance level 23.50 Silver recently reversed up from the strong multi-month support level 22.50 (which has been reversing the price from June) intersecting with the lower daily Bollinger.

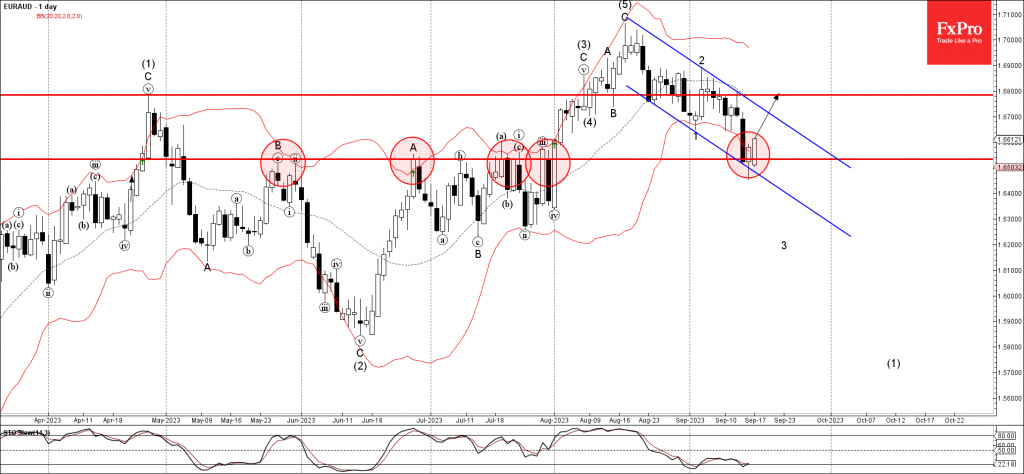

September 18, 2023

– EURAUD reversed from support level 1.6535 – Likely to rise to resistance level 1.6800 EURAUD currency pair recently reversed up from the support level 1.6535 (former resistance from May, June and July) intersecting with the lower daily Bollinger Band.