Technical analysis - Page 142

September 1, 2023

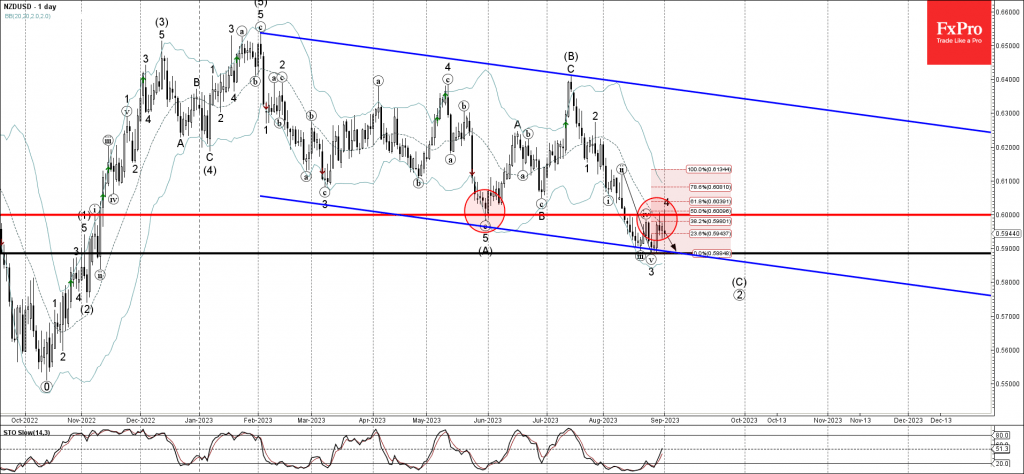

– NZDUSD reversed from resistance level 0.6000 – Likely to fall to support level 0.5900 NZDUSD currency pair recently reversed down from the strong round resistance level 0.6000 (former multi-month support from June), coinciding with the 20-day moving average and.

September 1, 2023

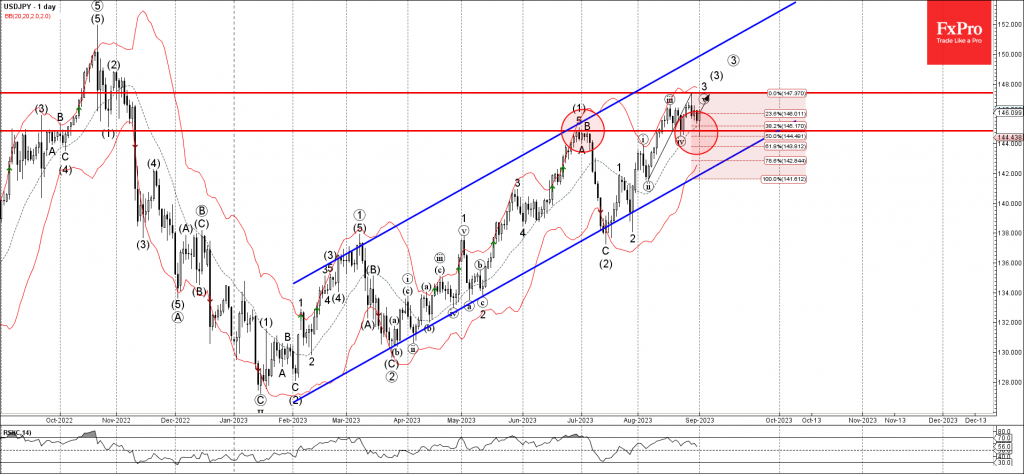

– USDJPY reversed from support level 144.85 – Likely to test resistance level 147.40 USDJPY currency pair recently reversed up from the support level 144.85 (former resistance from the end of June), intersecting with the 50% Fibonacci correction of the.

September 1, 2023

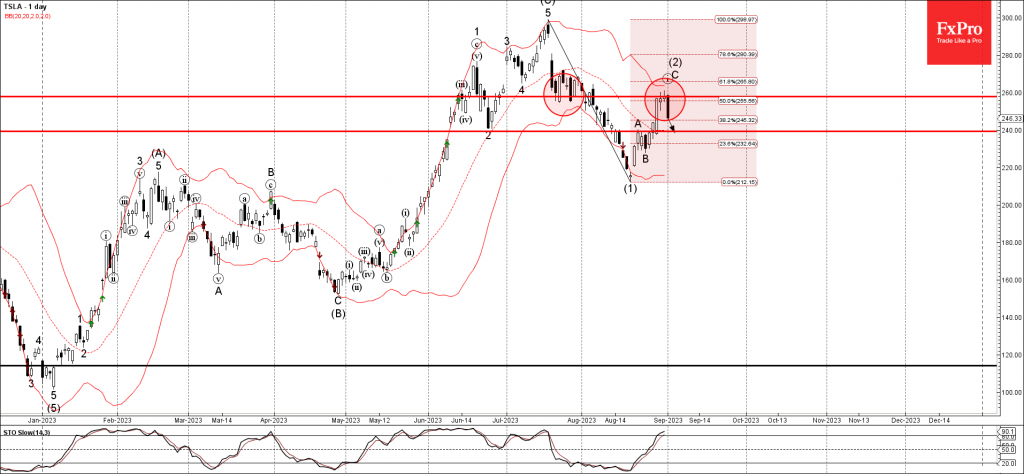

– Tesla reversed from resistance level 260.00 – Likely to fall to support level 240.00 Tesla recently reversed down from the resistance level 260.00 (former support level from the end of July), intersecting with the 50% Fibonacci correction of the.

August 31, 2023

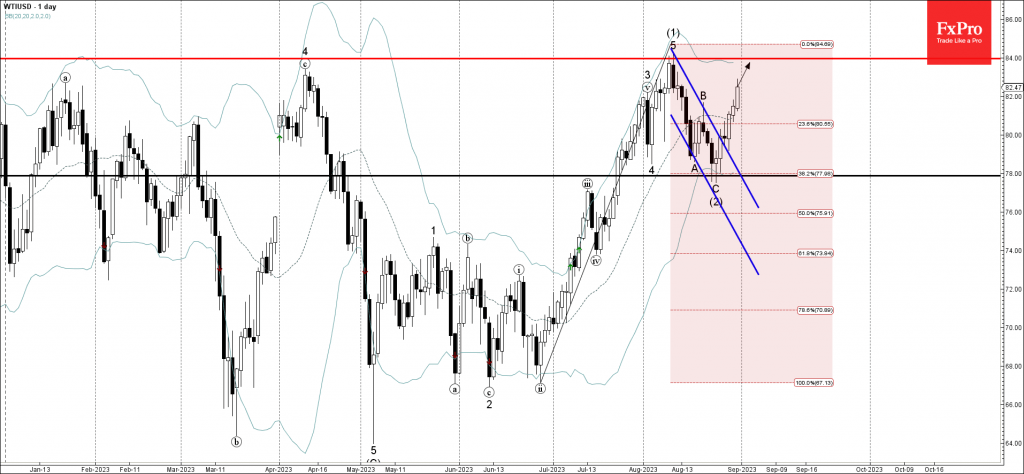

– WTI crude oil rising inside impulse wave (3) – Likely to test resistance level 84.00 WTI crude oil continues to rise inside the intermediate impulse wave (3), which previously broke the daily down channel from the start of August.

August 31, 2023

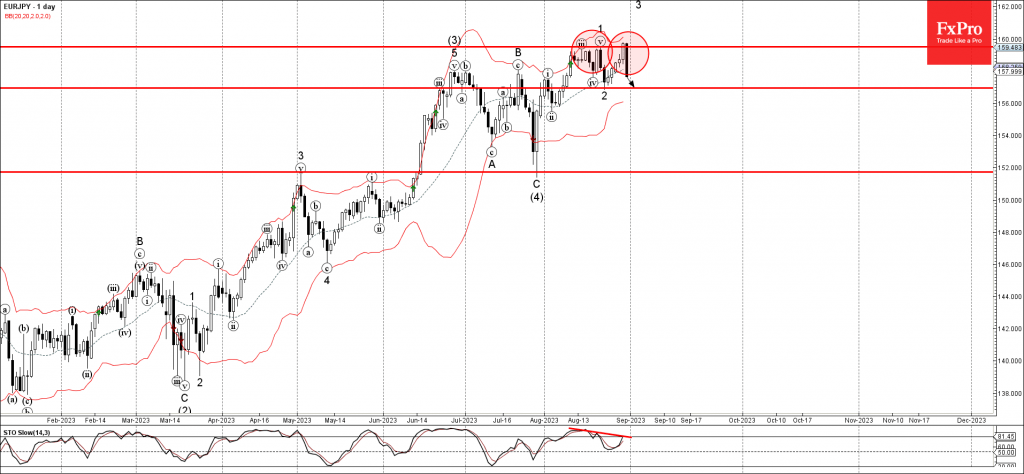

– EURJPY reversed from resistance level 159.50 – Likely to fall to support level 156.95 EURJPY currency pair recently reversed down from the key resistance level 159.50 (top of the previous minor impulse wave 1) intersecting with the upper daily.

August 31, 2023

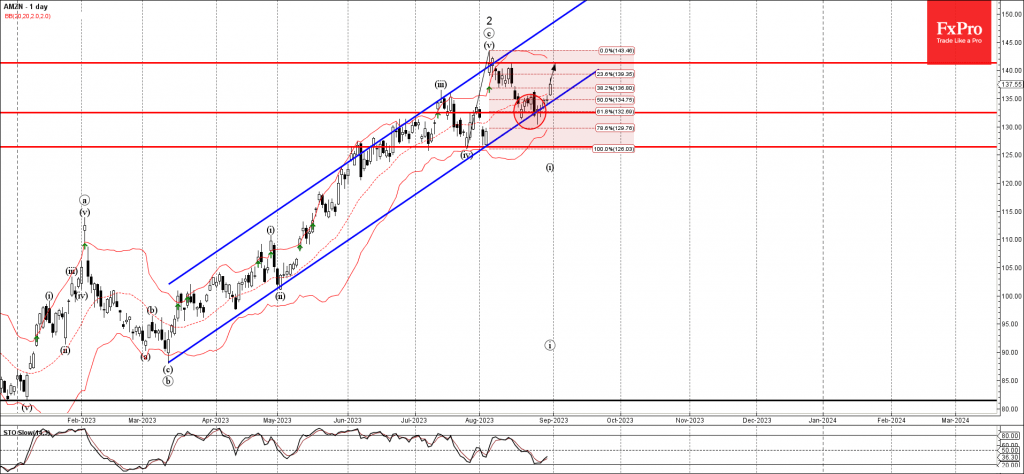

– Amazon reversed from support level 132.50 – Likely to rise to resistance level 141.30 Amazon previously reversed up from the key support level 132.50 (former resistance from July) intersecting with the support trendline of the narrow up channel from.

August 30, 2023

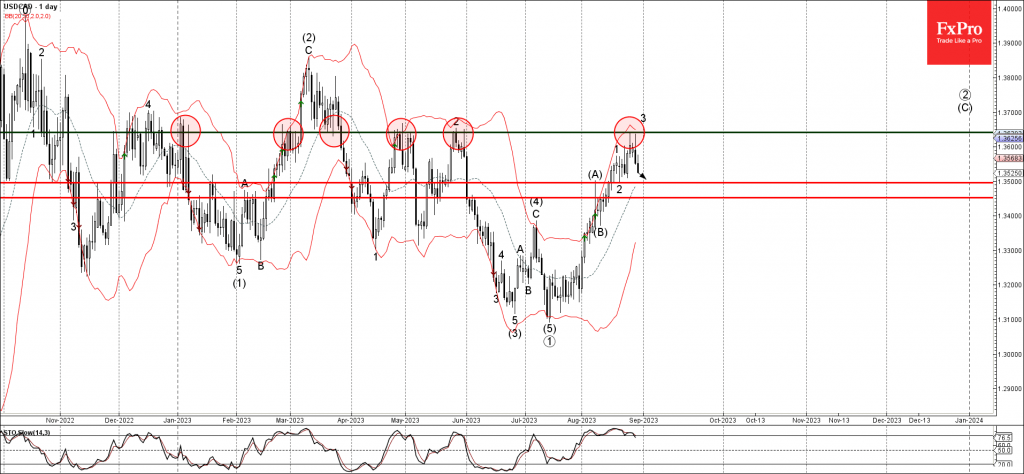

– USDCAD reversed from key resistance level 1.3645 – Likely to fall to support level 1.3500 USDCAD currency pair previously reversed down from the key resistance level 1.3645 (which has been repeatedly reversing the pair from January, as can be.

August 30, 2023

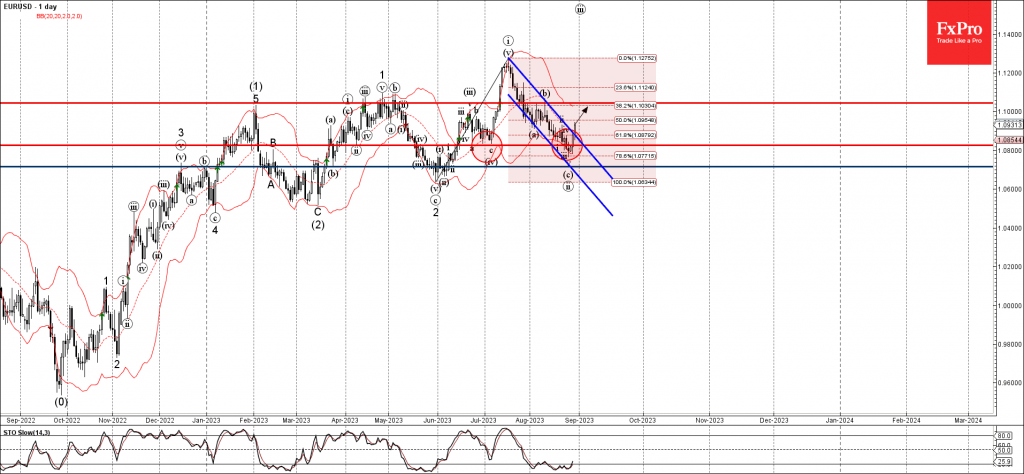

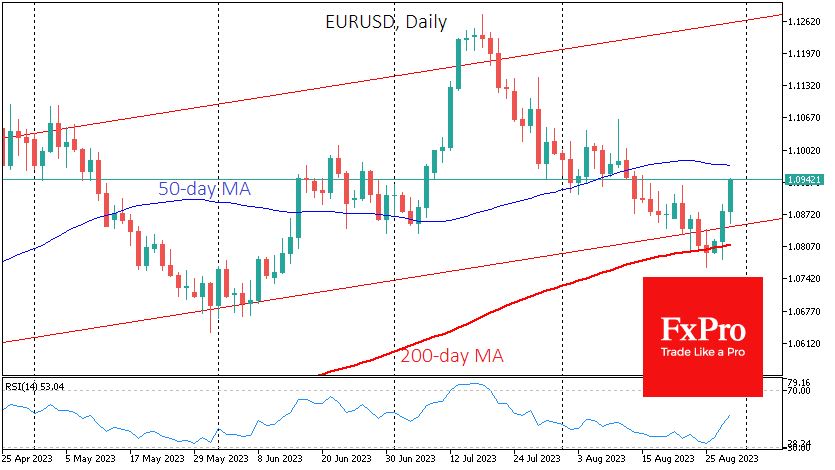

– EURUSD broke daily down channel – Likely to rise to resistance level 1.1045 EURUSD currency pair recently broke the resistance trendline of the daily down channel from the middle of July (which enclosed the previous short-term ABC correction ii)..

August 30, 2023

Inflation remains a driver of European financial markets, and the latest estimates point to stubbornly high consumer prices in Germany despite a continued fall in import prices. The German import price index fell by 0.6 per cent in July, the.

August 29, 2023

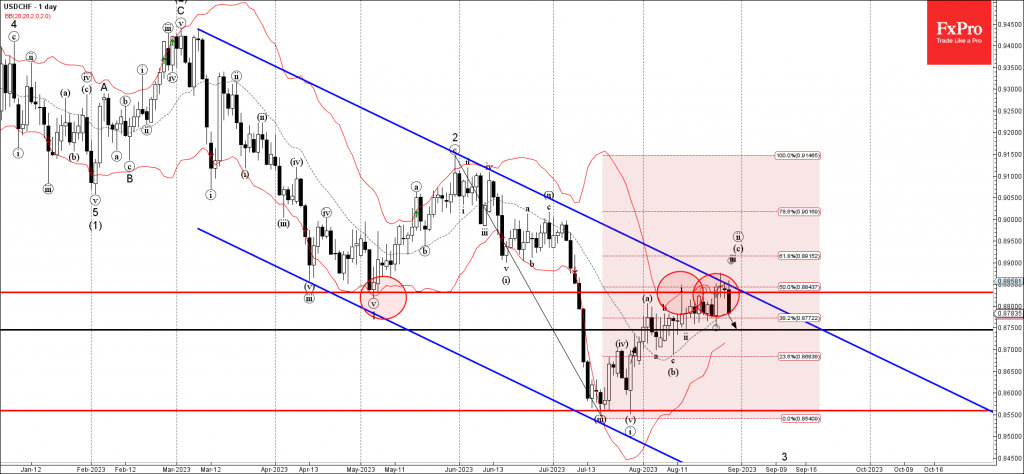

– USDCHF reversed from pivotal resistance level 0.8830 – Likely to fall to support level 0.8750 USDCHF currency pair recently reversed down from the pivotal resistance level 0.8830 (former multi-month low from May), intersecting with the upper daily Bollinger Band.

August 29, 2023

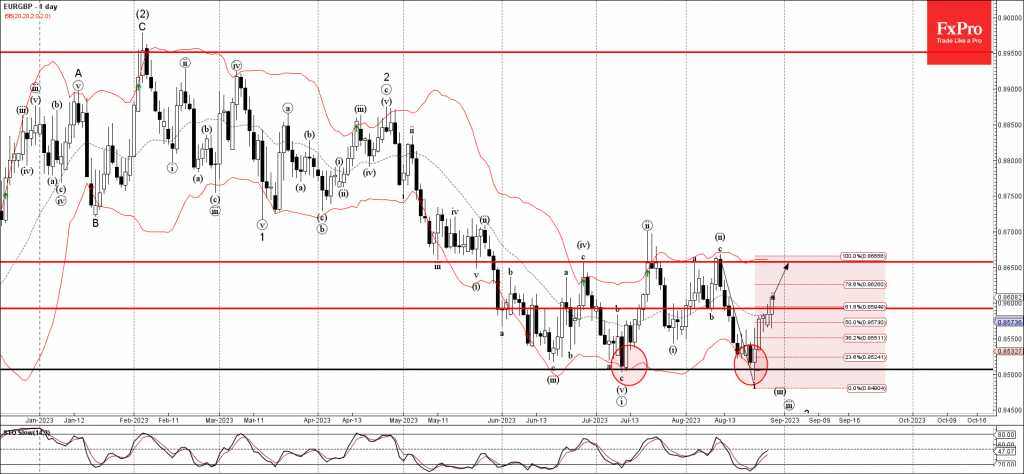

– EURGBP broke resistance level 0.8590 – Likely to test resistance level 0.8655 EURGBP currency pair recently broke above key resistance level 0.8590, intersecting with the 61.8% Fibonacci correction of the downward impulse from the start of August. The breakout.