Eurozone’s inflation surprise

August 30, 2023 @ 18:09 +03:00

Inflation remains a driver of European financial markets, and the latest estimates point to stubbornly high consumer prices in Germany despite a continued fall in import prices.

The German import price index fell by 0.6 per cent in July, the tenth consecutive month of decline. In the same month a year earlier, the fall was 13.2%. The figure was 0.3 percentage points lower than expected, which could act as an early indicator of a fall in headline inflation and reduce the chances of further tightening by the ECB.

However, preliminary estimates of consumer inflation for August later in the day showed an acceleration in Germany and Spain, setting up a robust CPI for the whole eurozone, which will be released on Thursday.

German consumer prices were around 6.1% higher in August than a year earlier, after three consecutive months of 0.3% increases. Consumer inflation in the eurozone’s largest economy has not fallen since May, although other price indices have moved into negative territory.

Consumer prices in Spain are rising at 2.6% year-on-year, up from 2.3% in July and 1.9% in June, which is unlikely to allow the ECB to loosen its grip next month.

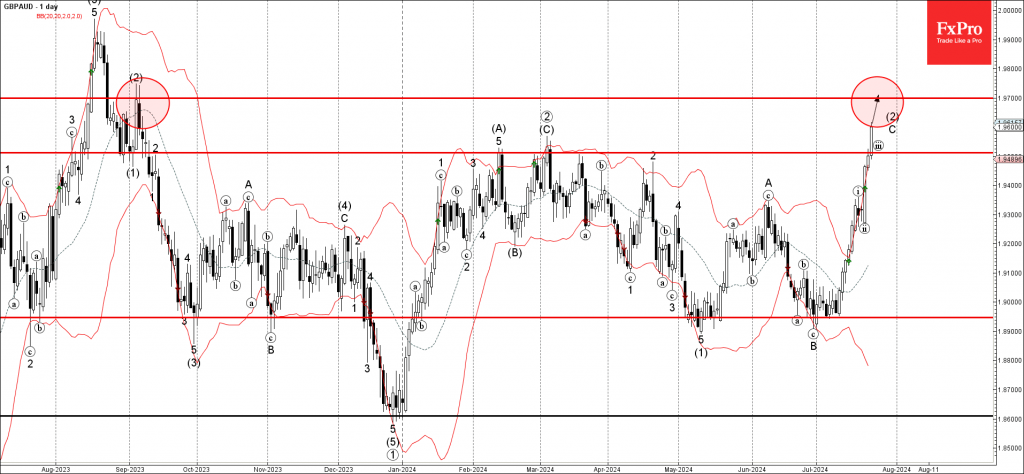

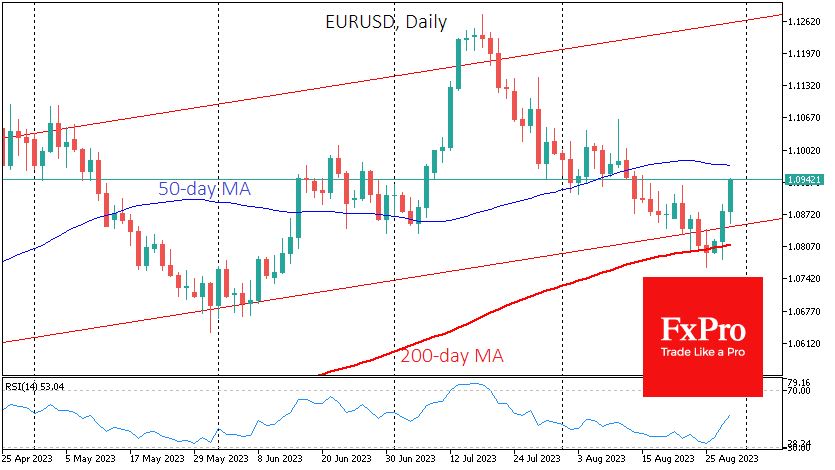

This is good news for the single currency. EURUSD gained over 1.5% to 1.0940 in less than 24 hours on the news, highlighting the cooling of inflationary pressures in the US against positive surprises from the eurozone.

EURUSD started to gain support on the retracement to the 200-day MA and back to the upward channel formed at the end of last year.

The FxPro Analyst Team