Technical analysis - Page 138

October 5, 2023

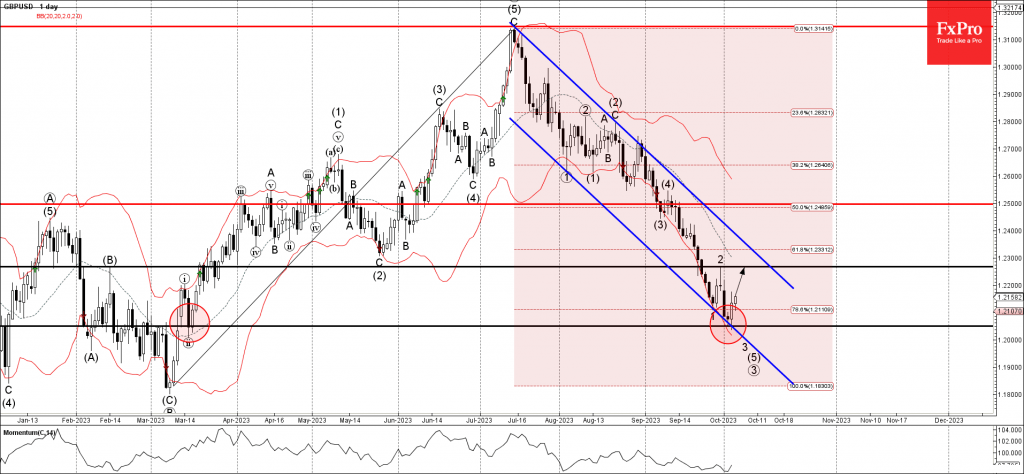

– GBPUSD reversed from support level 1.2050 – Likely to rise to resistance level 1.2265 GBPUSD currency pair recently reversed up from the key support level 1.2050 (former pivotal support from March) coinciding with the support trendline of the daily.

October 5, 2023

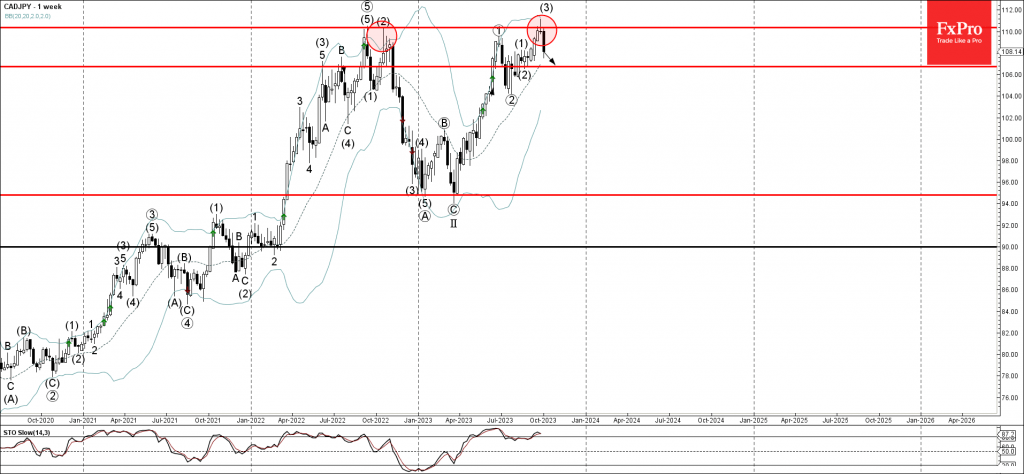

– CADJPY reversed from powerful resistance level 110.35 – Likely to fall to support level 106.7 CADJPY currency pair recently reversed down from the powerful resistance level 110.35 (which stopped the previous weekly uptrend in 2022) standing near the upper.

October 4, 2023

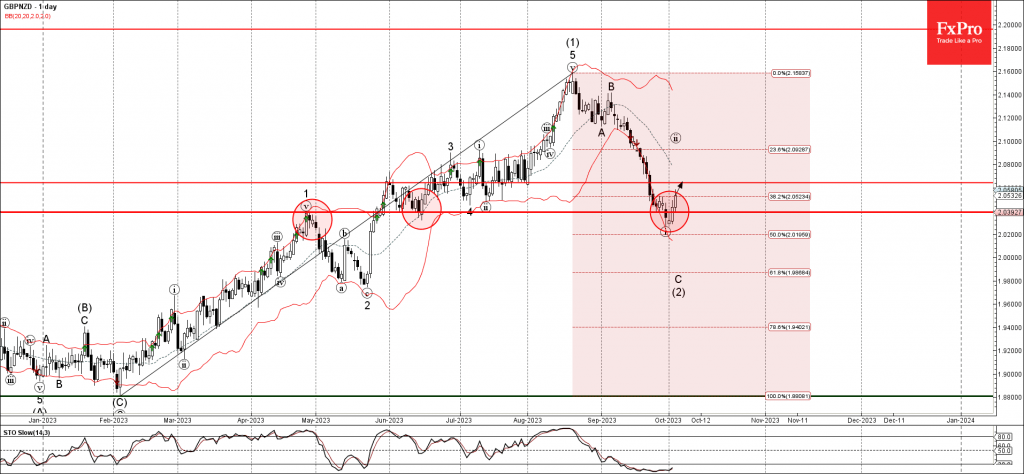

– GBPNZD reversed from support level 2.0390 – Likely to rise to resistance level 2.0645 GBPNZD currency pair recently reversed up from the strong support level 2.0390 (former monthly high from April and the monthly low from June), lower daily.

October 4, 2023

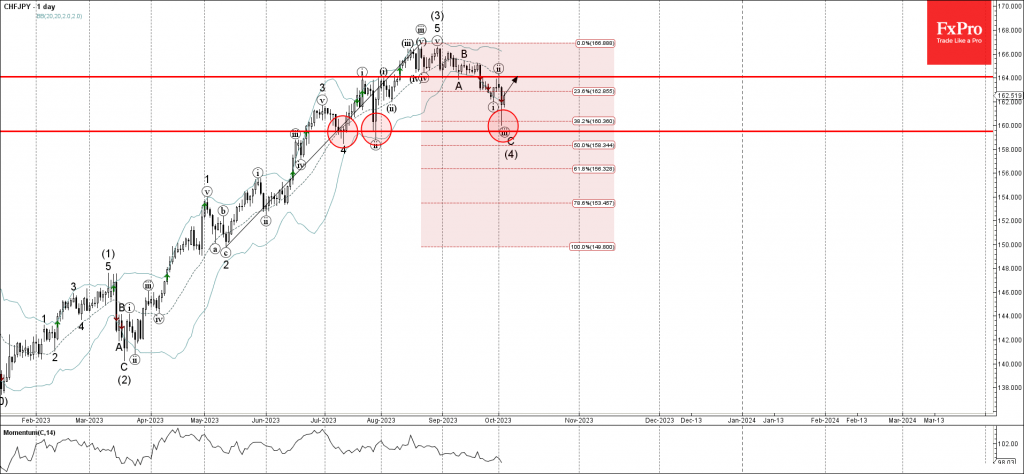

– CHFJPY reversed from support level 160.00 – Likely to rise to resistance level 164.00 CHFJPY currency pair recently reversed up from the key support level 160.00 (which has been reversing the pair from July), lower daily Bollinger Band and.

October 3, 2023

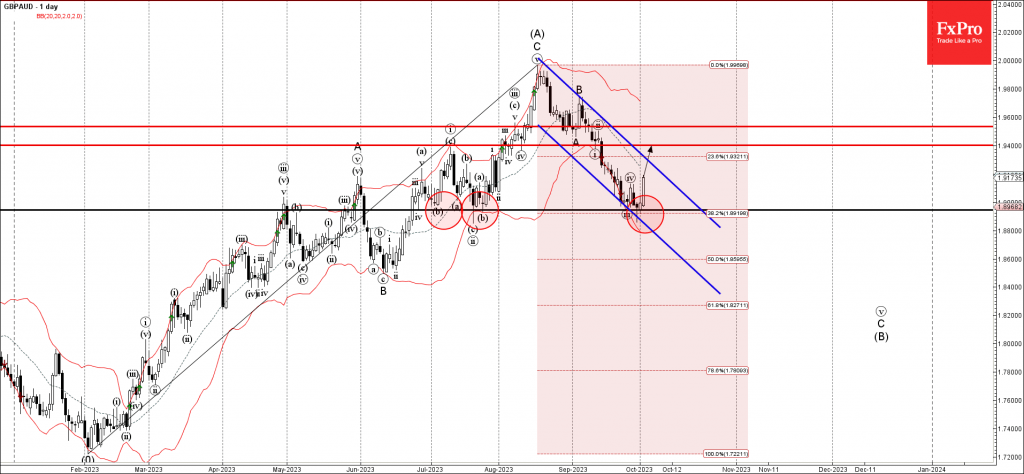

– GBPAUD reversed from pivotal support level 1.8945 – Likely to rise to resistance level 1.9400 GBPAUD currency pair recently reversed up from the pivotal support level 1.8945 (which has been repeatedly reversing the pair from the start of July).

October 3, 2023

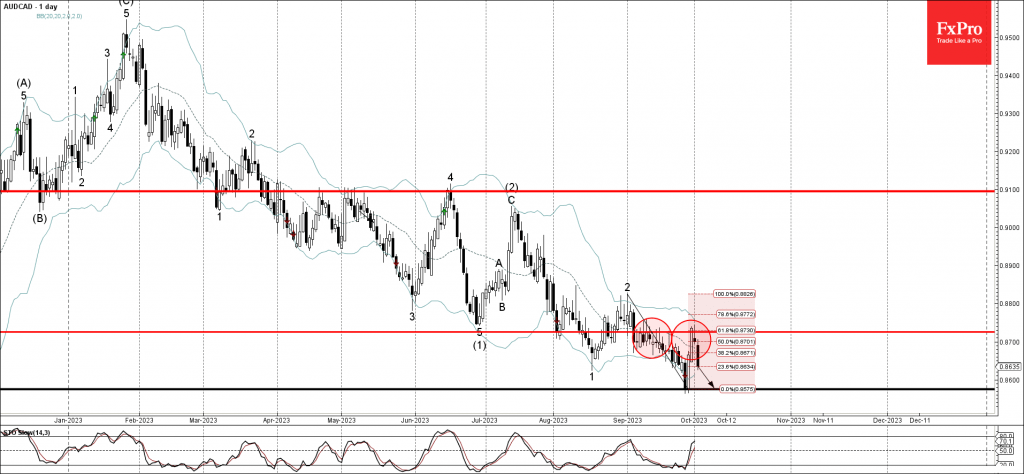

– AUDCAD reversed from resistance level 0.8725 – Likely to fall to support level 0.8575 AUDCAD currency pair recently reversed down from the pivotal resistance level 0.8725 (which has been repeatedly reversing the pair from the start of September) intersecting.

October 2, 2023

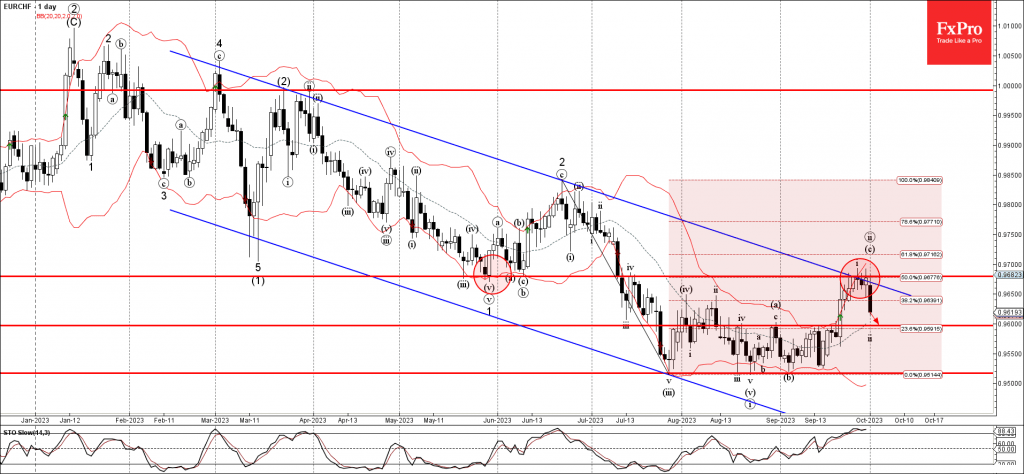

– EURCHF reversed from resistance level 0.9680 – Likely to fall to support level 0.9600 EURCHF currency pair recently reversed down from the key resistance level 0.9680 (former strong support from May) intersecting with the upper daily Bollinger Band and.

October 2, 2023

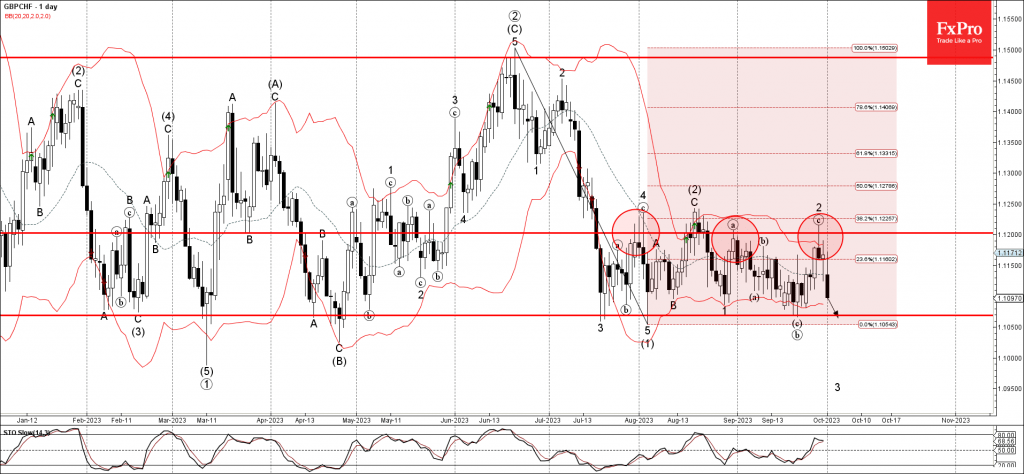

– GBPCHF reversed from resistance level 1.1200 – Likely to fall to support level 1.1070 GBPCHF currency pair earlier reversed down from the key resistance level 1.1200 (which has been reversing the pair from July) intersecting with the upper weekly.

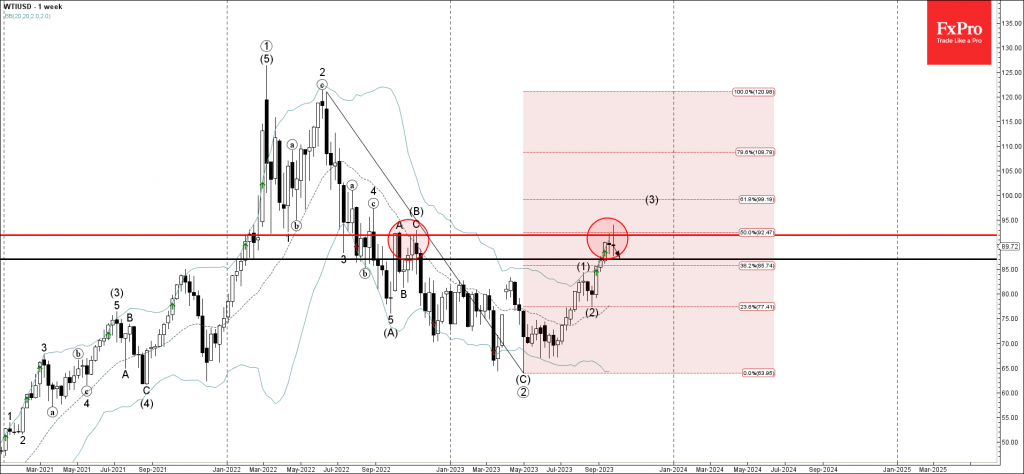

September 29, 2023

– WTI reversed from resistance level 92.00 – Likely to fall to support level 87.00 WTI crude oil earlier reversed down from the pivotal resistance level 92.00 (which reversed the price strongly at the end of 2022) intersecting with the.

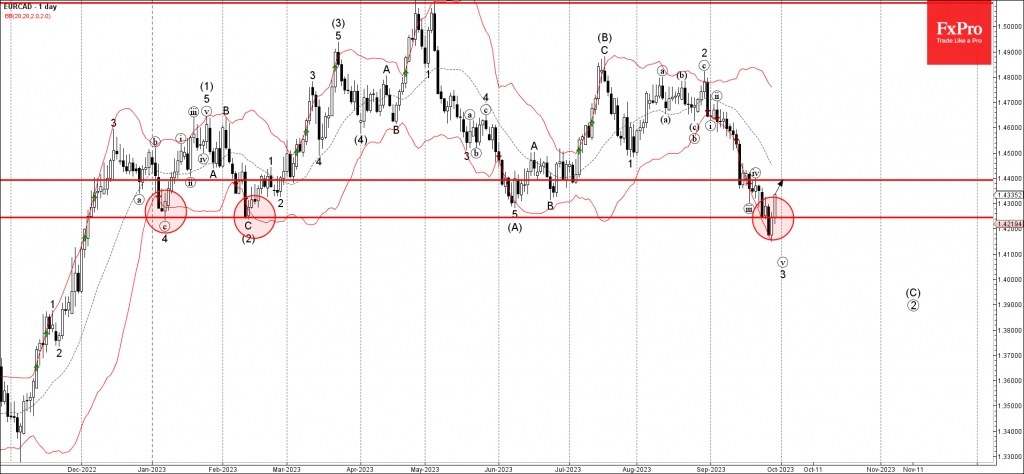

September 29, 2023

– EURCAD reversed from long-term support level 1.4245 – Likely to rise to resistance level 1.4400 EURCAD currency pair recently reversed up from the long-term support level 1.4245 (which has been reversing the price from January) intersecting with the lower.

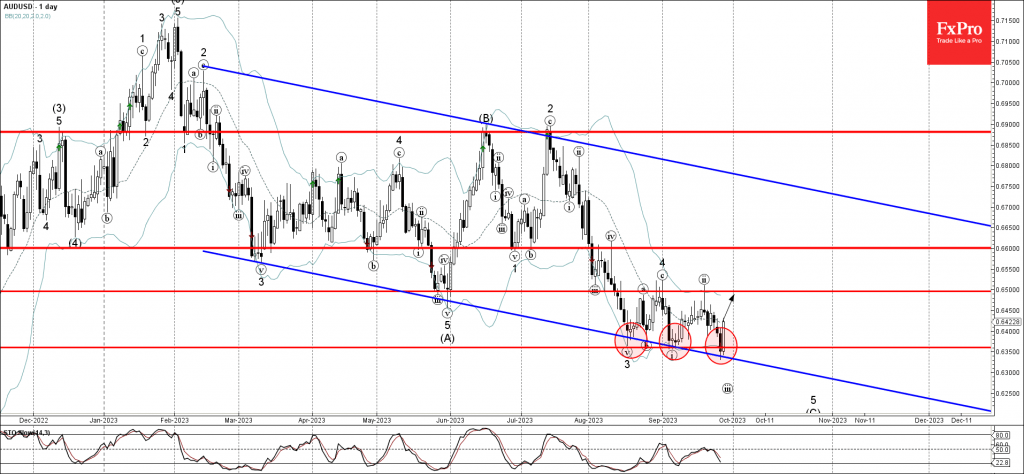

September 28, 2023

– AUDUSD reversed from support level 0.6350 – Likely to rise to resistance level 0.6500 AUDUSD currency pair recently reversed up from the key support level 0.6350 (which has been reversing the price from the middle of August) intersecting with.