Technical analysis - Page 137

October 13, 2023

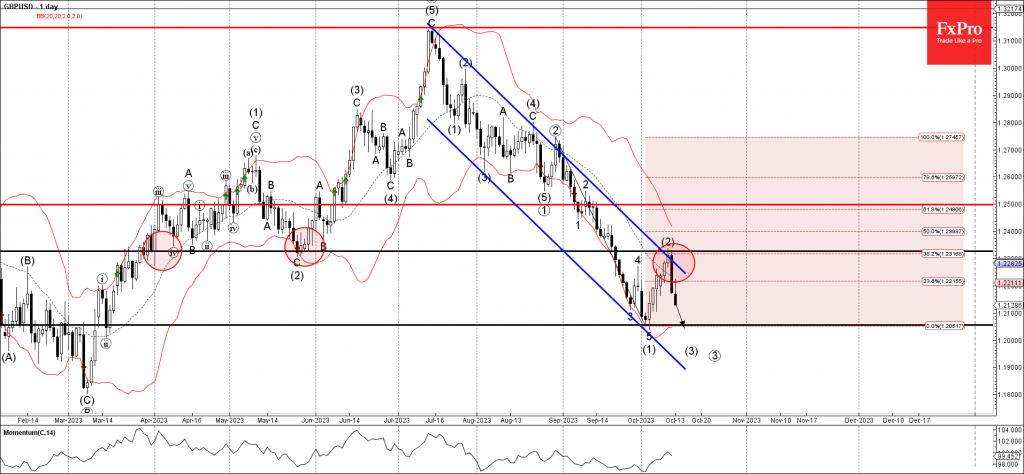

– GBPUSD reversed from resistance level 1.2325 – Likely to fall to support level 1.2055 GBPUSD recently reversed down from the key resistance level 1.2325 (former strong support from May) coinciding with the resistance trendline of the daily down channel.

October 13, 2023

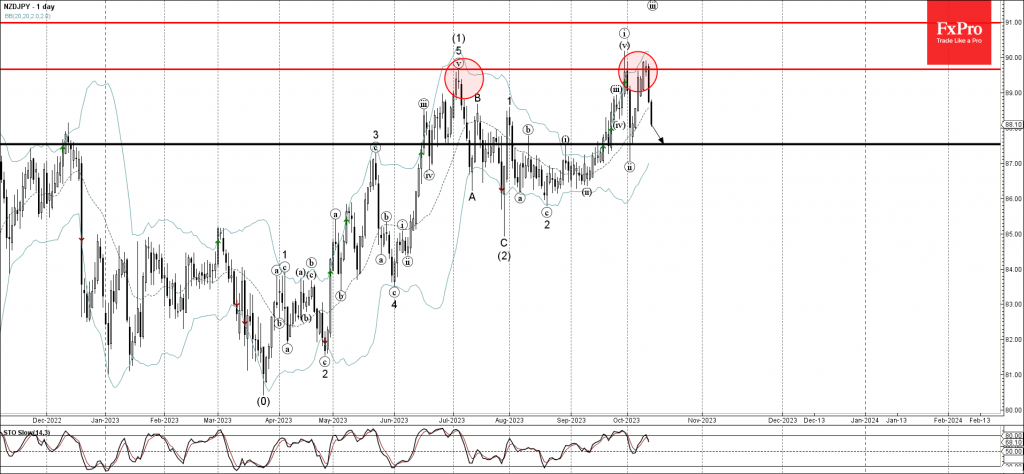

– NZDJPY under bearish pressure – Likely to fall to support level 87.55 NZDJPY under the bearish pressure after the earlier downward reversal from the strong resistance level 89.70 (previous multi-month high from July) coinciding with the upper daily Bollinger.

October 12, 2023

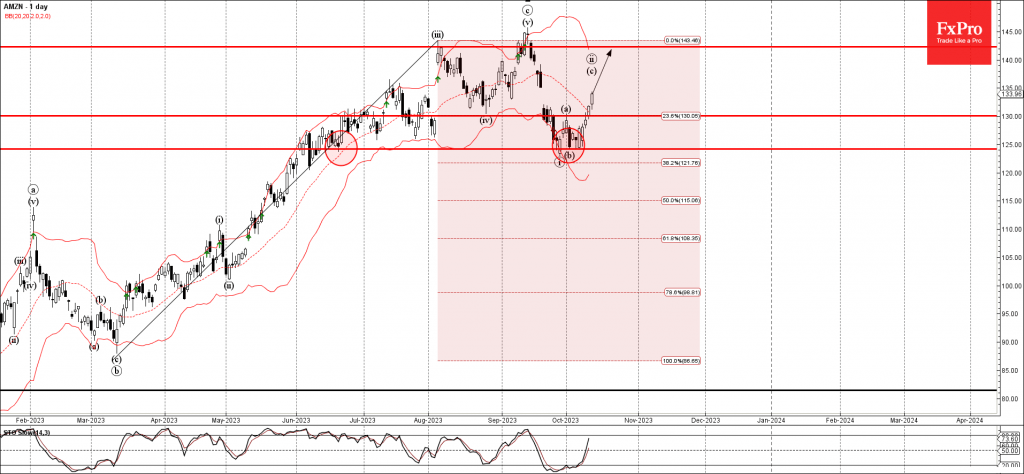

– Amazon broke key resistance level 130.00 – Likely to rise to resistance level 142.30 Amazon under the bullish pressure after the earlier breakout of the key resistance level 130.00 (top of the previous minor correction a from the end.

October 12, 2023

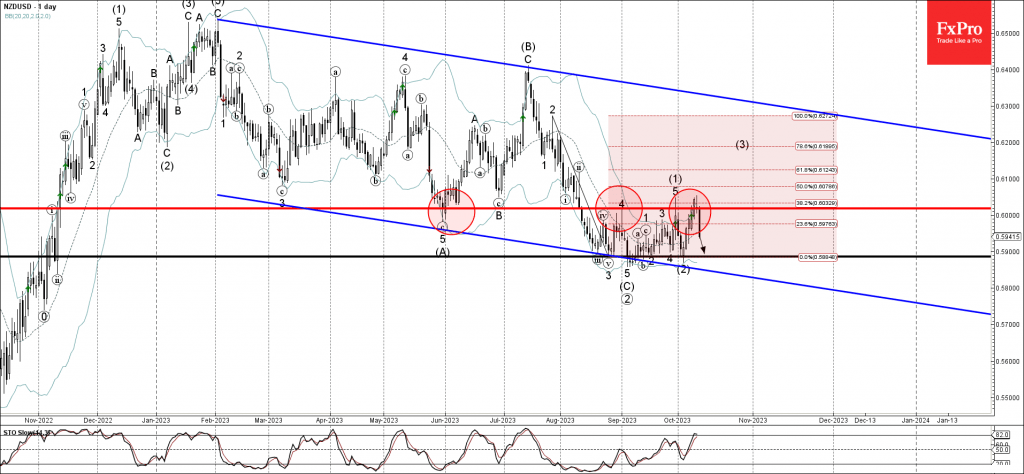

– NZDUSD reversed from key resistance level 0.6020 – Likely to fall to support level 0.5900 NZDUSD currency pair recently reversed down from the key resistance level 0.6020 (former strong support from June, which stopped the previous waves 4 and.

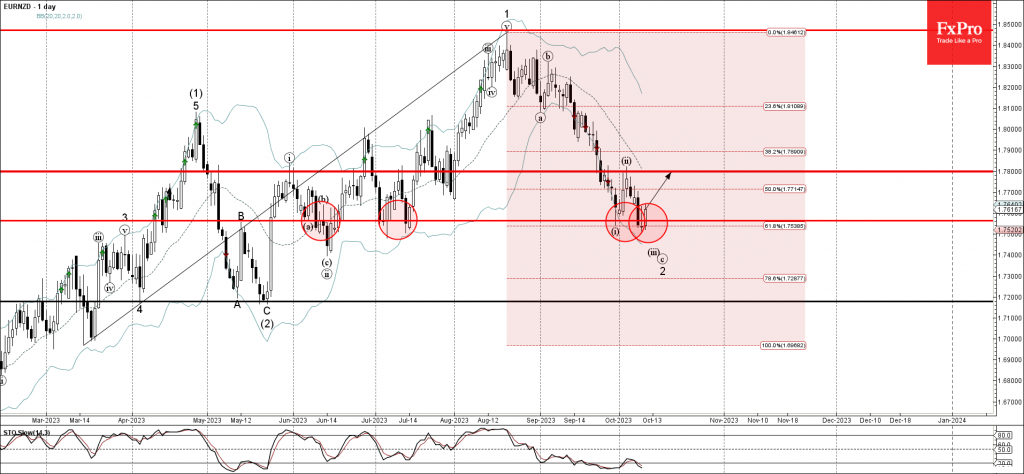

October 11, 2023

– EURNZD reversed from support level 1.7565 – Likely to rise to resistance level 1.7800 EURNZD currency pair recently reversed up from the key support level 1.7565 (which has been reversing the price from June), intersecting with the lower daily.

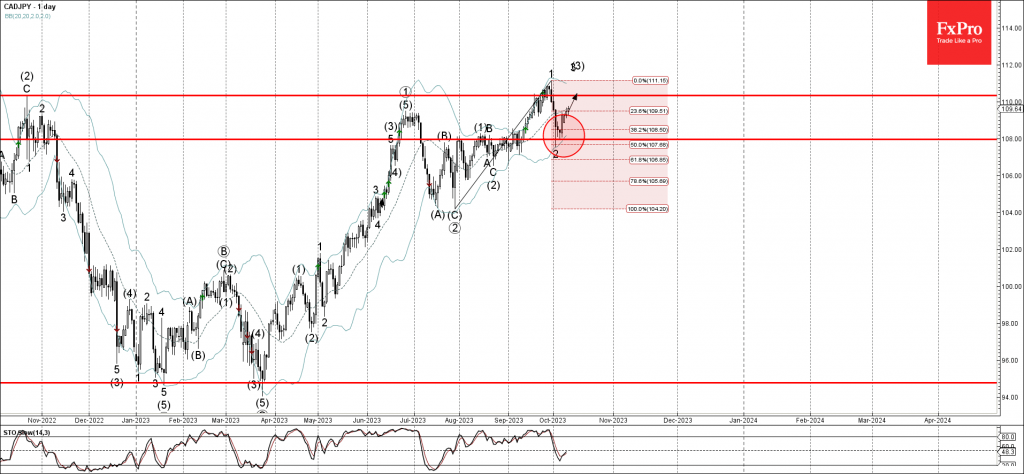

October 11, 2023

– CADJPY reversed from support level 108.00 – Likely to rise to resistance level 110.35 CADJPY currency pair recently reversed up from the pivotal support level 108.00 (former key resistance from July and August), intersecting with the lower daily Bollinger.

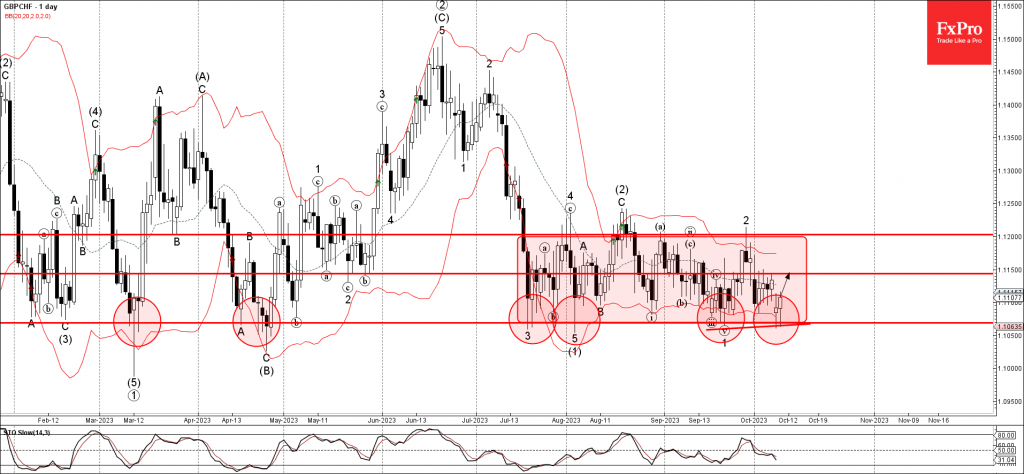

October 10, 2023

– GBPCHF reversed from support level 1.1070 – Likely to rise to resistance level 1.1150 GBPCHF currency pair recently reversed up from the pivotal support level 1.1070 (lower border of the narrow price range, which has been reversing the price.

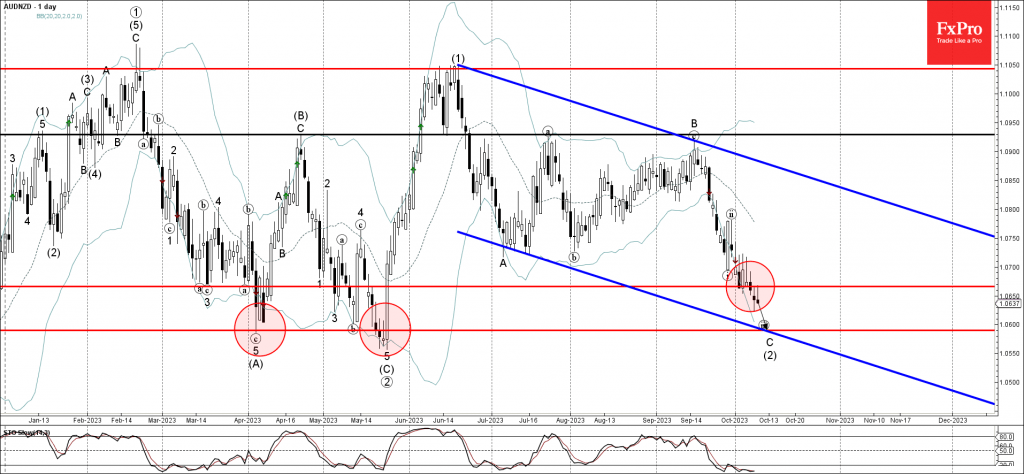

October 10, 2023

– AUDNZD reversed from resistance level 1.0665 – Likely to fall to support level 1.0600 AUDNZD currency pair recently reversed down from the resistance level 1.0665 (former support from the start of October). The downward reversal from the resistance level.

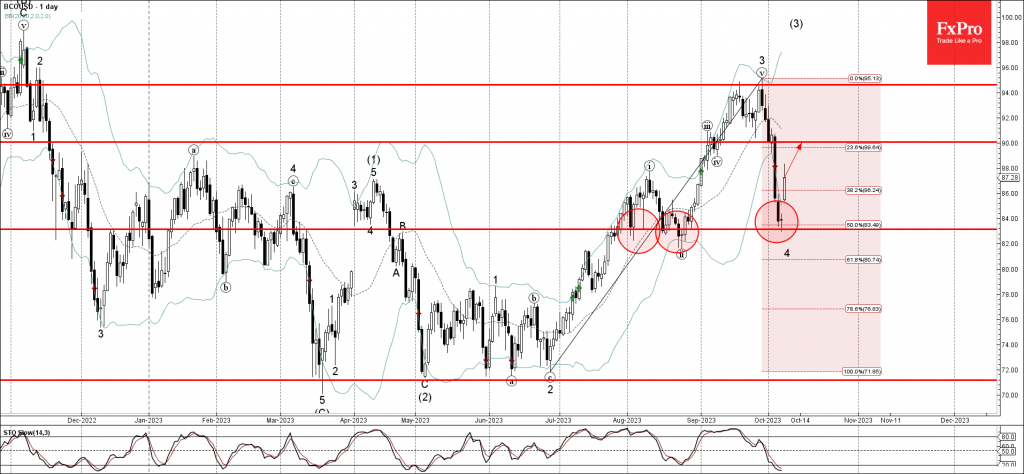

October 9, 2023

– Brent crude oil reversed from support level 83.15 – Likely to rise to resistance level 90.00 Brent crude oil recently reversed up from the support level 83.15 (which has been repeatedly reversing the price from the start of August),.

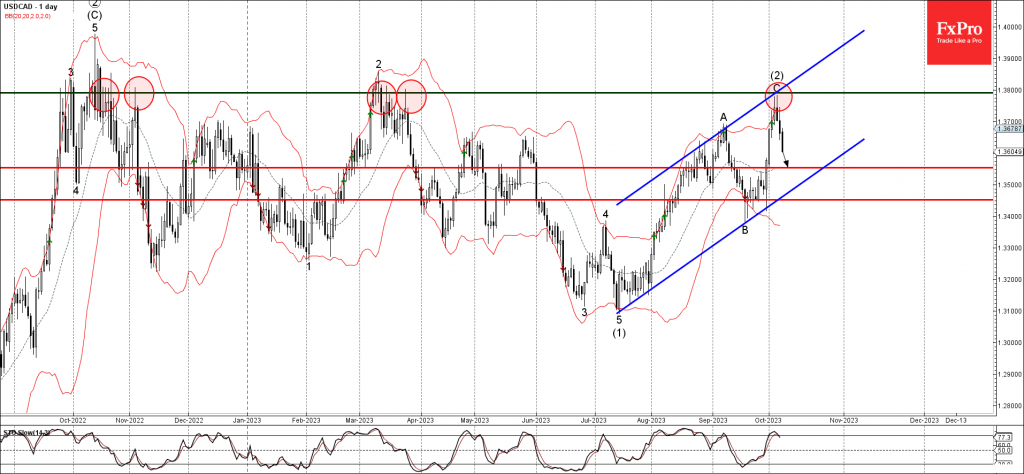

October 9, 2023

– USDCAD reversed from resistance level 1.3800 – Likely to fall to support level 1.3555 USDCAD currency pair recently reversed down from the resistance level 1.3800 (which has been reversing the price from October of 2022), coinciding with the upper.

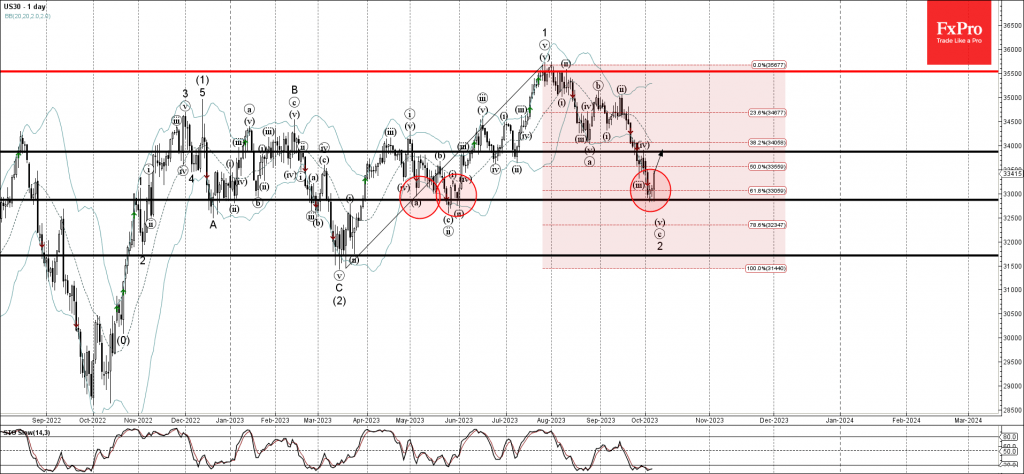

October 6, 2023

– Dow Jones reversed from support level 32875.00 – Likely to rise to resistance level 33875.00 Dow Jones index recently reversed up from the pivotal support level 32875.00 (which has been reversing the price from May), coinciding with the lower.