Market Overview - Page 96

September 6, 2022

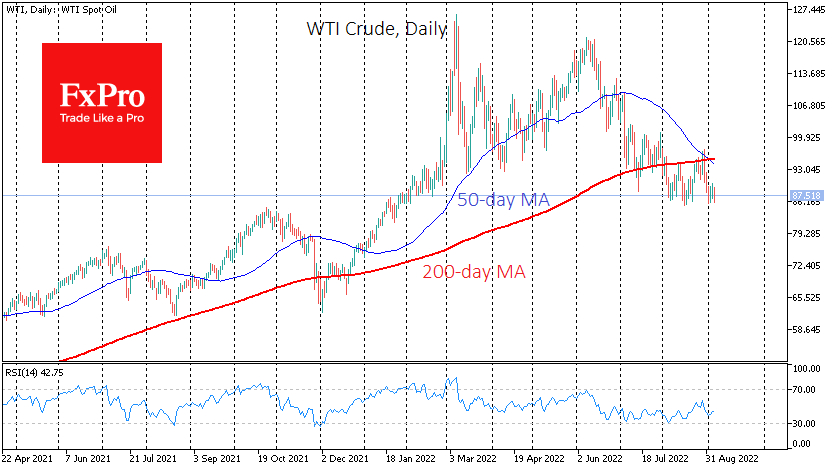

Brent and WTI spot prices are now lower than they were before the surprise from OPEC. The cartel yesterday surprised markets with a recommendation to cut oil production quotas by 100,000 BPD from October. The move is small but symbolic..

September 6, 2022

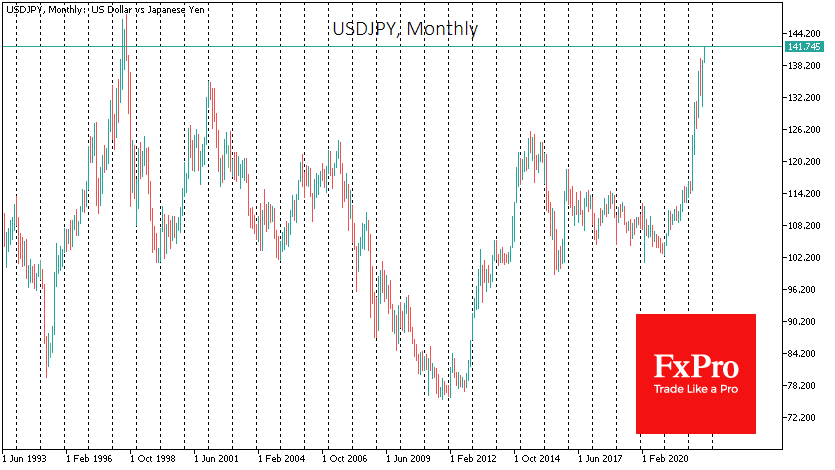

The Japanese yen is renewing 24-year lows against the dollar, and so far, policymakers have no safe tools to stop this decline. The USDJPY was above 141 on Tuesday morning, last seen in the first half of 1998. At the.

September 5, 2022

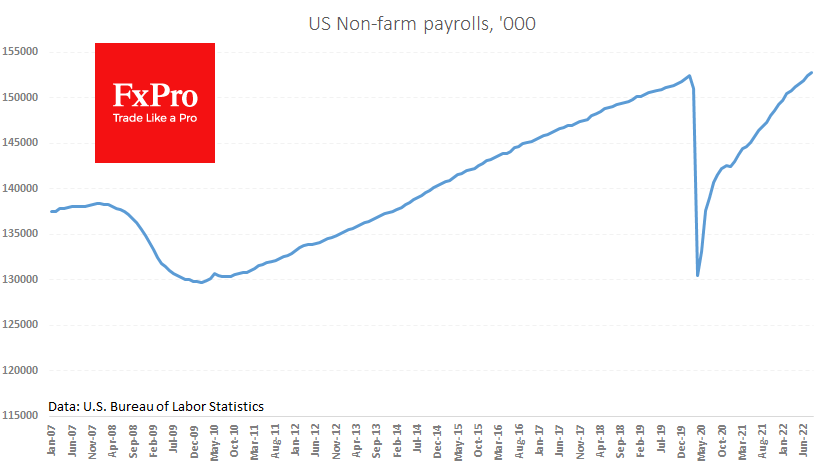

The US economy has created 315k new jobs, just above the forecasted 295-300K. The total number of employed people has surpassed the pre-pandemic highs with 152.7M. But, considering the natural population growth, the market is still not as tight as.

September 5, 2022

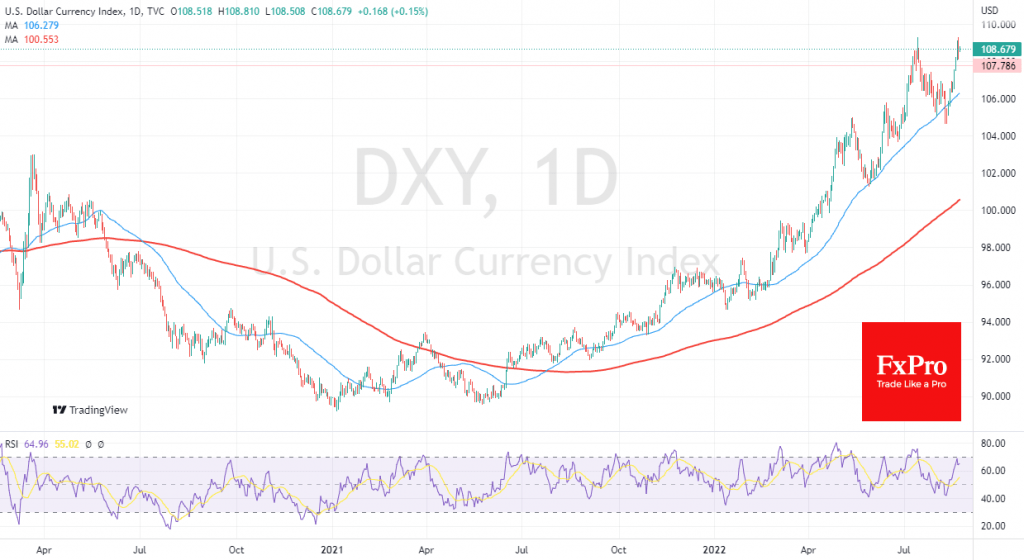

The dollar index rose above 110, updating 20-year highs on Monday morning as a flash reaction to increased pressure on the euro and British pound. European currencies are selling off amid an energy crisis related to Russian gas supplies, which.

September 2, 2022

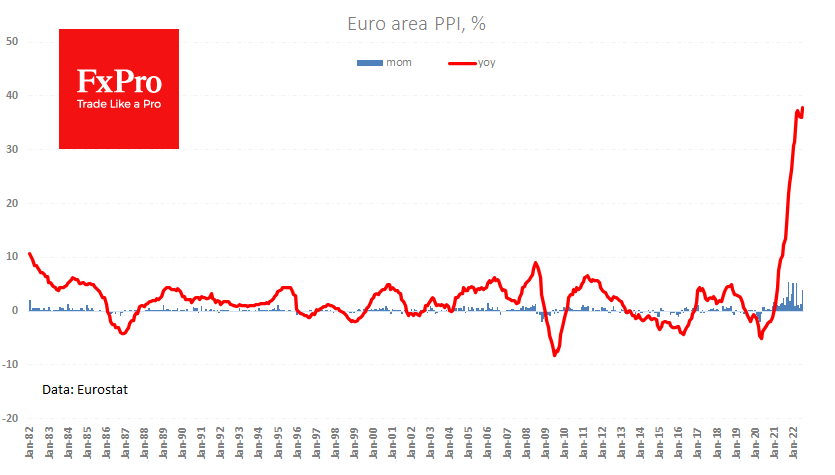

Another euro zone’s inflation report is noticeably above analysts’ expectations. Eurozone data published on Friday afternoon showed producer price growth of 4% for July and 37.9% year-on-year. At the same time, analysts had expected a 2.5% m/m increase and a.

September 2, 2022

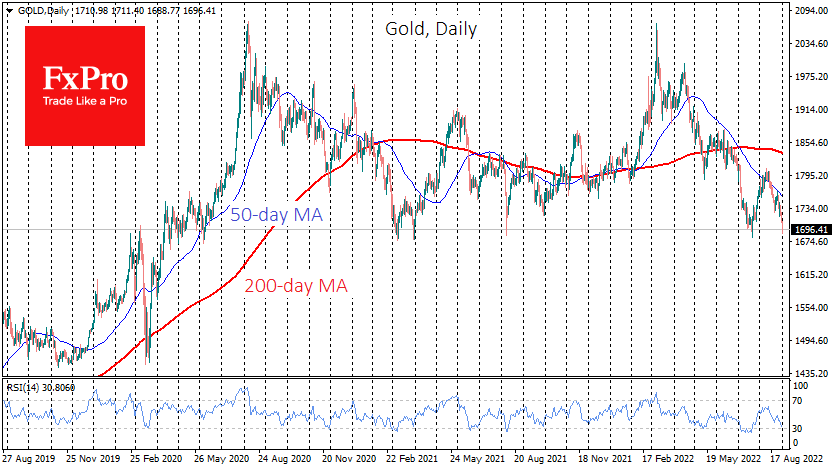

The gold price dipped below $1700 on Thursday, approaching the lower boundary of its trading range since May 2020. Gold has been finding buyers after emotional dips towards the lower boundary throughout this period. Perhaps the main reason for the.

August 30, 2022

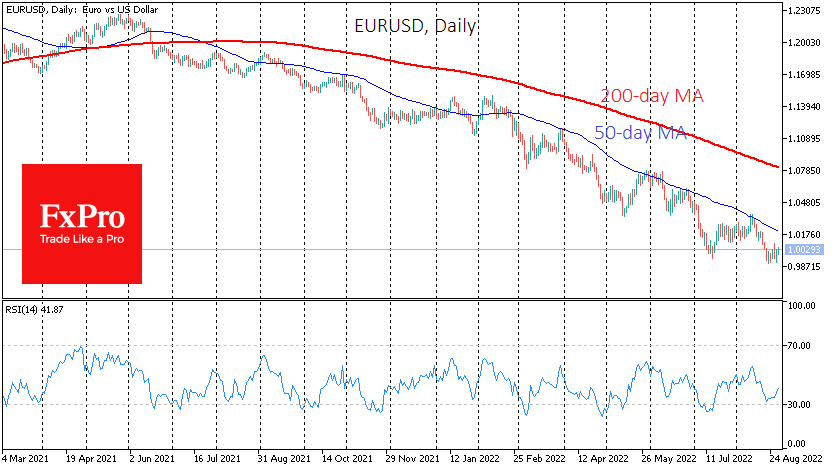

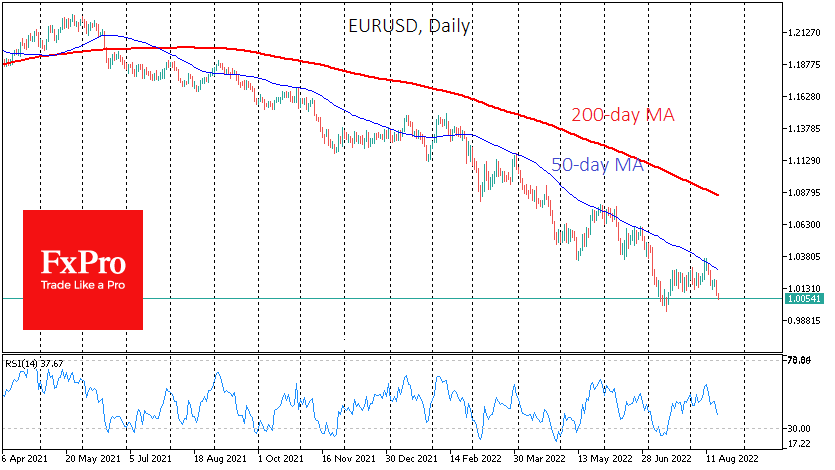

The fall in the single European currency has paused after briefly touching the 0.99 level earlier this month. As in July, the momentum of the EURUSD decline has sparked a resurgence of verbal interventions. Judging by the tone of recent.

August 24, 2022

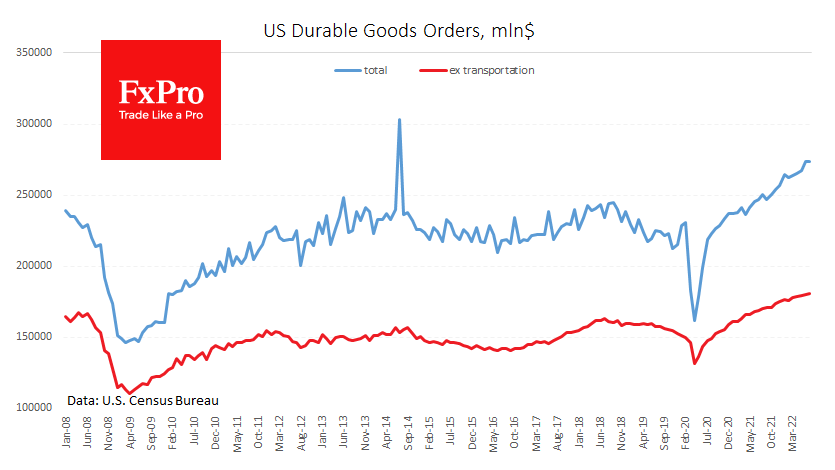

The value of US durable goods orders (DGO) for July was almost unchanged, against an expected 0.9% rise. It is also worth bearing in mind that an overly steep jump in June could cause July’s sluggishness. Moreover, the core metric.

August 24, 2022

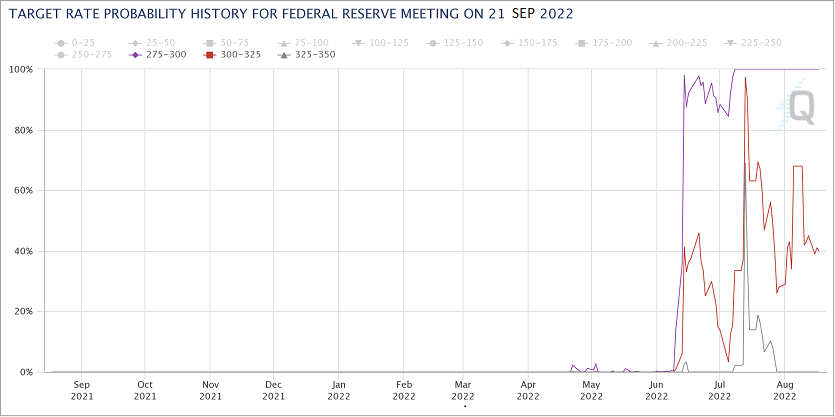

As is often the case, markets find themselves at important turning points ahead of significant scheduled events. One of the latter is the Monetary Policy Symposium in Jackson Hole, which starts later this week. This resort’s signs could break the.

August 19, 2022

The US dollar has quite expectedly accelerated its rise. EURUSD is trading less than 50 pips from parity, which it managed to defend in mid-July, having retreated from 20-year lows. GBPUSD has also quickly returned to July lows, losing more.

August 18, 2022

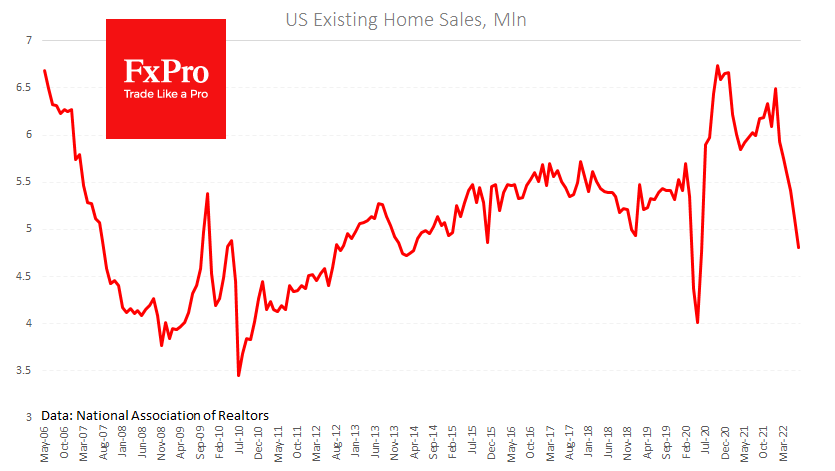

US secondary home market continues to shrink. Over July, they have fallen by a further 5.9%. The uninterrupted fall has been going on for the last six months, during which annualised home sales have fallen from 6.49 million to 4.81.