Market Overview - Page 87

November 24, 2022

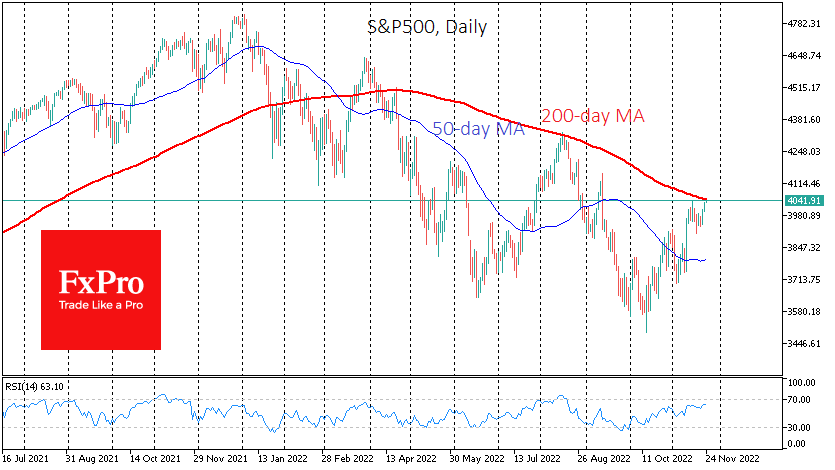

Investors were waiting for the November FOMC meeting minutes to clarify whether the committee would cut the pace of rate hikes. The minutes confirmed these expectations, but as they were primarily priced in, we did not see a strong reaction.

November 23, 2022

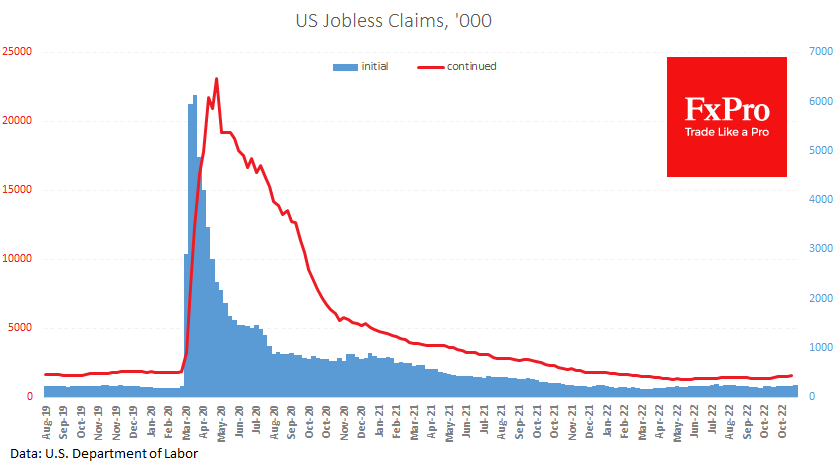

Weekly jobless claims in the USA rose to 240K last week, maintaining the upward trend since the end of September. The initial claims were the highest since August and exceeded expectations of 225K. The number of repeat claims was the.

November 23, 2022

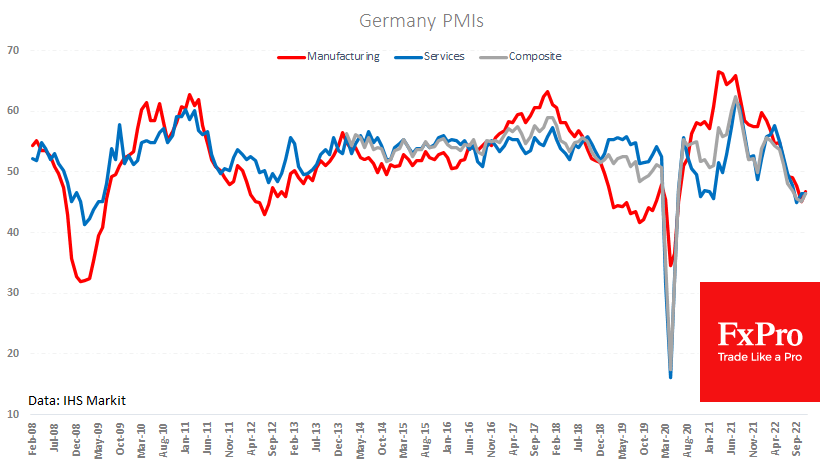

Preliminary eurozone PMI estimates are better than expected, although they point to an economic contraction. Germany’s manufacturing PMI rose from 45.1 to 46.7 in November, contrary to forecasts of a decline to 44.9. Values below 50 indicate an activity decrease,.

November 23, 2022

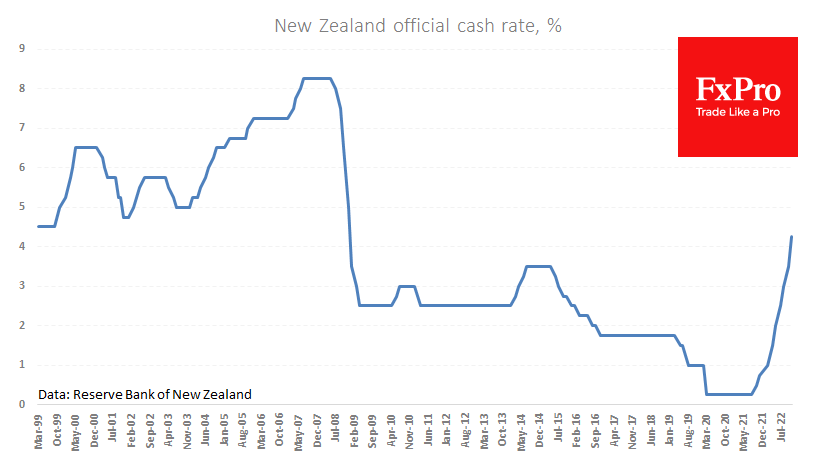

The Reserve Bank of New Zealand raised the rate by 75 points to 4.25% after five consecutive 50-point hikes. Analysts polled had anticipated such a result based on the signals sent by the central bank. RBNZ also began to reduce.

November 22, 2022

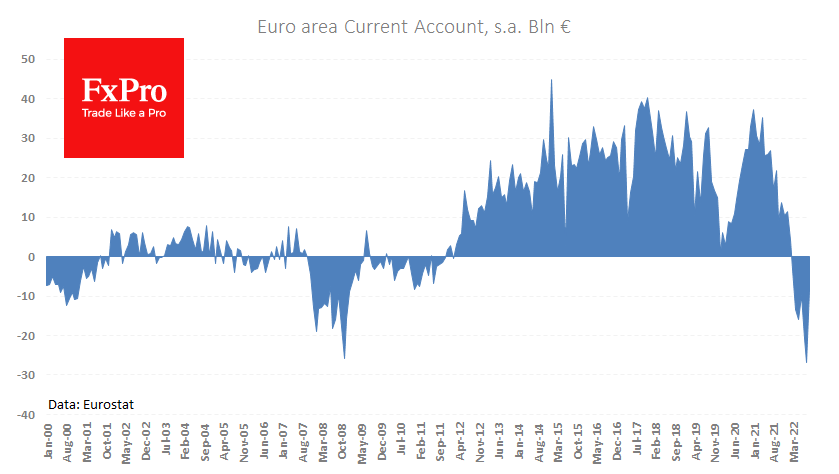

The balance of payments deficit in the eurozone in September was much smaller than expected at 8.1bn compared to 26.9bn a month earlier and the expected 20.3bn. Such a considerable difference was explained by a fall in the capital outflow.

November 22, 2022

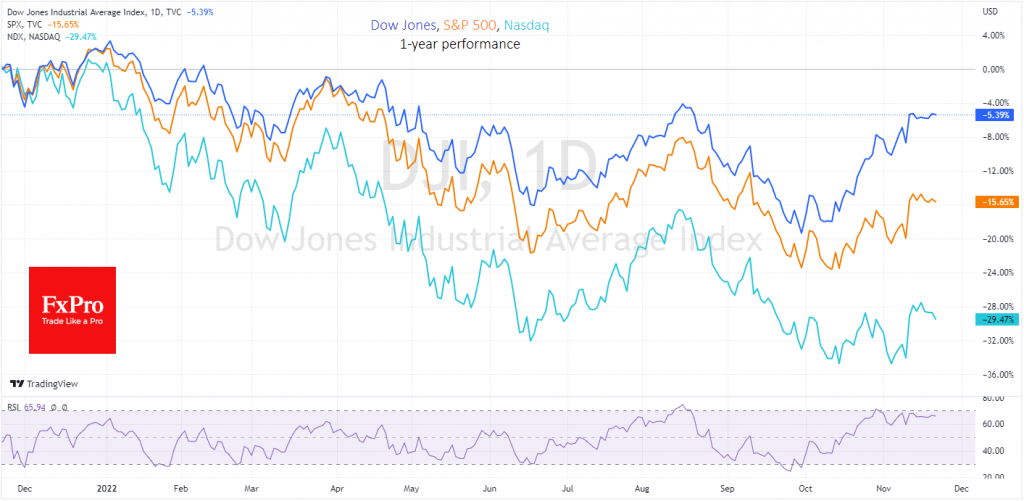

The Dow Jones index added around 18% to its lows at the start of October and still performing better than the Nasdaq 100 and S&P 500. The index includes 30 large companies with sustainable businesses, which is very important at.

November 21, 2022

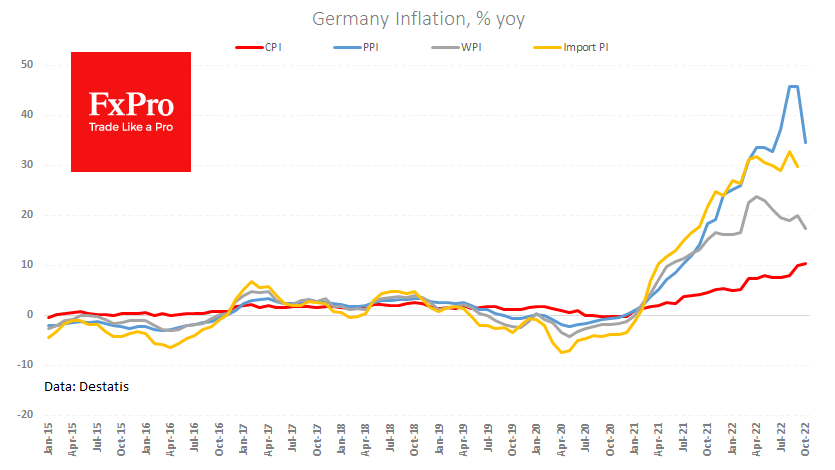

German producer prices lost 4.2% in October; its year-over-year growth rate slowed dramatically by 11.3 percentage points. This is an important and necessary reversal of the inflation trend that Europe’s largest economy has been waiting for. At the same time,.

November 21, 2022

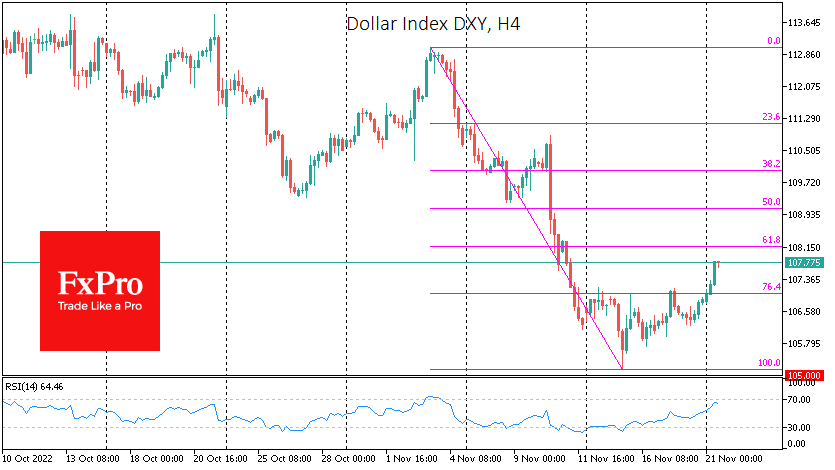

The Dollar Index has risen since last Tuesday, adding 2.5% to lows at 105.16. Speculators paused selling off the US currency in response to data and comments from Fed officials implying a higher interest rate target. The dollar’s pullback could.

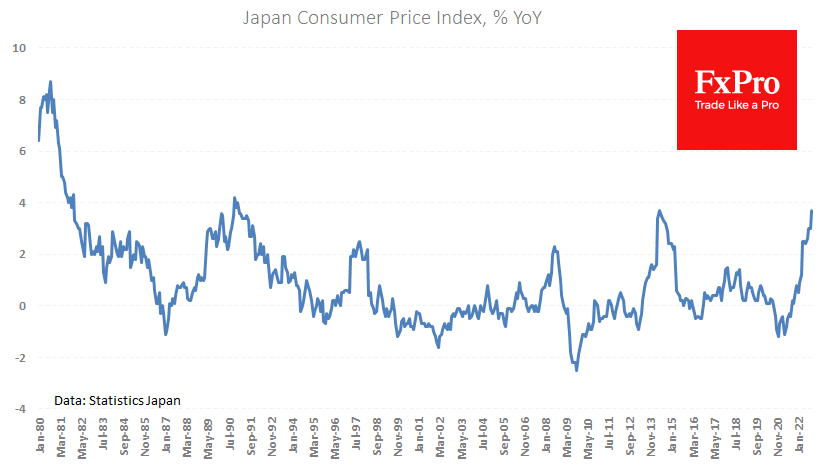

November 18, 2022

Consumer inflation in Japan accelerated to 3.7% in October, repeating 2014 highs and approaching the peak of 4.2% in late 1990. Excluding fresh food, prices rose by 3.6% y/y, the highest since 1982. At the same time, price growth was.

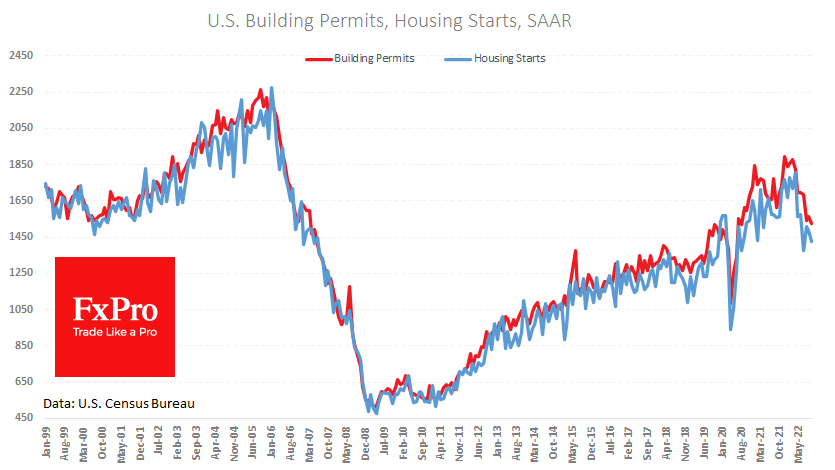

November 17, 2022

The number of building permits in the US fell by 2.4% to 1,526K, the lowest since June 2020, and is almost 20% below the peak a year ago. Housing starts fell by 4.2% to 1,425k. During the pandemic, the housing.

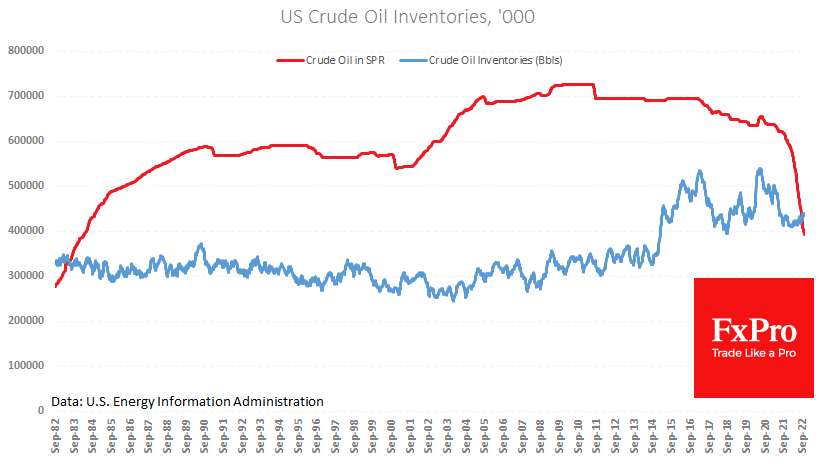

November 17, 2022

WTI oil is trading below $84, near last month’s lows, having failed to experience a buying spurt following the week’s inventory data. While commercial inventories were down 5.4Mln Barrels compared to an expected 2MB decline, oil sales from the Strategic.