Market Overview - Page 84

January 9, 2023

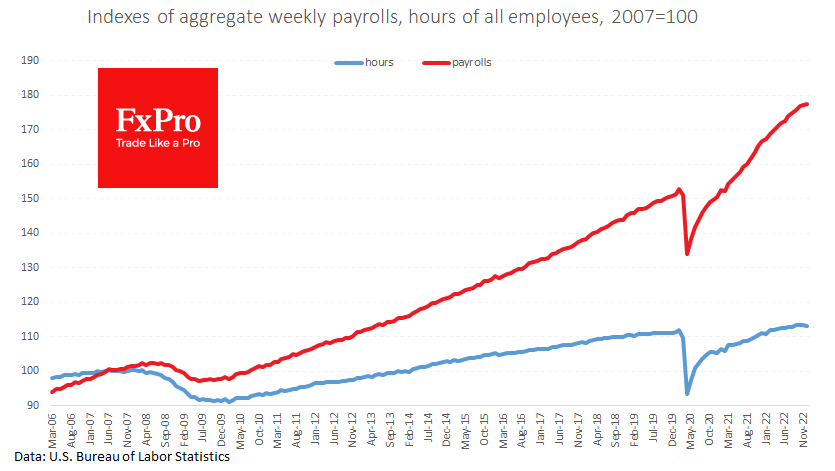

Data from the US on Friday supported risk appetite and provided a technically significant blow to the dollar against many of its peers. The monthly report showed that the US economy created 223k new jobs in December after 256k a.

January 5, 2023

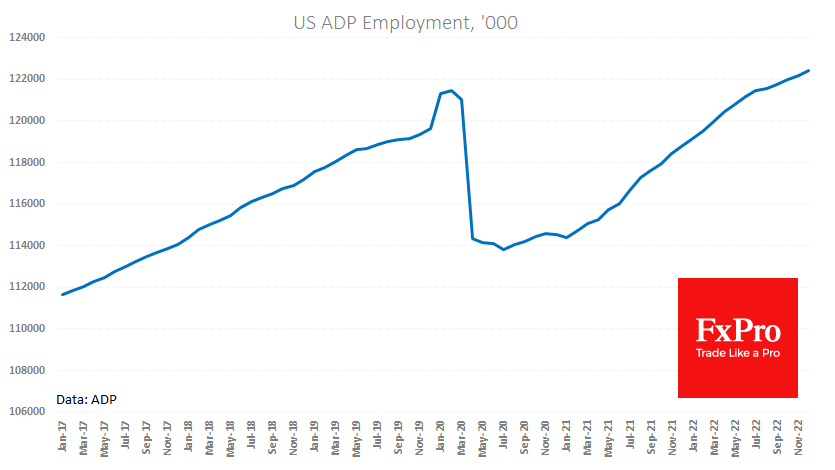

The ADP said the US private sector added 235K jobs in December in a report ahead of tomorrow’s official data release. The market expected an increase of 150k after a rise of 182K a month earlier. The ADP commented on.

January 5, 2023

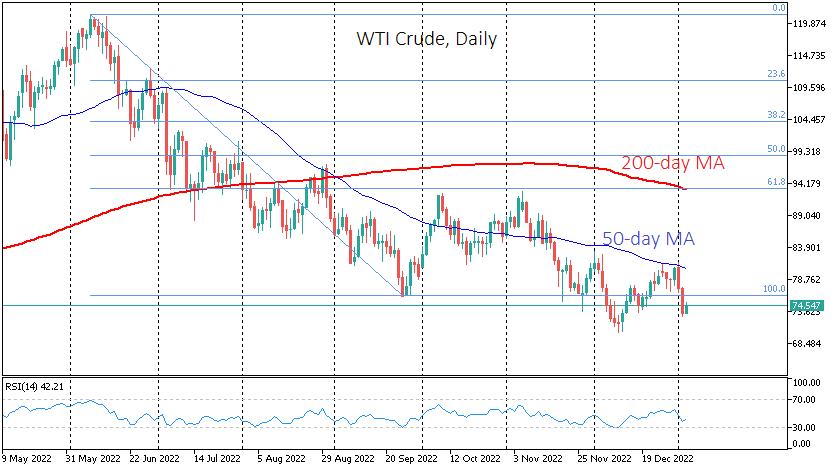

The first two trading sessions of the year have clearly shown that traders are sticking to the bearish patterns formed in the previous six months. Interestingly, oil is not even helped by apparent producer lethargy, which translates into stagnant production.

January 5, 2023

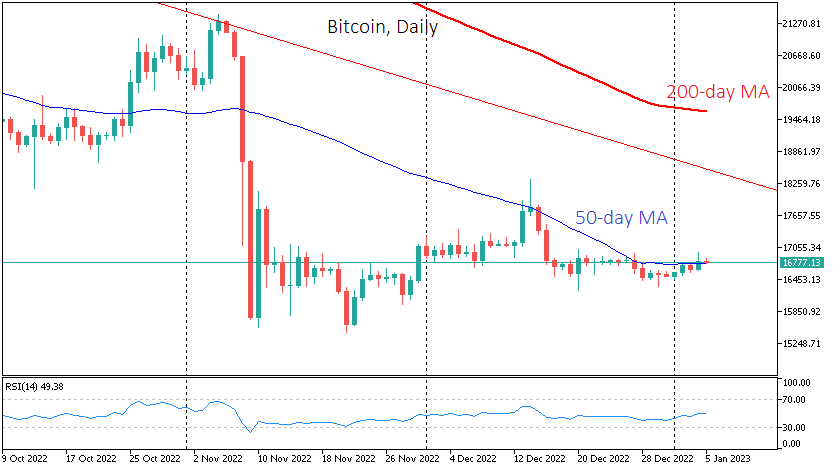

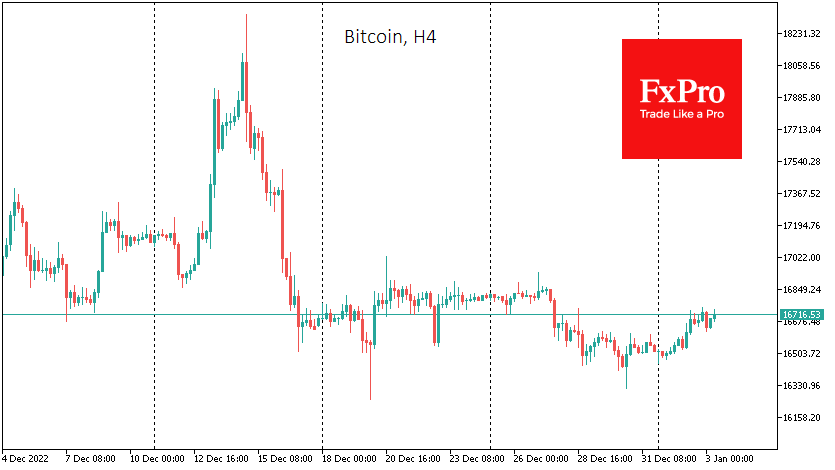

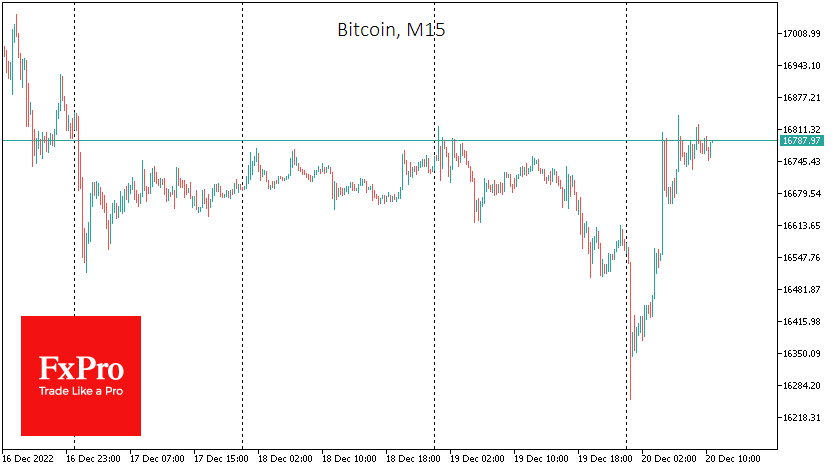

Market picture Bitcoin failed to break the $17K mark on Wednesday and has rolled back to $16.77K at the time of writing. Price fluctuations remain more than subdued. BTC remains slightly above its 50-day moving average (50-DMA). As capturing a.

January 4, 2023

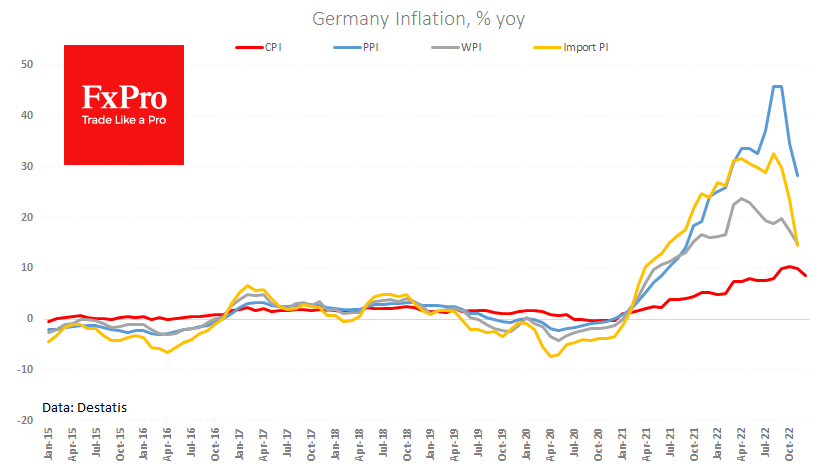

Inflation data from Germany yesterday and today reinforce hopes that the inflation wave is rolling back faster than expected. Whilst the early success does not promise a quick win, it does raise prospects that high inflation expectations have been avoided..

January 3, 2023

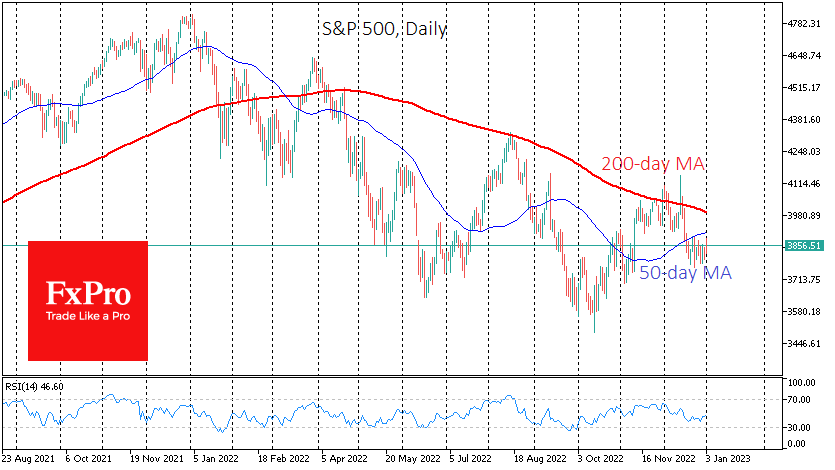

The S&P 500 index peaked in the first trading session of 2022, and it would be naive to expect the index to start rising from the first days of the new year. The stock markets may experience some pressure in.

January 3, 2023

Market picture Bitcoin has declined slightly over the past 24 hours – the bulls have still not decided to go on the offensive. Perhaps it is because of an overhang of selling orders from struggling miners. The first cryptocurrency is.

December 23, 2022

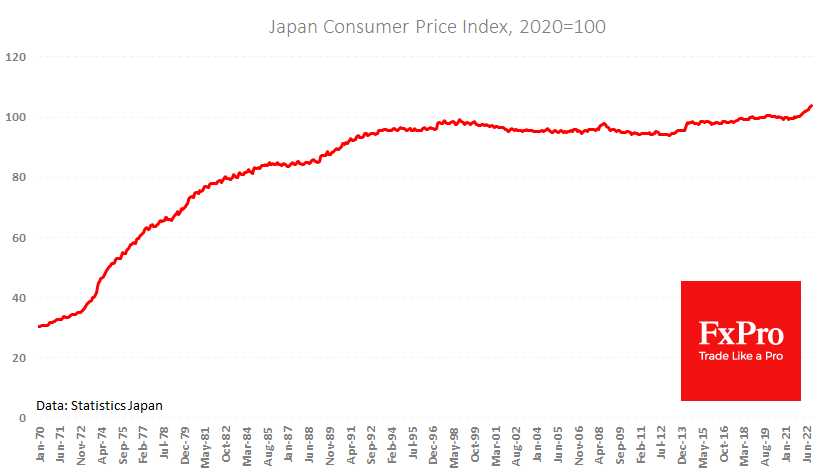

Japan boasts one of the slowest consumer price rises in the developed world. Data published Friday morning showed a 3.8% increase in prices in November compared to a year earlier, excluding fresh food and energy prices, an increase of 2.8%.

December 20, 2022

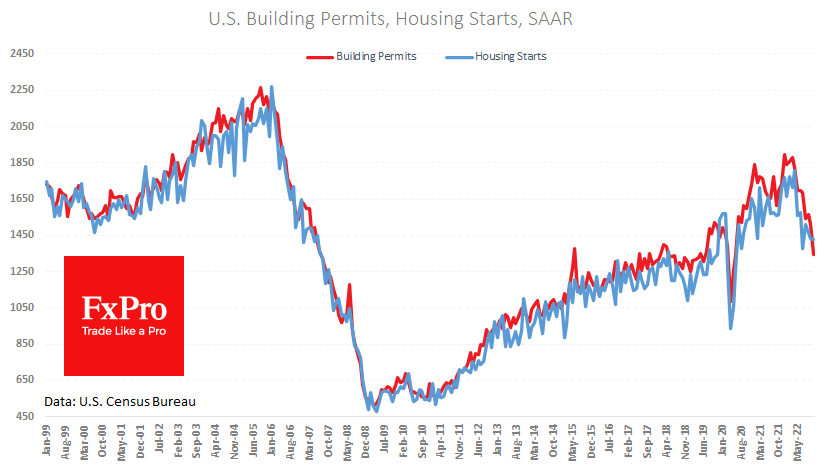

The number of US building permits issued collapsed by 11.2% in November to 1,342K after falling by 3.3% a month earlier. Barring a dip in the pandemic, this low number of permits was mid-2019 when the Fed turned to cut.

December 20, 2022

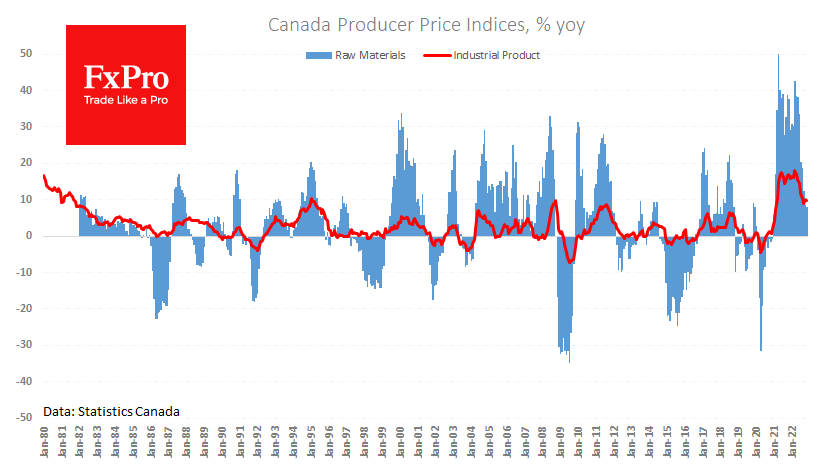

Canada’s producer price index fell 0.4% in November, sharply contrasting with the expected 2.2% m/m increase after jumping 2.4% m/m. An even more shocking contrast was in the commodity price index, where the decline was 0.8% m/m instead of the.

December 20, 2022

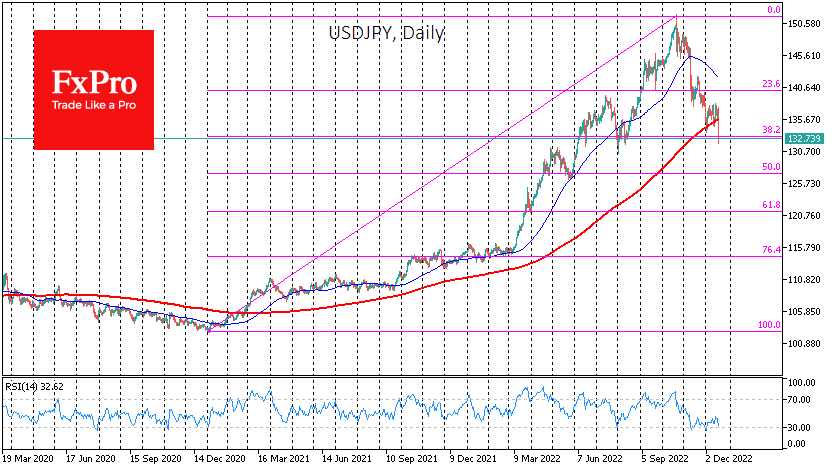

The Bank of Japan made a surprise move on Tuesday morning, extending the permissible yield range of 10-year government bonds. The decision caused the yen to strengthen by more than 3%, and the Nikkei225 index lost as much as 4%.