Market Overview - Page 82

January 27, 2023

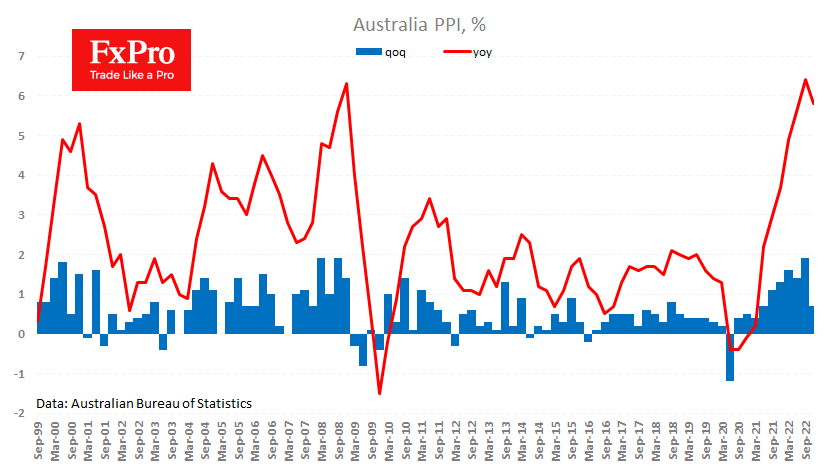

Australian inflation remains an important topic for the forex market as it tries to determine the central bank’s next steps in monetary policy. In contrast to the consumer inflation figures released earlier in the week, producer prices were surprised with.

January 27, 2023

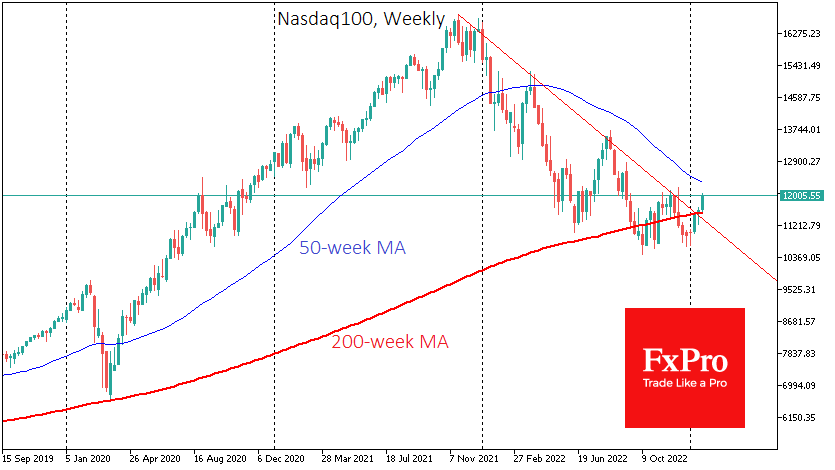

A bullish picture is forming on the Nasdaq100, suggesting that we see the beginning of a bull market and not just a rally in a bear market. If the index can close above 12000 by the end of next week,.

January 26, 2023

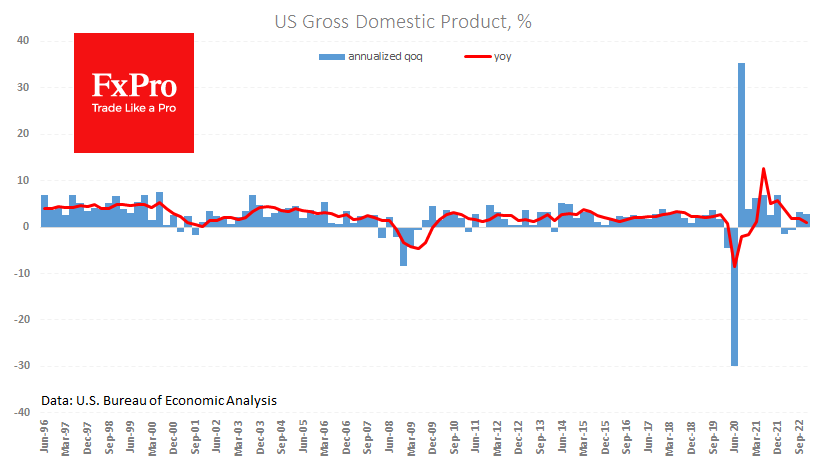

The preliminary estimate for the fourth quarter showed annualised growth of 2.9% (quarter-on-quarter growth multiplied by 4). This is a slowdown from the previous period (3.2%) but better than expected (2.6%). Compared to the same quarter a year ago, the.

January 26, 2023

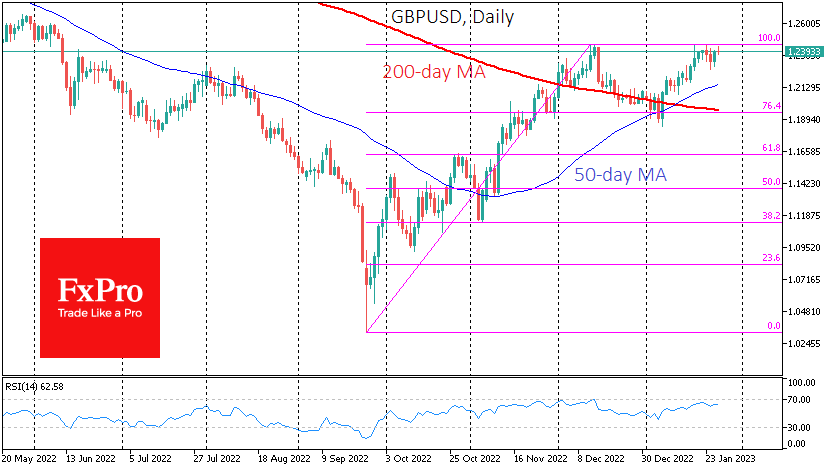

The British Pound is testing the $1.2400 level this week, above which it failed to consolidate in the middle of last month. The GBPUSD has yet to trade consistently higher since last June. Looking at the entire rally from September’s.

January 25, 2023

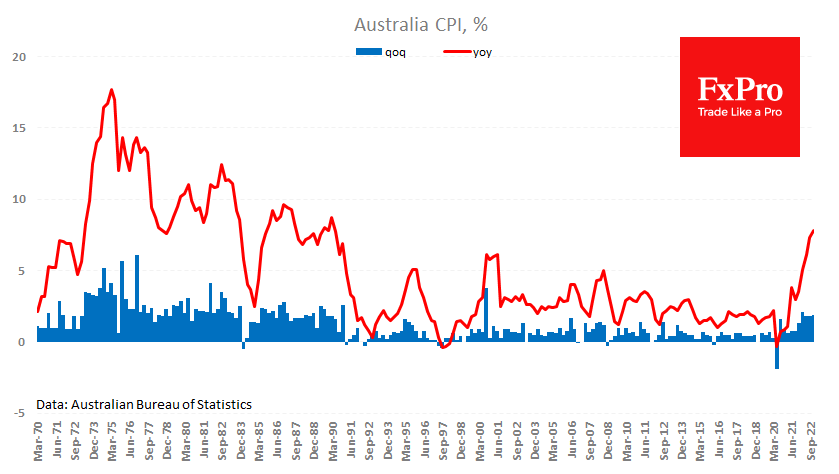

Inflation data continues to be the main driver of the markets. This morning the currency market focused on a surprise out of Australia, where the annual CPI growth rate for the fourth quarter accelerated from 7.3% to 7.8%, against expectations.

January 24, 2023

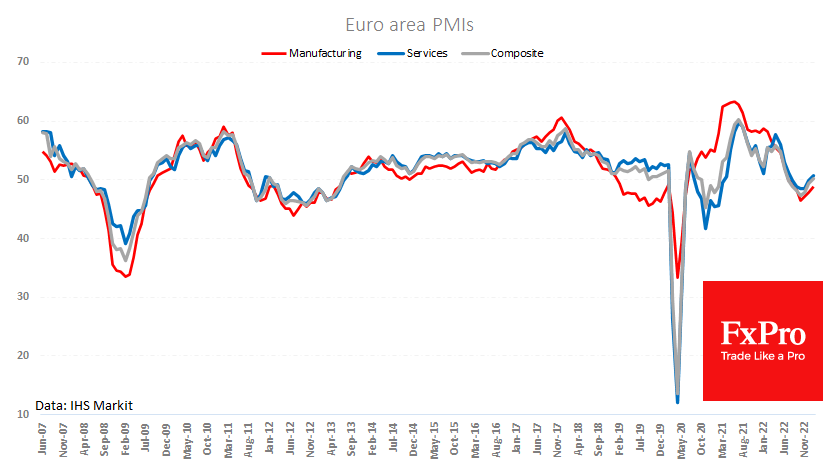

According to Markit’s preliminary estimates of business activity, the Eurozone economy has moved out of contraction and is trying to claw its way into growth. The eurozone composite PMI rose from 49.3 to 50.2, better than the expected 49.8. The.

January 24, 2023

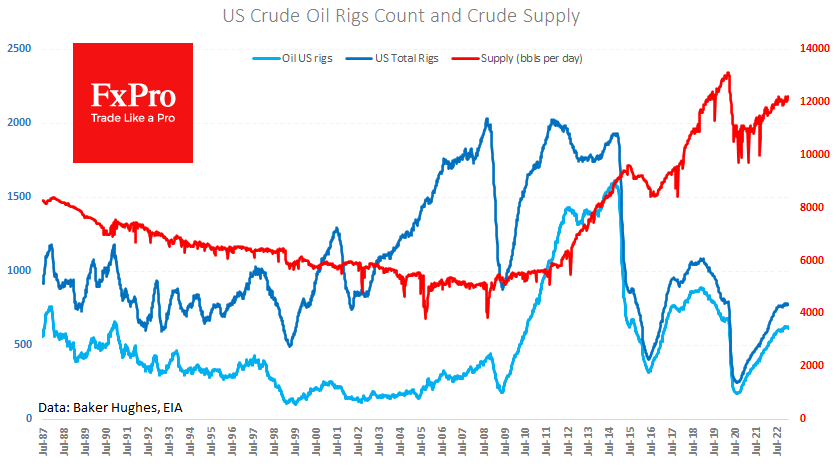

Oil briefly topped $82.50 per barrel WTI on Monday, testing the highs seen in the second half of November. The bulls are betting that China’s lifting of restrictions will boost global demand for commodities and energy. Although the US became.

January 23, 2023

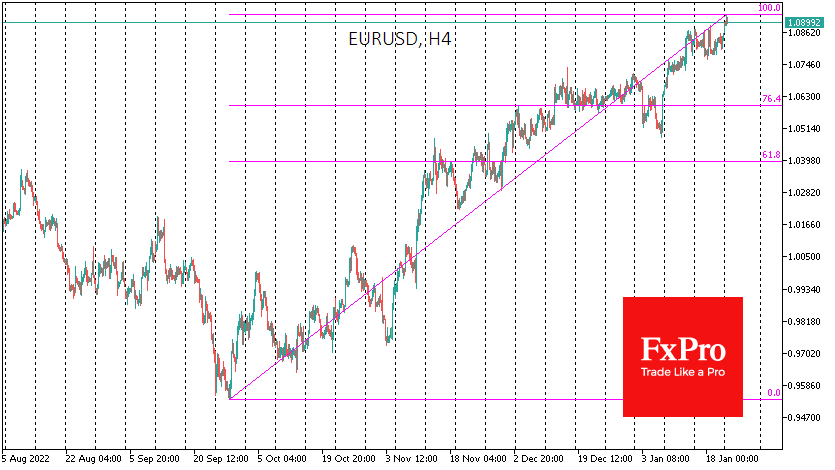

The EURUSD reached 1.09 early Monday, its highest level since April last year. A strong uptrend has been in place for the past four months, during which time the pair has risen from lows just above 0.95 to the current.

January 20, 2023

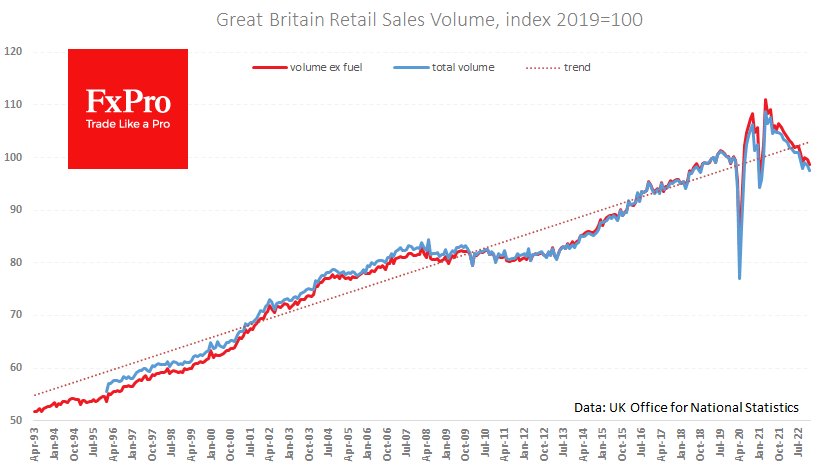

UK retail sales fell by 1% in December, excluding fuel by 1.1%. The data surprised analysts who had, on average, expected an increase of 0.5% last month. Sales were 5.8% lower than in the same month a year earlier, when.

January 20, 2023

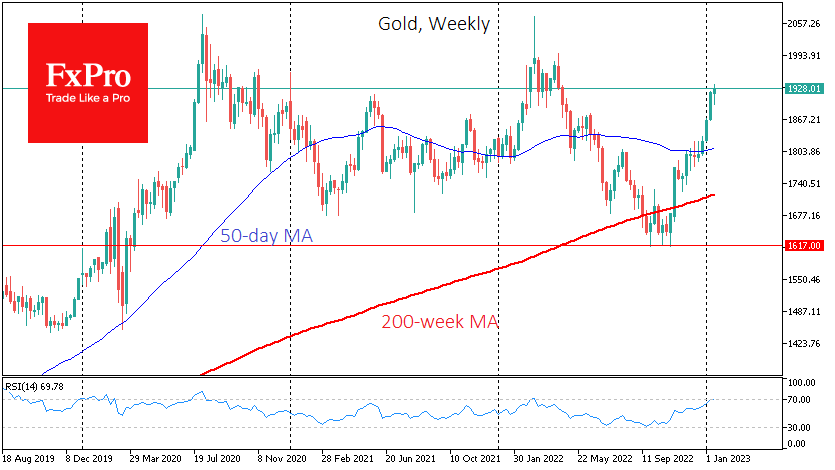

Gold has made an impressive rally in the last 11 weeks, adding 19.9% to its lows at the start of November and hitting highs since last April at $1937 this morning. While maintaining a bullish outlook on gold, we focus.

January 19, 2023

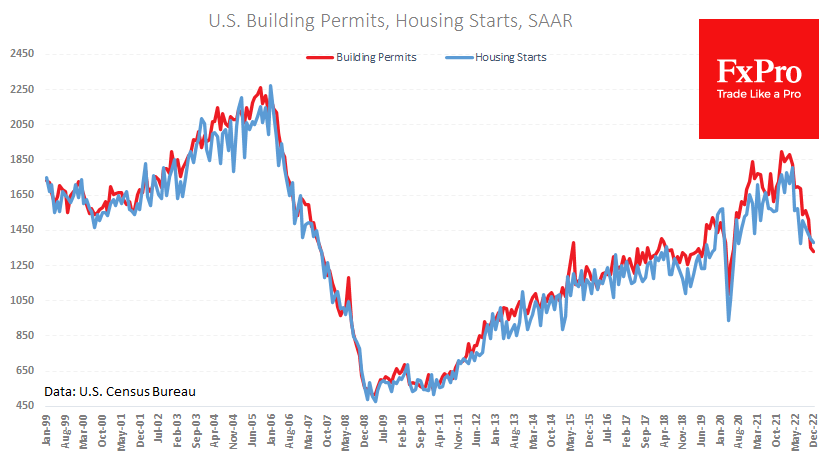

The number of building permits issued in the USA fell by 1.6% in December to 1,330k, the lowest number since May 2020. From the peak in March last year, the decline was 30%. The number of housings starts in December.