Market Overview - Page 81

February 23, 2023

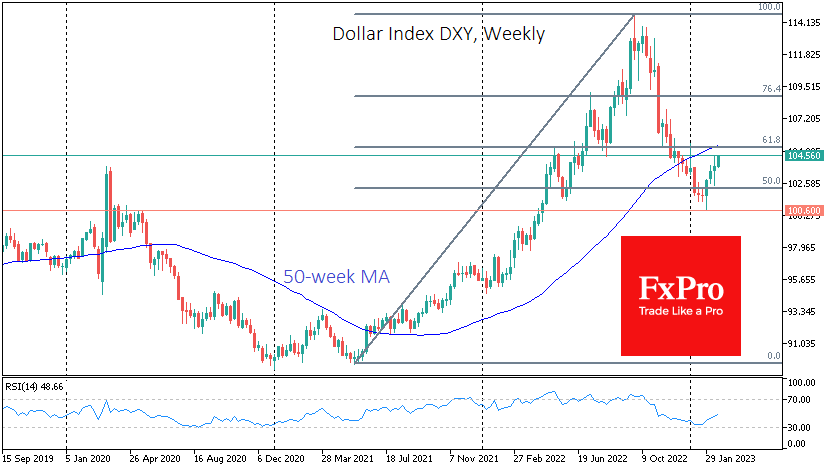

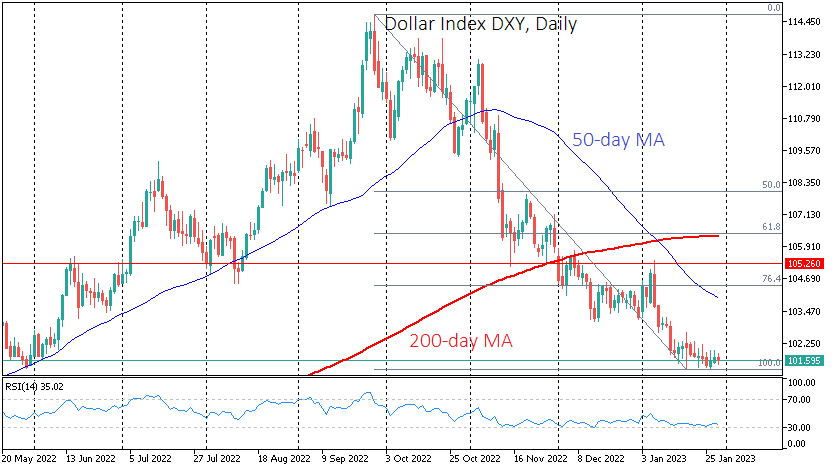

The Dollar Index has risen 3.8% to 104.5 from its lows in early February. Prior to that, the dollar index had been falling since late September, giving back half of the gains from the global rally triggered by the Fed’s.

February 22, 2023

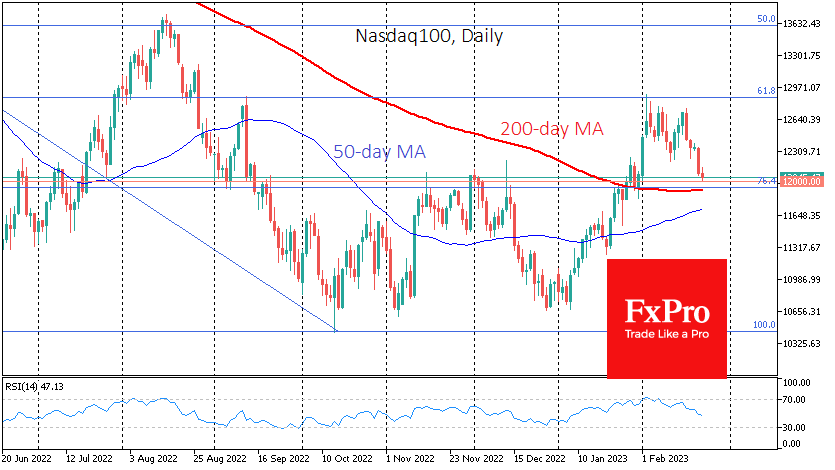

After losing more than 2.4% on Tuesday, the Nasdaq100 index has returned to the level from which it began February, near 12000. Apart from the nice round level, the 200-day moving average and local resistance from November and December are.

February 22, 2023

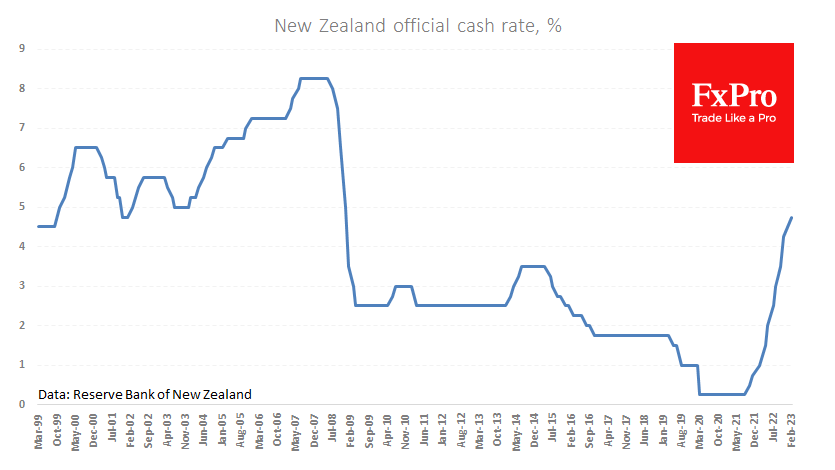

The Reserve Bank of New Zealand hiked its cash rate by 50 points to 4.75% early in the day. The rate has been raised by 425 points over the last ten meetings since October 2021, the sharpest uninterrupted hike in.

February 21, 2023

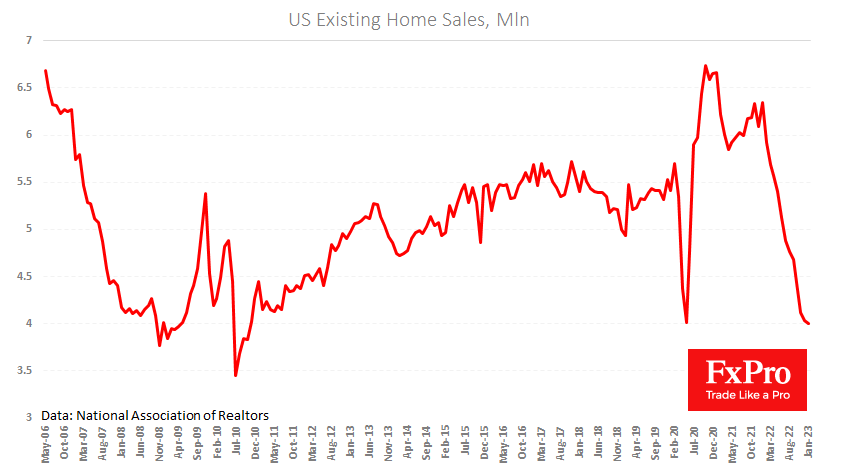

US existing home sales fell by 0.7% to 4.0 million in January. Although this is a nominal decline, it was the 12th consecutive month of falling sales. Sales fell below the pandemic low and were the lowest since October 2010,.

February 21, 2023

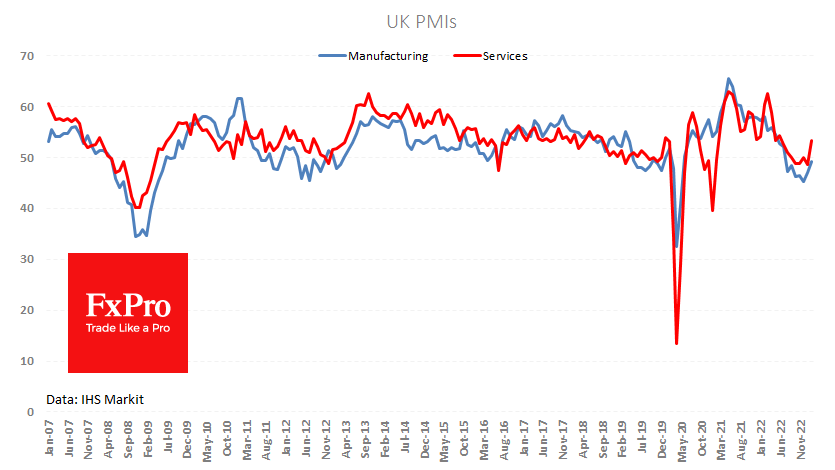

Preliminary UK business activity figures for February surprised on the upside, sending the Pound into a mini rally of 1% within half an hour of publication and supporting prices later in the day. The Manufacturing Business Activity Index climbed from.

February 21, 2023

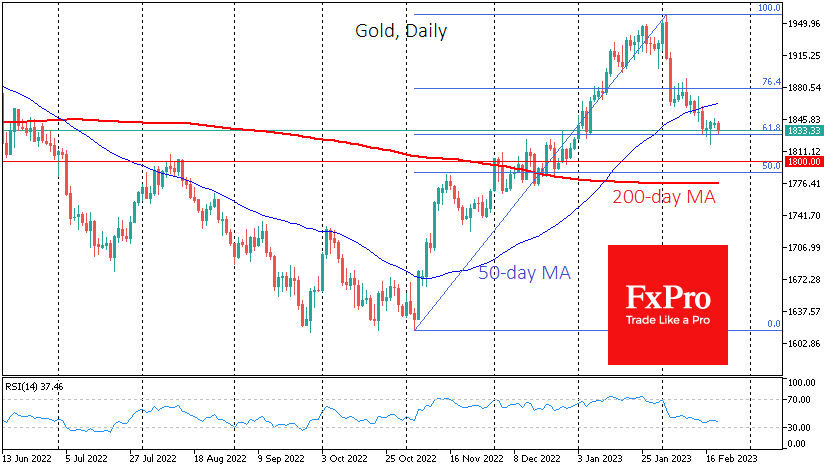

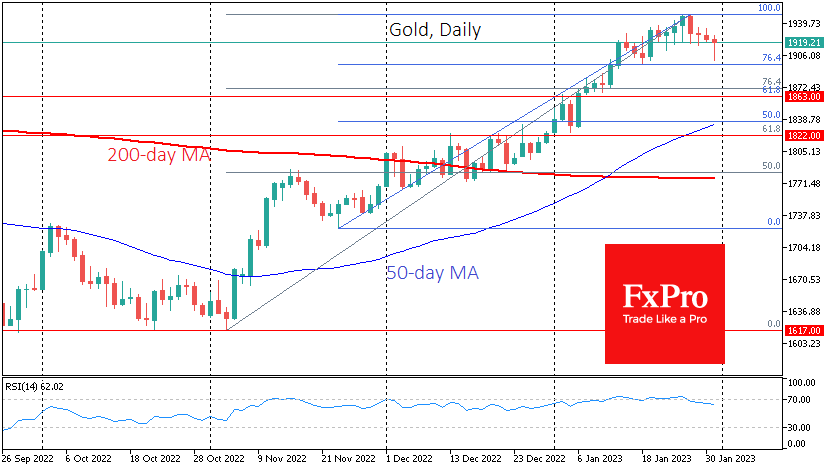

Gold has lost more than 6.5% from its early February highs, correcting the November-January rally. Now it’s time to decide on the next trend. The coming days should show whether we will see a new wave of growth in gold.

February 21, 2023

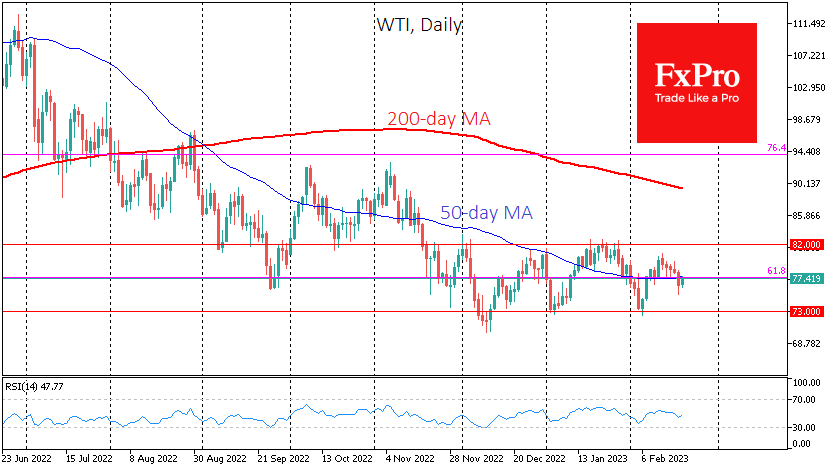

For the third month, oil has barely moved out of its wide range of $73-82 for WTI barrel and $78-88 for Brent. This is not a balance and equilibrium of supply and demand forces but a tug of war. This.

February 16, 2023

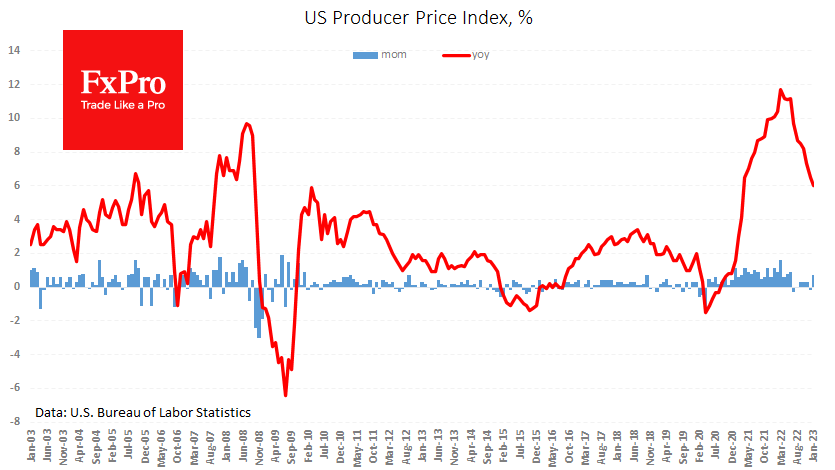

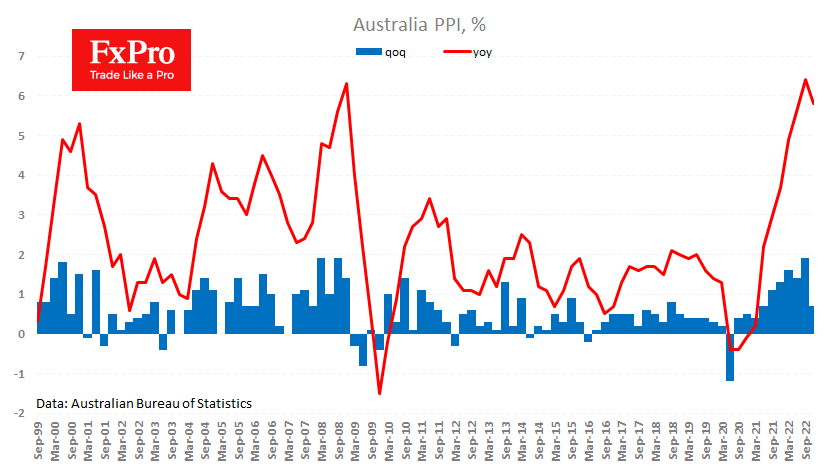

After consumer prices, US producer prices delivered another hawkish surprise. PPI rose by 0.7% in January, impressively stronger than the expected +0.4%. The annual price growth rate slowed from 6.5% to 6.0%, against expectations of 5.4%. It is worth disregarding.

February 16, 2023

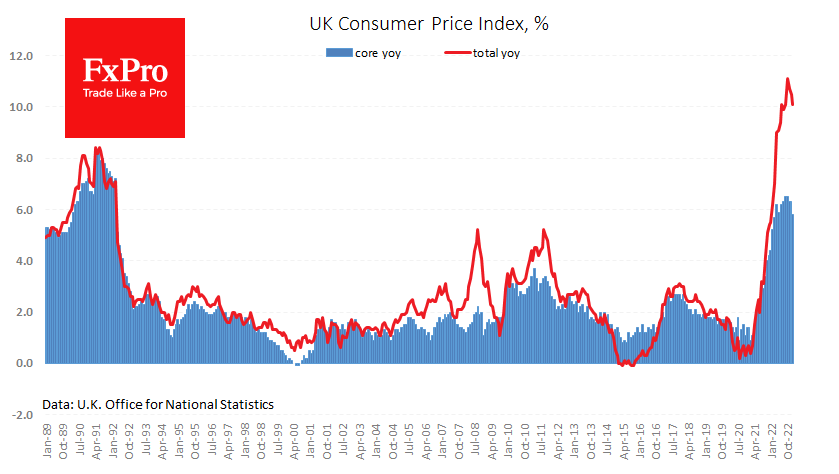

The UK’s rate of consumer price inflation remains one of the fastest in the developed world, although January’s figures were softer than expected. CPI fell by 0.6% last month, against expectations of a 0.4% drop. Annual inflation slowed from 10.5%.

January 31, 2023

Gold is declining for the fourth consecutive session, flirting with the $1900 level and $49 below last Thursday’s peak. Gold’s 2.5% retreat is much more pronounced than the dollar index’s 1% growth over the same period. The current reversal to.

January 30, 2023

This week has all the makings of being vital for the coming weeks and months, with the most important publications for the market in focus. The week’s main event will undoubtedly be the Fed’s interest rate decision. More specifically, the.