Market Overview - Page 72

June 16, 2023

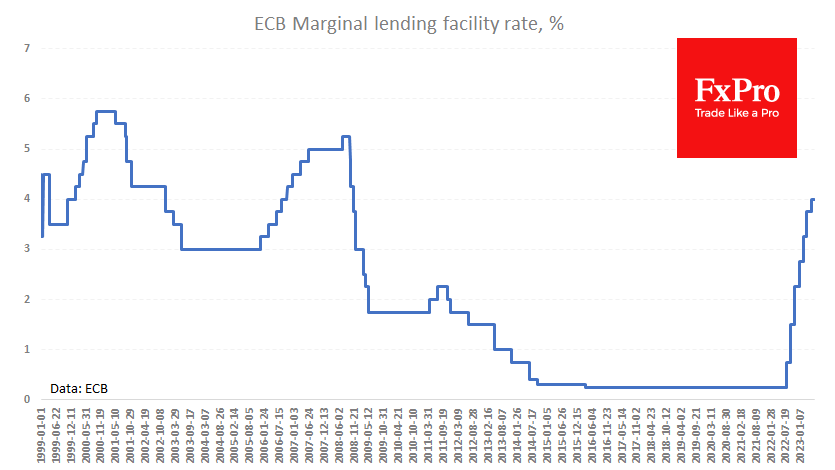

On Thursday, the ECB raised three key interest rates by 25 basis points, taking the benchmark lending rate to 4%, the highest since 2008. It also confirmed its intention to refuse to refinance coupons and maturing bonds, accelerating quantitative easing.

June 15, 2023

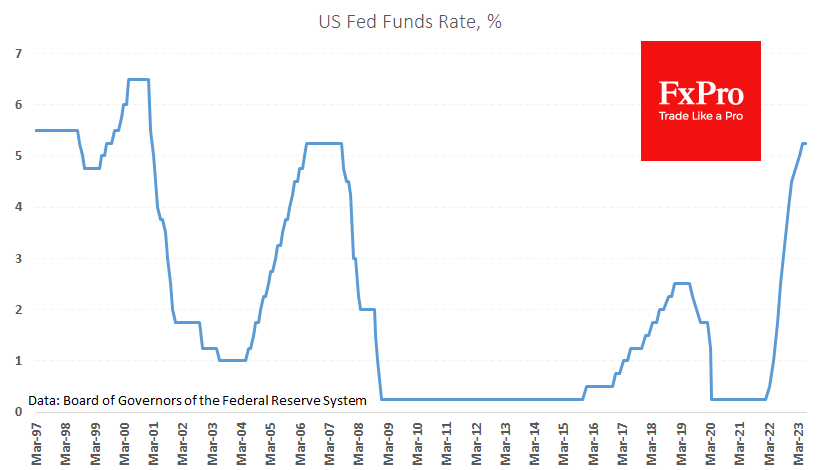

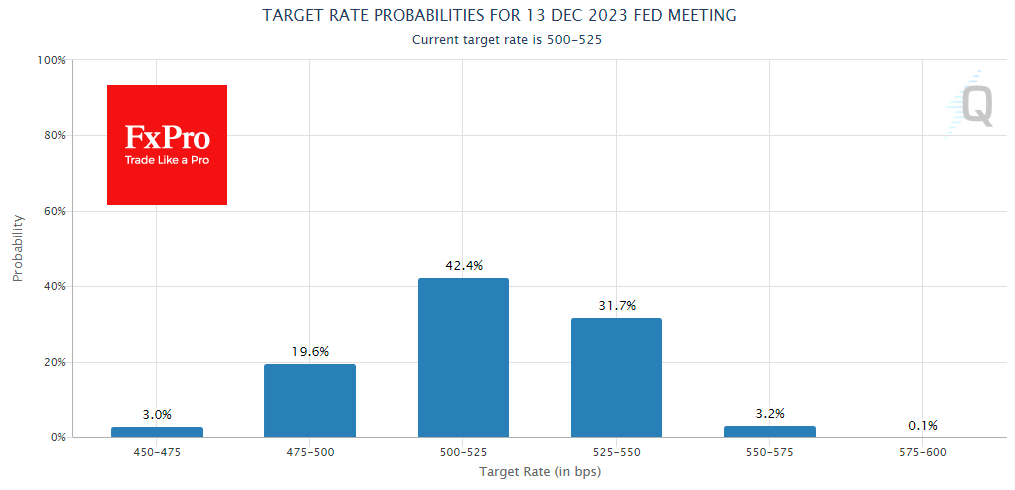

The Fed has paused its policy tightening while projecting two more rate hikes this year and no policy easing in the near future. This is more hawkish than the market expected, which anticipated a hike in July and a possible.

June 14, 2023

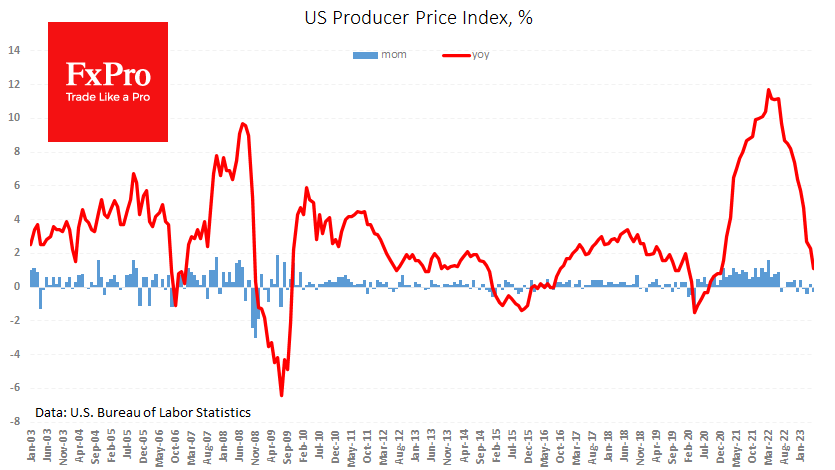

US producer prices fell stronger than expected, potentially reinforcing the dovish argument at the Fed. For May, PPI declined by 0.3% m/m, more than the expected 0.1%, and the index gained a modest 1.1% y/y after 2.3% a month earlier..

June 14, 2023

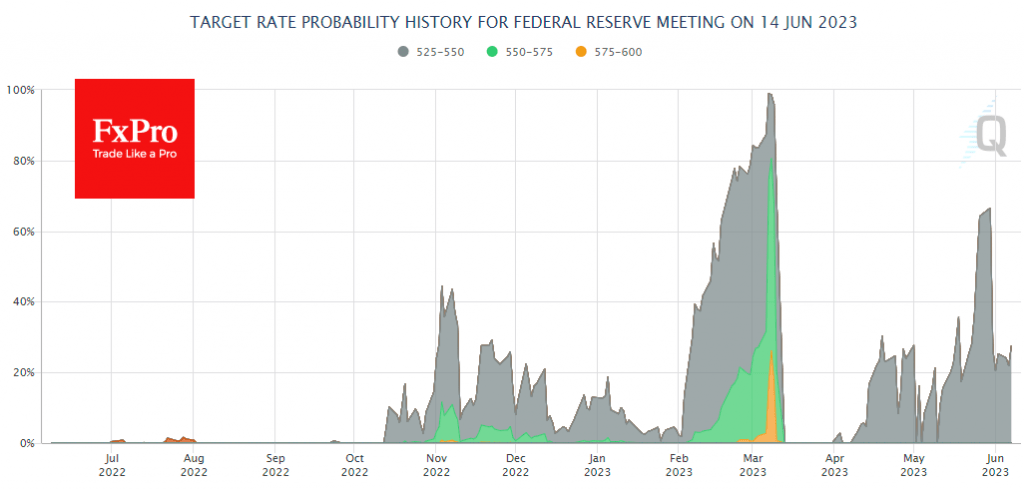

The Fed’s rate decision is the most anticipated event of the day and possibly the coming weeks. As usual, the markets have a strong consensus on what the central bank will do in the short term, but they are more.

June 13, 2023

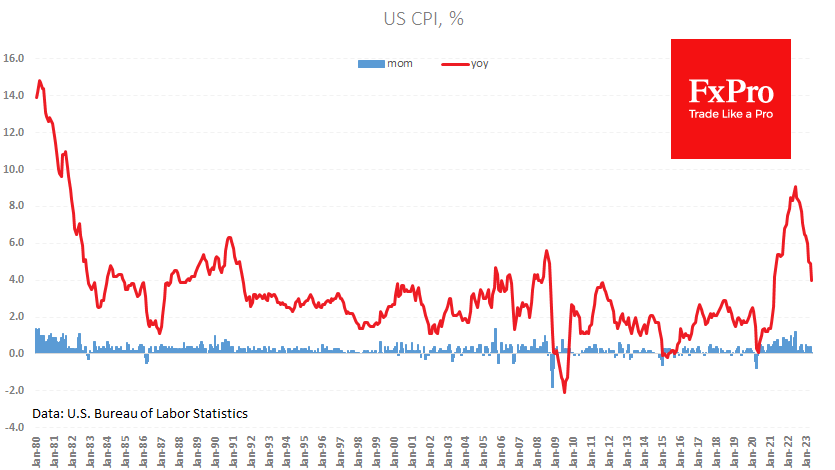

US consumer inflation slowed to 4.0% y/y in May from 4.9% y/y. The monthly gain was 0.1%. In both cases, the data was 0.1 percentage point weaker than expected, marking a slightly faster decline in the inflation problem than expected..

June 13, 2023

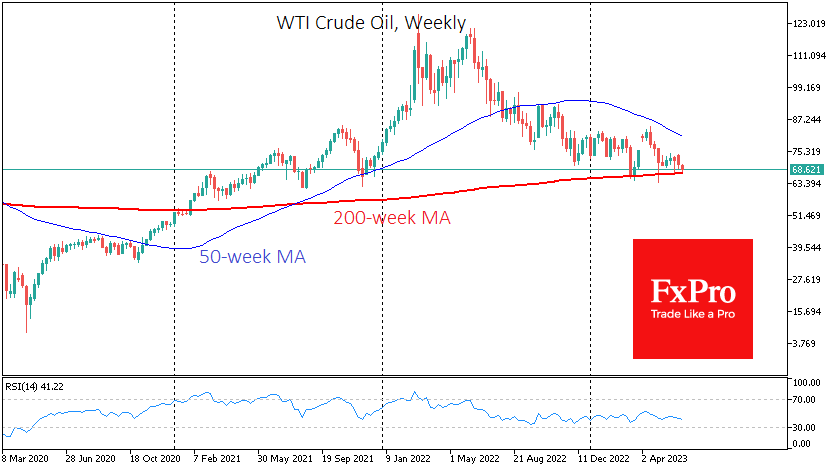

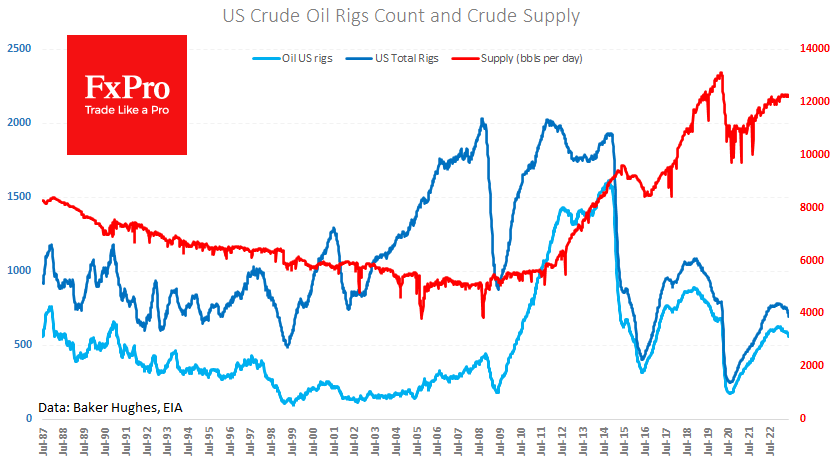

Oil lost more than 4% since the start of Monday, retesting the lower end of its range for the last three months. WTI briefly traded below $67.0 and Brent below $72. On Tuesday, oil is enjoying buying at the lower.

June 9, 2023

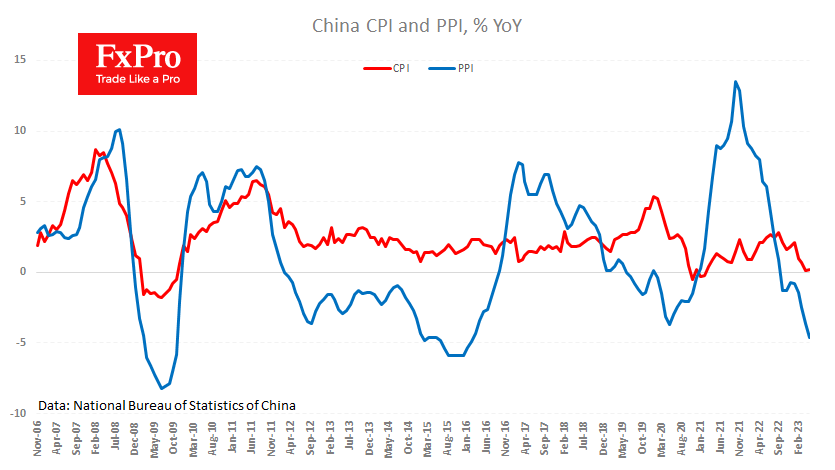

Inflation in China remains worryingly weak, official producer and consumer price data for May confirmed today. The CPI was up 0.2% y/y last month, only slightly increased from the 0.1% y/y pace in April. The producer price index shows that.

June 9, 2023

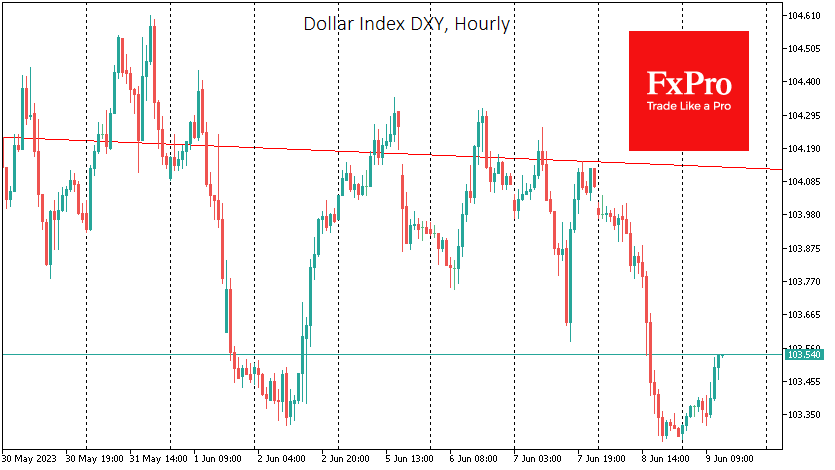

The dollar index lost about 0.7% on Thursday, briefly bouncing back under 103.3. The dollar’s rise against a basket of major currencies stalled late last month and has been trending lower since early June. A situation has developed in which.

June 8, 2023

The US indices had a strong but sharp divergence on Wednesday, a rare event to see. The Nasdaq100 index lost 1.75% on Wednesday, pulling back close to 14300 and almost wiping out the gains made since the beginning of the.

June 7, 2023

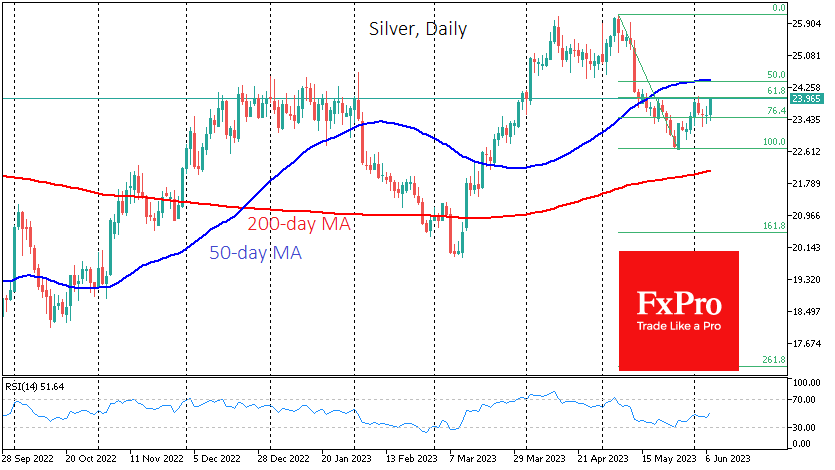

The precious metals market has slowed markedly after a tumultuous February-March and the second half of May. However, Silver continues to show signs of medium-term upside readiness. The May sell-off in Silver, which brought the price down over 13% from.

June 7, 2023

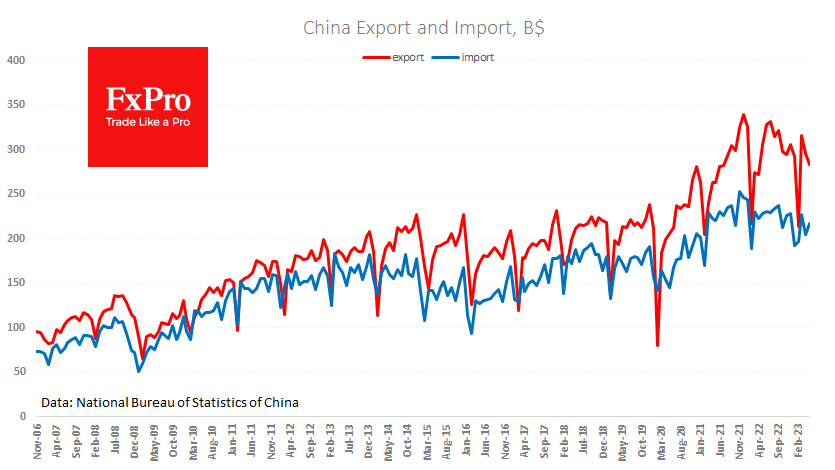

Further signs of a slowdown in China came from the trade balance. The foreign trade data published in the morning was noticeably weaker than expected. Dollar-denominated exports fell by 7.5% YoY despite a more than 4.5% weakening of the Chinese.