A favourable current for the Loonie

September 08, 2023 @ 18:01 +03:00

Better-than-expected Canadian jobs data made the Loonie seem stronger than the Greenback for a while, and it made another attempt to get back below 1.36 for USDCAD.

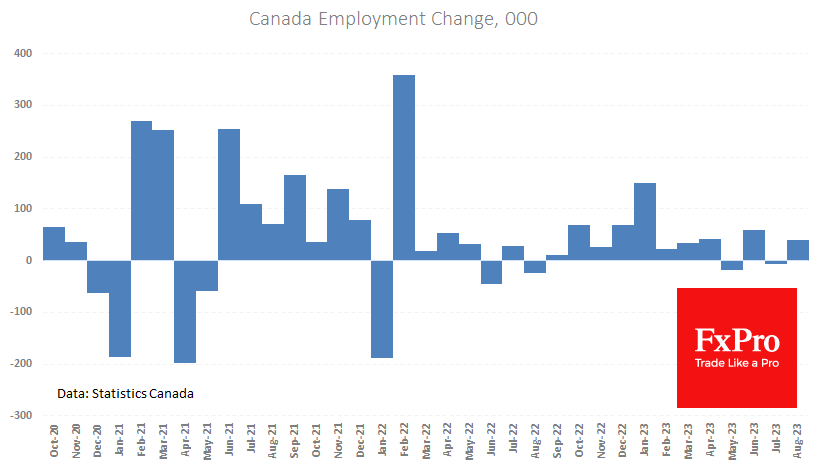

Payrolls rose by 39.9k, double the expected 19K. On a more positive note, 32.2K of the new jobs were full-time, showing confidence among employers.

The strong labour market underlines the persistence of a breeding ground for inflation. This is the most alarming type, as it is more difficult to cool down than the one provoked by a jump in raw materials. However, the recent rise in oil prices does not make life easier for central bankers.

Earlier in the week, the Bank of Canada also sided with the CAD, noting the risks of a return to inflationary pressures. The BoC made it clear that it is open to further rate hikes.

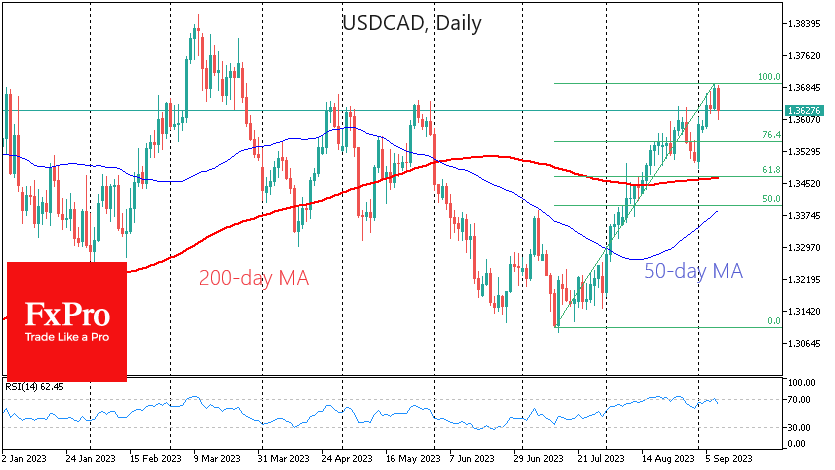

USDCAD mainly traded between 1.362 and 1.3680 for the third consecutive session. This is an impressive feat in the face of a generally strengthening dollar. An attempt to slip lower on the back of upbeat data could further prove the pair’s desire to break away from resistance near 1.36. Technically, the pair is forming a divergence between the price and the RSI on the daily timeframe. In addition, the latter has retreated from the overbought region.

The start of a full-fledged correction in USDCAD from current levels allows us to consider the 1.3570 area as the final correction target. The 200-day moving average and the 61.8% Fibonacci retracement from the pair’s July lows are concentrated here.

The FxPro Analyst Team