Market Overview - Page 71

July 5, 2023

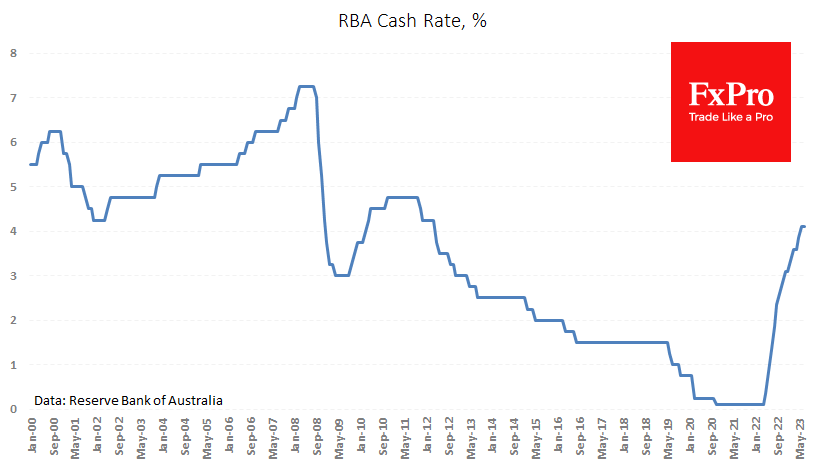

On Tuesday morning, the Reserve Bank of Australia left its key rate at 4.10%, somewhat surprising markets where expectations of a 25-point increase were relatively high. It was a hawkish pause with a warning of its intention to raise the.

July 4, 2023

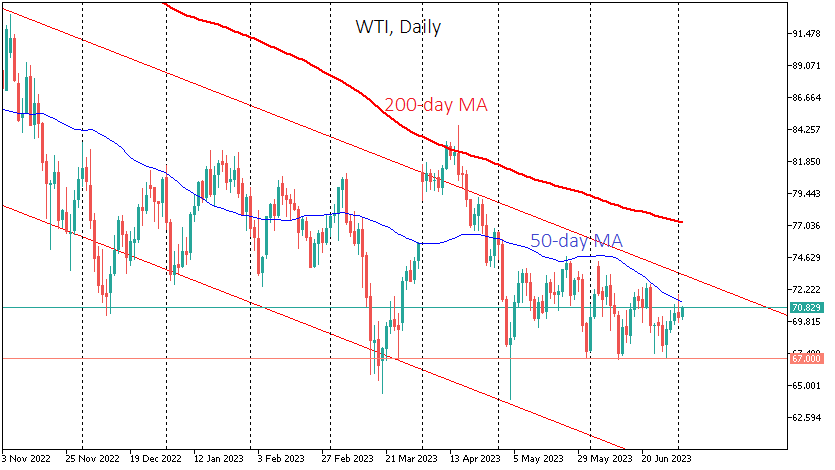

Oil has risen since last Thursday and regained momentum on Monday on news of new production cuts from Russia and Saudi Arabia. Russia announced on Monday that it would cut oil exports by an additional 500K BPD from August, on.

July 3, 2023

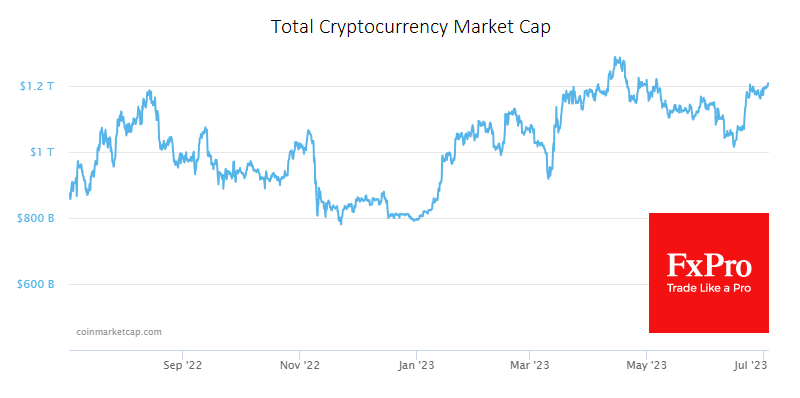

Market picture Bitcoin closed last week at zero, failing to move meaningfully away from the $30K level on good news about spot ETF bids or terrible news about SEC claims against it. As a result, the exchange rate is stomping.

June 28, 2023

US indices rose impressively on Tuesday, with the S&P500 up 1.1%, the Nasdaq100 up 1.75% and the Dow Jones 30 up 0.63%. Meanwhile, the VIX volatility index fell back below 14, and Bitcoin gained over 1.4%, at one point wiping.

June 27, 2023

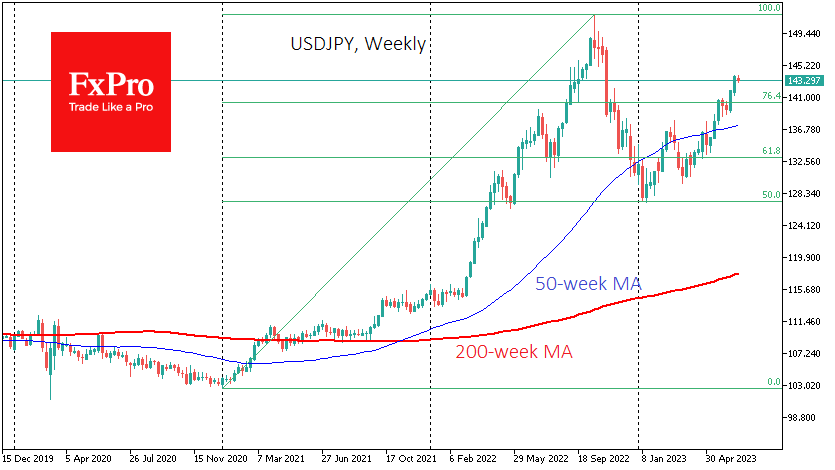

The Yen has been under pressure, losing 3.5% against the Dollar and over 5.6% against the Euro since the beginning of the month. The EURJPY has risen to its highest level since September 2008. The USDJPY is trading above 143.50,.

June 27, 2023

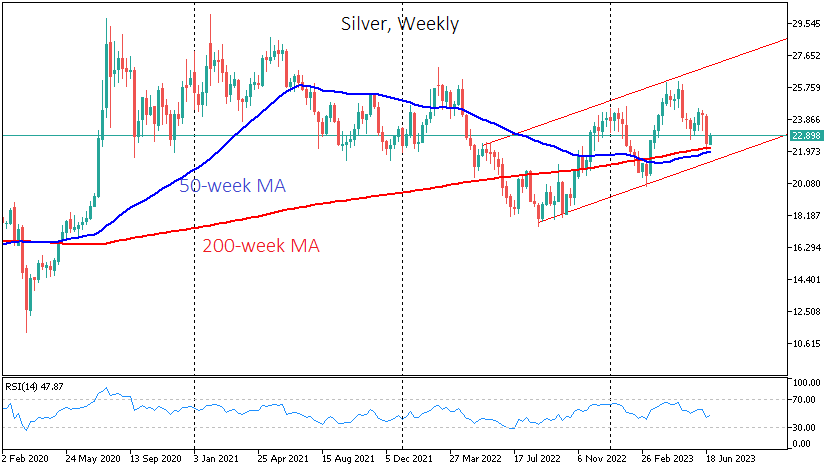

Silver fell sharply last week but has recently shown encouraging signs of recovery. The tactical objectives of silver’s decline appear to have been achieved, and silver is now in demand, reinforcing confidence that the bulls have defended the long-term uptrend. Last.

June 26, 2023

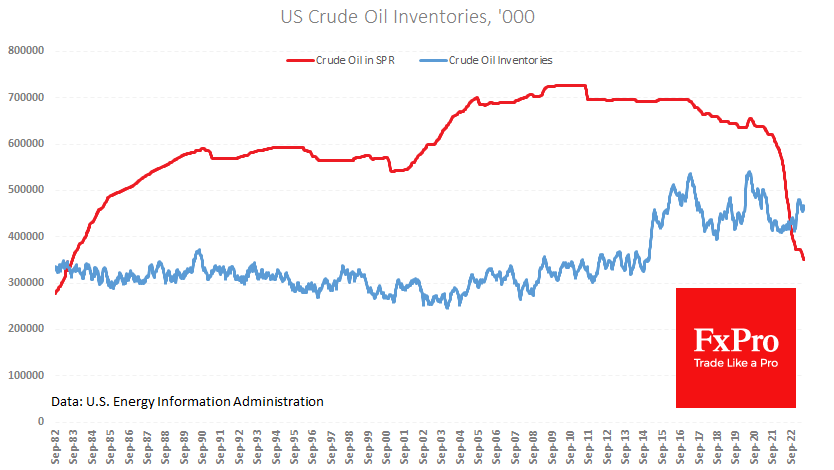

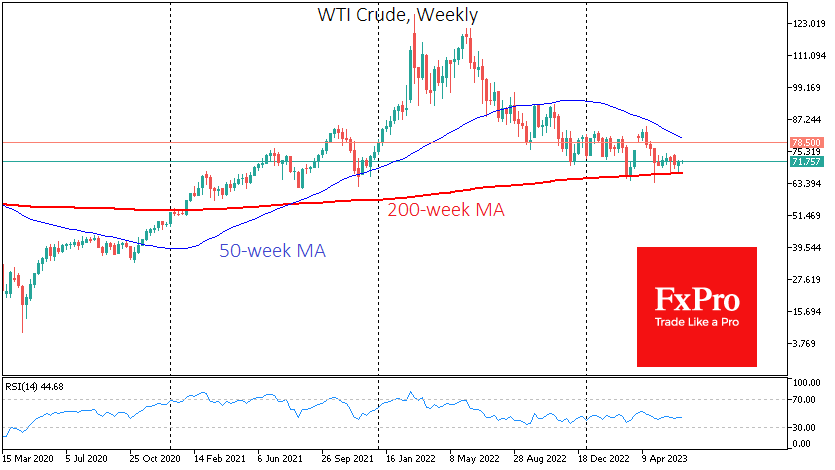

Events in Russia at the end of last week have once again set the stage for a price rebound from the lower end of the range seen in recent months. However, deteriorating global macroeconomic conditions leave us guessing as to.

June 23, 2023

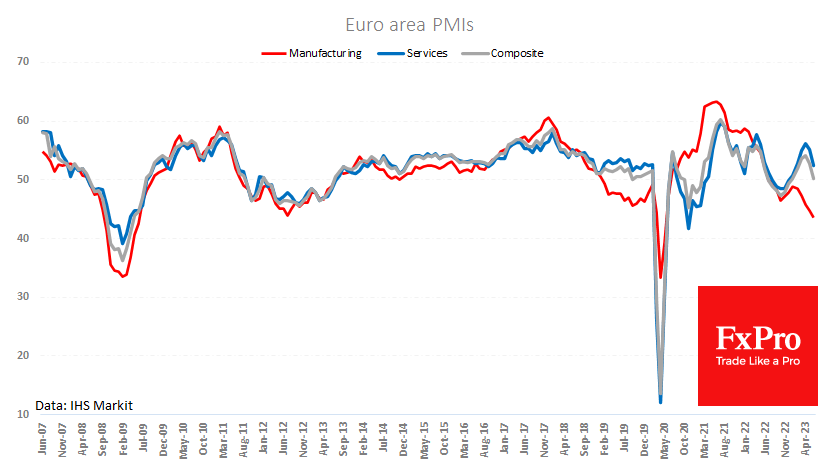

The Euro suffered a setback after the June PMIs revealed a slowdown in economic activity. Analysts were caught off guard by the contraction in French services, which dropped from 52.5 to 48.0 – far below the forecast of 52.2. Manufacturing.

June 22, 2023

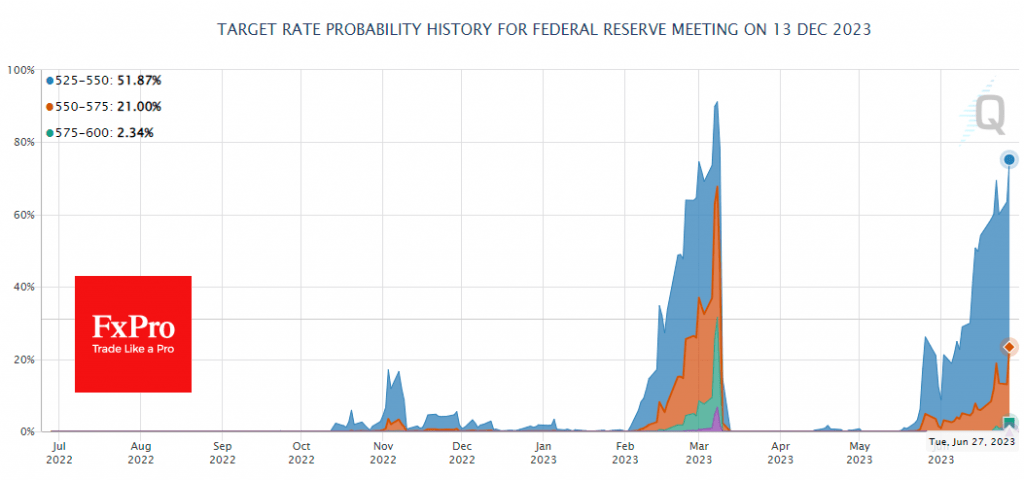

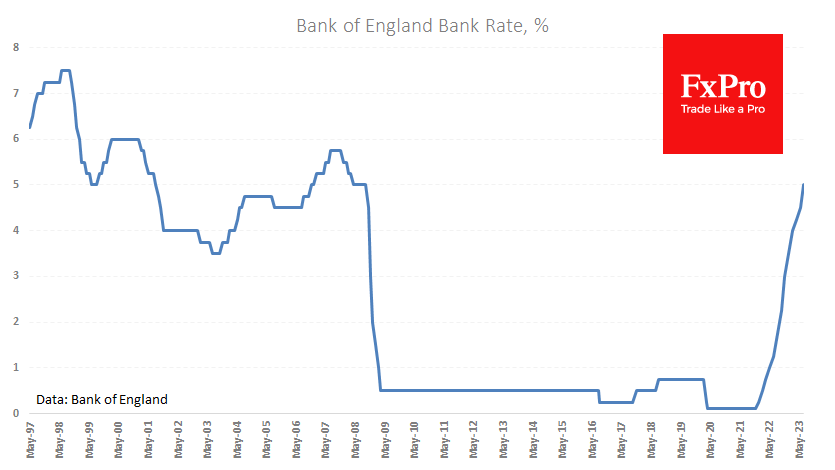

The Bank of England raised its key rate by 50bp to 5.00% – a sharper move than analysts who had made their forecasts earlier in the week had expected. However, it’s a logical move, given that the latest inflation data.

June 21, 2023

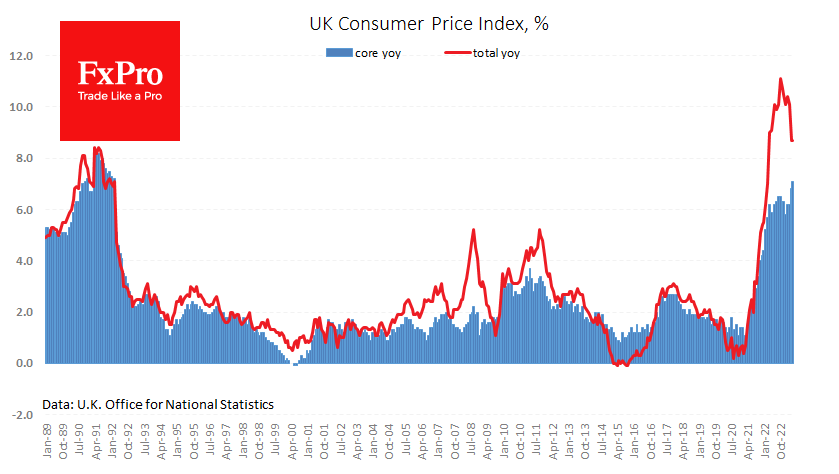

UK consumer inflation is in no hurry to recede. Fresh estimates for May showed prices up by 0.7%, following even stronger rises in the previous three months. Overall, the CPI rose by 4.2% between February and May. Year-over-year price growth.

June 21, 2023

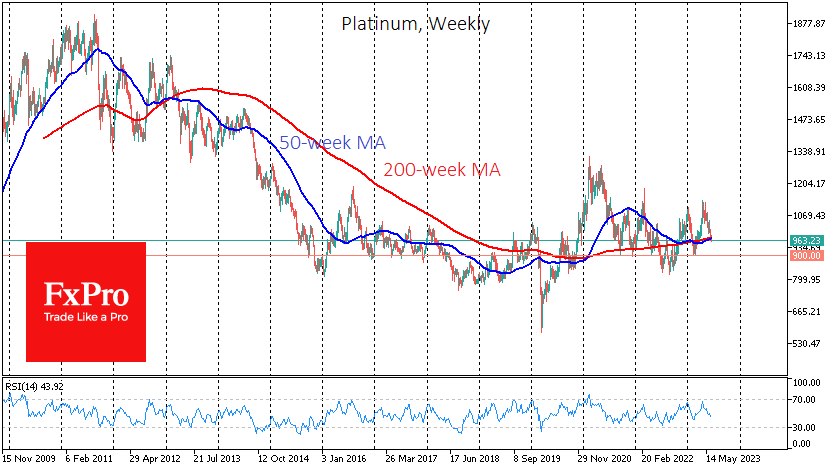

After a very mixed start to June, platinum, silver and gold are moving into a friendly downtrend. However, a technical correction is unlikely to break the long-term bullish trend. Platinum has lost over 3% since the beginning of the month,.