US oil inventories: historic sell-off in SPR and business as usual

September 15, 2022 @ 12:29 +03:00

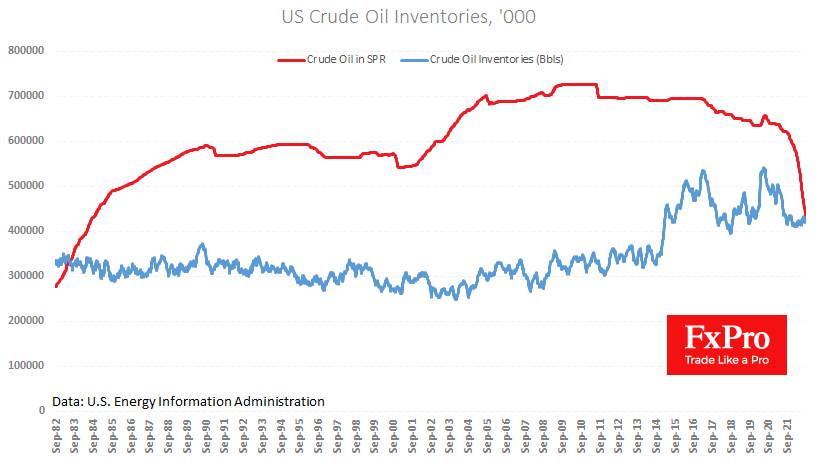

US commercial oil inventories rose by 2.4M barrels last week following an increase of 8.8M earlier. This dynamic fits in with seasonal trends, with inventories starting to fill at some point in September. Around the same time and volume levels, net accumulation was reversed in 2018 and 2019. Note, however, that before 2014 (the shale boom), the fluctuations in stocks were mainly within the 300-360M range. So, here we see some business as usual for commercial producers.

A vital point of the picture is the 30% drop in strategic reserves over the last year, almost equal to commercial reserves.

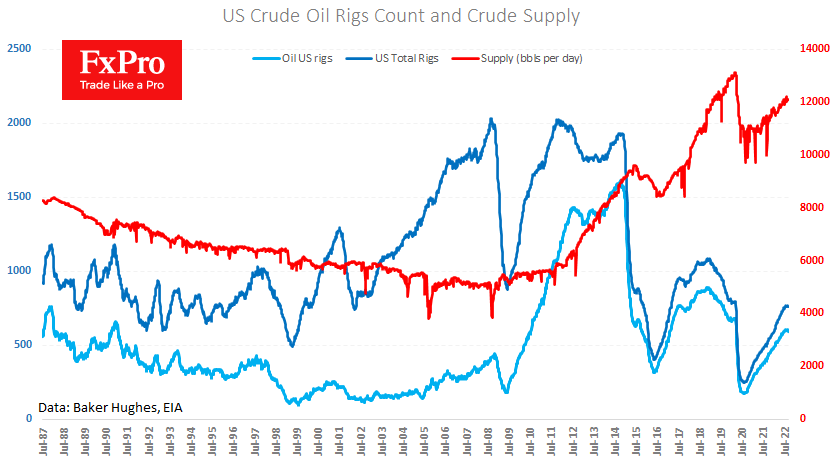

In other words, a net fall in overall inventories could have stimulated a ramp-up in production. But we see a slow increase in volumes compared to the 2011-2015 and 2016-2020 episodes. And there are a couple of significant reasons for this.

First, the sale of oil from reserves aims to bring down the final price, which is not to the producers’ liking and is holding back investment. In the last couple of weeks, the number of working rigs in the US has been falling, clearly showing that businesses are in no hurry to sell oil at a discount from the free market, topping up reserves.

Secondly, production in the Permian Basin – the main shale production region of recent years – is declining. New drilling is going to make up for the exhausted fields. Increased rates and the promise to raise more, combined with rising wages, further hold back the process.

As if that were not enough, US producers said Europe should not expect further supply increases. Perhaps this signals that companies following OPEC have switched from fighting for market share to maximising profits.

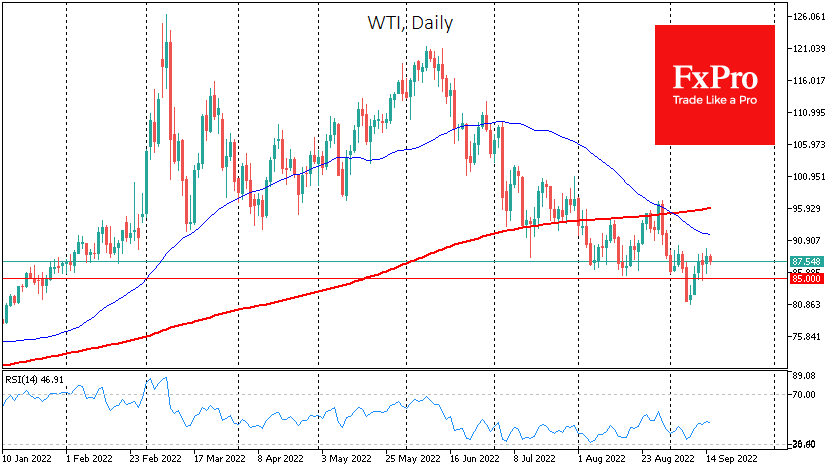

As a result, we see gains in oil and gas prices over the last week against a general decline in financial markets. At the same time, we believe that the US government is unlikely to quickly abandon its oil price restraint policy, postponing the restocking momentum.

Investors and traders should also remember that a decisive policy tightening, by historical standards, puts additional pressure on prices. In our view, the downward momentum in oil prices is not over yet, although local attempts for WTI to exceed $91.50 and for Brent to return to $97 cannot be ruled out.

The FxPro Analyst Team