Market Overview - Page 7

December 3, 2025

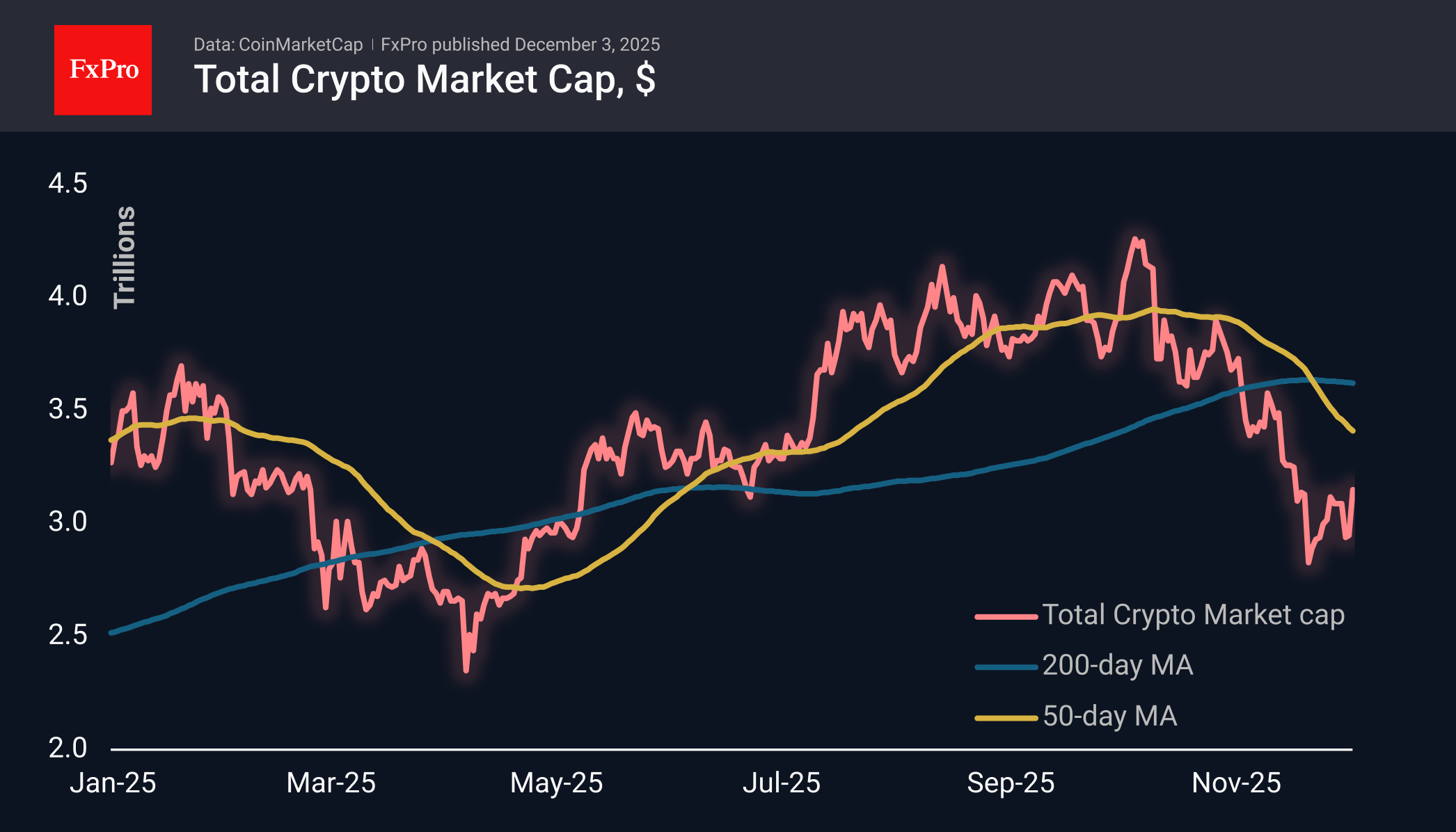

The crypto market rises on institutional moves; Bitcoin rebounds, with uptrend signs emerging. Vanguard, BoA open crypto access for clients.

December 2, 2025

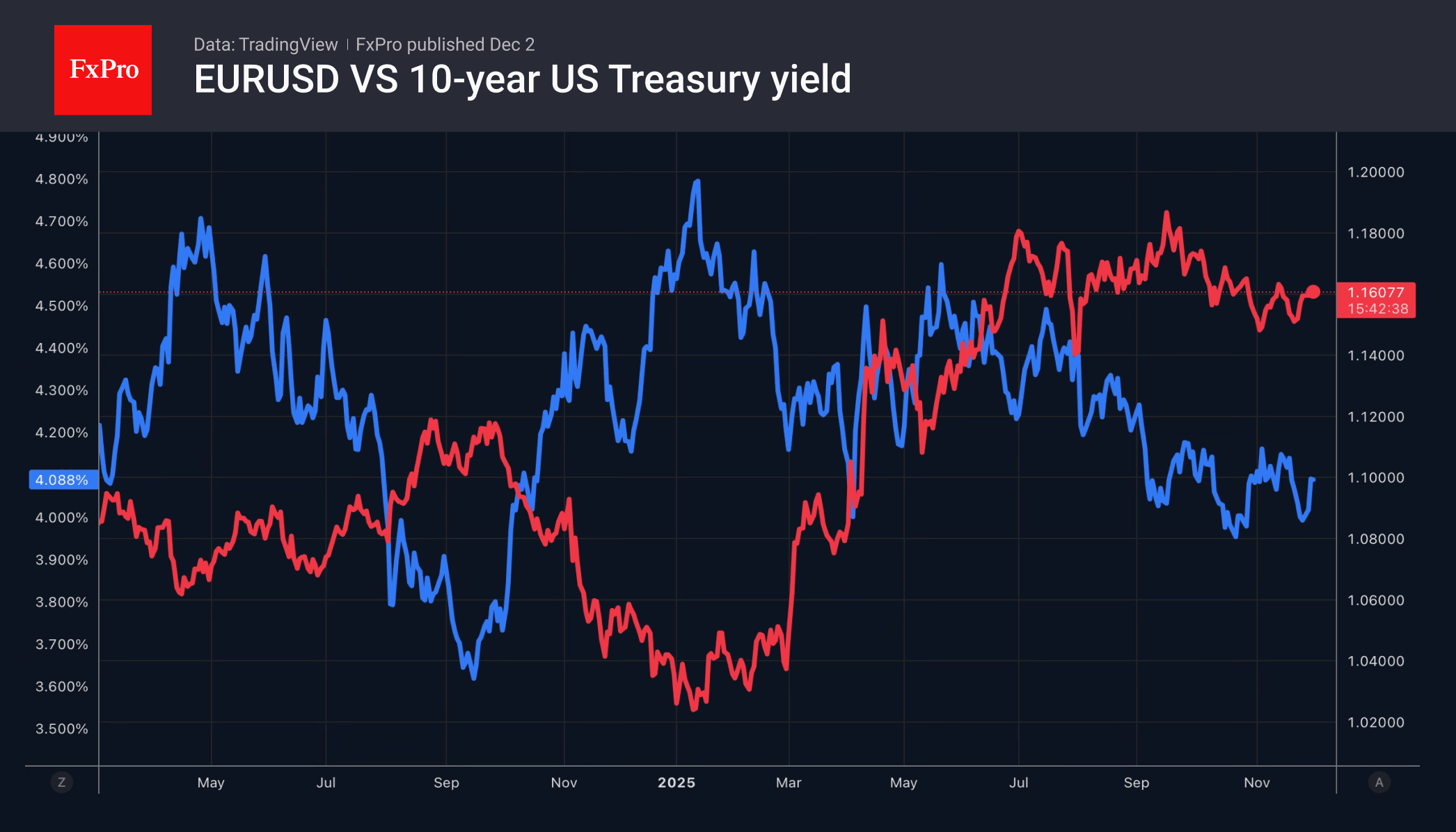

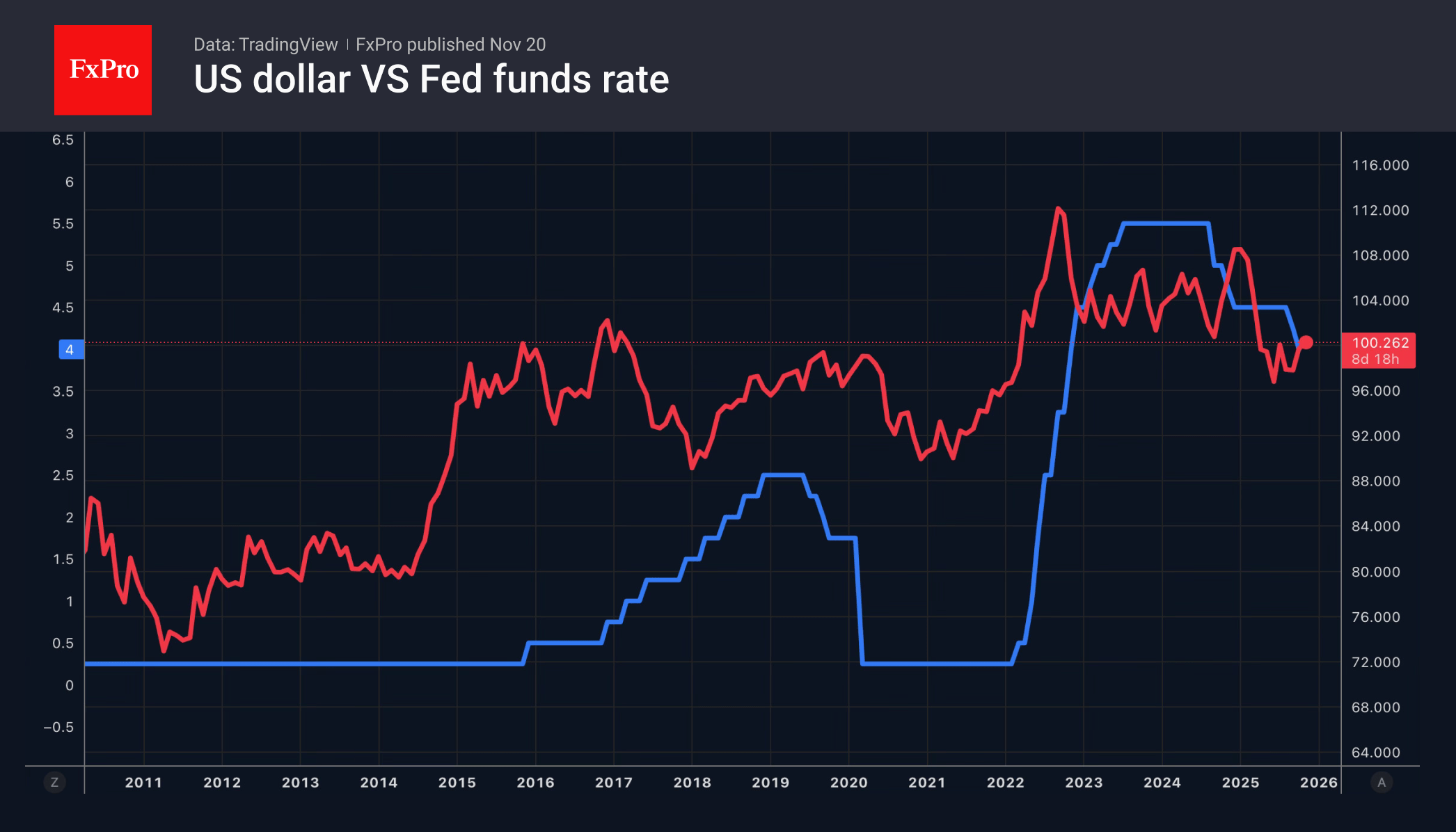

Hassett may become Fed chair as US rate cuts loom. AI boosts US over Europe; BoJ rate hike raises Treasury concerns.

December 2, 2025

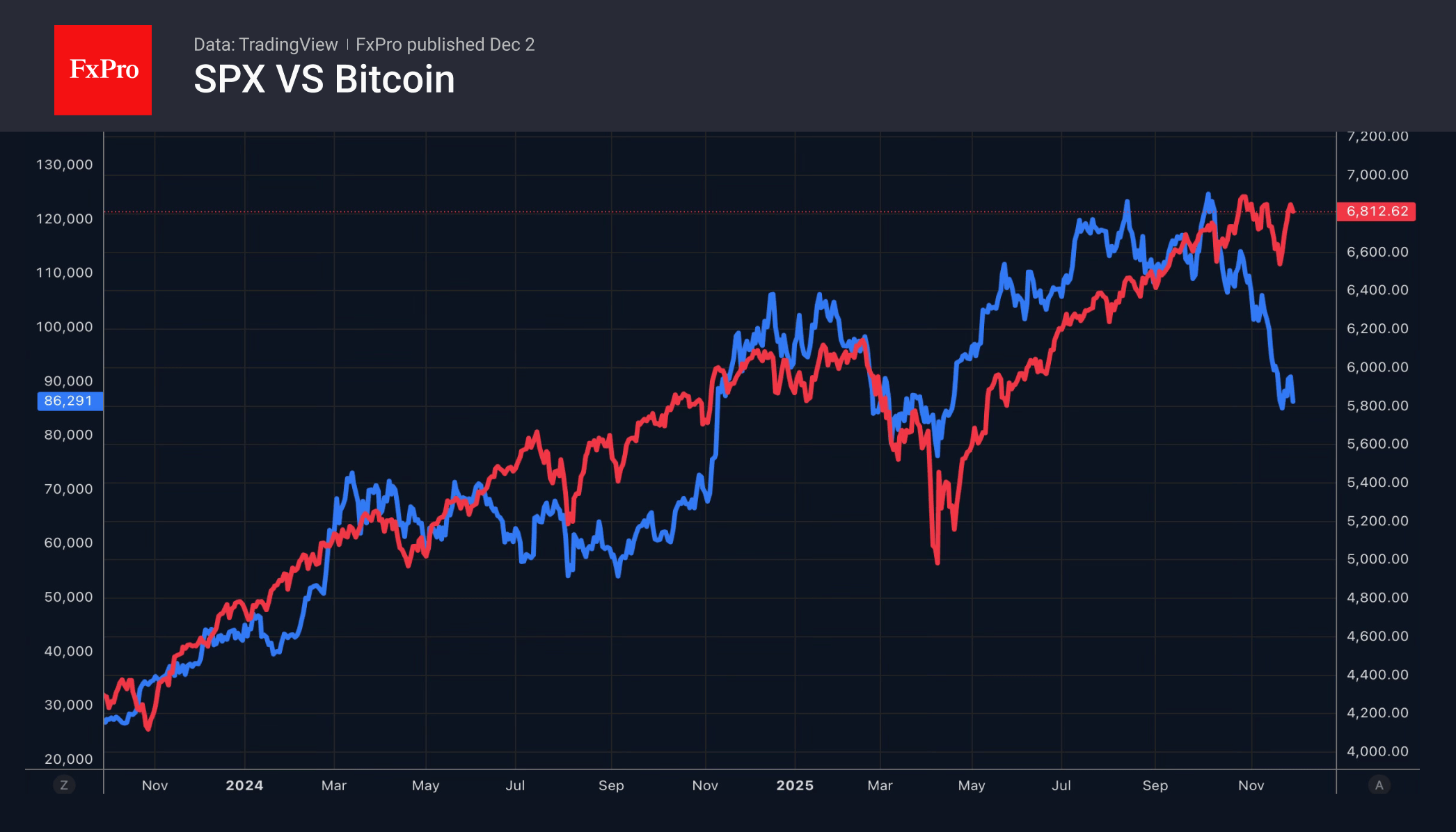

The S&P 500 is gearing up for one of the best months of the year, Christmas rally and a Fed rate cut.

December 1, 2025

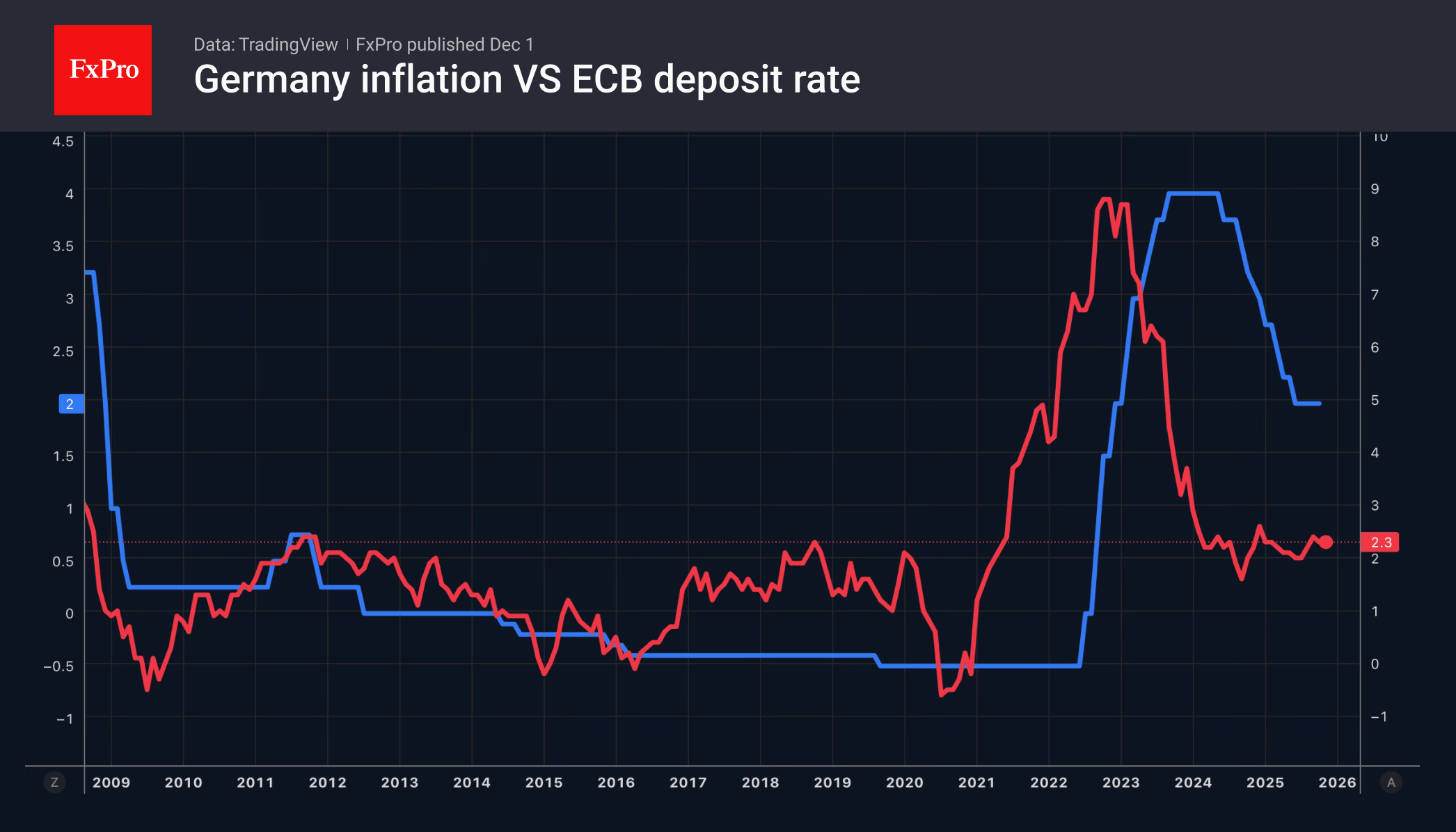

Euro rises on German inflation; yen strengthens as BoJ eyes rate hike; pound faces pressure after UK budget and capital flight.

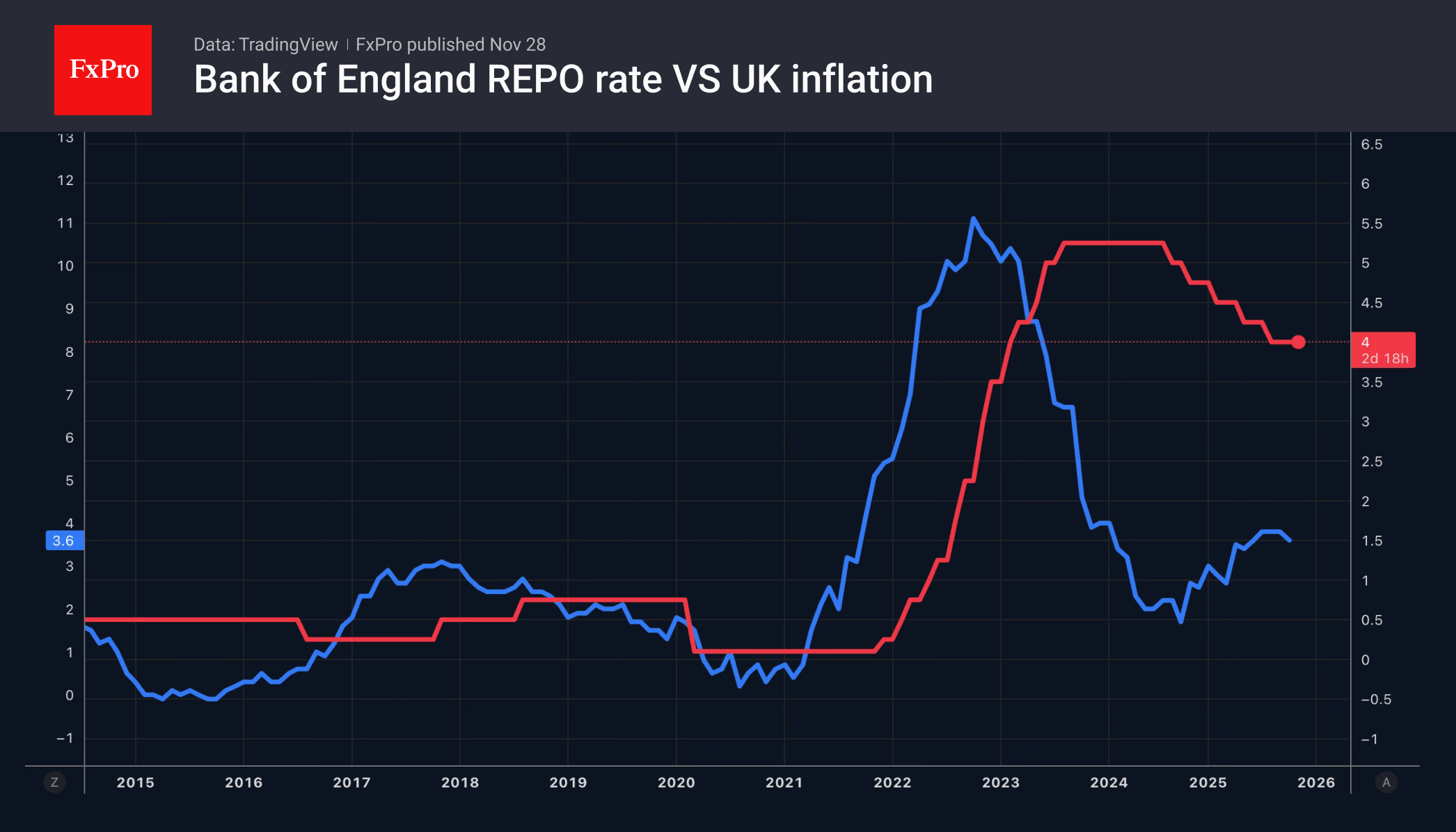

November 28, 2025

Monetary policy divergence is set to favour the yen in 2026, while UK fiscal measures and rate cut expectations impact the pound and US dollar.

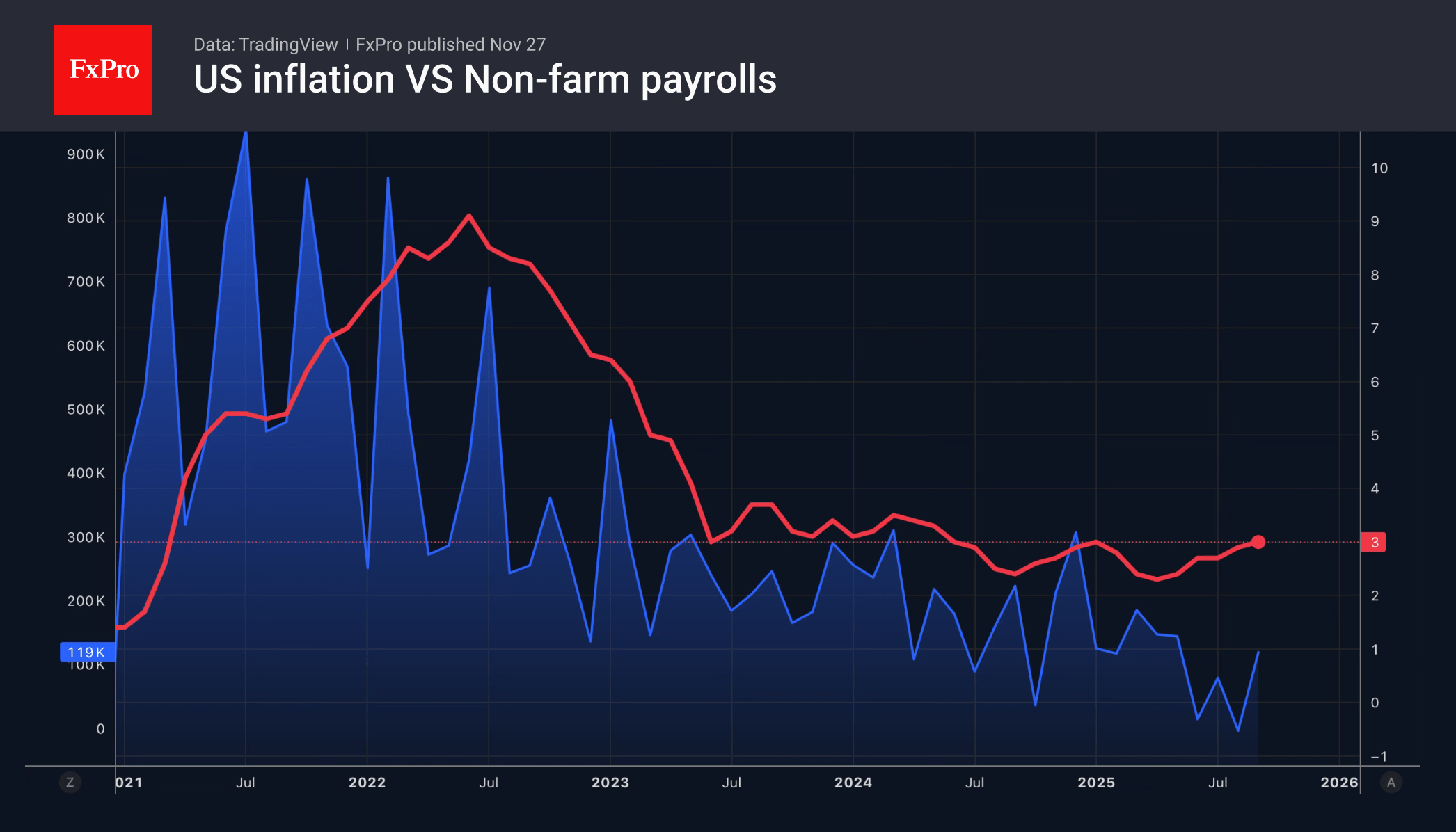

November 27, 2025

The US dollar weakened due to dovish Fed signals and poor data, while rival currencies rose on positive domestic developments.

November 26, 2025

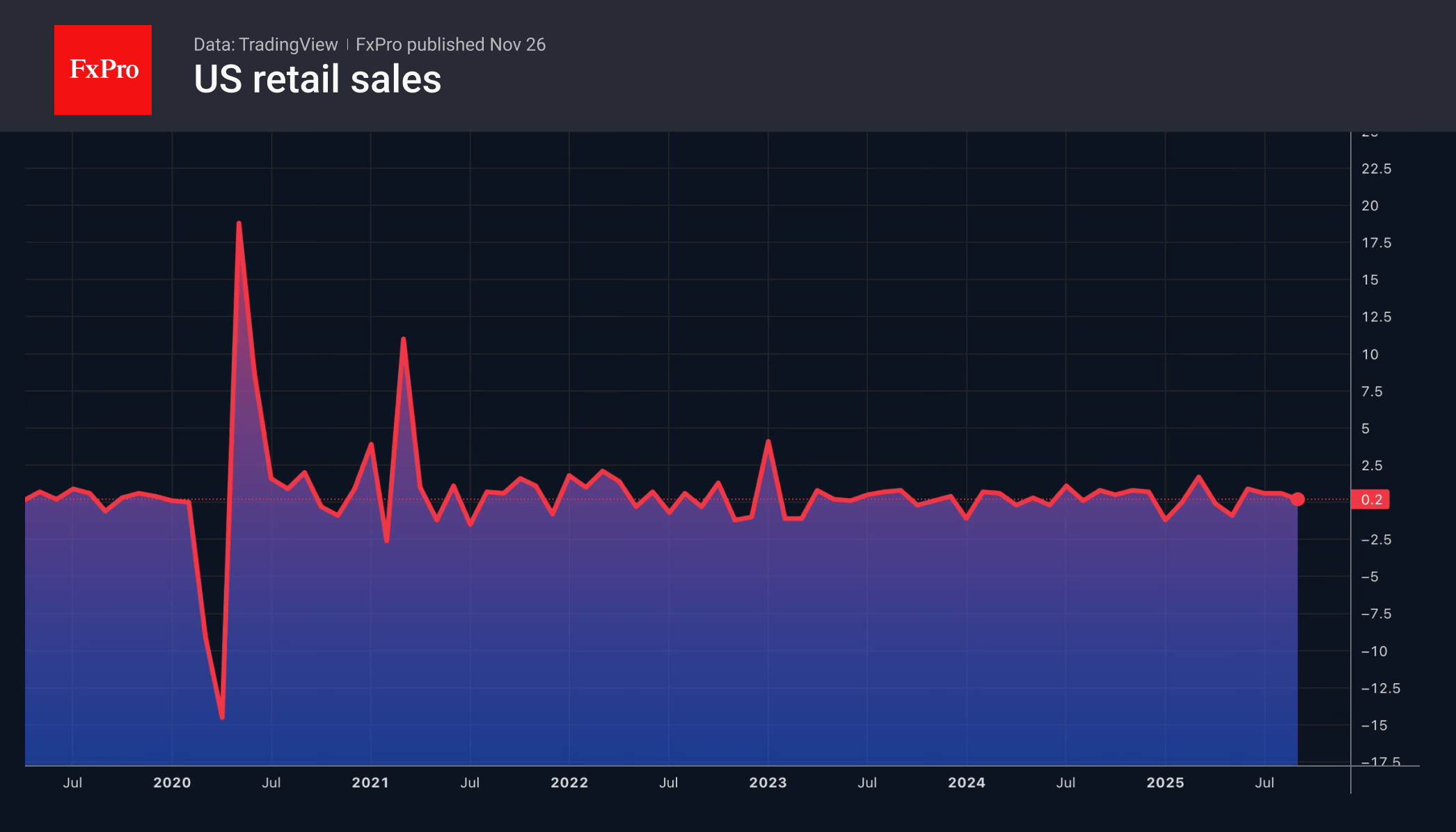

The pound faces volatility ahead of the UK budget, while US economic weakness and rate cut prospects pressure the dollar and boost the euro.

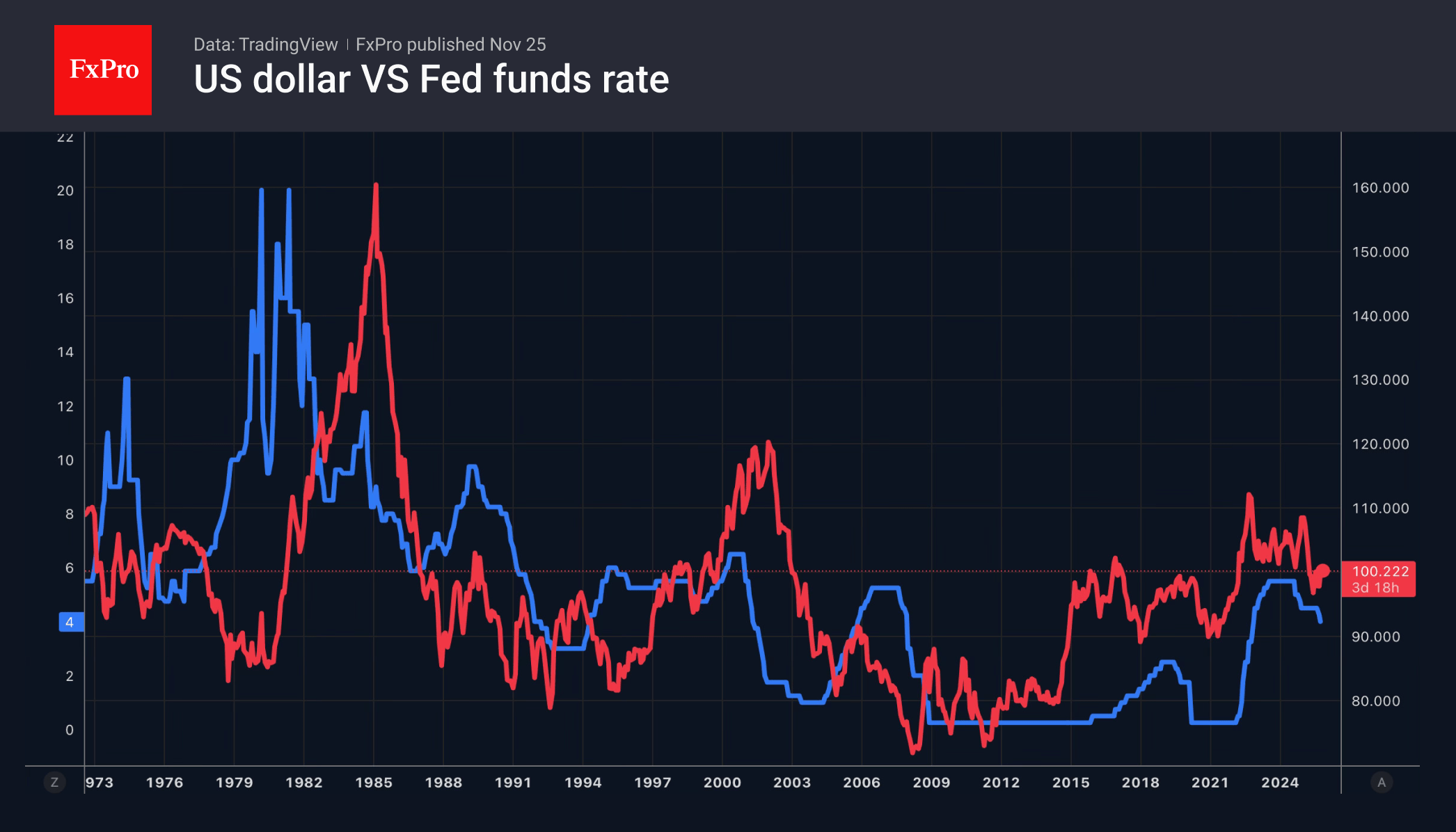

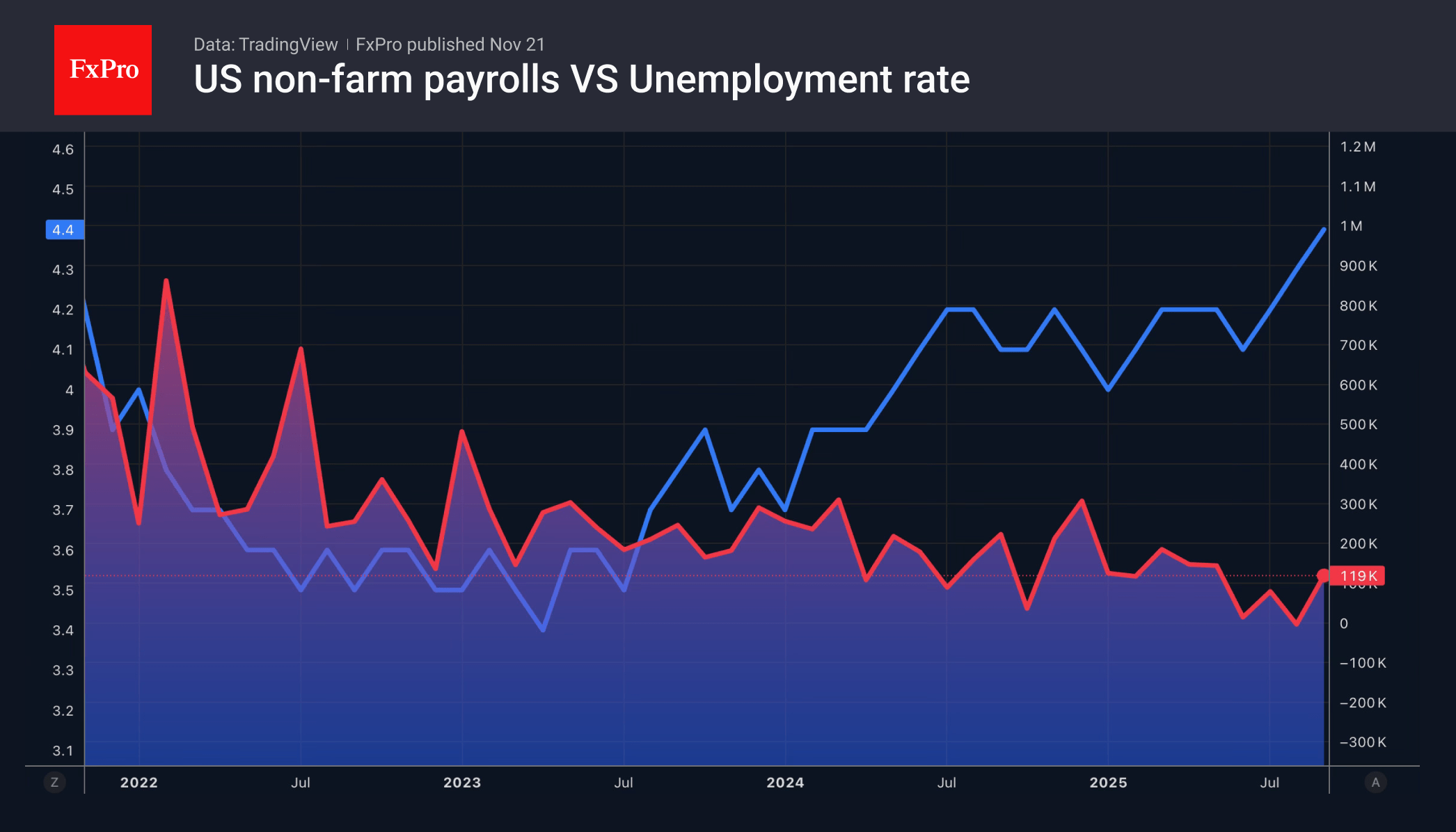

November 25, 2025

The US economy is strong, thanks to spending on AI. The Fed is easing interest rates while tightening forecasts, but the Trump factor has not yet played out.

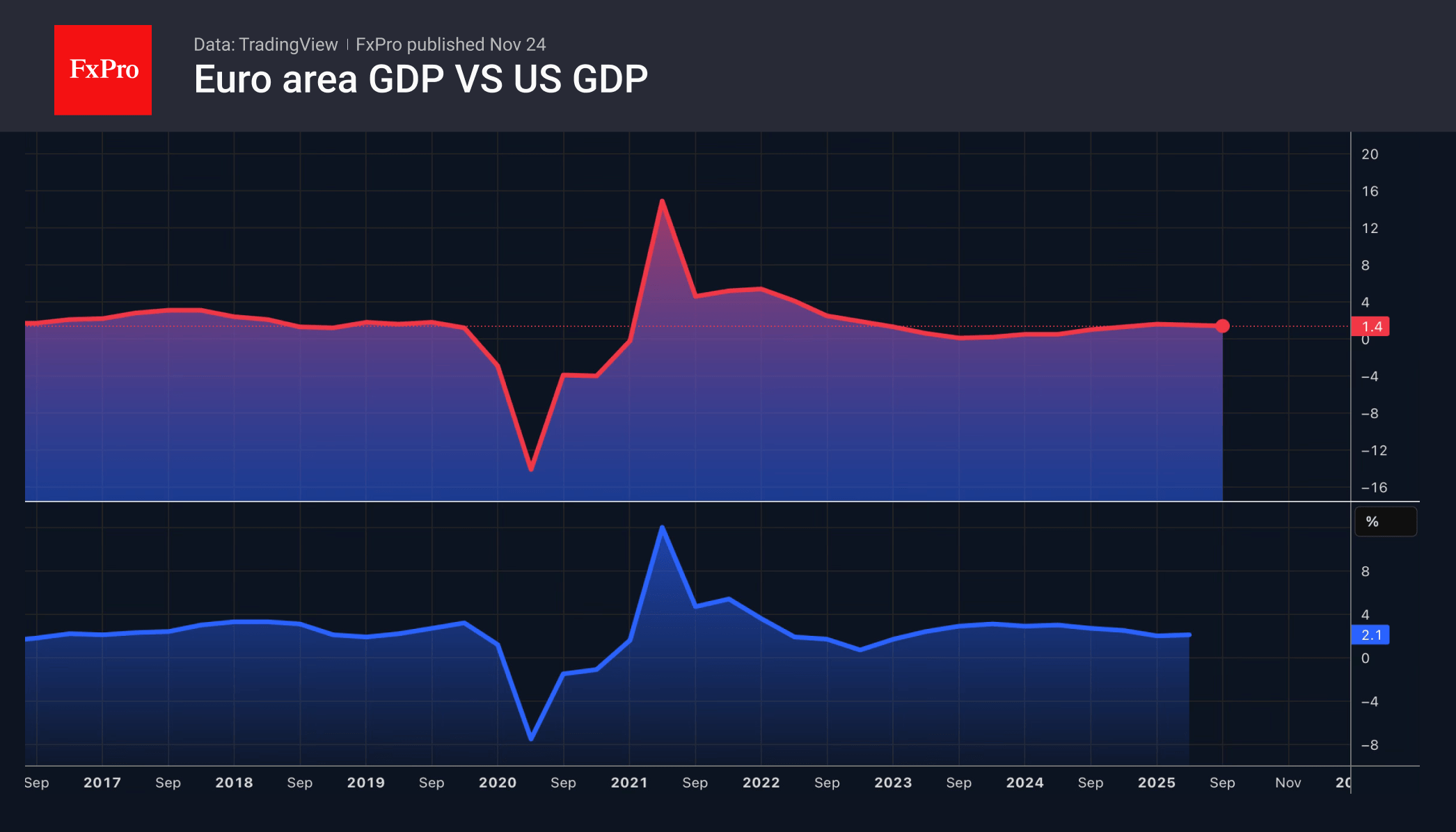

November 24, 2025

Positive developments in Europe support the euro, while uncertainty in the US and prospects for a rate cut weaken the dollar.

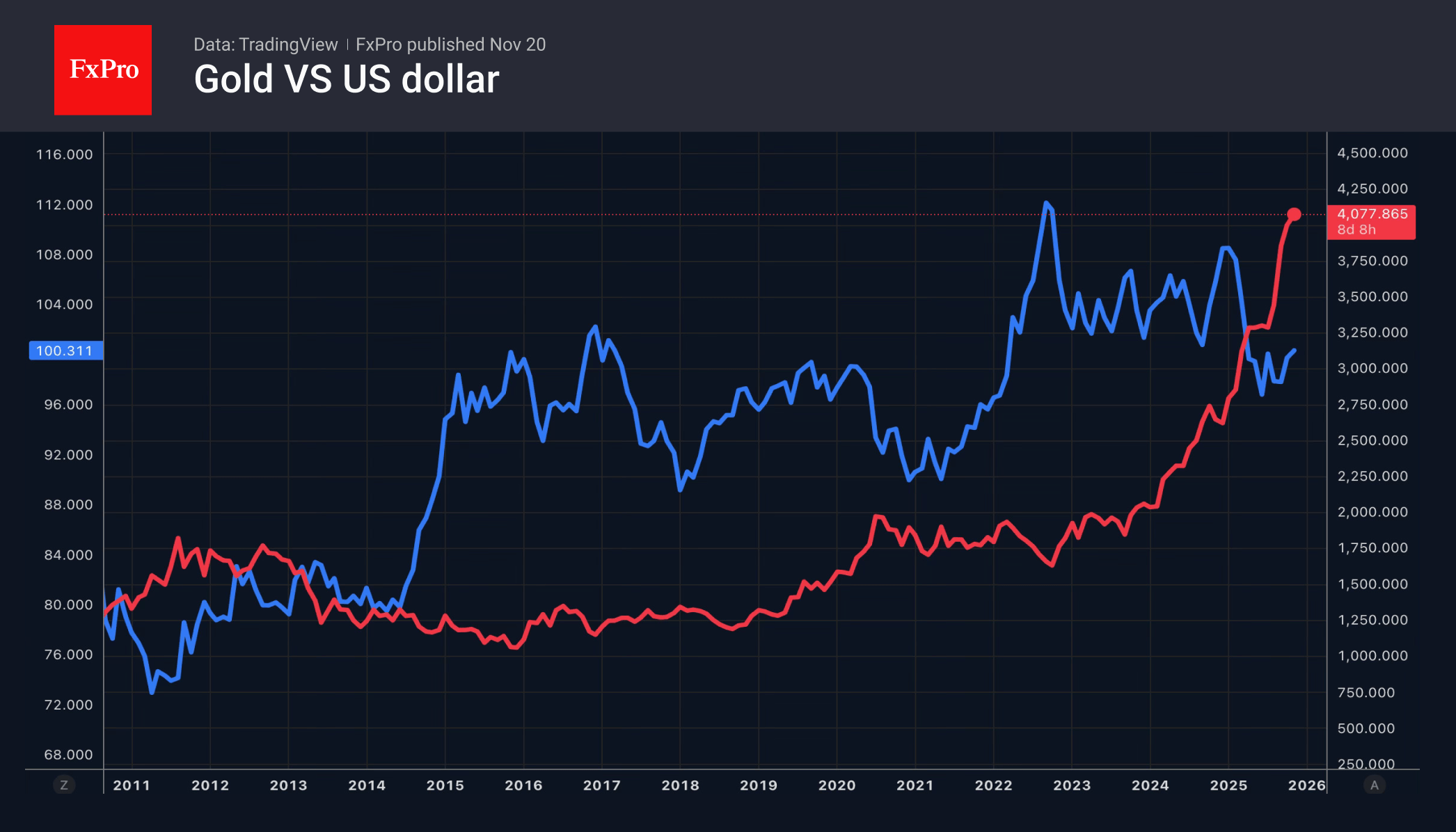

November 21, 2025

Gold remains resilient despite US dollar strength, central bank buying increases, but a rate cut delay and key price levels risk reversing the trend.

November 21, 2025

The US dollar holds firm amid global uncertainty, cautious Fed, slow Bank of Japan, and a potentially surging pound driven by UK policy hopes.