Market Overview - Page 63

October 30, 2023

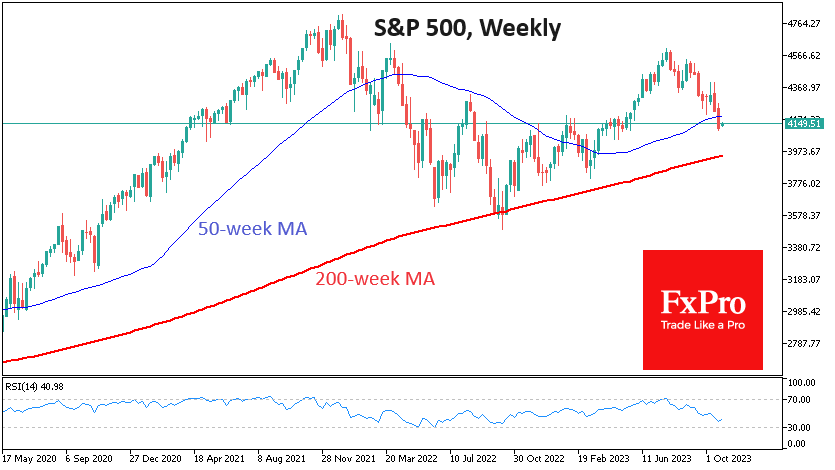

Futures on the S&P500 are rising early Monday after a correction last week. Markets are gearing up for a week of important events, from releasing the US Treasury’s borrowing plans to the FOMC’s comments on interest rates and the monthly.

October 26, 2023

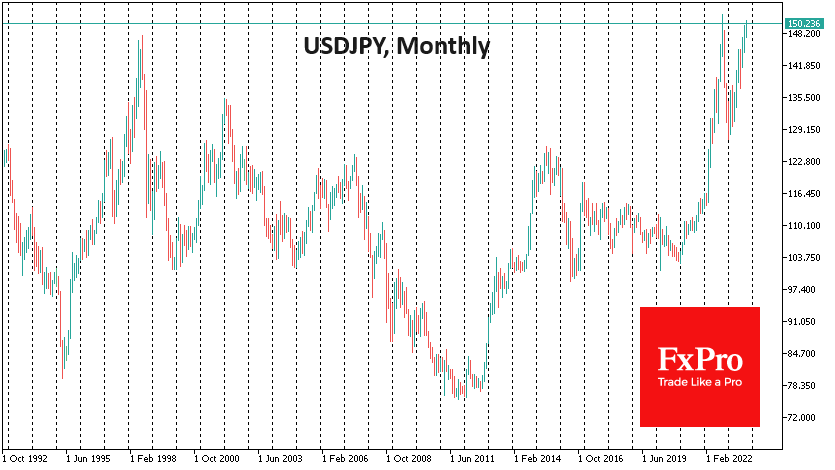

A strengthening US dollar pushed the USDJPY to 150.77 early Thursday. Except for just over 20 hours on 21 October 2022, the pair hasn’t traded higher since 1990. Almost a year ago, a breach of the round 150 level triggered.

October 25, 2023

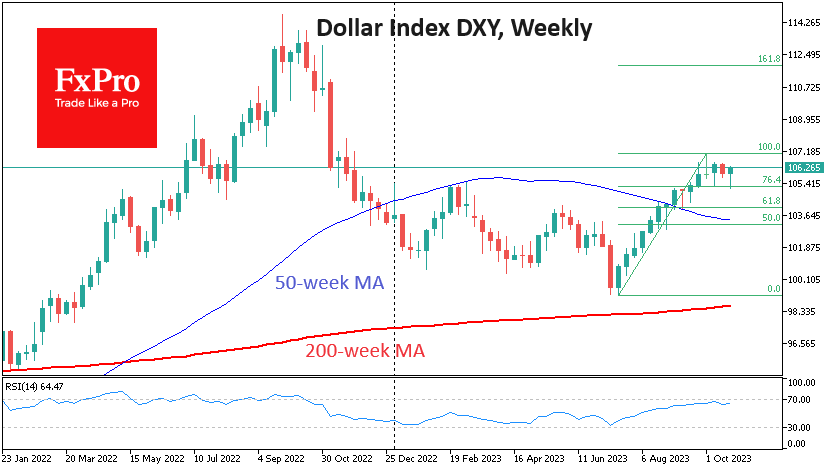

After starting the week in retreat, the US dollar reversed sharply higher in the European session on Tuesday and is on the offensive on Wednesday. Dollar bulls have returned to active buying after a long but shallow correction from earlier.

October 25, 2023

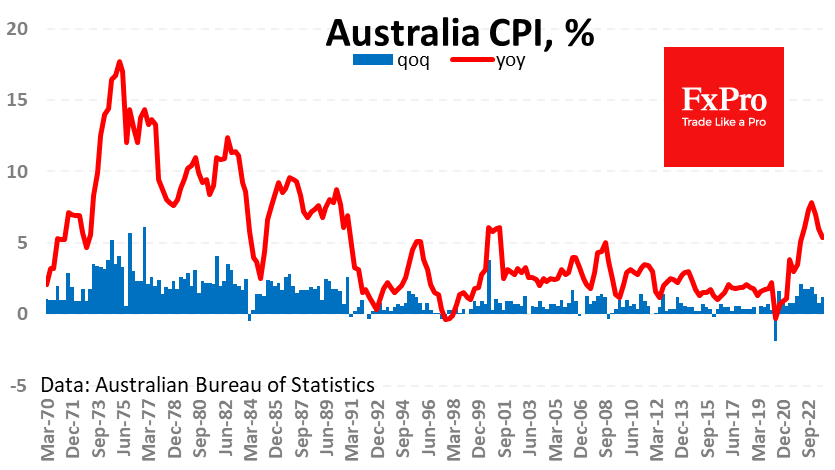

Australian inflation surprised on the upside, reigniting expectations of another rate hike as early as November. However, the Aussie could not enjoy the buying momentum for long as the US dollar strengthened. In the third quarter, CPI rose 1.2%, accelerating.

October 24, 2023

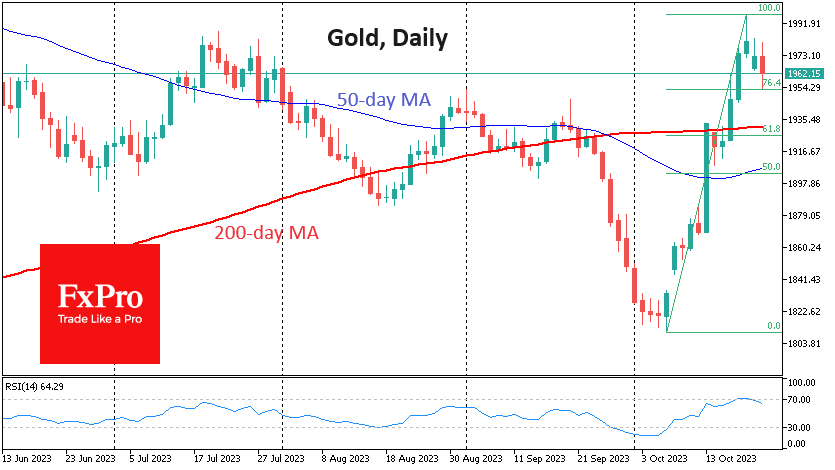

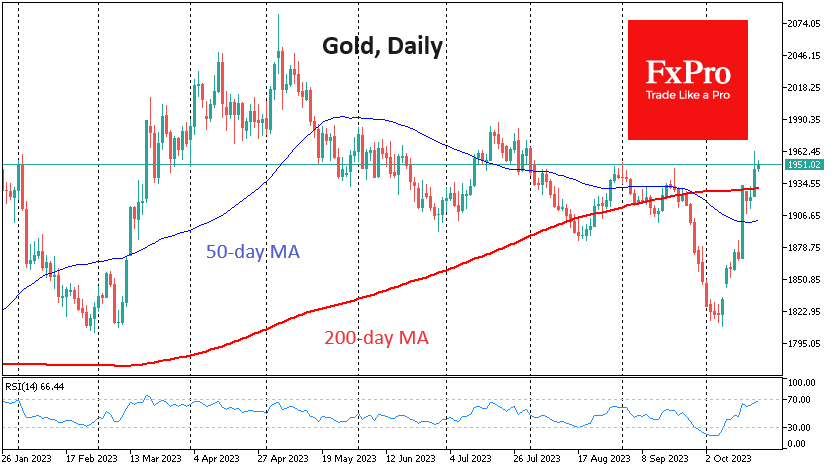

Gold is experiencing profit-taking after an impressive rally following the escalation in the Middle East. The cost of a troy ounce of gold was down to $1955 at the peak of the European session on Tuesday, after a two-week rally.

October 24, 2023

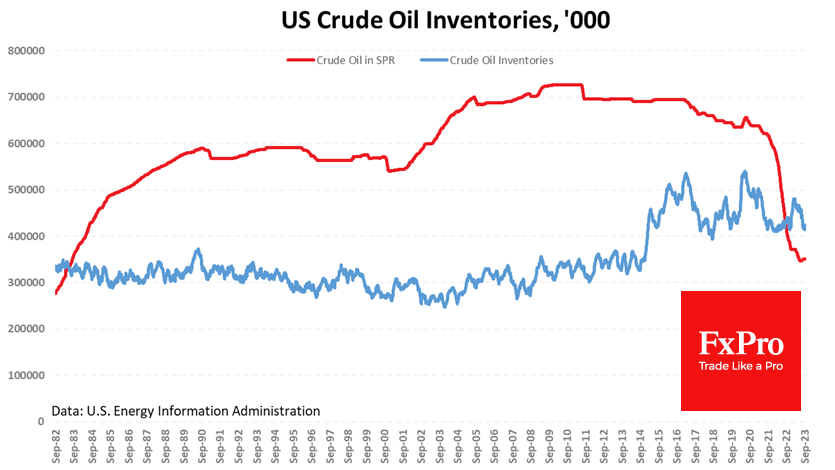

The US “Big Oil” has picked up recently, with both production growth and mergers and acquisitions. At the end of last week, the number of active drilling rigs in the US rose to 502 oil rigs and 122 gas rigs, according.

October 24, 2023

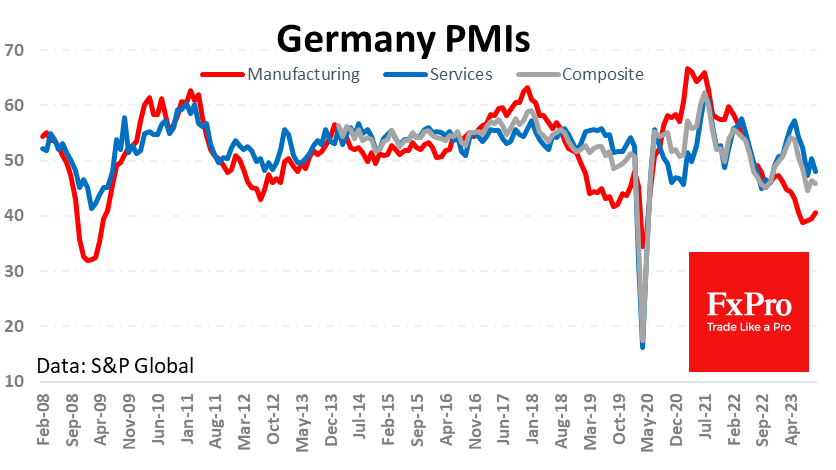

Economic activity in Europe is cooling, raising the spectre of an emerging recession in Germany and the whole eurozone. The PMI indices have proven to be a reliable indicator of the economic cycle for currency and equity market investors. The.

October 23, 2023

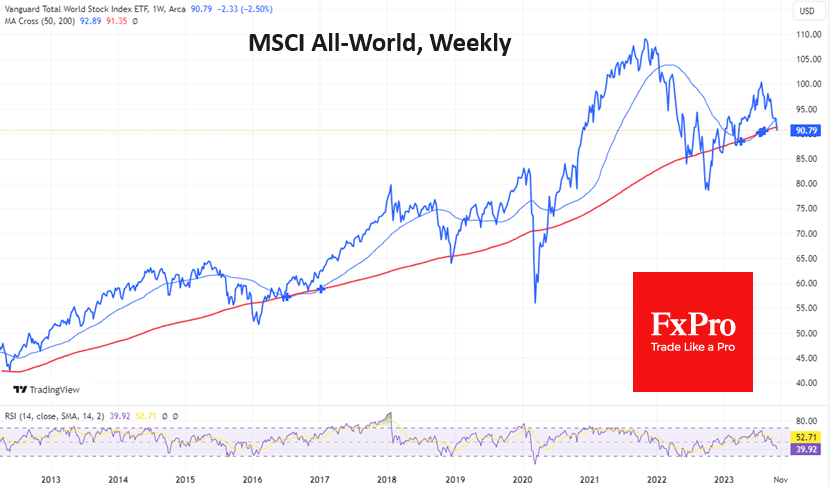

Markets had a heavy end to last week and continued to give up ground at the start of this week. The MSCI All-World Global Equity Index returned to its March lows, and US indices gave bear signals. The index of global equities.

October 19, 2023

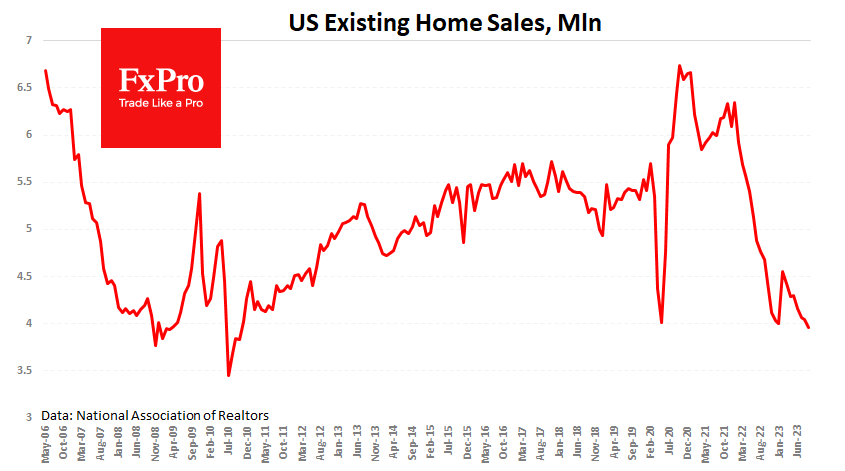

Sales in the secondary housing market in the US have fallen to an annualised pace of 3.96 million. At the peak of the downturn, the figure managed to stay above 4 million. Only during the darkest times for the US.

October 19, 2023

Gold is trading at nearly $1950 an ounce, having surged since the end of July after hitting $1810 just under two weeks ago on October 6th. Gold lost value rapidly in late September as US Treasury yields rose. However, the.

October 18, 2023

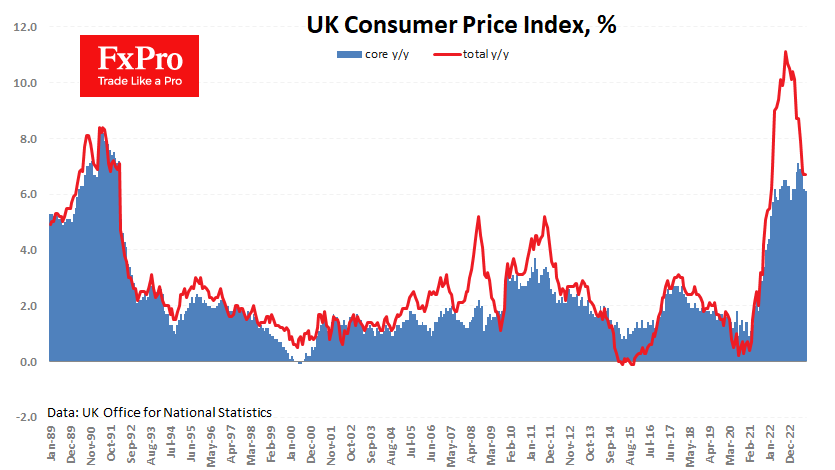

UK inflation data came in slightly higher than expected, helping the Pound to perform better than other European currencies on Wednesday. Headline inflation was 6.7% y/y in September, the same as the previous month and 6.8% in July. So we.