Market Overview - Page 56

February 19, 2024

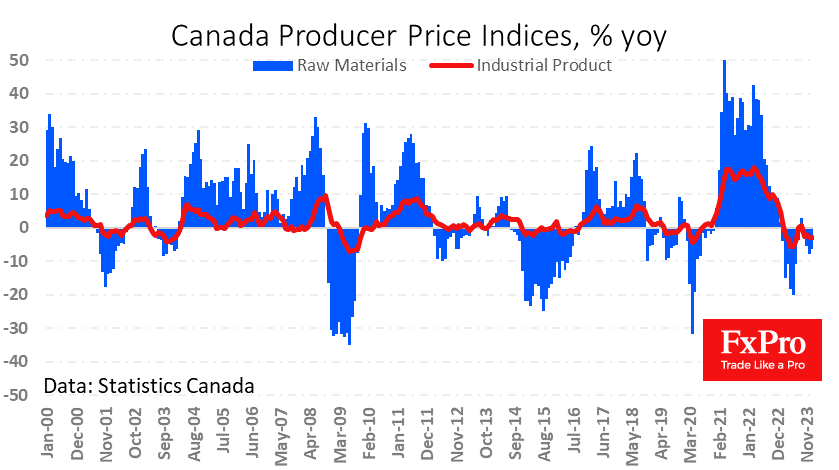

Producer prices in Canada fell by 0.1% in January after a cumulative drop of 2.9% in the previous three months. Prices are now 2.9% lower than a year ago, picking up the pace of decline. Looking through all these large swings since.

February 19, 2024

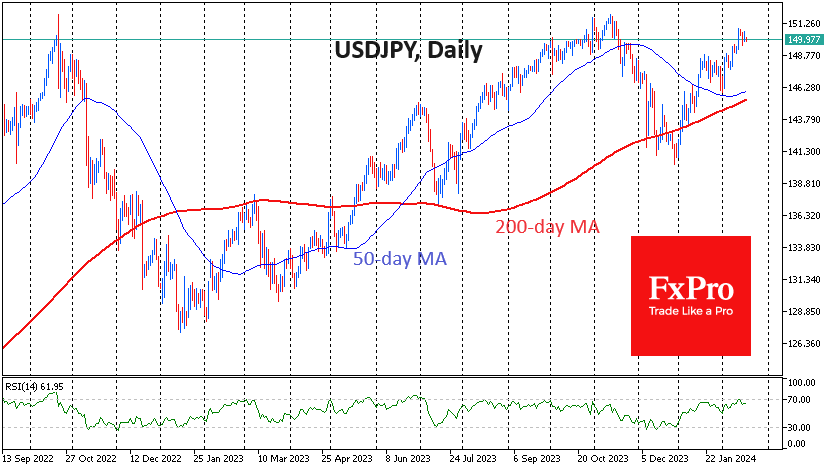

The Japanese yen is hovering near 150 per dollar, retreating from last week’s four-month highs of 151. The 150-152 area is hazardous for short-term traders, as this is the level from which the Japanese Ministry of Finance intervened in October.

February 16, 2024

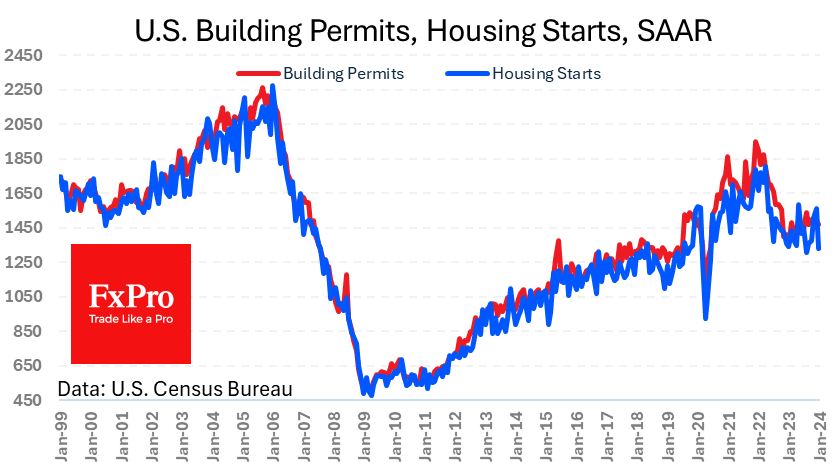

US housing starts plunged 14.8% to 1.331m in January, reversing four months of growth and taking the figure back to last year’s lows. This is in sharp contrast to analysts’ average expectations of 1.450m. The number of building permits issued.

February 16, 2024

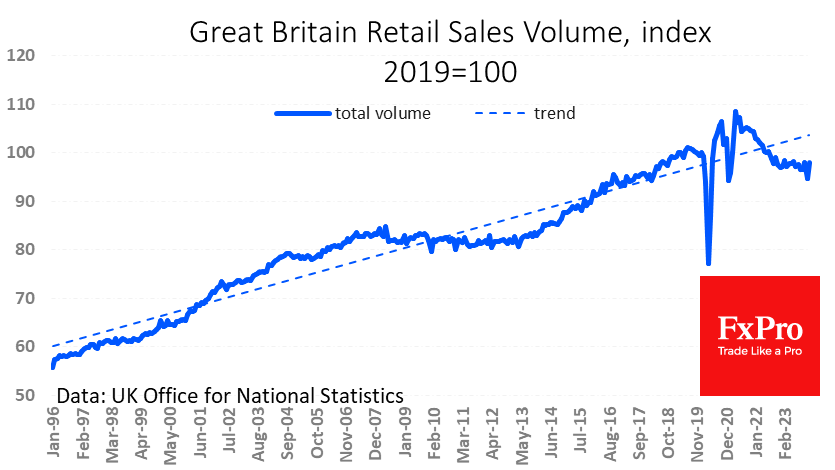

UK retail sales rose by 3.4% in January, mainly recovering from the previous month’s dip but showing very high volatility. Last month’s miss led to talk of a looming recession despite a strong labour market. The new data reduced the.

February 15, 2024

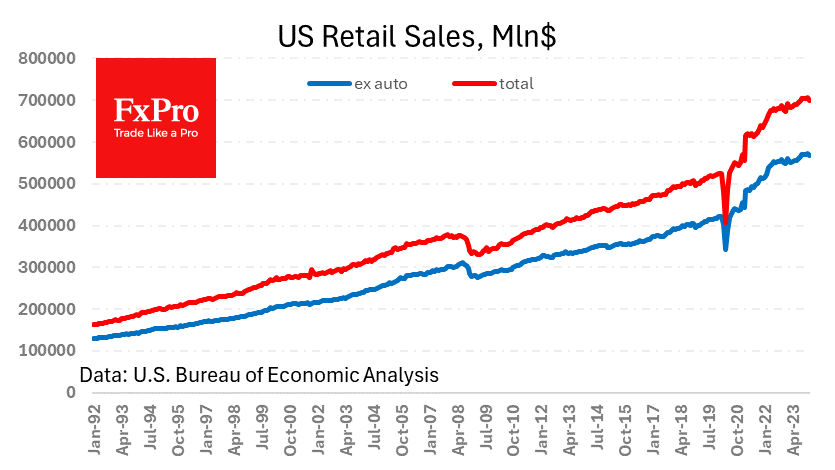

US retail sales fell 0.8% in January instead of the expected 0.2% decline. Sales excluding autos fell 0.6% instead of the expected 0.2% rise. This drop took sales back to their lowest level since last July. Fuel sales last month.

February 15, 2024

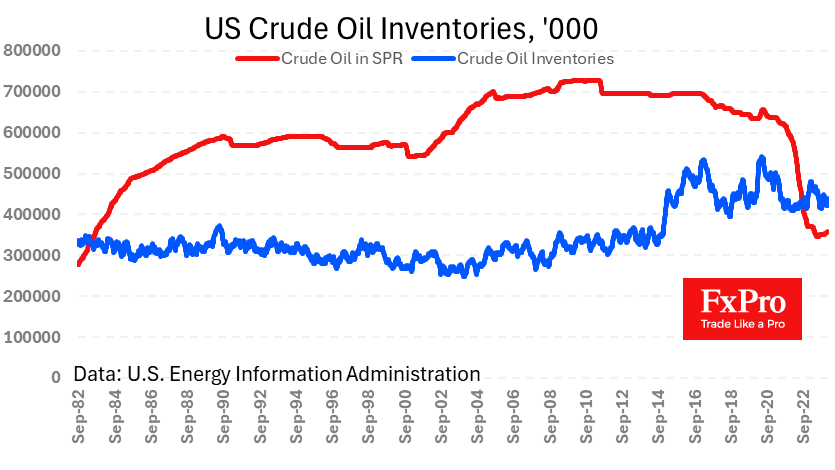

Oil once again failed to confirm the bullish trend on Wednesday, moving lower under pressure from news of a jump in US inventories. The Department of Energy reported that commercial inventories rose by 12 million barrels last week, bringing the.

February 14, 2024

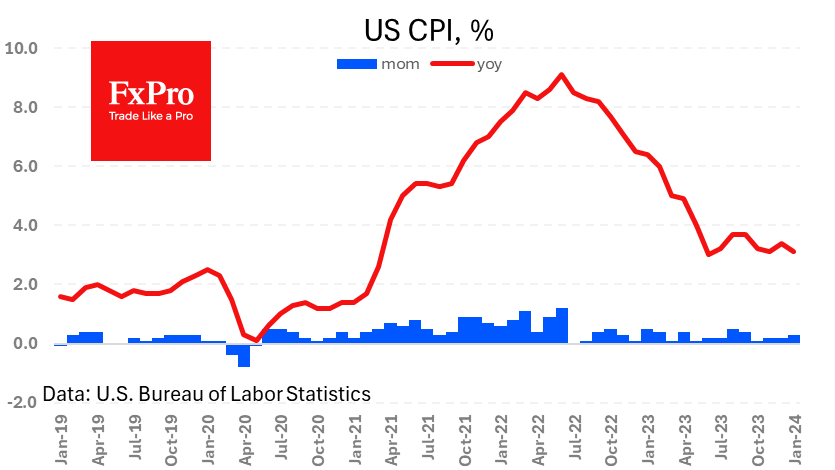

The release of last October’s US inflation data was a real blockbuster for the markets, creating powerful one-way movements. Consumer prices rose 0.3% in January, while annual inflation slowed from 3.4% to 3.1% instead of the expected 2.9%. The core.

February 13, 2024

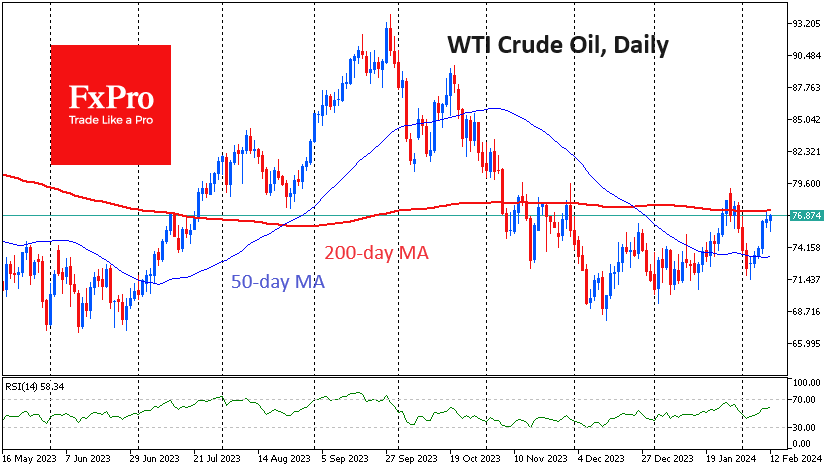

Oil went on the offensive last week, once again confirming the importance of support at the 200-week moving average. Both robust US economic data and OPEC+ intentions to keep production under control fuelled the rally. All this is on top.

February 13, 2024

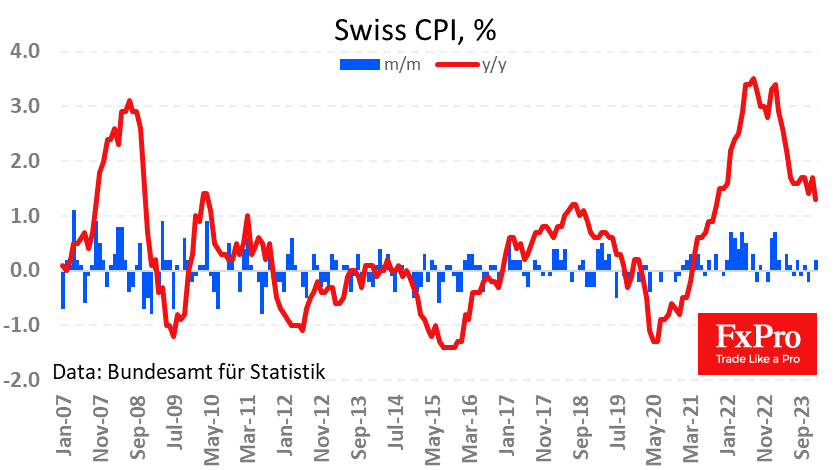

Consumer inflation in Switzerland slowed to an annual rate of 1.3% in January, the lowest since October 2021. This is significantly lower than the 1.7% recorded in the previous month and was expected on average by analysts. The current level.

February 13, 2024

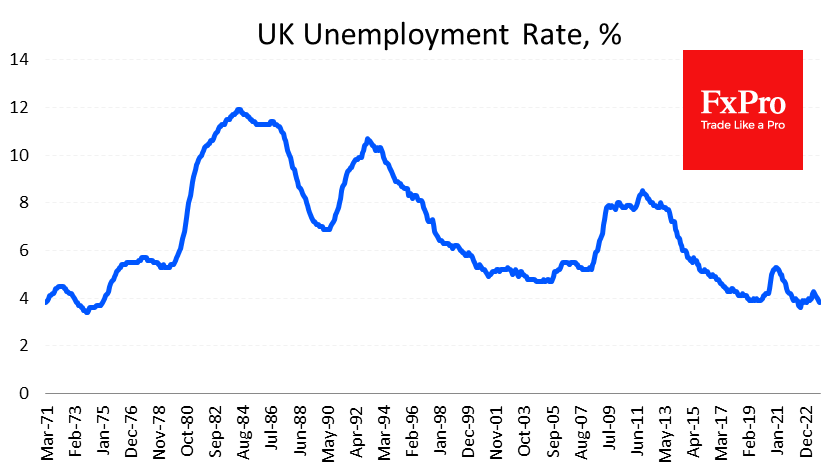

Economic data continues to be on the Pound’s side, with another set of better-than-expected figures, this time from the labour market. The unemployment rate fell from 4.2% to 3.8% against expectations of 4.0%. A fall in the number of active.

February 9, 2024

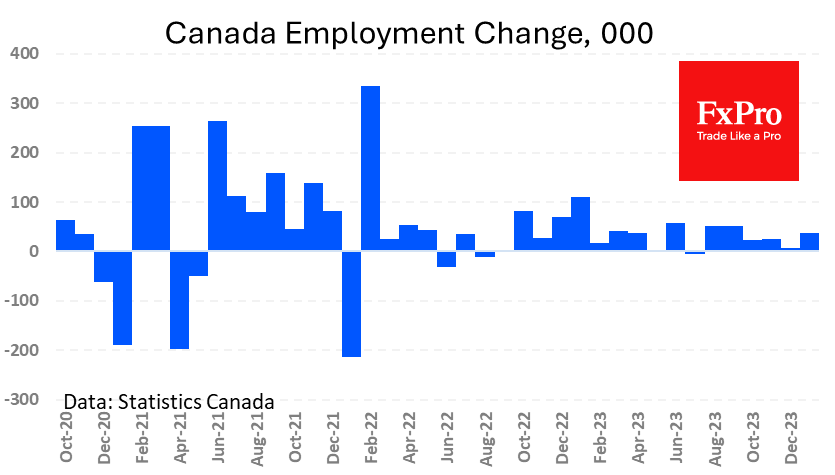

The Canadian dollar rallied on the release of January’s employment figures. However, it will be difficult to sustain the gains and build on the offensive if we focus only on the data released. According to StatCan, employment grew by 37.3K.