Market Overview - Page 53

March 29, 2024

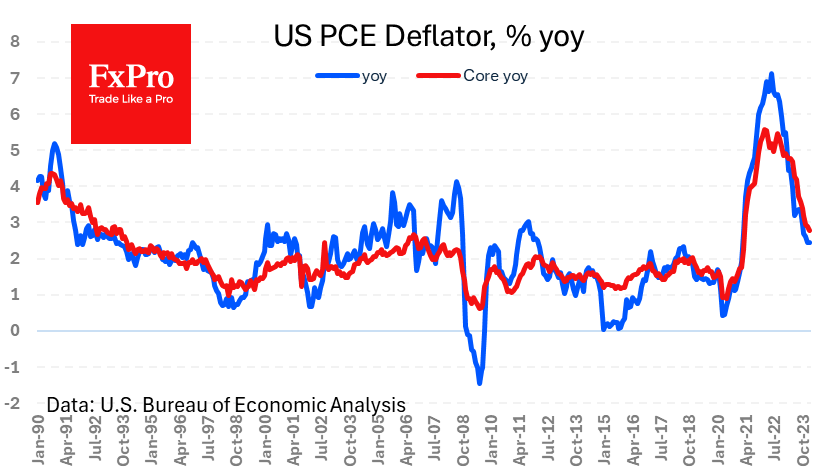

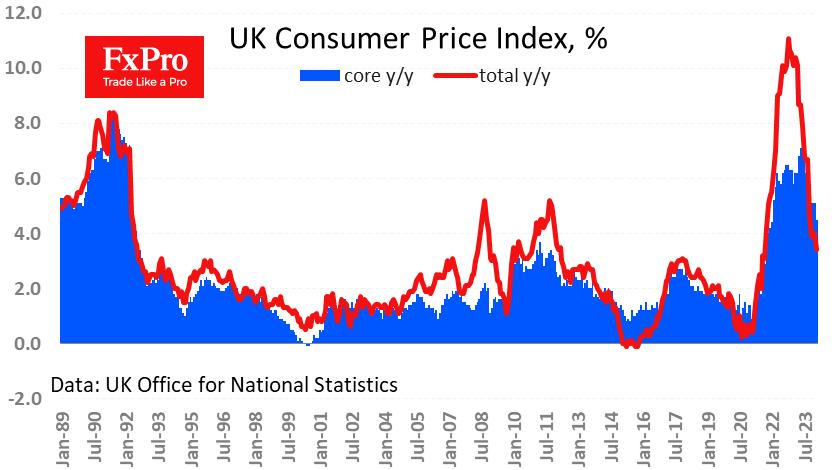

Friday’s market focus was on US household income and spending data and the Personal Consumption Expenditures Index (PCE), the Fed’s preferred measure of inflation. Core PCE Price Index rose 0.3% m/m and 2.8% y/y, which is in line with average expectations and.

March 29, 2024

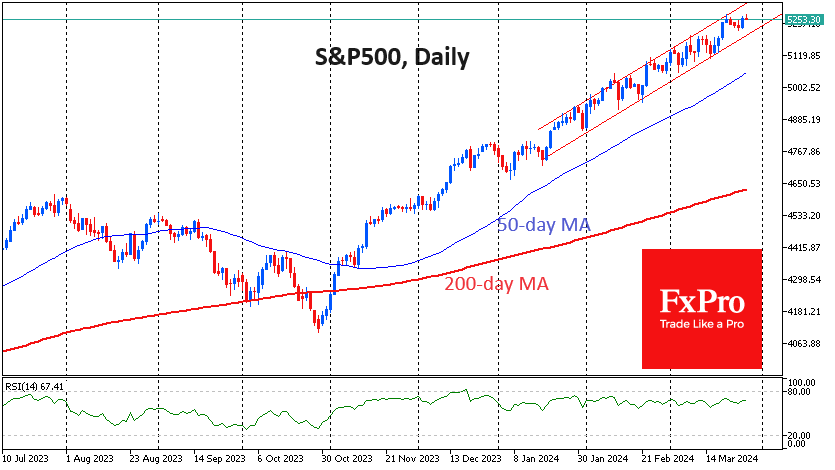

The US equity market continued its upward trend, with the S&P500 rising 10.8% in the first quarter, exceeding the historical average gain for a full calendar year. We are even more impressed by the low volatility of the index since.

March 28, 2024

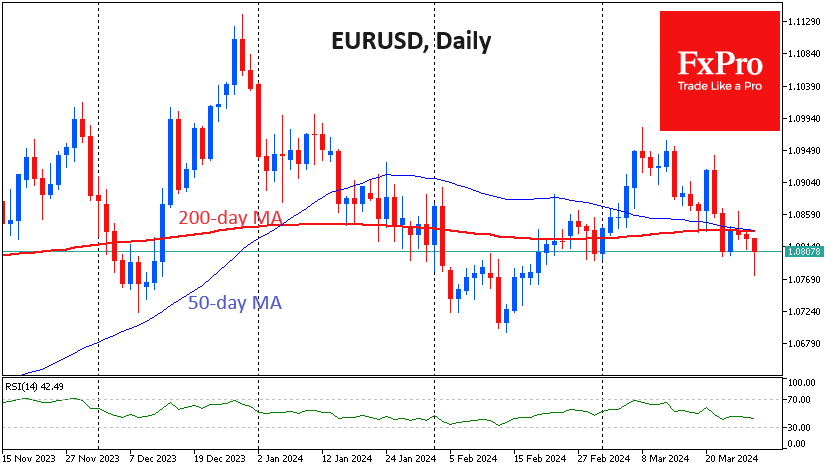

The EURUSD accelerated its decline on Thursday, losing for the third consecutive session and falling to a five-week low below 1.0790. The pair’s downtrend has been in place since the 8th of March when the latest employment report was released..

March 27, 2024

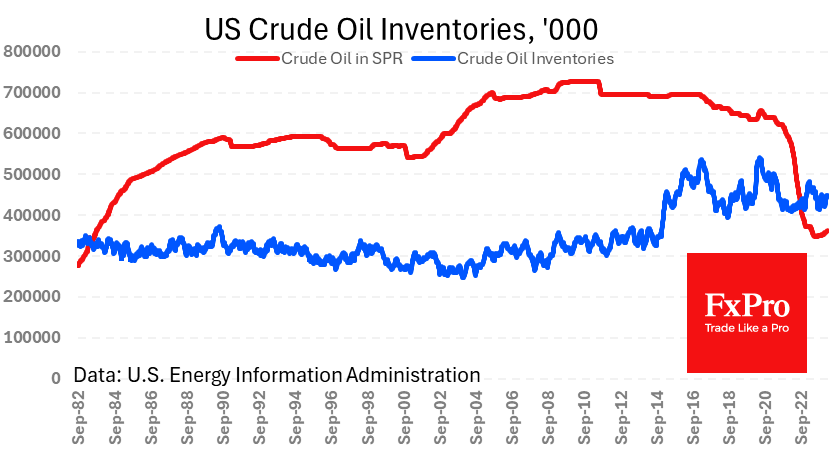

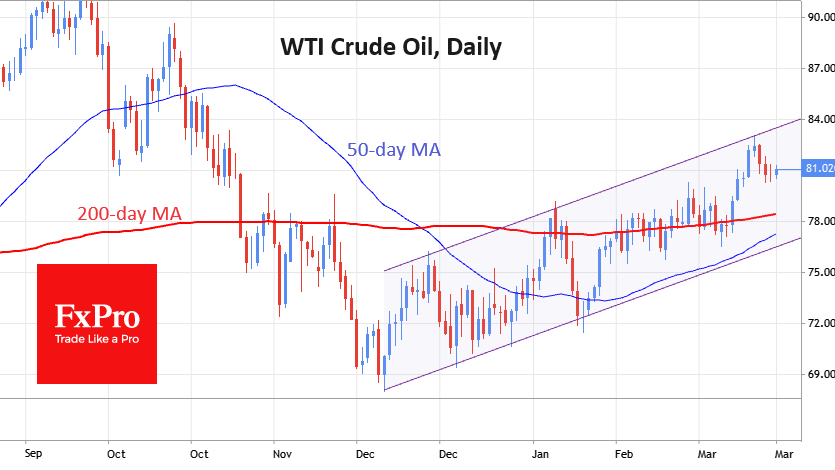

US commercial oil inventories rose by 3.2m barrels last week, against expectations for a decline of 0.7m. At the same time, the Strategic Petroleum Reserve rose by 0.74m barrels, maintaining the pace of recovery since mid-December. Oil production maintained its.

March 27, 2024

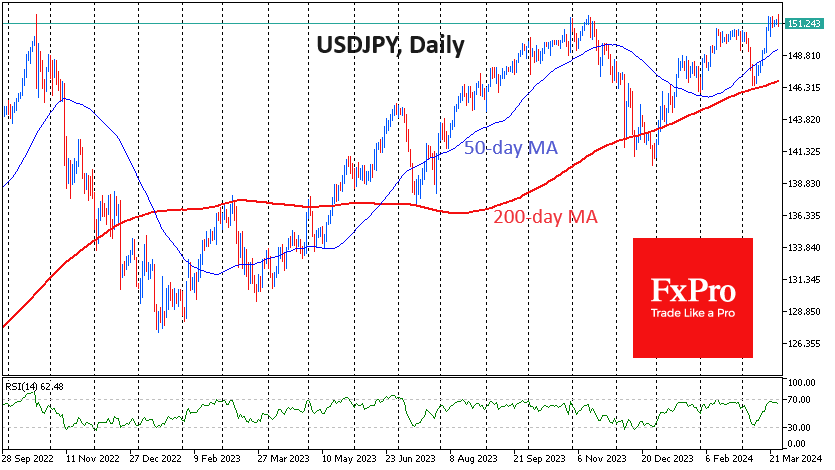

The reversal of the Bank of Japan’s monetary policy tightening at the beginning of March not only failed to reverse, but also added to the Yen’s weakening trend. The systematic pressure on the Japanese currency raises even more questions, given.

March 27, 2024

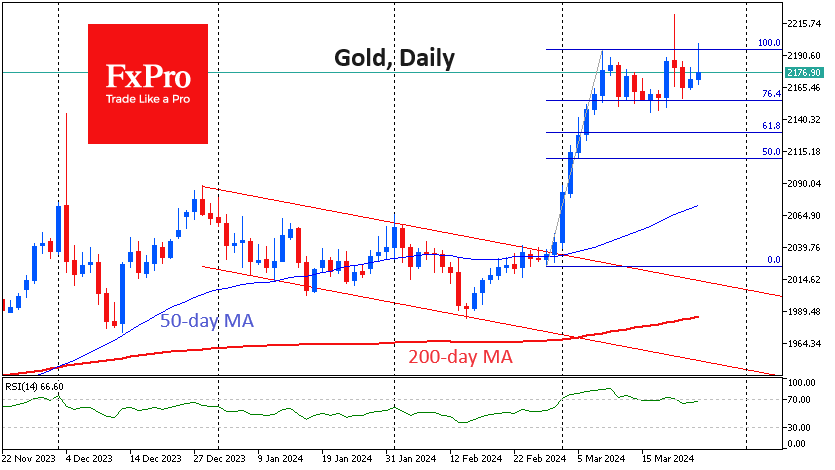

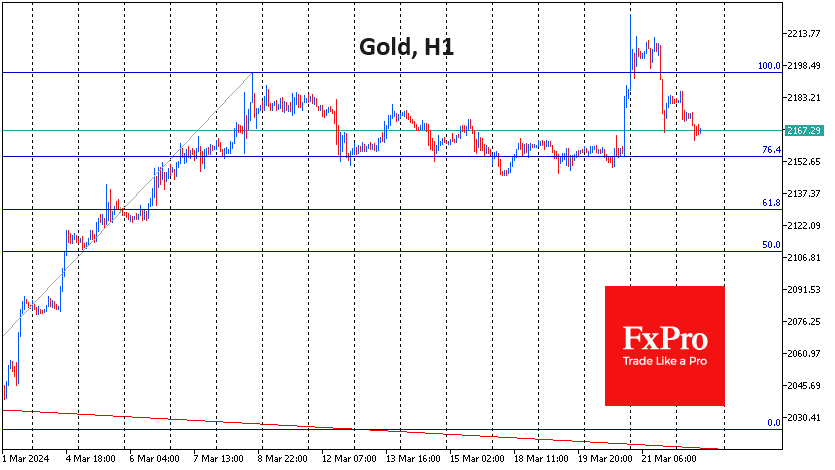

Gold breached the $2200 mark for the second time in history on Tuesday before retreating to $2182 in early US trading. Cryptocurrencies are trading in the same direction as gold today, but silver, platinum and copper are failing to make.

March 25, 2024

Oil closed last week with minimal gains, settling just above $80 per barrel WTI. It appears that much of the commodity speculation has moved into cocoa, leaving oil at the mercy of longer trends. WTI has been trading in a.

March 22, 2024

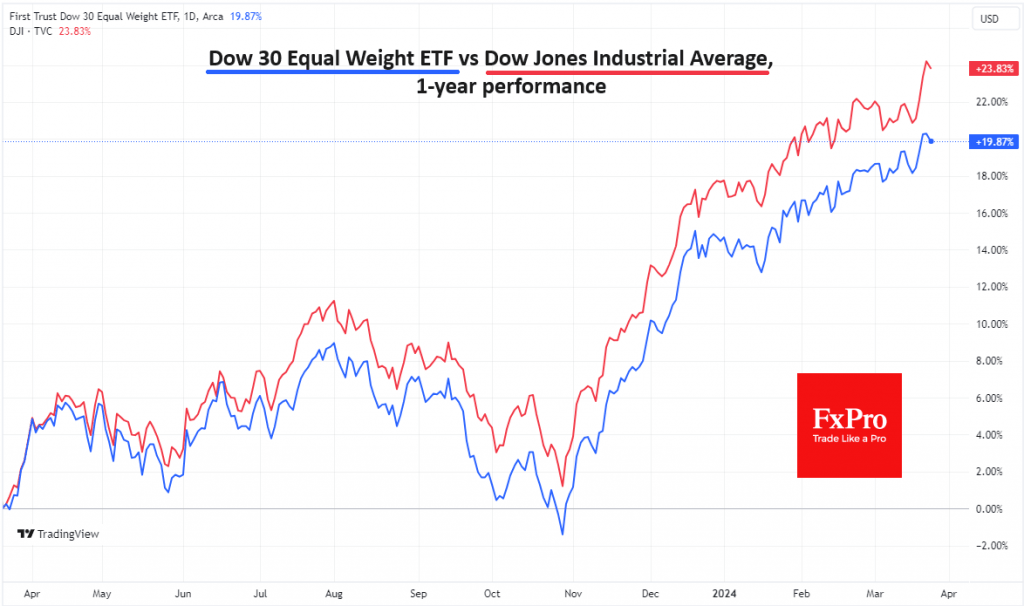

The US Dow Jones Industrial Average was one step away from the milestone of 40,000 on Thursday, having gained 3% in four days since the start of the week. Friday saw the traditional quiet pullback as traders took short-term profits. .

March 22, 2024

The Fed’s comments led to a 3% rise in gold, but the dollar’s recovery in the second half of Thursday reduced this gain to just 0.5%. Technically, the outlook is unclear, but fundamentally, things are still on the side of.

March 22, 2024

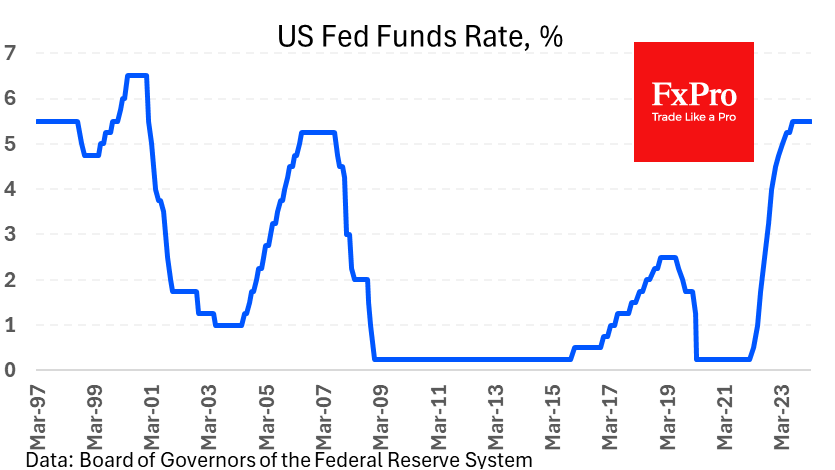

The Fed left its key interest rate unchanged, and the forecast for its reduction this year was unchanged, but it supported risk appetite in the global markets. After the announcement, the US dollar accelerated its decline, losing around 1% from.

March 20, 2024

The FOMC meeting is the main event of the day on Wall Street and can set the market mood for weeks to come, as the Fed often leads global monetary policy cycles. No actual rate changes are expected today, and.