Market Overview - Page 51

April 25, 2024

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously.

April 25, 2024

Change in the Nasdaq100. The selling on the Nasdaq100 from 12 to 19 April, which sent the index down more than 7%, has stimulated buying interest this week. They see falling prices as an opportunity to buy stocks at a reduced.

April 24, 2024

The US dollar’s gains stalled last week, and on Tuesday, it lost a third of a cent against a basket of major currencies to 105.4 from a peak of 106.3 the week before. Yesterday’s pullback more closely resembles the start.

April 23, 2024

Boosted interest in the Euro emerged after preliminary PMI estimates showed a surprising acceleration in the services sector, which was able to offset the negativity from industrial weakness significantly. Both France (46.2 to 44.9) and Germany (41.9 to 42.2) saw.

April 23, 2024

Gold is under pressure this week, having pulled back to the $2300 per troy ounce level. The decline since Friday’s close is over 3.7%. The formal trigger is a more moderate escalation in the Palestinian-Israeli conflict than expected at the.

April 22, 2024

Oil prices have retreated to their lowest levels since late March, approaching a critical support level. WTI barrels dipped to $80.60 early on Monday. The price found support at the $80.0-$80.50 zone a month ago before accelerating higher and breaking.

April 17, 2024

The US dollar is losing 0.2% since the start of the day on Wednesday against a basket of major currencies, signalling traders’ eagerness to lock in some profits after a 2.5% rally over the previous seven days. Interestingly, dollar fatigue.

April 16, 2024

Gold has been behaving erratically, having had a positive and negative correlation with global risk appetite in recent days. On Friday, the price set an all-time high above $2430, losing $100 before the end of that day, nullifying the most.

April 15, 2024

US retail sales rose 0.7% in March after a 0.9% jump (revised from 0.6%) in February. An increase of 0.4% was expected. Such strong data reverses the pattern of last month when February’s growth did not outweigh January’s dip. By.

April 15, 2024

Oil is losing more than 1% on Monday, below $84 a barrel for WTI and below $89 for Brent after Friday’s rollercoaster, when prices peaked above $87 and $91.6, respectively. The drivers were geopolitics, where fears of an escalation of.

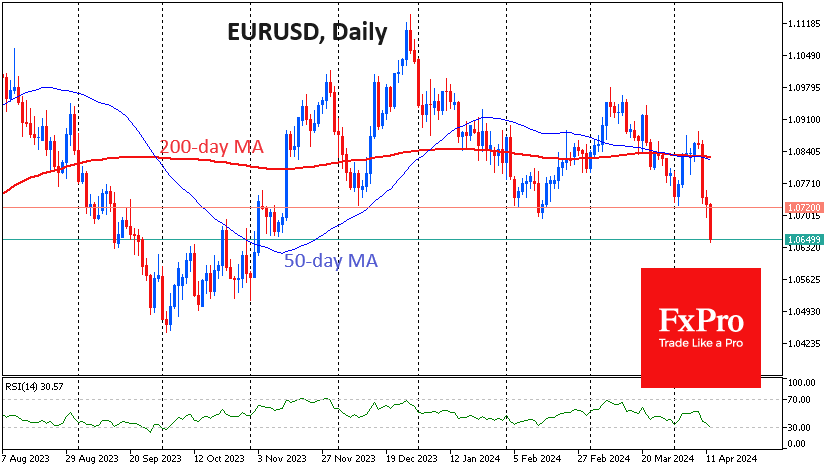

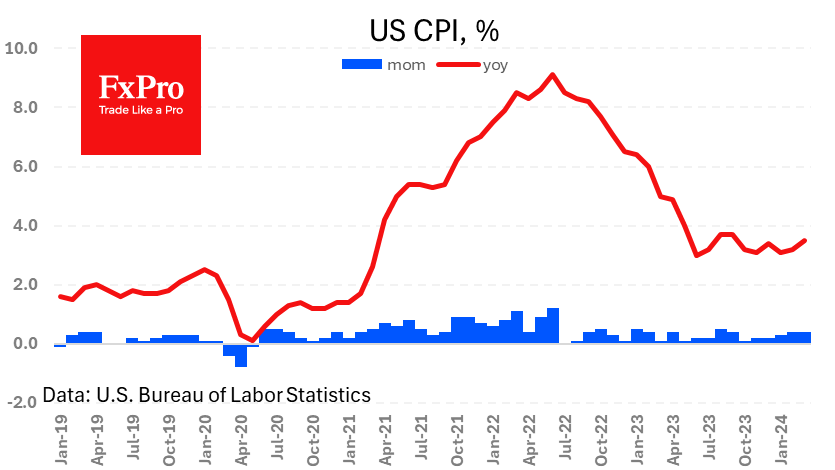

April 12, 2024

EURUSD is losing 1.9% from Wednesday’s peak to a five-month low at 1.0650. US inflation data and ECB comments highlight the divergence of Fed and ECB monetary policy. Wednesday’s US inflation report appears to have set the trend for the.