Market Overview - Page 50

May 14, 2024

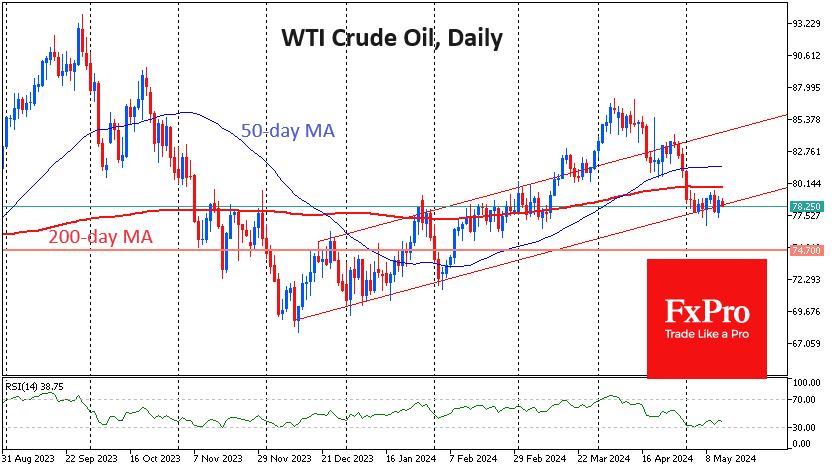

Crude oil has been under pressure over the past four weeks but has been gaining support on the decline to $77 per barrel WTI and $82 per barrel Brent since the beginning of the month. The price has been consolidating.

May 10, 2024

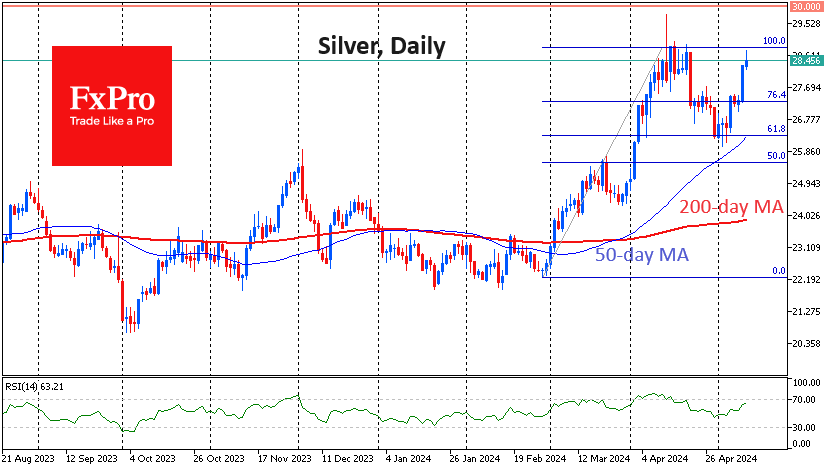

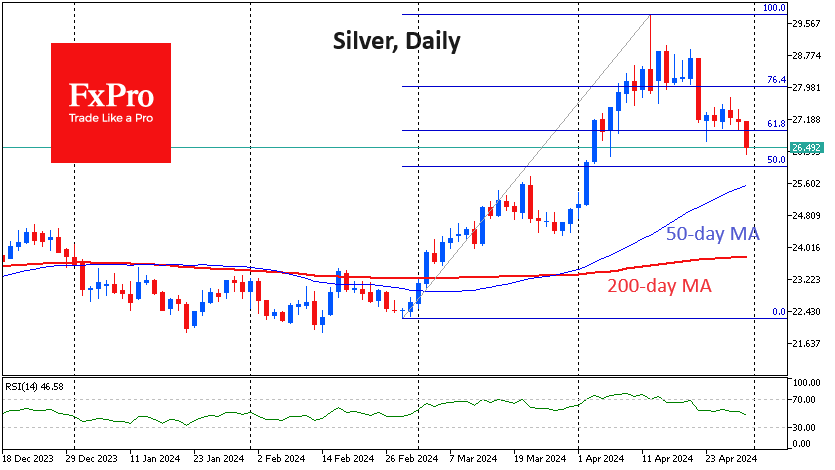

Gold and silver have been enjoying a return to demand since early May, and buyers have stepped up in the last couple of days, bringing gold back above $2370 and silver back above $28.5. Silver has recovered to the $28.0-28.8.

May 8, 2024

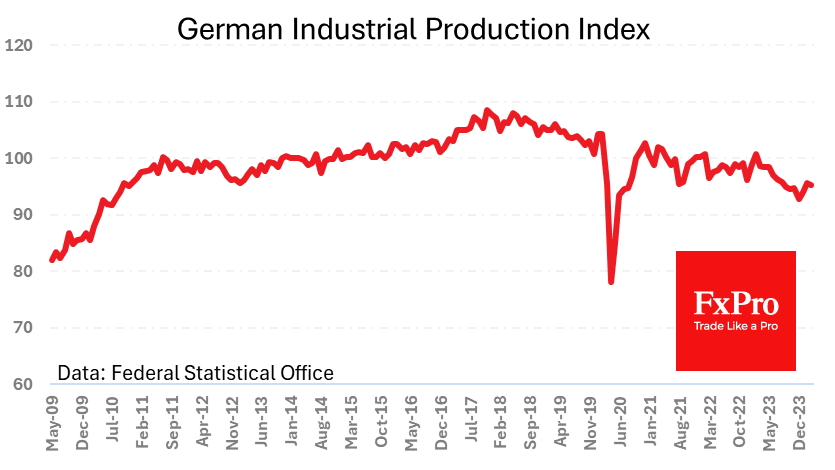

German industrial production continues to decline. The rate of contraction in March was slightly better than the average forecasts but maintained the downward trend. The index of industrial production fell by 0.4% in March and by 3.3% y/y, having lost.

May 8, 2024

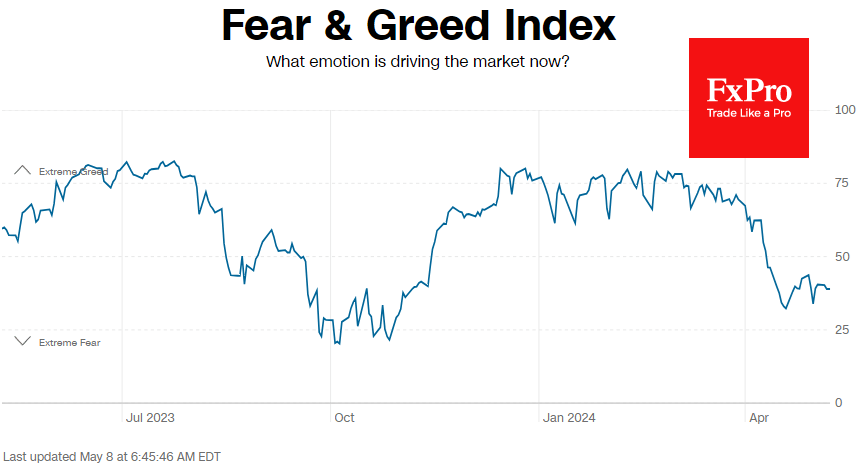

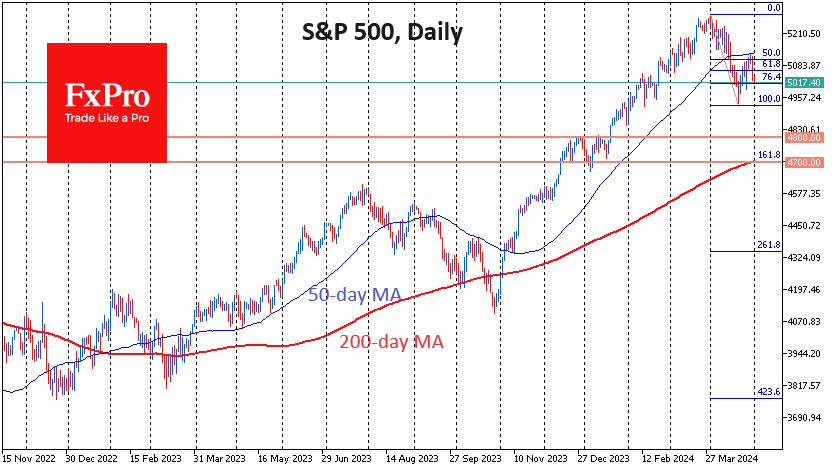

US indices have been gaining daily since the beginning of May. They have found strength amid relatively weak job reports and quite upbeat quarterly earnings. The S&P500 and Nasdaq100 indices are just 1.5% below the all-time highs set in March. .

May 7, 2024

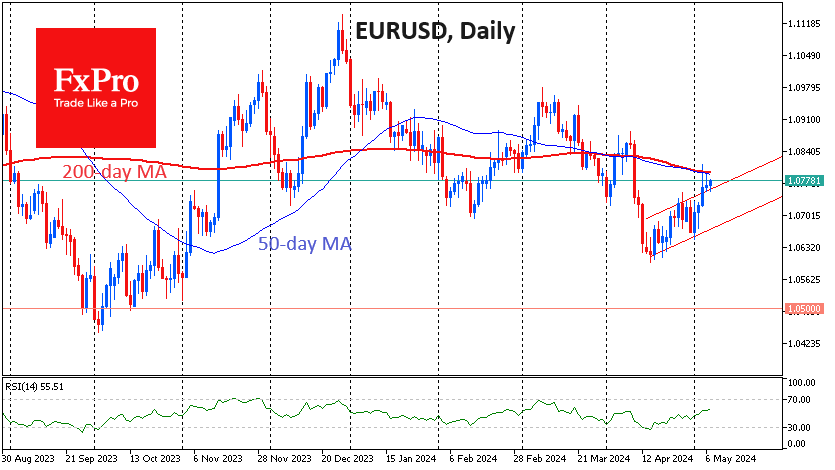

The single currency is trading near $1.076, waiting for further cues and facing serious resistance in its attempt to consolidate above 1.08 on Friday. On Friday, EURUSD’s growth accelerated against the trend of the previous three weeks on negative US.

May 6, 2024

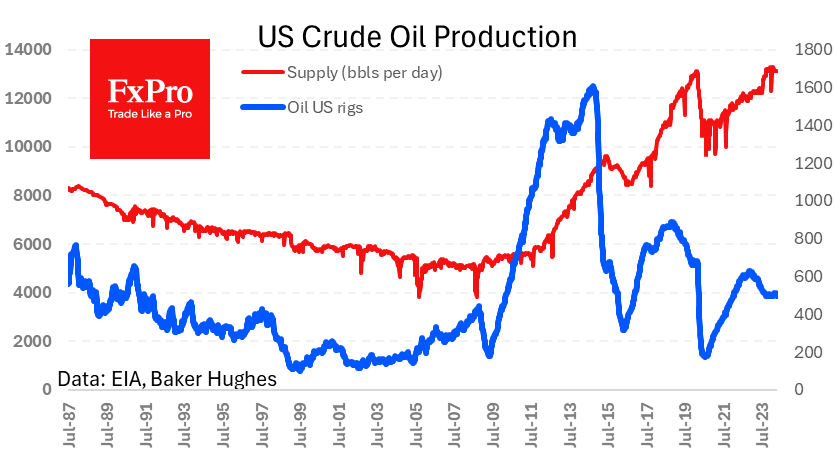

The number of operating oil rigs in the US fell by 7 to 499. This is the lowest in 12 weeks and further confirmation that even with relatively favourable oil prices, producers are in no hurry to ramp up production.

May 3, 2024

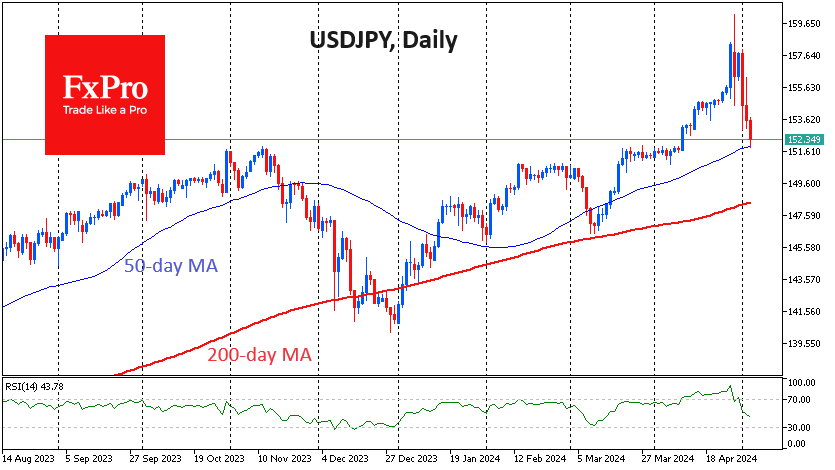

USDJPY was slipping below 153 on Friday morning, a three-week low and having lost over 4.5% from a peak of 160.2 at the start of trading on Monday. Behind the pair’s rise is a long-term fundamental factor: a huge and.

May 1, 2024

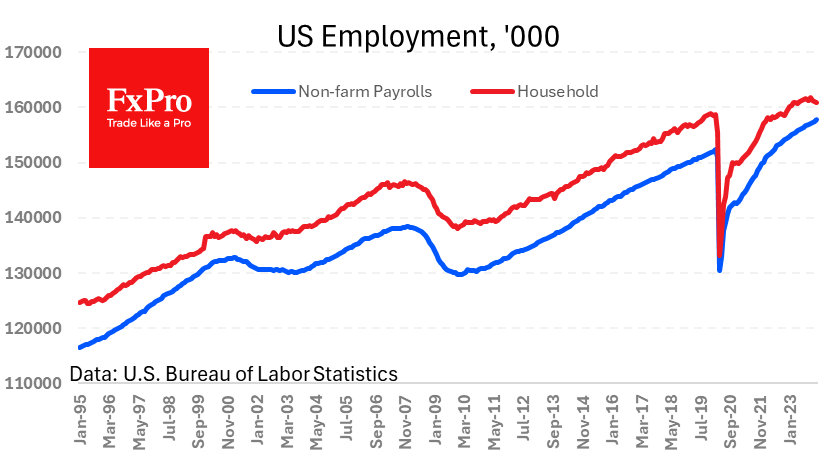

The monthly ADP labour market report showed that America created 192K new jobs in April, above the forecasted 179K and following +208K in March (revised from 184K). Overall, there was a slight slowdown in wage growth to 5% y/y from 5.1%.

May 1, 2024

Bears showed strength ahead of the FOMC decision. U.S. indices sagged on Tuesday as investors opted to risk off. They are awaiting a tighter Fed tone following Wednesday’s meeting. The S&P500 suffered a sell-off as it attempted to climb above.

April 30, 2024

Silver has lost 2.6% since the start of the day on Tuesday to $26.4 per ounce. After a failed attempt to climb above $30 per ounce on 7 April, the downside momentum in Silver has been replaced by sideways consolidation.

April 29, 2024

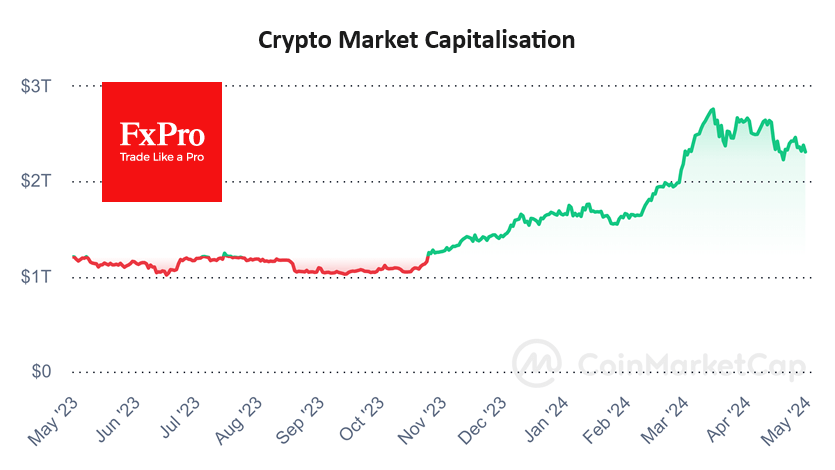

Market picture The crypto market has lost 3.3% in the last 24 hours to $2.3 trillion. The last time this level of capitalisation was on 19th April. Most worrying is the reversal of the trend from up to down last.