Market Overview - Page 485

July 10, 2019

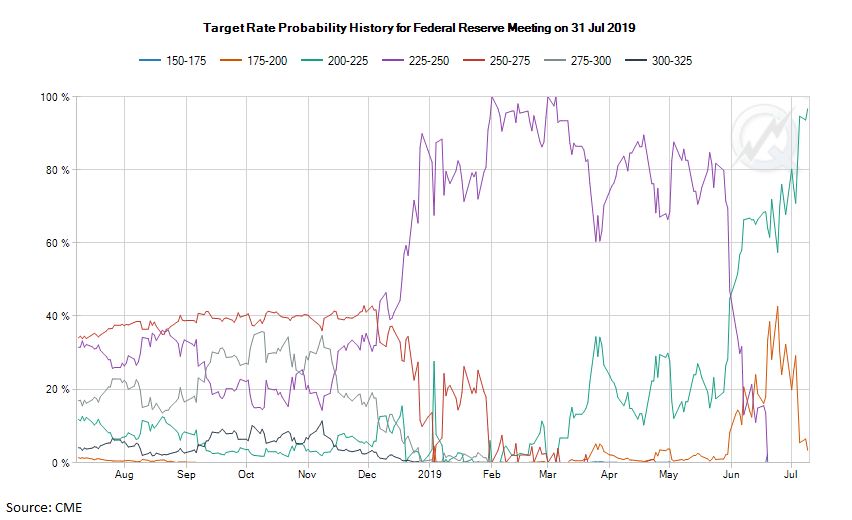

Market focus Markets are focused on Powell’s US Congress speech tonight, suggesting that it can give a definitive answer to the question of whether the rate will be cut at the end of this month. The Federal Reserve is actively.

July 10, 2019

Bitcoin mining difficulty – a measure of how hard it is to compete for mining rewards on the world’s first blockchain network – has posted its largest two-week increase in 12 months. According to BTC.com data, mining difficulty reached 9.06.

July 10, 2019

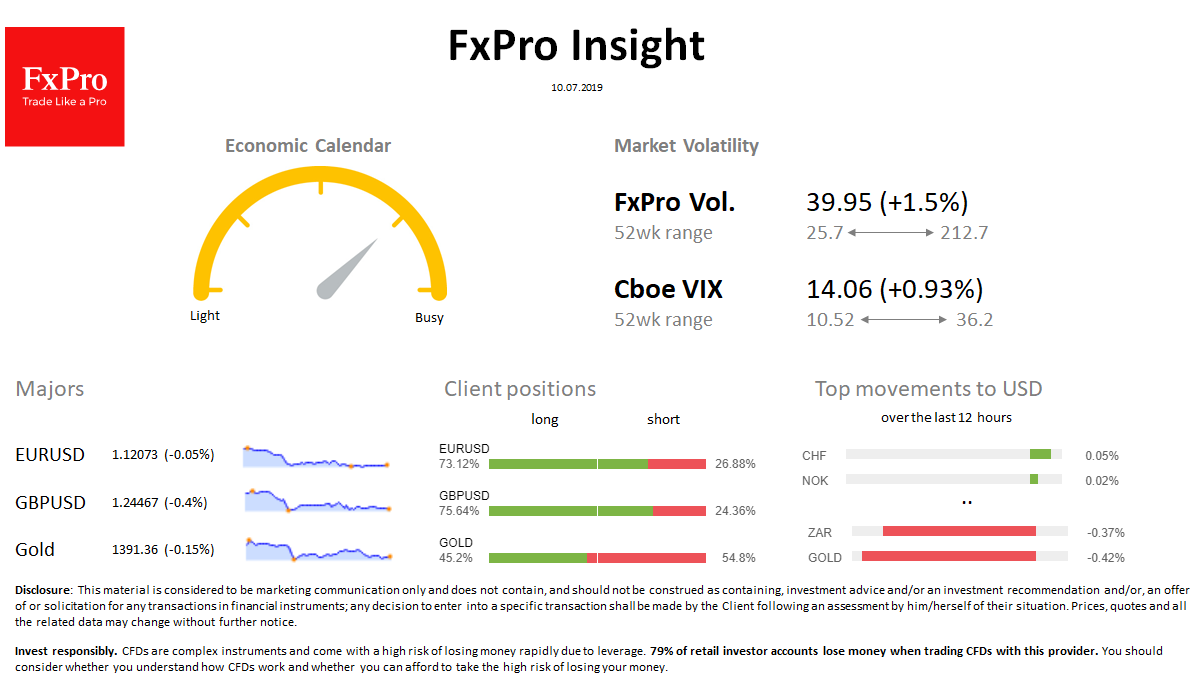

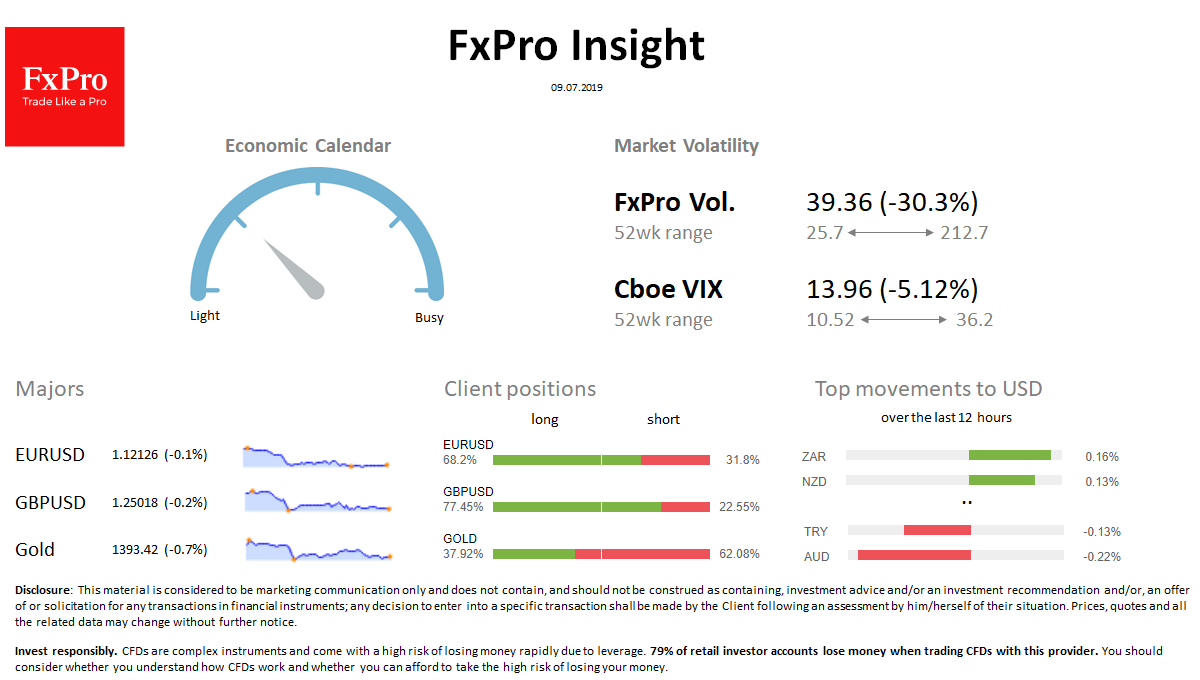

Market overview FX: USD recaptures its positions in anticipation of Powell’s speech. GBP remains below 1.25, falling to 2-year lows yesterday. Stocks: The pressure on the stock indices went back during the Asia trading session. SPX returned to Tuesday’s opening.

July 10, 2019

President Recep Tayyip Erdogan risks pushing Turkey’s economy into an economic collapse similar to those seen in Latin America under populist regimes, according to Ashmore Group Plc. While more diversified than Venezuela’s oil-dependent economy, Turkey is currently on a very.

July 10, 2019

Cameron and Tyler Winklevoss have big plans for the crypto exchange, Gemini, not to mention their expectations for bitcoin. In a panel discussion with “Bitcoin Billionaires” author Ben Mezrich and The Wall Street Journal’s Paul Vigna, the Winklevosses discussed bitcoin.

July 10, 2019

U.S. President Donald Trump can either be a “tariff president” or a “two-term president,” a public policy expert said Tuesday. It remains relatively undetermined to what extent U.S.-China trade tensions have weighed on the American economy, but any continued damage.

July 9, 2019

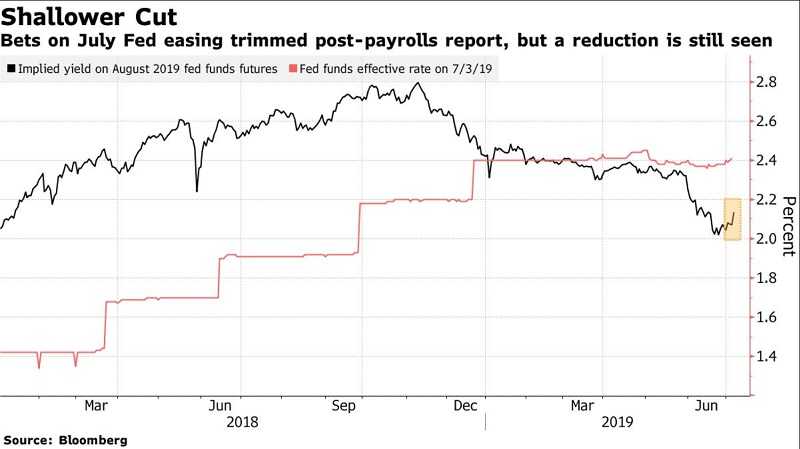

Market focus The corrective pullback is developing on the revaluation of the Fed’s monetary policy. Friday’s Nonfarm Payrolls are still influencing the investors’ sentiments.

July 9, 2019

Crypto markets have spent most of the weekend in consolidation as Bitcoin takes a breather. Eyes are starting to turn to Litecoin once again as the halving clock ticks down with less than a month to go. The clock is.

July 9, 2019

The bitcoin price is once again trading above the $12,000 level, and the current market cycle could take the price to a new all-time high. Morgan Creek Capital Management CEO Mark Yusko was featured on CNBC, where he emphasized that.

July 9, 2019

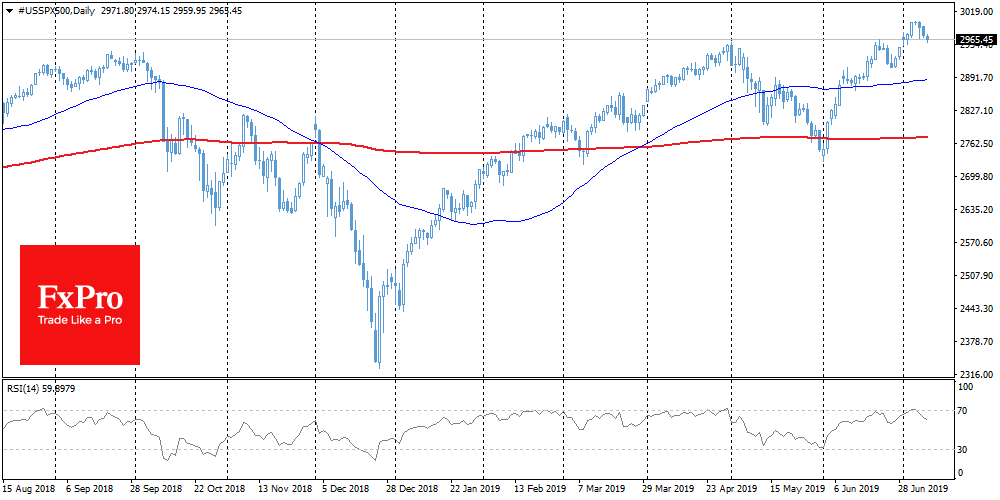

U.S. equities fell as investors took a cautious approach to a week full of central bank activity. Treasuries edged lower and gold retreated. The S&P 500 slipped for a second day after Friday’s blow-out jobs report altered market calculus for.

July 9, 2019

Market overview FX: USD craved upward, but the pace of growth slowed down recently. Market volatility has generally decreased in anticipation of new signals from the Fed. Stocks: Indices are losing ground on the reassessment of the Fed policy expectations.