Market Overview - Page 44

August 2, 2024

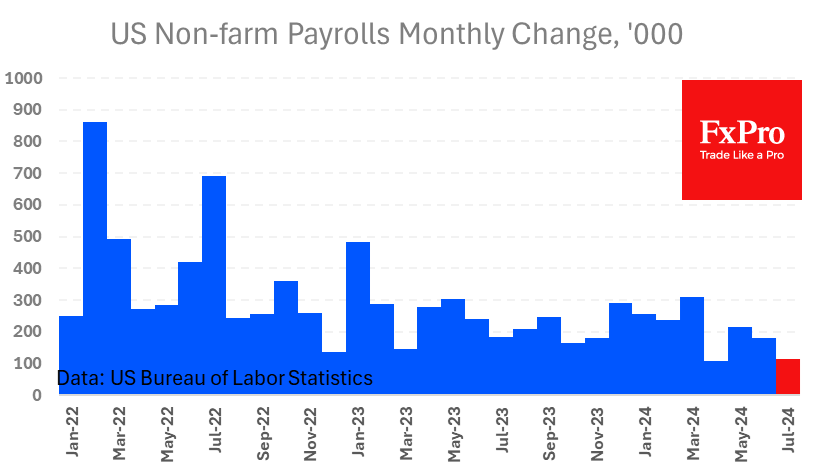

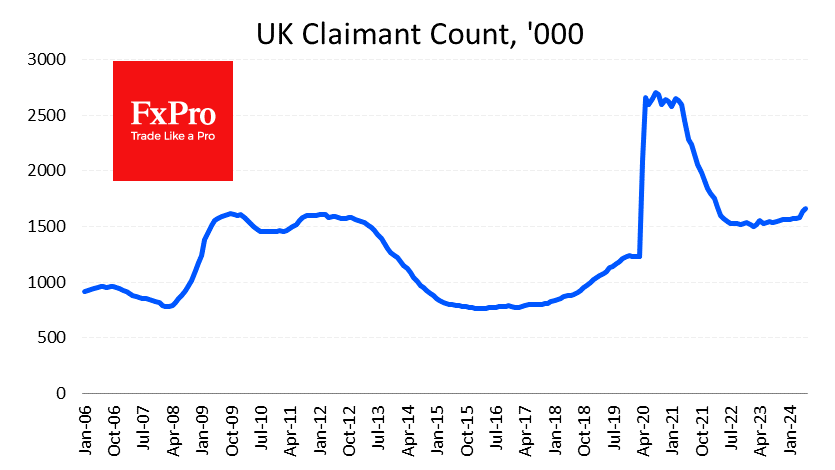

The US economy added 114K jobs in July, well below expectations. The private sector added 97K jobs, the smallest increase since March last year. The market’s knee-jerk reaction was also exacerbated by a rise in the unemployment rate from 4.1%.

July 30, 2024

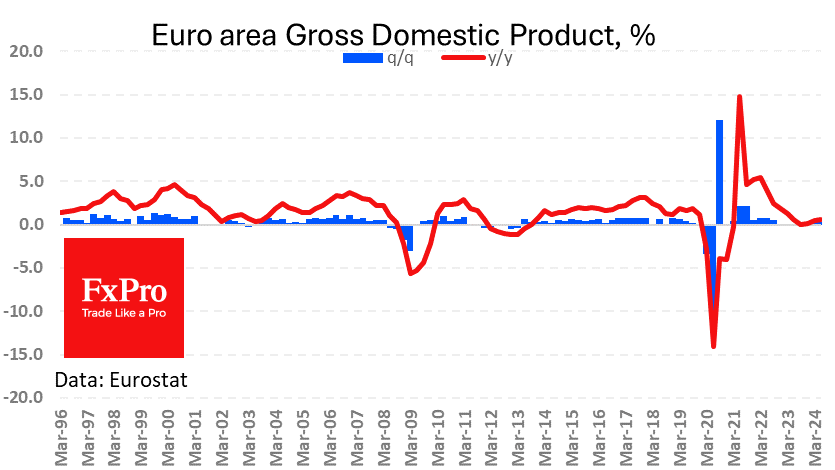

Eurozone GDP grew by 0.3% q/q and 0.6% q/q, showing some acceleration and exceeding average forecasts. This is still a very low pace, but the economy has managed to add in a high interest rate environment, avoiding recession. The situation.

July 29, 2024

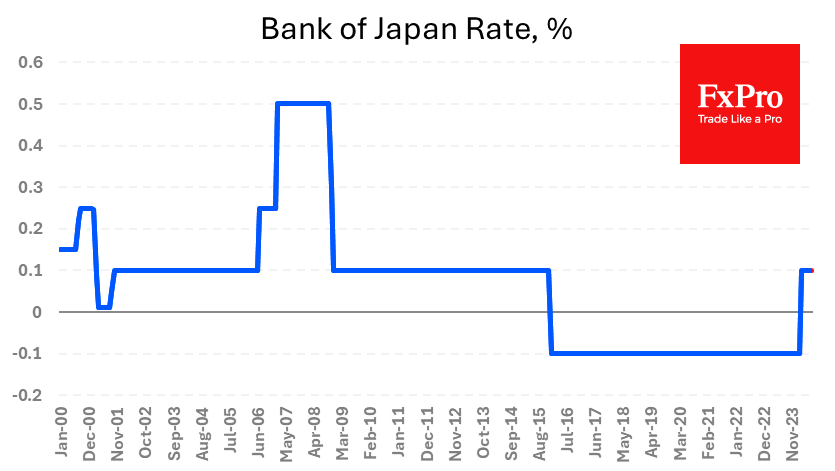

The week ahead will be packed with significant economic events, so the market behaviour could turn into quite a bumpy ride this week. On Wednesday morning, the Bank of Japan will announce its rate decision and the parameters of its.

July 29, 2024

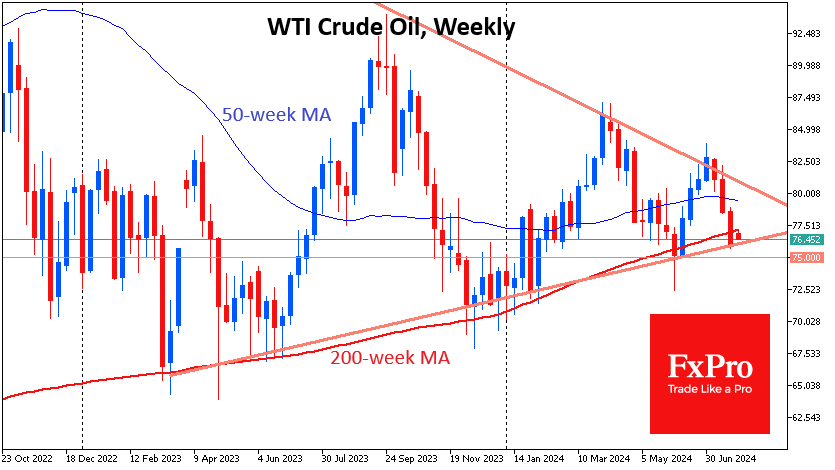

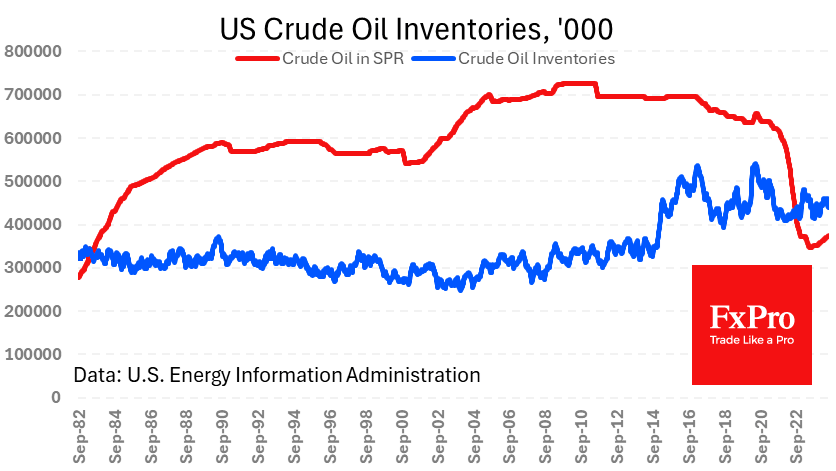

Oil is currently adding 0.6% to $76.45 per barrel WTI, but that’s only half of the spurt at the start of trading after the weekend. An important technical signal is forming in oil, as it closed last week below its.

July 29, 2024

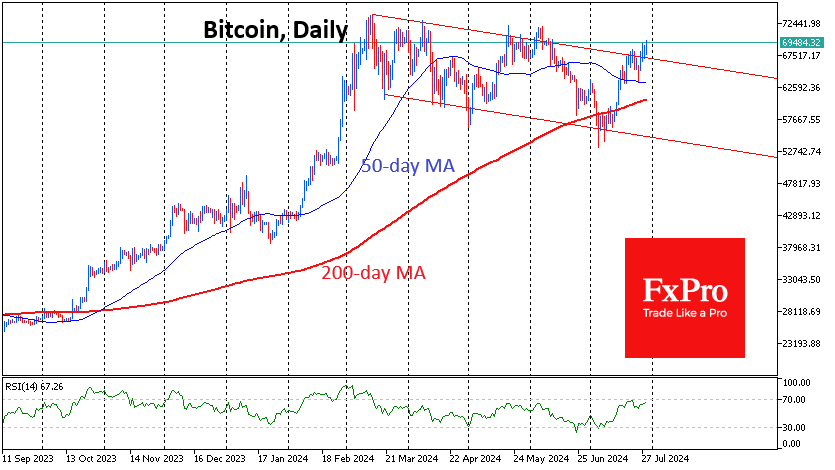

Market picture The crypto market cap has returned to its peak, which reached around $2.49 trillion a week ago, adding 3.3% in the last 24 hours. At this stage, the top coins are the lifting force for the market, with.

July 26, 2024

Friday saw the release of the last important piece of the inflation puzzle ahead of next week’s Fed meeting. The FOMC’s preferred measure of inflation, the Core Personal Consumption Expenditures Price Index, rose 0.2% m/m and 2.6% y/y, keeping the.

July 26, 2024

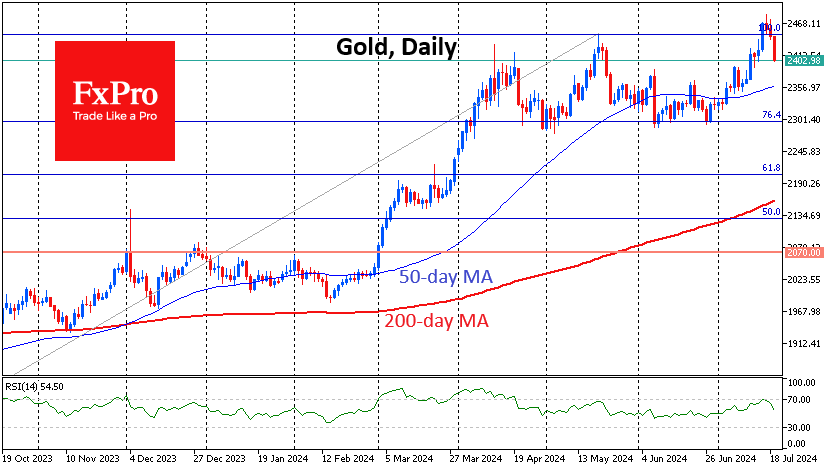

Gold came close to closing lower for the second week in a row, falling to $2372 per troy ounce on Friday morning, $111 below its high on July 17th. This decline occurred in two impulses, with an intermediate correction in.

July 25, 2024

The markets have taken a beating: the rise in volatility on FX and equities around the world is clearly visible. Commodity markets have also been hit. Traders who have seen the markets move live since the global financial crisis must.

July 23, 2024

Last week, the dollar index regained some of its losses from the previous four weeks, but technically, it looks like short-term profit-taking by sellers before a new downward momentum. The US dollar has been under pressure since late June as.

July 22, 2024

Crude oil is hitting five-week lows, trading at $78.3 per barrel WTI. Oil volatility has been declining for two years, forming a sequence of lower peaks and higher lows. A very similar pattern in oil was formed in 2011-2014 and.

July 19, 2024

Gold made an impressive 3% surge during the week, breaking May’s all-time highs. However, it then retreated to the downside, selling off throughout the second half of the week. What should you watch out for to see if this is.