Macroeconomic pressures on oil, as geopolitics temporarily out of play

August 08, 2023 @ 17:22 +03:00

Oil is down around 2.5% since the start of the day on Tuesday to $80.1 per barrel WTI, as a loss of traction in risk assets coincided with a fresh wave of concerns over China’s growth rate.

Foreign trade data from the world’s second-largest economy highlighted a 14.5% y/y decline in exports and a 12.4% y/y decline in imports in July. In both cases, the fresh data was worse than expected and previous figures. This led to a broader trade surplus in July but did little to cheer investors, who sold off the yuan and markets in general.

China’s weakness in global trade is seen as a manifestation of weakening global demand. Politburo’s attempts to revive domestic demand have not produced visible market success or excitement. This is visible in the dynamics of the stock market, the yuan, and the Copper.

Oil performs better than the market in this story, supported by OPEC+ supply cuts and the unwillingness of the US to regain lost market share. The States didn’t hesitate to do so until 2020. Still, after the pandemic, it’s easy to see the reluctance to increase production. Since the beginning of the year, production has averaged just over 12.2 million BPD, contrary to recession forecasts that never materialised.

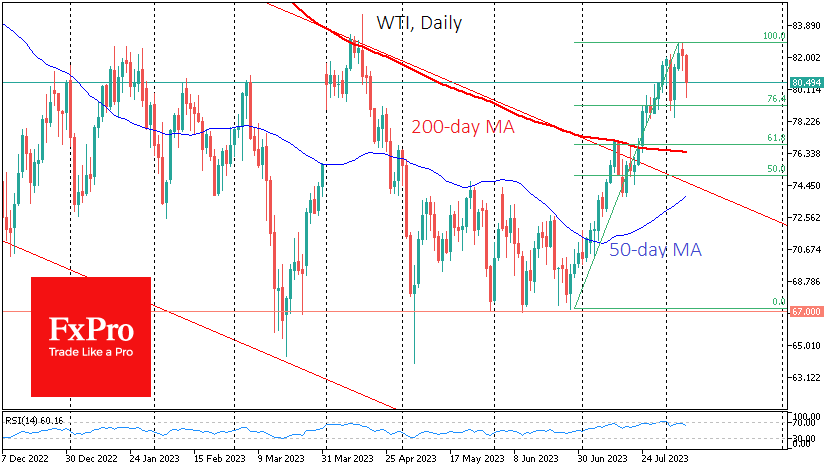

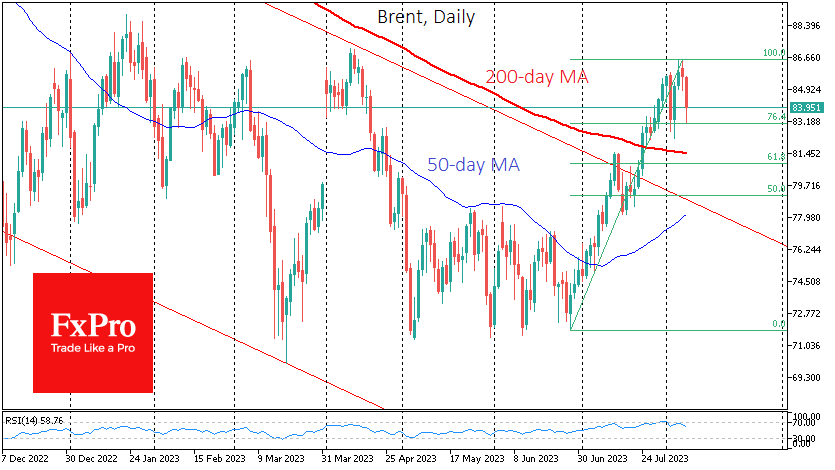

From the technical analysis perspective, Crude Oil is somewhat overheated and vulnerable to at least a corrective pullback. WTI’s rally from late June lows near $67 to $82.9 earlier this week marks a gain of more than 20%. A full-blown correction in this environment suggests a decline to $76.5-$77, with a lower bound at the 200-day average and an upper bound at 61.8% of the rally.

The bearish reversal earlier this week is quite close to the previous three turning points in oil in November last year and January and April this year, which also supports further declines.

We also noted earlier that Russia and Saudi Arabia are announcing new cuts or extending current cuts as prices fall towards $67 for WTI or just over $71 for Brent. The downside from current levels remains impressive, making new OPEC+ moves unlikely.

Looking at the bigger picture, a similar battle between geopolitics and economics was won in 2014 and 2020. However, closer coordination between the second and third-largest oil producers after the US cannot be ruled out.

The FxPro Analyst Team